Pip

A pip is the standard smallest unit of change in the exchange rate of a financial instrument.

3 minutes for reading

Definition of pip

A pip (Price interest point) is the basic concept of a unit of change in the price of a financial asset, most commonly used in the forex market. Market participants buy and sell currencies whose value is expressed in the monetary unit of another country. The quotes for these currency pairs are displayed as bid and ask spreads with an accuracy of a few decimal places.

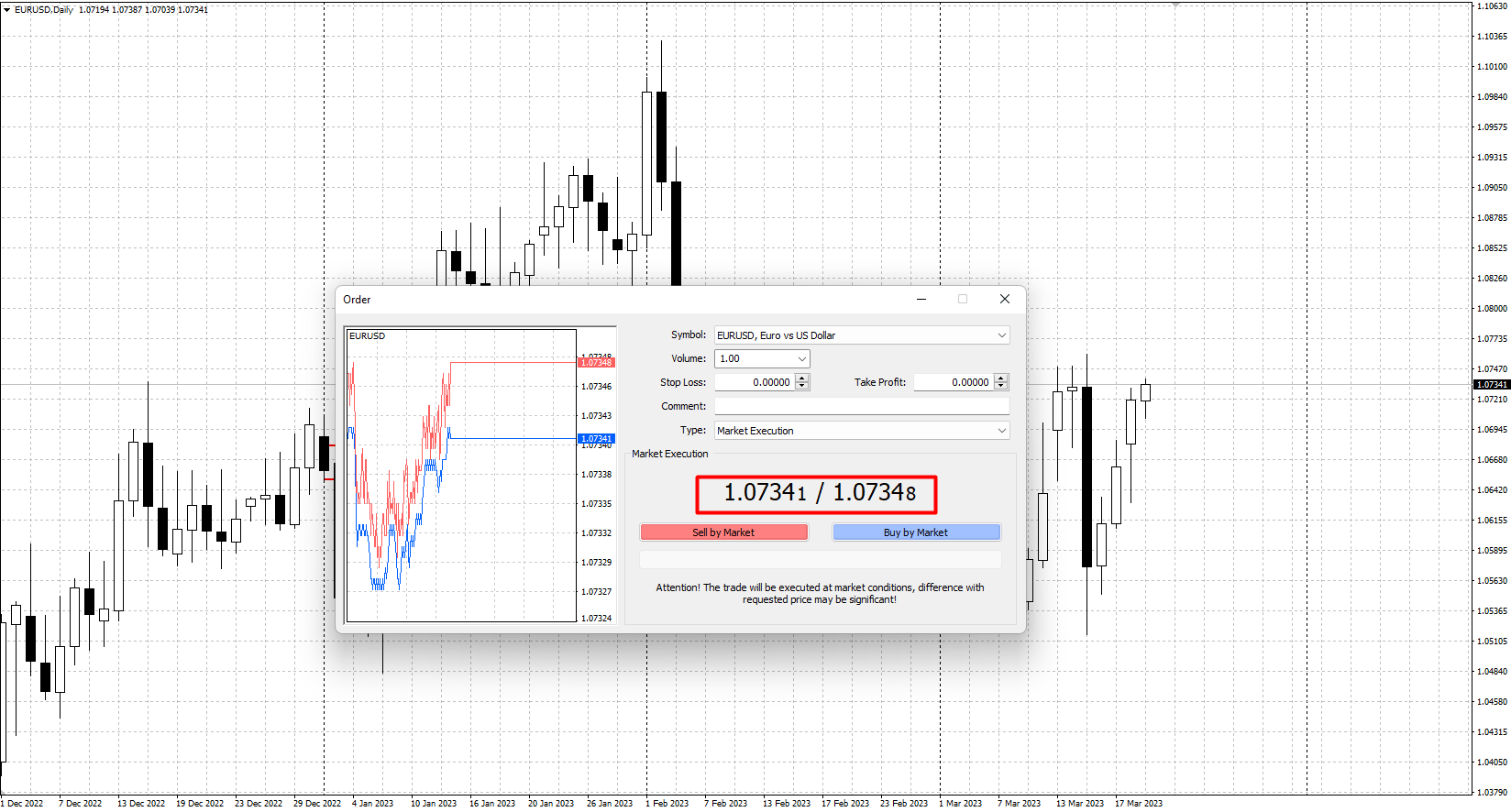

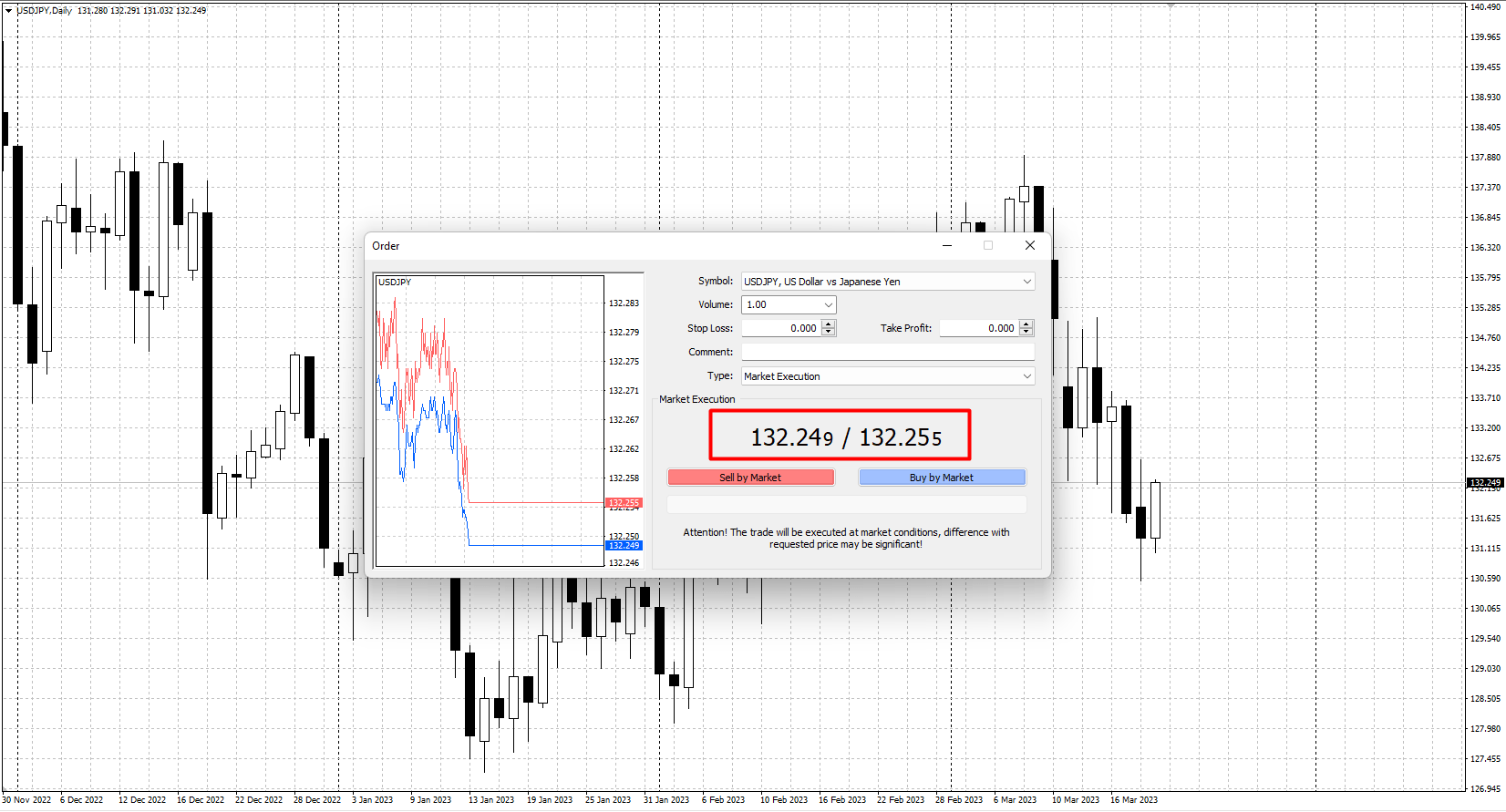

Changes in the exchange rate of currency pairs are commonly measured in pips. Up until about the early 2000s, currency pairs quoted in the US dollar had four decimal places, while pairs quoted in another currency had two decimal places. For example, one pip was 0.0001 for EUR/USD and 0.01 for USD/JPY.

With the turn of the century, ECN accounts have become more popular because they are characterised by large trading volumes and floating spreads. Therefore, currency pair quotes with five and three decimal places have been used to make calculations more accurate. For example, for the EUR/USD currency pair one pip equals 0.00001, and for the USD/JPY pair 0.001.

In the forex market, each currency has its own relative value, so the price of a pip for different currency pairs can differ. The pip value for any currency pair is based on the volume of the position. Moreover, the pip value may vary depending on the current exchange rate of the pair unless it is quoted in US dollars.

Modern trading platforms calculate the pip value of different financial instruments automatically, and there are also calculators to help traders. There is also a formula for calculating the price of a pip manually.

Formula for calculating the pip value for currency pairs quoted in USD

Pip value = A * B * C

- A is the lot size

- B is the number of lots

- C is the pip

For example, the cost of changing 1 pip of a EUR/USD quote by one standard lot would be

100,000 x 1 x 0.00001 = 1 USD.

Formula for calculating the pip value for currency pairs not quoted in USD

Pip value = A * B * C / D

- A is the lot size

- B is the number of lots

- C is the pip

- D is the current quotation to USD

For example, the cost of changing 1 pip of a USD/JPY quote with one standard lot and a rate of 137.00 would be

100,000 * 1 * 0.001 / 137 = 0.73 USD.