How to Calculate Return on Investment (ROI)

7 minutes for reading

Many traders buy/sell a variety of assets on a regular basis, but only a few know how to correctly estimate the quality of their investments. Professional traders quite often use the ROI (Return On Investment) – an index that helps to assess how fully your investments have paid back, which, will help you make money in the long run. Also, the ROI index is used for effective investing not only in business but in any financial assets. Mathematically speaking, the ROI is the relation of the net profit to the investment.

What is the ROI needed for?

In real business, this index helps to estimate your investments in the long run. If a trader or investor wants to sell their profit from selling securities, the ROI will help them compare different companies to assess which stocks will be more profitable.

An investor can in this way build a stock portfolio of the most stable companies, regardless of market fluctuations. To estimate investments in stocks, we can take any security as an example to find out what ROI we will get.

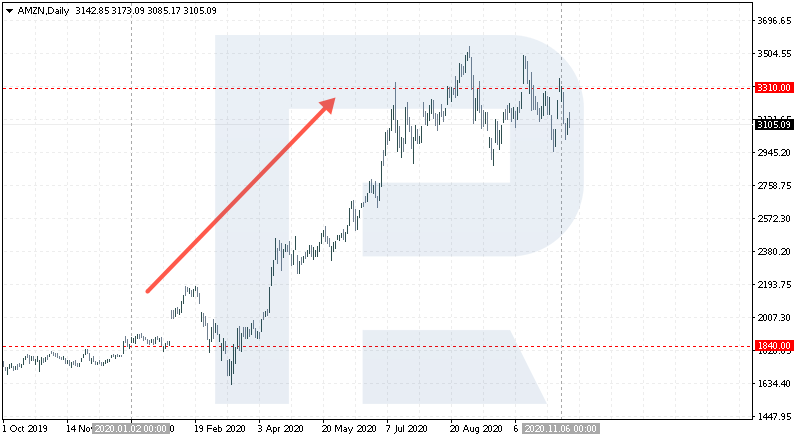

An example of ROI for Amazon

At the beginning of 2020, one Amazon stock cost 1,840 USD. We buy one – this is the size of our investment.

In November 2020, the stocks are sold for 3,310 USD each. Thus, by buying this stock in January 2020 and selling it in November of the same year, we have earned 1,470 USD of net profit. Let's calculate the ROI: divide 1,470 by the amount of your investment (1,840) and multiply by 100%.

$1470/$1840*100%=79%

It's important to understand that if the return on investment is higher than the interest on a bank deposit, then you might consider investing in this company. But this statement, of course, assumes that the value of the shares will be growing, and the company will be paying out dividends.

On the other hand, if the ROI drops lower than the interest on a bank deposit, try to avoid such investments. This might mean a deep market decline.

In our example, thanks to the growth of the stock price, the ROI turned out to be extremely high. Of course, we must realise that the market may correct, and the index will in reality be lower.

What ROI value is considered optimal?

In real business, an ROI value above 10% is considered optimal. If the ROI is below this level, then consider investing in a simple bank deposit.

In the currency, stock, or oil market, the ROI may even be negative. Moreover, plenty of experienced investors are ready to spend their money on underpriced assets.

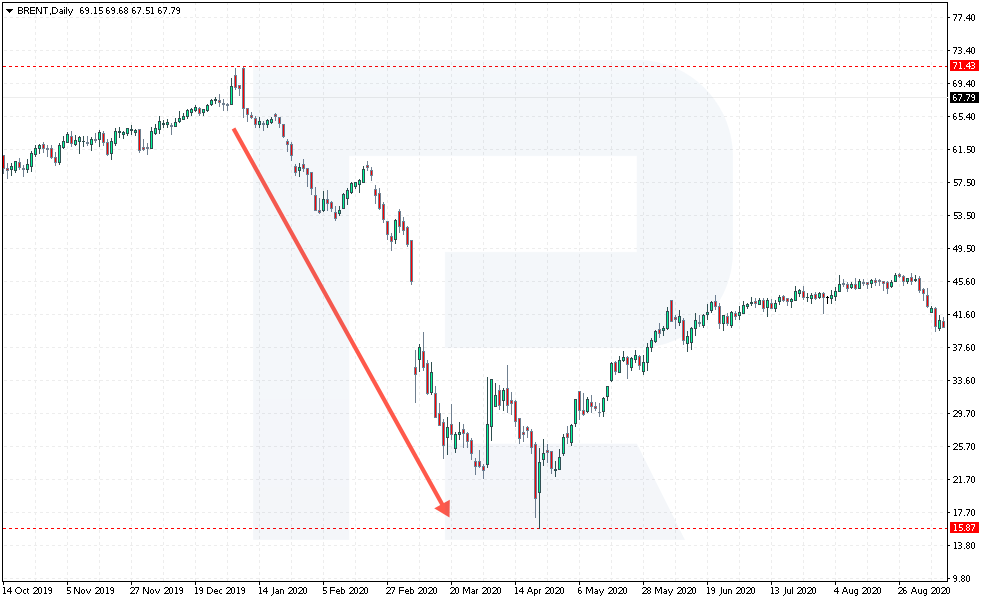

Let's consider Brent oil as a trading idea or example. The oil market is quite prone to steep declines, and the instrument may experience an extended downtrend. During such times, examine the lowest negative ROI and try to buy only with a low ROI. In this respect, we will follow the instructions of the great Warren Buffett who has taught us to buy assets at their bottoms rather than tops.

For example, since the beginning of 2020, oil has fallen from 71 to 16 USD per barrel, which means an ROI of -77%. If we had bought oil at its top, we could sell it at a much lower price several months later, which is totally unprofitable.

On the other hand, such a situation can be a good signal to buy the asset that has suffered the most losses. Then exit the market when the ROI reaches 50%. Nevertheless, an experienced trader can estimate the situation without additional calculations.

The main advantages of the ROI

Firstly, we can say that the calculation is simple. Investments in a company or the profitability of the stocks of several companies can be compared quickly and easily. Thus you will be able to spread your investments evenly.

It can be said that the ROI index is the best solution for a quick assessment of a business or a company on the whole.

Next, is the historical analysis. We can quickly and easily estimate the correctness of our investments.

The main drawbacks of the ROI index

The ROI index does not account for the time factor, i.e. it is not quite clear which period you should calculate the index for, and how much your results will depend on this.

For example, the ROI may be good for several years but poor for the period from the beginning of the year. This is for the investor to decide while taking various time data into consideration. It might be useful to conduct your own research and single out your preferred time factors, as the data and expenses are not accounted for.

As the data and expenses are never accounted for. As a rule, it is not always possible to collect all the necessary digits to help your research into a large company. On the other hand, in the stock market, expenses can include various commission fees or the difference between buying and selling prices. Many investors have noted that this index is absolutely useless for complicated markets.

Unfortunately, we do not calculate the potential profit, but get a value for a certain period. It would be interesting to find the perspective of a couple of upcoming years to determine the ROI level of these time periods.

Conclusion

Some consider the ROI to be a popular coefficient – particularly popular with marketers these days. As for its use in any financial market, it can be helpful when conducting research and all sorts of checkups.

Like in the example with Brent, the ROI can signal to buy, showing a market decline and pushing to open long positions. On the other hand, we can simply assess the size of the decline and find maximal drawdowns that would also hint at an upward reversal.

All in all, the ROI index might give you ideas for enhancing your trading efficacy, just like any other instrument. However, it is more useful for those investors who simply assess the profitability of their investments.

* - Past performance does not predict future returns.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high