Dividend Investment Strategies: Real Cases

8 minutes for reading

The "buy and hold" strategy is the simplest strategy for making a profit on the growth in the value of shares – you just need to buy securities and hold them for as long as possible. In this case, it's worth using technical analysis to identify the best entry point with minimal risks.

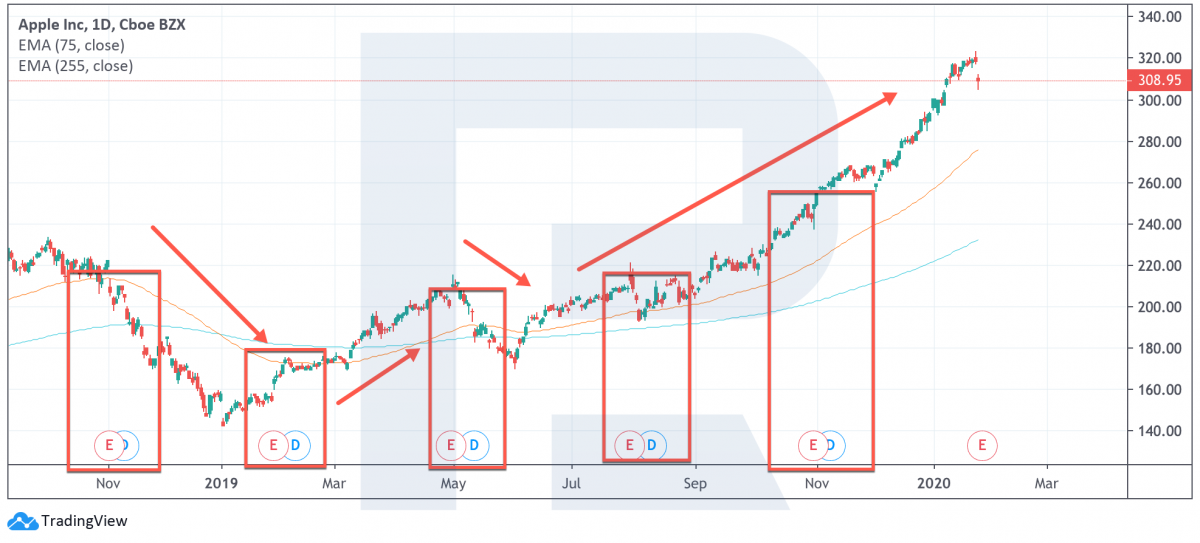

However, in the example of the growth of Apple's stocks, we can see a steep rise even after a swift decline. Let's recall that Apple's stocks fell to $142 in January 2019, but currently, their price is testing at $320. This shows us that the price more than doubled in just one year, which is remarkable.

Today, we shall discuss one more option on the stock market at the time of the dividend payment. Here are the details, the serious advantages, drawbacks, and peculiarities.

What are dividends?

Fundamentally, dividends are a share of a company's profit. If you are a dividend holder, you have the right to receive a part of the company's profit, which is divided among its shareholders. It's fairly easy to become a shareholder: you simply need to buy company stocks on the exchange, and they will earn you the right to receive dividends from the chosen company.

For example, Apple Inc. is paying out dividends to its shareholders every quarter – four times per year. As a rule, the sum aimed for paying out dividends makes 30% of the company's net profit. The net profit is distributed over a week's time. Dividends amount to $0.77, so if you hold 10 Apple stocks, you will receive $7 as dividends. Over the period of one year, the stock price has grown more than twice, with dividend holders receiving extra passive income every time. Not bad at all!

However, Apple Inc. has not always paid out dividends to its shareholders. In 1995, it was decided to invest all the capital in the business and the development of new products and services. Apple Inc. did not begin paying out dividends until 2012 when it was decided to initiate them again.

Dividend cut and the growth of the stocks

Information about the dividends on the stocks of a company can be found in the dividend calendar. The details about dividend payments are normally announced after the shareholders' meeting. This might happen several months before the actual payment of part of the company's profit to its shareholders.

The dividend cut or the so-called registry closing day is the last day when the shareholder must hold the stock (buy the stock or already own it) to be eligible for payment of stock dividends.

There are even such strategies in which the investor buys stocks before the dividend cut day to receive additional income as quickly as possible. On the other hand, there are investors who choose to sell their stocks before the dividend cut day, even if they had been holding them for several months. The number of traders with the intention of earning on dividends without effort grows swiftly before the dividend cut day, which provokes the growth of the stock price. The stock price declines immediately after the distribution of the profit because the traders sell their stocks as soon as they receive the payment.

What happens to the dividends if the stocks fall?

There are two different scenarios: attempting to make a profit on the stock price fluctuations, and on the dividends. If you bought 10 Apple stocks at the beginning of 2019 at the price of $145, you can now sell them at $318 and earn $1730. However, to receive funds, you must first make a sell operation on the exchange, and then start using the assets. You can make a profit on the stock price fluctuations by way of buying cheap stocks and waiting for the right moment to sell them at a higher price.

As for receiving income from dividends, there is no need to constantly buy and sell stocks to gain profit. In fact, if you're a dividend holder, you don't have to do anything at all. The company will pay a part of its profit to you in your capacity as an investor in the company. So, you don't need to sell your stocks. To receive dividends from a company, you just need to buy stocks and hold them.

Popular strategies of making money on dividends

Receiving additional income simply by holding some stocks in their portfolio pushed traders and investors to create various strategies aimed at maximising possible income and minimising risks.

Long-term buy of stocks

The simplest option is to just buy stocks of one or two promising companies and hold them for as long as possible, regardless of the fluctuations of the stock price. What's more, the current stock price is not significant because very few of us know what will happen in the future. For example, with Apple Inc., we saw the stock price doubling in just one year.

On the other hand, although things might seem quite simple, it's not easy for investors to watch the market fall – most likely, they'll just escape the downtrend with losses. Experienced traders advise to always be ready for such losses.

For example, Warren Buffet has frequently stated that sometimes doing nothing may be much more profitable than buying and selling stocks. He pushed us to the idea that it's much more effective to spend time studying companies and choosing promising stocks than to trade intraday without a system.

Of course, there are examples of strong intraday traders, but most average market participants can receive income from passive investments of free funds in stocks. A serious drawback of the strategy is its being long-term, and the advantage is making a profit on future dividend payments.

Buying stocks before the dividend cut day

As we have mentioned above, when the dividend size becomes known after the shareholders’ meeting, the interest of traders in the stocks starts growing, and the securities go up thanks to strong buys. The closer the dividend cut day, the higher the rise of the stock price.

The strategy implies buying the stocks well ahead of the cut, not just a couple of days before. Essentially, the stocks should be bought immediately after the shareholders’ meeting, before the quotations move too much upwards. In this way, an investor can earn on both the dividend payments and the growth of the stock price. It's important to remember that when we are players in the market, things don't always go according to our plan; that is exactly why the rules of money management are to be followed.

Buying stocks after the dividend payment

As a rule, after the dividends are paid out, the stock price falls for the size of the payment. At this point in time, we can consider buying stocks, counting on further growth of the stock price. We should not be expecting a quick income from dividends at this time, but wait for the next payment. However, a strong decline after a dividend cut allows us to buy the stocks at a lower price than the previous one, which will later make our profit on the fluctuations.

It takes the stocks two to three months to recuperate, and in rare cases, they return to their previous levels after a couple of weeks or even days. A big advantage of this strategy is to see stock price growth in the mid-term.

It's curious that dividend payments have little influence on stocks in the US market. With Apple Inc., we do not see serious drawdowns on the price chart. Such moments occur, but it can be said that during extended declines dividend payments just push the market even lower due to enforced pressure from the sellers.

Summary

On the whole, attempting to get income on dividends is not difficult; you just need to hold the stocks before the dividend cut. On the other hand, depending on the market type, the stock price can seriously decline after this event, and traders must be ready to assume these risks. In any case, before buying any stocks, it is necessary to study the chart behaviour historically to assess and estimate the income from dividends.

Buying stocks immediately after the dividend cut might bring much more profitability in perspective than a banal attempt to buy securities only a couple of days before the dividend payment. And the words of the market celebrities are worth remembering: buying stocks for the long term may be a better strategy than buying and selling on a daily basis to capitalise on daily price fluctuations.

* – Past performance does not predict future returns.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high