NASDAQ-100: How to Invest in the Index

6 minutes for reading

In this overview, we will get acquainted with the popular NASDAQ-100 stock index. This is the index of high-tech companies and is one of the top-three US indices.

The history of the NASDAQ stock exchange

The NASDAQ (National Association of Securities Dealers Automated Quotation) stock exchange is one of the leading US exchanges; it was founded in 1971 and specialises in the stocks of high-tech companies. Its name is the abbreviation of the name of a quotation system that was used for identifying the quotations of stocks and other calculations that were carried out.

The exchange exists from as early as 1939, following the enactment of a law that made all brokers who were out of functioning exchanges, unite in self-regulated institutions. This is how the NASD (National Association of Securities Dealers) was created. It united the participants of the US OTC stock market.

In the 1960s, the stock market was actively being systematised and automatised. Thanks to the development of computer technology, an OTC electronic system of trading stocks was created. It was called NASD Automated Quotations (NASDAQ). NASDAQ eventually became the first electronic stock exchange in the world, thanks to all trading operations having been computerised.

Nowadays, NASDAQ is one of the largest world exchanges. It specialises in stock operations of high-tech and software development companies. NASDAQ lists the stocks of more than 4,000 companies; while also calculating stock indices for different sectors of the economy.

Popular NASDAQ indices

Based on the stocks traded in NASDAQ, a whole range of stock indices in different sectors of the economy are also calculated, such as NASDAQ Composite, NASDAQ Bank Index, NASDAQ Computer, NASDAQ -100, NASDAQ Biotechnology, and more. Let's talk about three popular indices.

NASDAQ Composite

This is the very first index that appeared in NASDAQ: it is based on the growth of all companies listed in the exchange. NASDAQ Composite is calculated by the method of weighted market capitalisation. This means that the largest companies traded in the exchange influence the final result more than others.

This might be the main composite index of NASDAQ. The popularity of the index was somewhat deteriorated by the so-called “dot-com collapse” – the swift decline of the computer and IT market in 2000-2001. As a result, NASDAQ Composite slumped and could not restore for a long time, so the NASDAQ-100 became the most attractive index.

NASDAQ-100

This index, which appeared in 1985, is a modified weighted index that tracks more than 100 largest non-financial companies of NASDAQ. It is often interpreted as a “tech” index because of the presence of technology companies in it.

NASDAQ-100 includes giants, such as Amazon, Apple, Tesla, Alphabet (Google), Facebook, Cisco, Intel, Microsoft, Adobe, and Netflix. Almost all the companies in the index foster innovation, and share the same characteristics: speedy growth, global attractiveness, and liquidity. In this respect, NASDAQ-100 became the “barometer” of the high-tech sector and a popular financial instrument.

NASDAQ Biotechnology

This is a younger but still popular index, which includes the stock of biotech and pharmaceutical companies in NASDAQ. Currently, the index includes stocks of over 200 companies. Being a weighted index in terms of capitalisation, NASDAQ Biotechnology has been estimating the situation in US medicine and healthcare since 1993.

Trading strategies in NASDAQ-100

As noted above, NASDAQ-100 is one of the largest world stock indices, popular among traders and investors. It can be traded by various financial instruments: futures, special funds, CFDs – depending on your broker. Have a look at the main strategies.

Long-term strategy

It is a well-known strategy for NASDAQ-100. Its main principle is to wait for a correction and buy the index at the beginning of a new wave of growth while we expect it to renew the highs. This is quite a simple strategy, but you have to be patient for profit to grow to the desired level.

For example, you could buy NASDAQ-100 in March this 2020, at the falling of stock indices, which was provoked by the coronavirus epidemics. Winding up the decline, the index reversed upwards, and in six months renewed its all-time high, almost doubling its quotation from the year’s lows.

Of course, we should remember that the growth was rather abnormal, explained by a huge money inflow from the Fed. Under normal circumstances, you would have to wait longer.

Medium- and short-term

As a rule, such trading requires leverage. In short-term trading, a position is held for one or several days, while in medium-term trading, it's held from one day to several months. Swing-trading, day-trading, scalping – all these types of trading can be applied to NASDAQ-100.

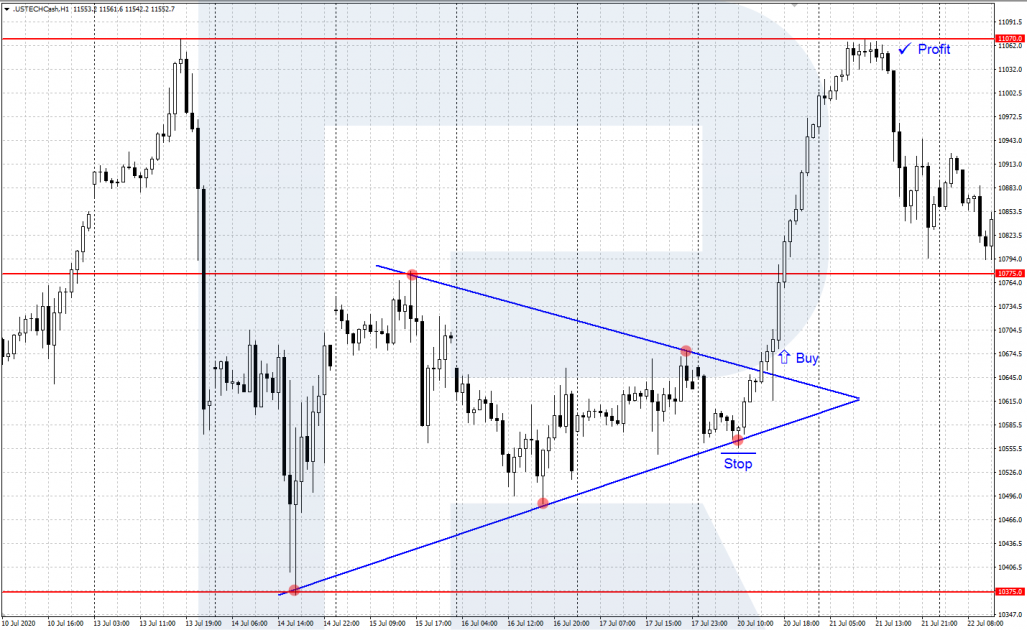

Stock market news is a good source of information, but the trading decisions should also be based on technical analysis. Support/resistance levels and lines, price patterns, candlestick combinations, Price Action patterns, indicators – all these means help find potential trading opportunities.

Entering a position (for example, based on a tech analysis pattern) by an increased lot (with leverage), with small goals and risk control is the main principle of short-term trading.

Summary

The NASDAQ-100 index is calculated based on the results of about 100 largest non-financial companies. This is one of the leading stock indices, reflecting the state of the tech sector in the world economy. NASDAQ-100 is a well-known instrument among investors. It can be used for short-term marginal trading, applying modern methods of tech analysis, and controlling risks.

* - Past performance does not predict future returns.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high