Ask

Ask is the price of a financial instrument at which there are current bids for its sale. It is the best market value to buy a particular asset here and now.

2 minutes for reading

What is Ask?

Ask, also known as the offered price, is the lowest price at which a seller is willing to sell a particular asset. Out of all the simultaneously existing offers from different sellers at different prices, Ask is the offer with the best value for the asset.

How Ask is different from Bid

The term Ask represents the lowest price for an asset among all the offers currently available in the financial market from different sellers. The opposite of Ask is Bid – the current price at which buyers want to buy the asset. It is important to remember that Ask is always higher than Bid.

What is Spread?

Spread, according to the most common definition, is the difference between the buy (Ask) and sell (Bid) prices of stocks, bonds, currencies, and other financial assets. In other words, it is a kind of indicator that shows the supply and demand ratio for one or another asset. It is measured in points, but can also have a monetary value. Spreads can be fixed or floating. In stock trading, the second option is more common. The value of the floating spread can vary depending on the liquidity of the asset: the higher the liquidity, the lower the spread, and vice versa. Floating spreads also tend to increase during times of high market volatility, which is usually associated with the publication of various news and important economic statistics.

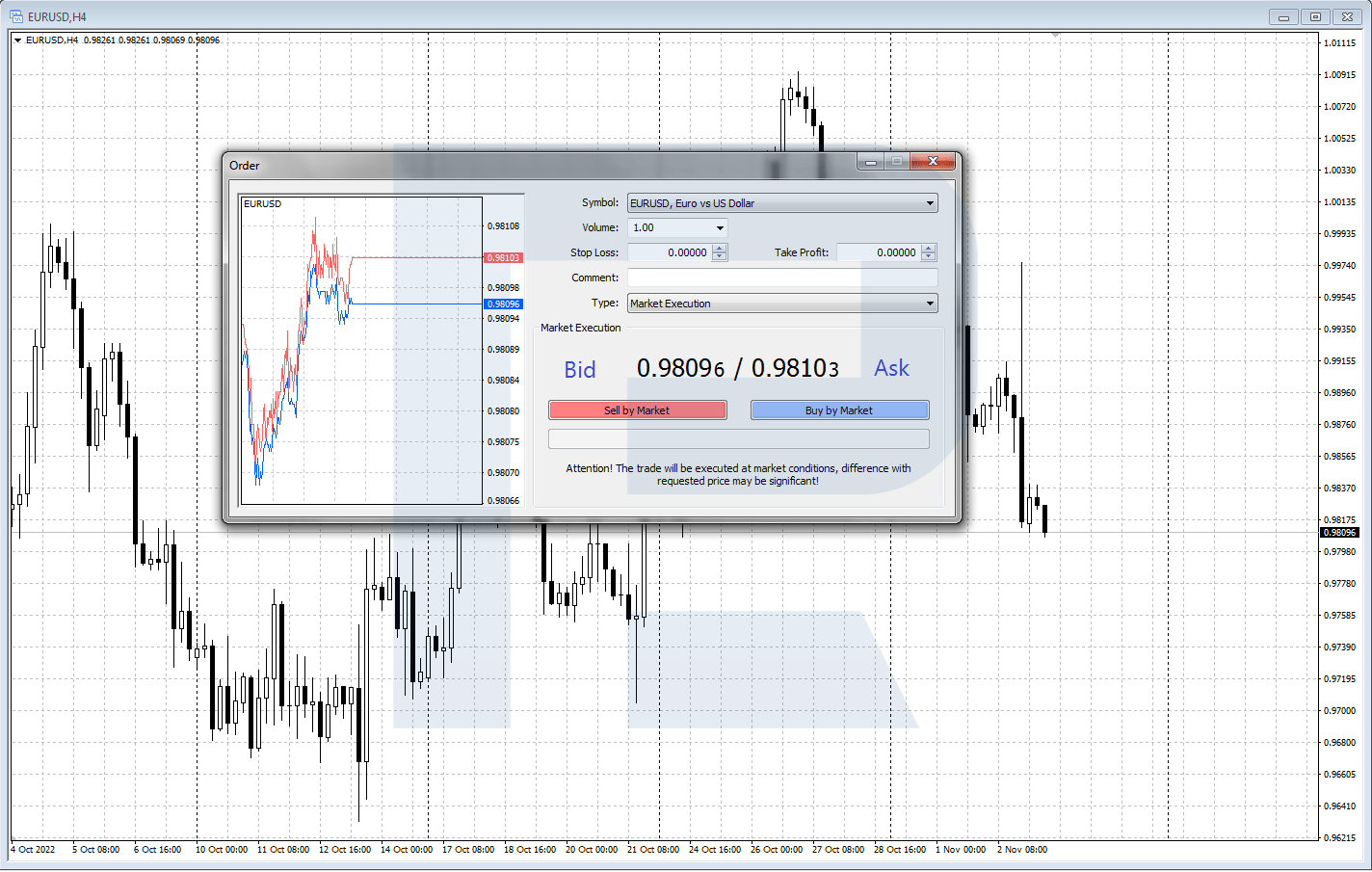

Ask, Bid, and Spread examples for EUR/USD

The forex market is the largest financial market in the world, reflecting the current dynamics of world currency trading. The most traded pair in terms of volume in international trade is EUR/USD. At the time of writing this article, the quotes of the EUR/USD pair were 0.98096 / 0.98103. On the left is the Bid price, and on the right is the Ask price. Spread = Ask − Bid 0.98103 − 0.98096 = 0.00007 USD

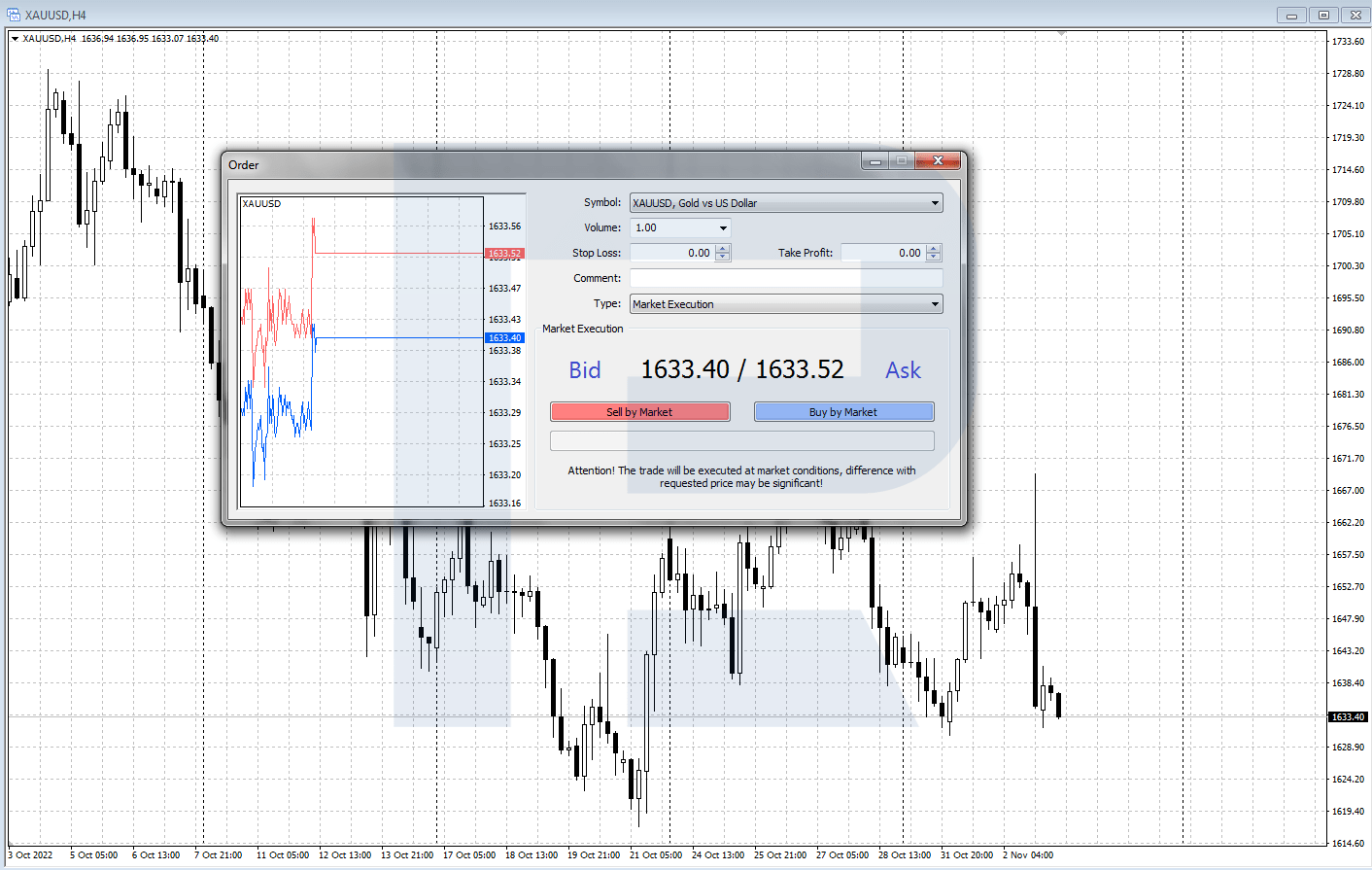

Ask, Bid, and Spread examples for XAU/USD

Gold is another popular financial instrument in global trading. It is traded on the spot as futures, options, ETFs, and CFDs. At the time of writing, the XAU/USD spot price was 1633.40 / 1633.52. Spread = Ask − Bid 1633.52 − 1633.40 = 0.12 USD