Shooting Pips: Trading the Sniper Strategy

8 minutes for reading

Today, there are plenty of trading strategies and work options for various markets both with indicators and without them. The Sniper strategy belongs to the second group: it consists of chart analysis solely, involving no additional indicators.

Opinions differ about using just the price chart for trading. Some think that this type of trading is subjective, and several traders may see different signals on the same chart. Moreover, this trading method is hard to back-test, unlike the work of indicators, where you can study all previous signals rather easily.

However, the Sniper remains popular among Internet users, experienced traders and beginners alike. In this overview, we will discuss the peculiarities, advantages, and drawbacks of the strategy.

Description of the Sniper strategy

The strategy is meant for intraday trading, which means positions are not transferred to the next day. Also, trades are not opened at the moment of the publication of important economic news. The strategy uses classical instruments of graphic analysis, such as the support and resistance levels, range levels. The publication of news, in this case, may hinder trading the levels.

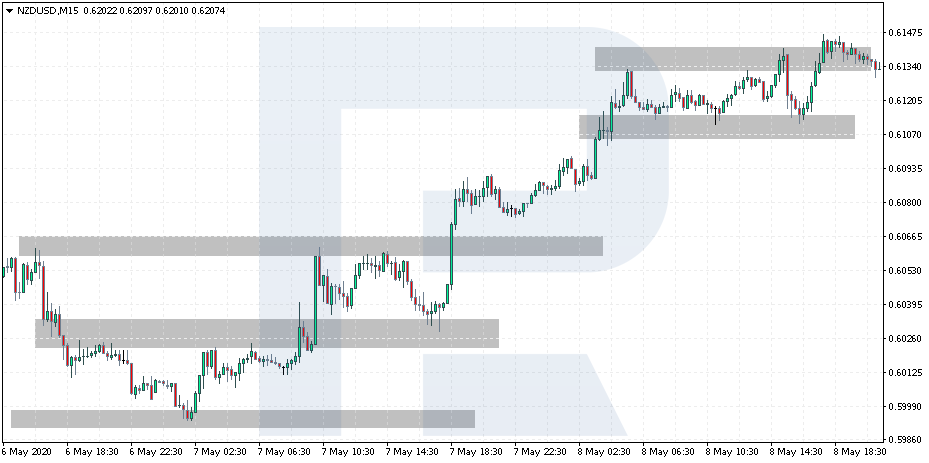

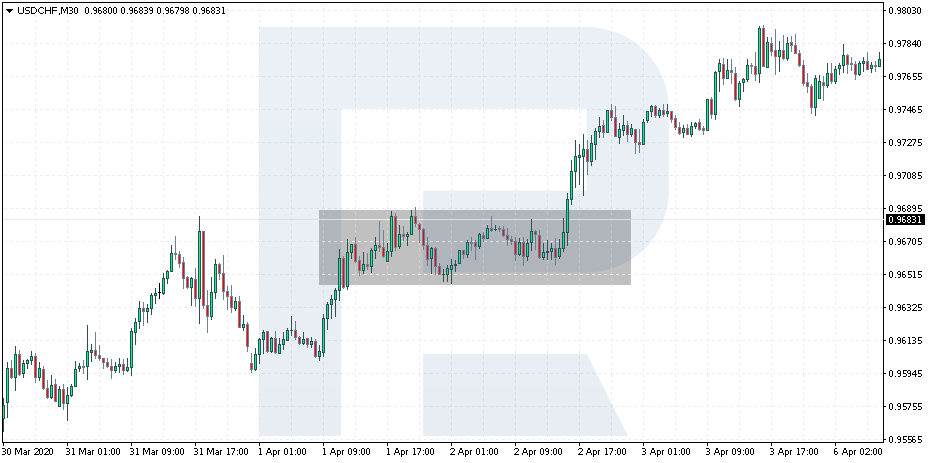

The idea is to open positions in the direction of the breakaway of the channel that was formed at night - using horizontal levels. As a rule, at night, volatility drops significantly, and flats form, squeezed between strict levels.

A large advantage of the strategy is the opportunity to add new positions in the direction of the prevailing impulse to the existing ones. So, if we missed the moment to open a trade, this is okay, a signal for a new position may as well form during the day.

Characteristics of the Sniper strategy

You may use any instrument or timeframe with this strategy. It was initially meant for GBP/USD due to the high volatility of the pair, however, it shows good results with other pairs.

As a rule, you enter the market on M1-M5 and define the overall trend on H1 or a longer timeframe. So, to work with the Sniper, you need:

- any high-volatile currency pair or any asset, such as Gold. We concentrate on exiting the night flat and the subsequent impulse that the market will further support.

- Trade in the European and American sessions only. Here, we also focus on the energetic movements of the asset during the most active trading sessions.

- Money management is also vital. Choose the lot size wisely and never allow an excessively high risk per one trade because such a position may entail huge losses as no trading system guarantees 100% success.

- Use M1 and M5 for opening positions, while H1 and H4 - for finding important graphic levels because on minute charts the levels will be too abundant, hence, it will be hard to find important ones.

- Hold trades intraday only and never transfer them to the next day because at night a new channel forms, and its breakaway will give us new trades the next morning. Try to follow this rule and exit the market before the end of the day.

Important terms of the strategy

The author adds specific names for the levels on the chart and other elements of the system, highlighting the uniqueness of the trading system.

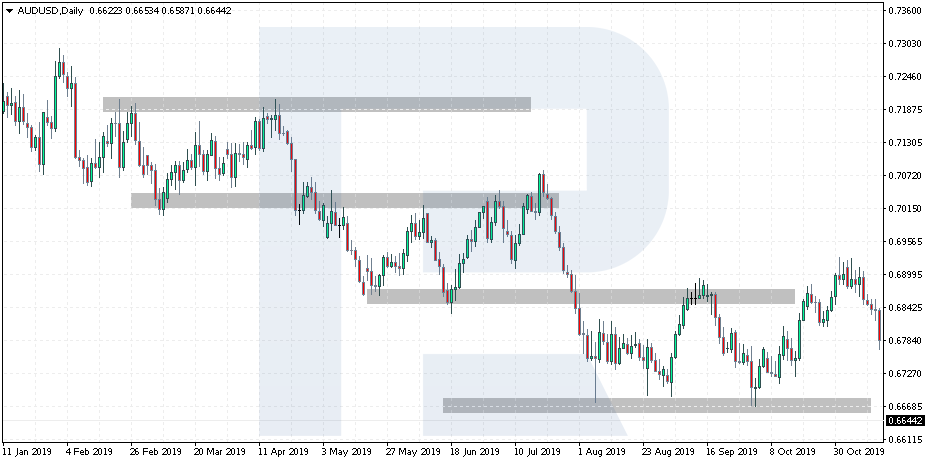

- Bank Level (BL) is the area where the previous daily candlestick closes. A breakaway of this level may indicate a further movement in the direction of the breakaway.

- High and low levels are drawn through the highs and lows of the previous trading day; they are important areas on the price chart.

- Total Impulse Level (TIL) is a strong support or resistance level from a higher timeframe (H1 or H4).

- The Level of Sharp Change In Trend (LSCT) is the area on the chart where a price with a long bar shadow in the direction of the trend appears. After such a movement, the trend reverses, which is clearly visible on the chart.

- Impulse Level (IL) marks small sideways movements on smaller timeframes, such as M5 or M15. Several candlesticks from such a timeframe create the sideways movement.

- Consolidation area is the flat formed at night in the Asian session; a breakaway of this channel gives a signal to enter the market.

- Safe means transferring the trade to the breakeven. The trader transfers the Stop Loss to the entry point, and in case the trend reverses, the trade closes at zero. The second part of the position should be closed after the price covers the distance sized as the Stop Loss.

How to open a selling trade by the Sniper strategy?

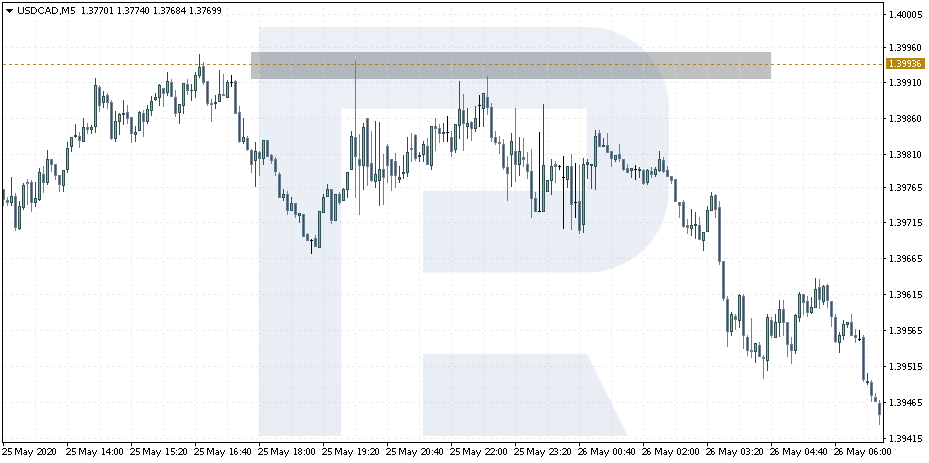

Any position by this strategy forms after impulse levels form on minute timeframes. If we're waiting for a selling trade, a level below the preceding Impulse one must form and the lower border of the channel formed in the Asian session must be broken away. Enter the market after a small correction if the following conditions are fulfilled:

- The body of the impulse bar is 4 points lower than the lower border of the consolidation. This is for us to assess the strength of the breakaway that must not be either too strong or too weak - 4 points are optimal.

- After such a strong movement, the price corrects upwards, the size of the correction must be no more than 15 points. If the correction is over this, the market might have already worked off the movement, so we might never reach the Take Profit.

- If the channel is wider than 20 points. In such a case the movement risks to be weaker than expected.

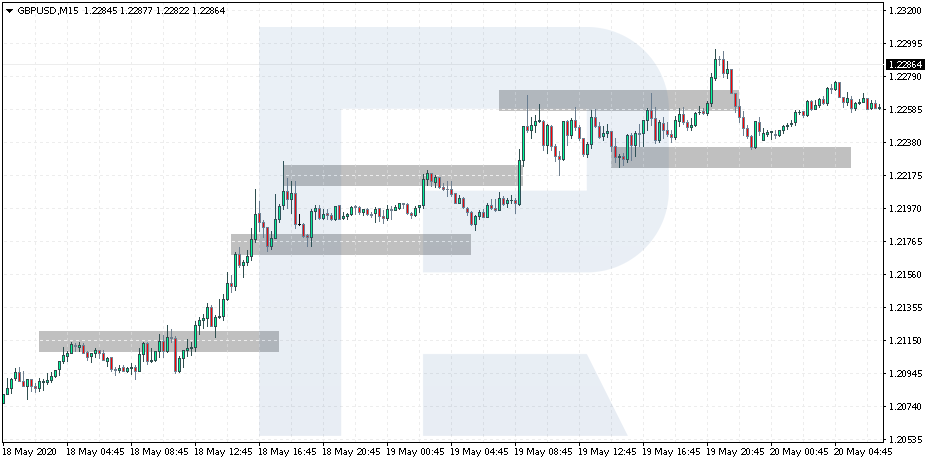

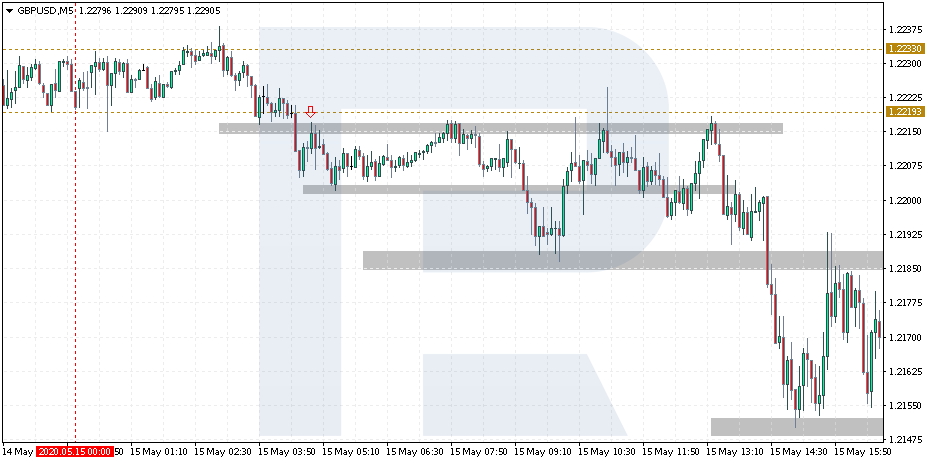

An example of a selling trade by the Sniper

On the GBP/USD chart, there formed a high-quality channel during the Asian session; the range does not exceed 20 points. We wait for a breakaway of this channel, which happens at the 4.00 bar. We also see that the size of the candlestick that broke the channel downwards is also over 4 points. Next, the price pulls back to the broken channel border; the pullback is no more than 15 points - so, we may enter the trade.

We take 50% of the position as soon as the price falls by the width of the channel and hold the remaining 50% until the trend dries out. You will perhaps understand that the trend is over and it is time to exit the position when the high will be broken away.

How to open a buying trade by the Sniper?

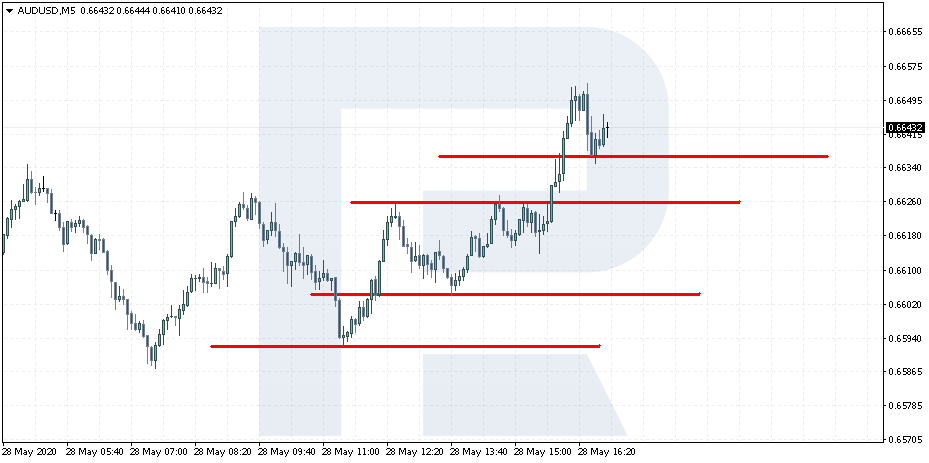

In this case, the tactics are vice versa, we wait for the range to be broken away upwards, which will signal to buy by the strategy.

- Here, we also need the impulse candlestick to be broken away for more than 4 points.

- After significant growth, wait for a correction to the range border. If the size of the correction is over 15 points, do not enter the market.

- Remember to assess the width of the channel which should not be over 20 points.

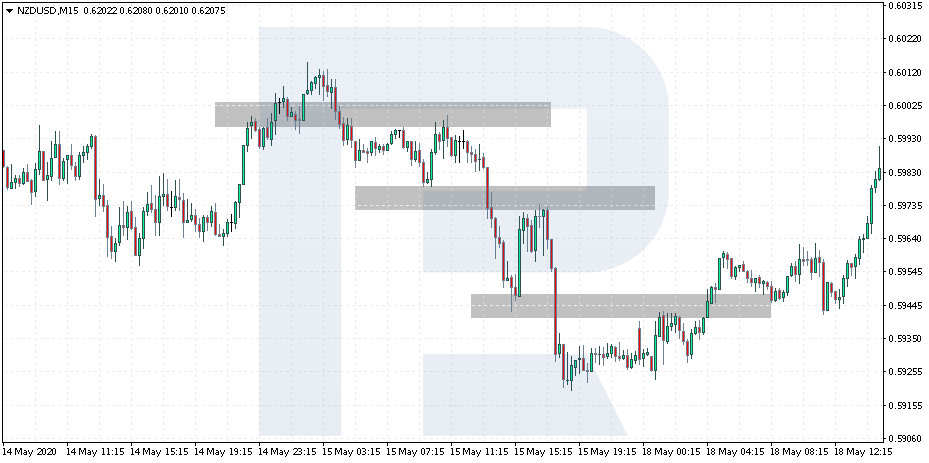

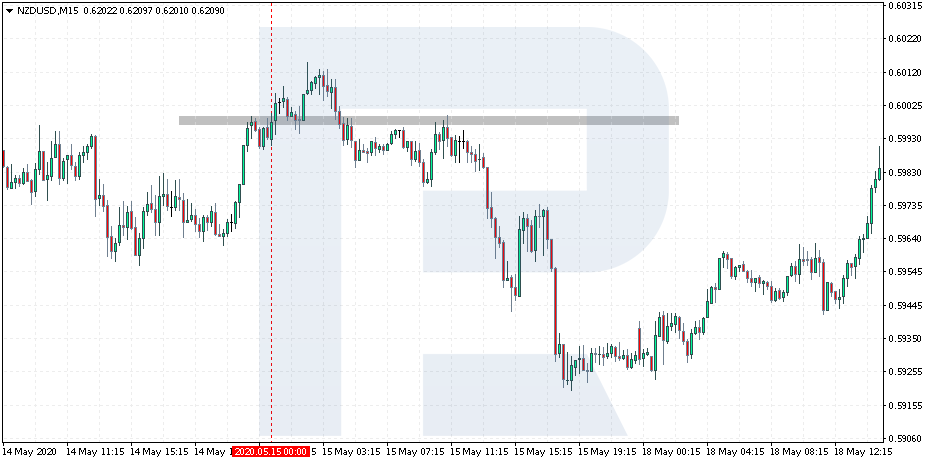

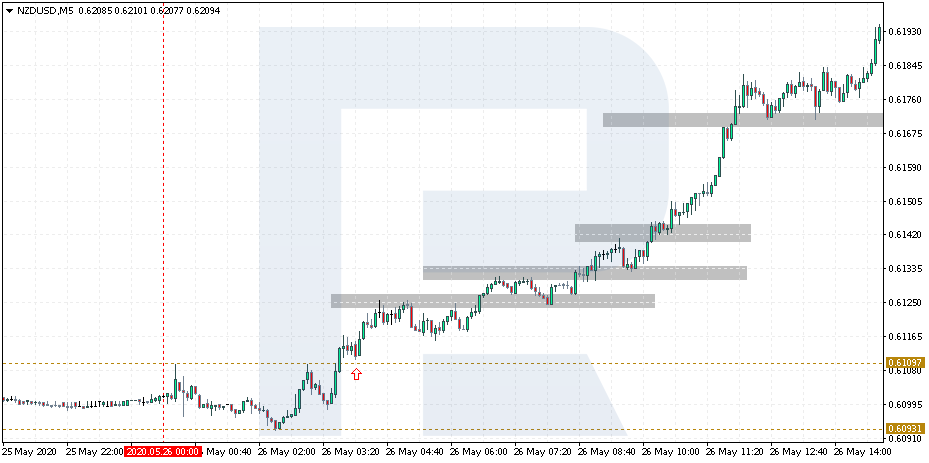

An example of a buying trade by the Sniper

Look at the NZD/USD chart. During the Asian session, a channel sized 16 points formed. We wait for this channel to be broken away, which happens on the 3.00 candlestick. The bar breaks the channel upwards, it is sized over 4 points. Then the price pulls back to the upper border of the channel; the pullback was below 15 points, so we may enter the trade.

Here, we take 50% of the first order and wait for the trend to come to an end in the second position. As soon as the price starts showing the lows that are lower than the previous one, we may consider the trend to be over. However, the trend lasts for quite long.

Closing thoughts

On the one hand, the Sniper strategy is rather simple: it has clear rules of trading. However, much depends on the trader's skills, their assessment of the support and resistance levels, as well as finding the channels on price charts correctly. Also, there are levels added by the author, which makes finding them more difficult.

On the whole, the Sniper includes classic tech analysis of the chart enhanced by the author with the unique descriptions and terms. The strategy may suit the traders who prefer trading often and with small risks; but remember that it requires a lot of attention, knowledge, and back-testing.