Roblox IPO: Toy For Kids Entering Adult Market

5 minutes for reading

The global industry of entertainment develops at an impressive speed. Its intrinsic part is video games that are especially popular among kids under 14. Game producers have been extremely lucky in 2020: the pandemics of COVID-19 triggered the growth of their profits because parents and kids started spending more time at home and tried to fill up their leisure.

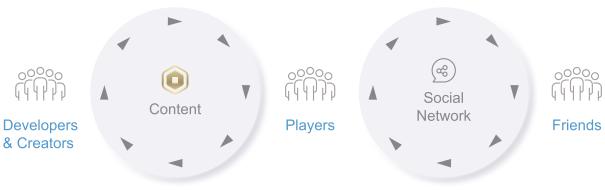

Roblox is the creator of an online platform on which everyone can construct their virtual world, create, and launch a game. Various developers have created over 69 million virtual spaces in the 3D world of Roblox. The platform is extremely popular among youngsters under 16; however, the number of adult users keeps growing. This means that the scenarios of games meet the expectations of various ages.

The IPO of the Roblox Corporation has been one of the most anticipated in 2020. The company applied for the IPO in October. The placement is planned in NASDAQ under the ticker RBLX.

Let us now concentrate on the details of the business of the company.

Roblox business

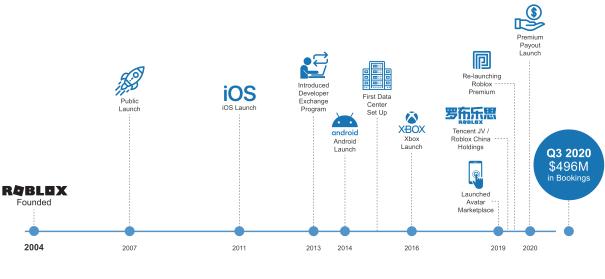

Roblox was founded in 2004 in California (USA). It works on two markets at once:producing video games and teaching children programming. This helps it diversify its business and financial flows. See the way the company has passed below:

Monetization is based on the Freemium model – basic functions are available to all users, ut paid subscription allows buying certain things inside the game itself. Also, the subscription switches off ads and enhances customization opportunities of your profile. Currently, the revenue from the subscription is much lower than that from ads and the commission fees of other developers, but the company is trying to reverse this trend.

The platform has its own currency Robux that you can use for paying for goods in the game and upgrading your character. Among kids, the feature of creating your personal avatar is extremely popular. For a separate fee, users can even hire a server for a virtual party. This was a great solution during the tough quarantine measures of this spring when people even celebrated birthdays online.

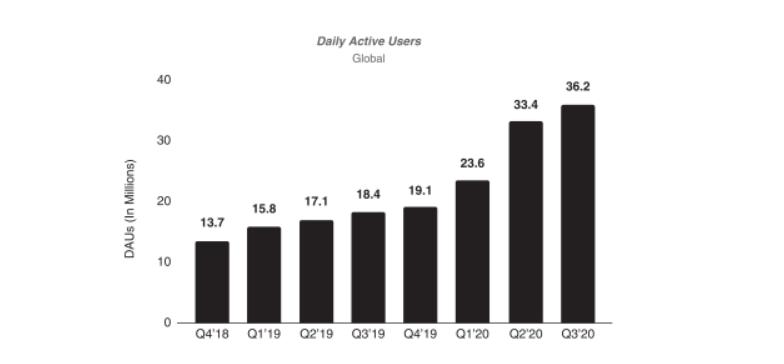

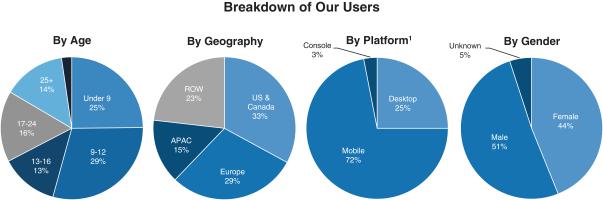

In the third quarter of this year, the number of active users of the platform reached 36.2 million people. The company offers individual solutions to kids depending on their age, gender, and interests. Anyone can create their unique world available from any gadget (the platform adapts for all). See the structure of ownership below:

When playing, users can send messages to each other; there are filters for parents’ control that deletes negative comments. This has become a unique market advantage of Roblox.

Quite often, users join in by groups sharing the same interests. Positive feedback to a game is 95% on average. This means the clients are extremely loyal.

As we have mentioned, on the platform, kids can learn programming in the form of a game. Such methods attract more target clients than dry school-style lessons.

Thanks to such a vast range of functions and opportunities, users spend on the platform over 3 billion hours a month.

Now to the financial performance of the company.

Roblox financial performance

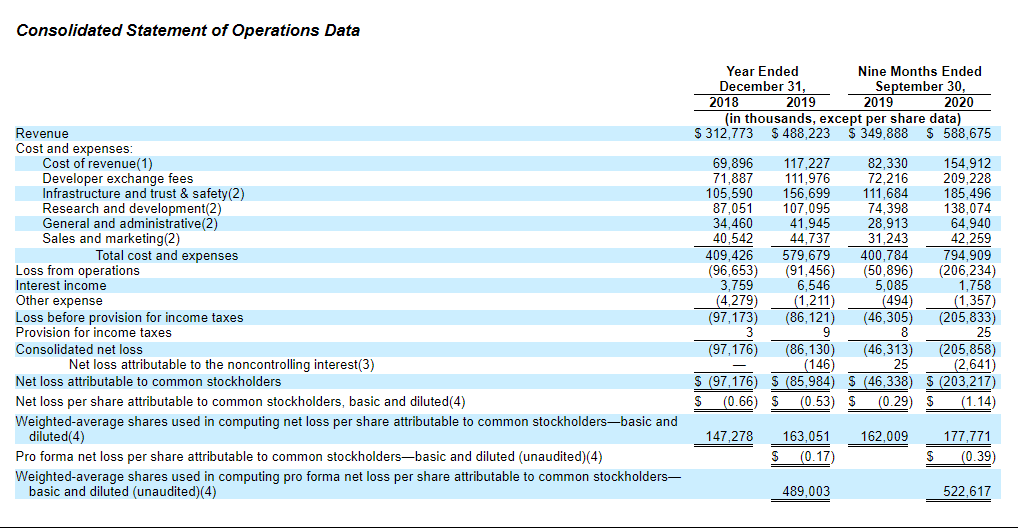

According to the S-1 report, Roblox is a losing company. So, let us get started from its revenue: during the last 12 months, the company has made 727 million USD.

The surplus of the revenue during 9 months of this year amounted to 68.25% compared to the results of the same period last year. In 2019, Roblox made 56/09% more of revenue than in 2018. So, the business of the company grows by 50% annually: the forecast revenue in 2020 is 821.43 million USD. The company invests over 30% of its revenue in development because the platform requires optimization. In three quarters of 2020, the expenses on Research and Development grew by 85.58% compared to the same period of 2019. This makes the net loss of the company grow as well – after 9 months of this year, it reached 205.83 million USD.

Strong and weak sides

The advantages of the company are:

- No rivals to its unique product;

- It attracted 150 million USD during the last round of financing;

- The company is estimated for 4 billion USD;

- Over 7 million developers are working on the platform;

- User activity has been growing constantly since 2018;

- The pandemics of Covid-19 and mass vaccination will last until 2021, which gives better chances for increasing the base of paid subscriptions;

- The company works worldwide, so it does not depend on he situation in a separate country.

The disadvantages of the company are:

- The revenue of the company depends on te activity of users, and kids lose interest much quicker than adults do (40% of users are kids under 12 y.o.);

- The company fights constantly with forbidden content, and if its safety system fails, it will pay fines;

- Rivals with a more appetizing offer (Sony, Activision Blizzard) might appear at any moment;

- After the quarantine if lifted, the company risks facing a decrease in the user activity.

Roblox IPO details

The underwriters of the company are Goldman Sachs & Co. LLC, Morgan Stanley, J.P. Morgan, Allen & Company LLC, BofA Securities, and RBC Capital Markets. The initial application amounts to 100 million USD but the company has chances to attract up to 400 million USD.

To estimate a company that does not generate a net profit, we use the P/S (price/spending) multiplier. While for video games developers the minimum is 5, the minimum estimation of Roblox is 4 billion USD (0.821 billion USD * 5).

As for comparative analysis, the counterpart of Roblox Unity Software Inc. is now estimated as 49 revenues. Thus, the maximal capitalization of Roblox reaches 40 billion USD (0.821 billion USD * 49).

I recommend this company for medium-term investments.