Corsair Gaming Gaining the Market Sea with Its IPO

7 minutes for reading

The provider of high-performance equipment for professional gamers and game streaming accessories Corsair Gaming carried out an IPO on September 22nd, 2020. Trades started on September 23rd, 2020 in NASDAQ with the CRSR ticker.

About the Corsair Gaming

Corsair Gaming was founded in 1994 and became the pioneer in the segment of high-performance RAM cards. The headquarters of the company is in Vermont, California. Today, this company is the leader in the production of equipment for video games and high-performance streaming. The company offers a whole range of products for gamers, picky PC users, and esports-players – from mechanical keyboards to special PCs of CORSAIR ONE series. Thanks to the cult of quality, unique design, and high performance, the company’s products have hundreds of prizes in the sector. The employees of the company use its products as well.

In 2018, Corsair Gaming started a series of mergings, buying the producer of streaming equipment Elgato Gaming. A year later, it bought Origin Computers that produced game PCs. The same year, it also bought SCUF Gaming – a leader in the segment of game controllers.

Corsair Gaming has outlets and employees in the USA, China, Russia, Great Britain, the United Arab Emirates, and more than 20 other countries. The company’s marketing policy is aimed at the extension of SCUF, Origin, and Elgato to keep old clients and attract new ones. The company owns 212 patents and has 83 more being considered. To get fast feedback from clients, the company moderates the forum on its website.

Main investors and partners

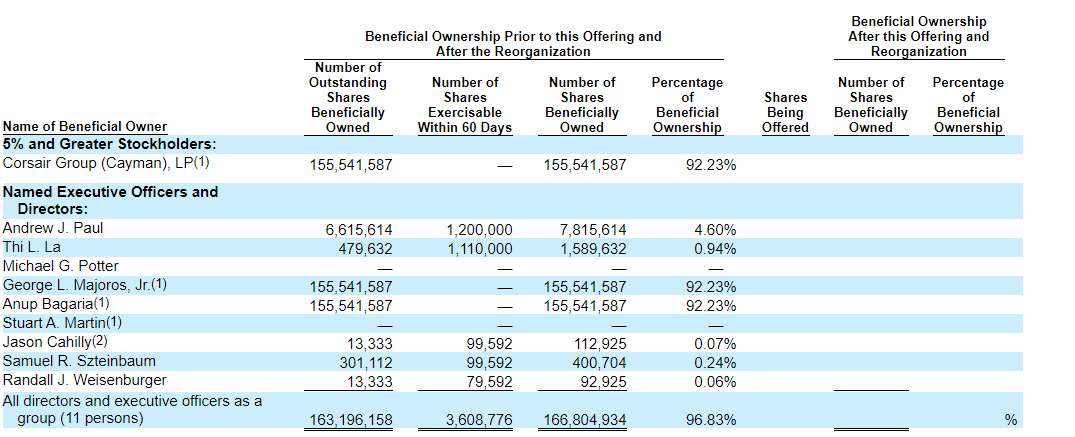

The key investors of the company are George Majoros and Andrew Paul. The former owns 92% of the company’s shares, the latter – 4.6%. After the IPO, these shares will decline to 77% and 4.3%, respectively. The unrolled structure of shareholders looks the following way:

The company carried out 2 rounds of financing for a sum that currently seems ridiculous – 80 million USD – in 2009 and 2013. The main partners of the company are:

- Amazon.

- Best Buy.

- Boulanger.

- Micro Center.

- Ask.com.

- Newegg.

- JD.

- Mindfactory.

- Tmall.

- Fnac.

- Ingram Micro.

The company’s products are sold in 75 countries. Corsair Gaming is closely tied to the world esport community: it supports a game streamer Summit1g, whose YouTube channel boasts over 5 million subscribers, as well as other bloggers and publics on Twitter, Facebook, and Instagram. Thus, it would be hard to find a gamer ignorant of Corsair Gaming.

Main rivals of Corsair Gaming

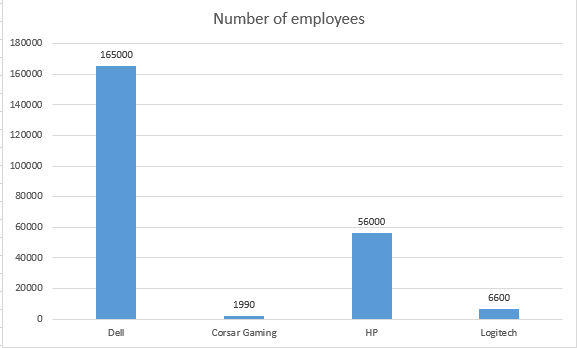

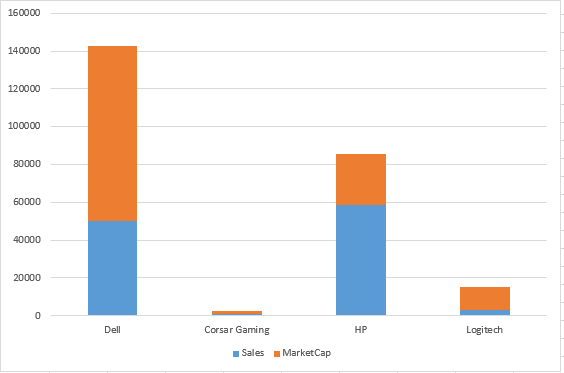

The company works in a market with very tough rivalry: it competes with such companies as Dell, Razer, Logitech, Steelseries, Seasonic, Thermaltake, and even Microsoft. Hence, we can see that the success of Corsair Gaming is explained by its reputation among gamers and esport players. Any mistake may cause huge losses and a loss of their share of the market. If the graphic processor presented earlier turns out a failure, the company will lose trust, which will make its financial results drop. To understand the size of the company, let us compare it to its nearest rivals in terms of the number of employees:

As we see, Corsair Gaming has a lot more goals to be reached: in other aspects (in absolute measures) the picture is more or less the same. We will discuss relative measures when speaking about the financial reports of the company, where the difference is not that prominent.

Market perspectives

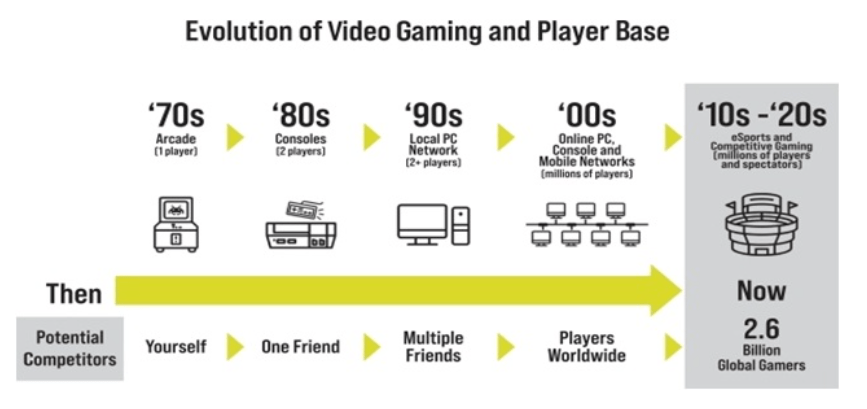

The world market of video games in 2019 amounted to 151 million USD; the forecasts for 2027 promise growth by 12.9% annually on average. Video games become more and more popular every year, and the number of spectators may be compared to that of more traditional sports, such as basketball. The League of Legends world championship in 2019 was watched by 100 million people, while the final of the NBA gathered 5 times less.

In 2019, the number of gamers in the world amounted to 524 million people; about 94 million of them spent over 1,000 USD each on their game PCs. The expenses on paid subscriptions on games were higher than on subscription to music.

The advantages of Corsair Gaming are as follows:

- popularity among the target audience;

- a world network of outlets;

- a differentiated program ecosystem;

- selling both via retail sales channels and directly to the consumer via the website;

- a strong team of top management with rich experience.

Corsair Gaming IPO details

On September 22nd, the company carried out an IPO in the NASDAQ exchange, and on September 23rd, it started trading under the ticker CRSR. It has 91.86 million stocks in circulation.

The underwriters of the IPO are:

- Goldman Sachs & Co. LLC

- Barclays Capital Inc.

- Credit Suisse Securities (USA) LLC

- Macquarie Capital (USA) Inc.

- Robert W. Baird & Co. Incorporated

- Cowen and Company, LLC

- Stifel, Nicolaus & Company, Incorporated

- Wedbush Securities Inc.

- Academy Securities, Inc.

By the IPO, the company plans to attract about 135 million USD with the placement range of 16 to 18 USD per stock. Thus, the capitalization will amount to 1.65 billion USD. The many attracted by the IPO will be allocated the following way: by 86.6 million USD the company will pay of some debts, while the remainder will augment to the working capital and corporate needs.

Financial results of Corsair Gaming

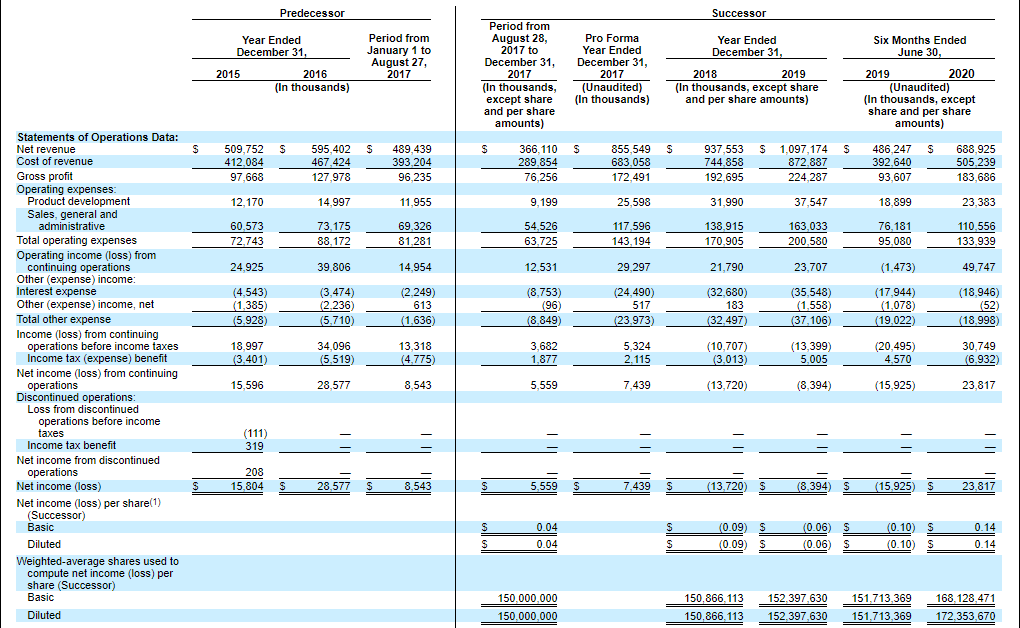

Corsair Gaming provided a full financial report from 2015 through June 30th, 2020.

Based on the data of the first six months of 2019 and 2020, we can figure out the growth by 41.10%: 486.15 million USD against 688.92 million USD. During the last 12 months, the revenue amounted to 1.01 billion USD, which makes the company “very cheap” compared to its rivals.

In 2017, 2018, and 1029, the gross profit reached 20.2%, 20.6%, and 20.4%. Comparing the first six months of 2019 and 2020, we see a gross profit of 19.3% and 26.7%, respectively. Corsair Gaming is making a net profit of 7.4 million USD, 13.7 million USD, and 8.4 million USD in 2017, 2018, and 2019. In the first six months of 2019 and 2020, the net profit was 15.9 million USD and 23.8 million USD, respectively. This means the company managed to cover for its losses and made some net profit. As long as the market is expected to grow to 286 billion USD by 2027, Corsair Gaming looks quite attractive. Judging by all mentioned above, the minimal target of growth for the stocks might be 34-40 USD.

Summary

Corsair Gaming has been in the market for 26 years, the brand is well-recognizable, and the company generates a net profit. This time we are considering not a losing but promising company but a strong player with an immaculate infrastructure of global sales and marketing. The main channel of attracting new clients is social networks, and it was chosen far long before the boom of Facebook, Twitter, and YouTube. This confirms the high strategic proficiency of the team.

As for the financial results, they are also impressive. Both assets and liabilities are growing, which makes the development of the company quite balanced. The net profit during the six months of 2020 is 23.8 million USD, and the revenue for the last 12 months is 1 billion USD and grows by 20% y/y on average.

Beginning the IPO, the company estimates itself for a bit more than its annual revenue, while its rivals demonstrate capitalization of 2-3 annual revenues. Thus, we may call the company underpriced, which creates a more than 100% potential of growth for the capitalization. More than 70% of the stocks are still owned by Corsair Gaming, which means the company will not change its course of development. All this makes the company attractive for investments in the medium and long run.