Ten Point Trading Strategy: Morning and Night Trading

5 minutes for reading

The Ten Point trading strategy is well-known by a wide circle of market participants and is based on simple entry rules; the percentage of profitable trades is quite high. An everyday profit, even if it is small, is good not only for the deposit but for the trader’s attitude to the market situation. This, in turn, inspires the trader for further work.

Peculiarities of Ten Points

The main part of beginners in Forex meet their death as traders due to trivial greed and endless losing trades. Meanwhile, beginners dream of making a huge profit right from the start, ignoring safety issues of careless and thoughtless strategy. Many do not guess that it is much easier to make small profits daily instead of a huge profit once in a long time.

The Ten Points strategy will help you maintain healthy excitement and enthusiasm while you are learning to hunt big trends. Trading the trend is much more profitable than trading counter the trend; however, it requires from a trader certain knowledge and skills. And if the trader decides to skip losing trades, their deposit must be large enough to endure this.

So, for a beginner, it is much easier to find one entry point on a technical level a day and take their almost guaranteed 10-20 points of profit per session, spending the remaining time on analyzing the situation and perfecting their trading strategy that will later bring the profit.

Trading rules of Ten Points

The rules of this strategy are quite simple but, as in any other case, require discipline. This strategy is based on breakaways of price levels. There are several options of entering the market, which we are going to discuss:

Option one: trading at night

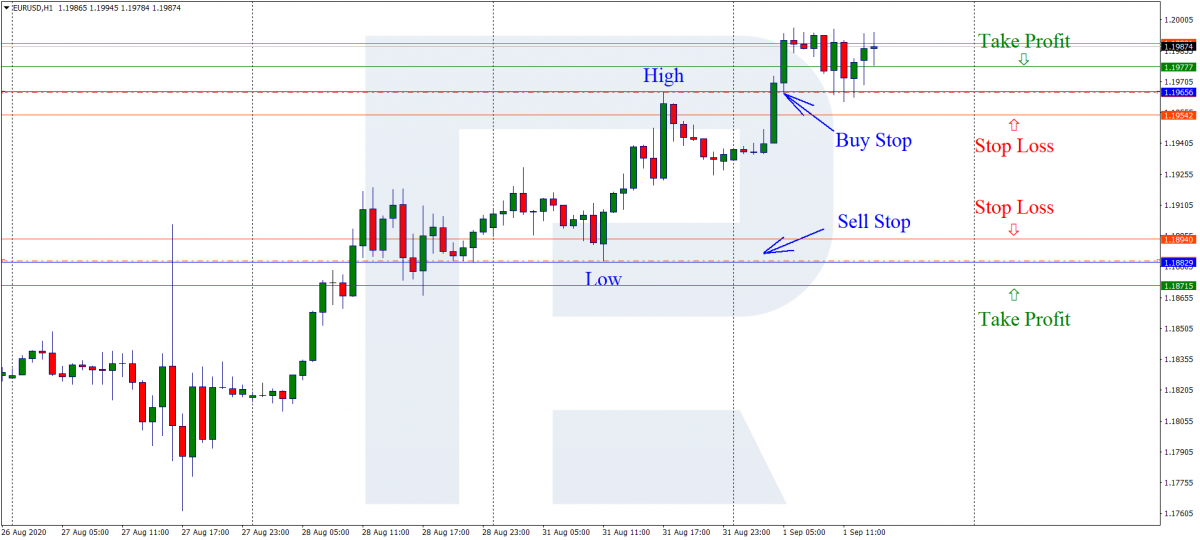

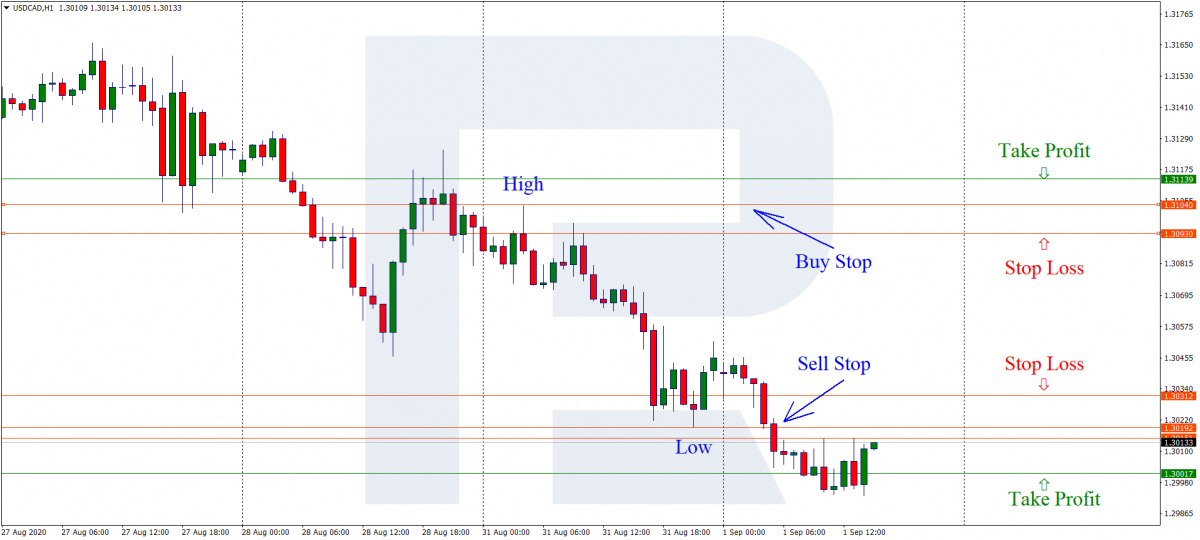

At the opening of a trading session (00:00 GMT), the trader draws support and resistance levels based on the data from the previous session. We look for the highs and lows of the preceding period. There is a theory that the price may break away the highs and lows of the previous session because major market players put their Stop Losses and pending orders there.

When such orders are triggered, the price may make a sharp movement, which is what we are looking for. Some might say that we are making wild guesses about the direction in which the price will go, but this is the point.

Entering the position

Marking the high and low on the chart, place pending orders on their breakaways. Use Buy Stop for buys and Sell Stop for sales. To decrease the probability of false triggering, place the orders two points away from the extreme (the Buy Stop – two points above the high, the Sell Stop – two points below the low).

Wait for the trading situation to develop. The Stop Loss is 20 points away from the entry point. As the name of the strategy suggests, the TP is 10 points away from the entry price. Let us now discuss the situation when these conditions change.

Exiting the position

The first condition is triggering of one of the orders; in this case, delete the second one manually, regardless of the results.

The second way of exiting is deleting both orders at the end of the trading session, if they have not been triggered, and placing new ones based on the new data.

Option two: trading in the morning

Technical conditions here are absolutely the same as in the previous case, only the time changes. Judging by my sufficient experience in financial markets, I would say that the trader should work in a comfortable time of the day, which means daytime (of course, this depends on individual opportunities and habits).

Trading late at night is especially tiresome, hence the trader may make unfortunate errors; moreover, volatility in the Asian session is rather low. Thus, analyze the trading situation in the morning and place the orders. Delete the invalid order right after the other one is triggered. Delete all orders at the end of your workday: no pending orders must remain open after the trader leaves their workplace. This is the issue of deposit safety.

Ten Points trading strategy: additional conditions

- The SL and TP sizes are valid for 4-digit quotations (ex. 0.1234); for 5-digit quotations, the TP must be 100 points and the SL – 200 points;

- Currency pairs are EUR/USD or another pair with a small spread and low volatility. Cross-rates do not suit the strategy;

- Timeframe: draw the levels on H1 and place orders on M15;

- If the price broke away yesterday’s highs/lows before you place the orders, do not place any;

- Theoretically, you can place another order after the position closes by the Stop Loss, but in practice, this may lead to a series of losing positions;

- Before you start trading, check the economic calendar and make sure there is no important economic news in the session;

- One trading session – two pending orders. In certain cases, you may leave the second order, keeping an eye on it, if the first one closed by the TP, and the price is making a serious pullback towards the second order.

- The European and American session are optimal for trading.

Closing thoughts

Ten Points is a highly profitable strategy. However, it still has drawbacks: for example, if volatility is low, orders do not trigger. And if volatility was high yesterday, the price may just stick in a flat. Also, a very limited choice of instruments might scare off some traders. However, regardless of this strategy bringing a very modest profit per session, it might become your good helper.