Bid

Bid is the price of a financial instrument at which there are current purchase orders. It is the best market value to sell a particular asset here and now.

3 minutes for reading

What is a bid?

Bid or bid price is the highest price at which a buyer is willing to buy a particular financial asset. Out of the total number of current offers from the different buyers at different prices, the Bid is the offer with the highest value for the asset. That is, it is the best market price to sell.

How Bid differs from Ask

The opposite of the Bid price is the Ask price, which is the current market price at which sellers are willing to sell the asset. Note that Bid is always lower than Ask. The Ask value reflects the lowest market price at which an asset can be bought from all the currently available offers from the different sellers.

What is Spread?

The term Spread in economics and finance is most commonly used in relation to prices. In most cases, it refers to the price difference between the same asset or similar financial instruments. Spreads are usually valued in points, but can also have a monetary value.

There are bid-ask spreads, yield spreads and calendar spreads in exchange trading. The Bid-Ask spread is the difference between the best bid and ask prices at a particular time of trading.

Spread can be floating or fixed. The first option is the most common in the financial markets. The value of the floating spread can vary depending on the liquidity of the asset: the lower it is, the higher the spread, and vice versa.

The spread tends to increase at times of increased market volatility, which is usually associated with the release of important news or macroeconomic indicators. When the volatility subsides, the spread returns to its minimum values.

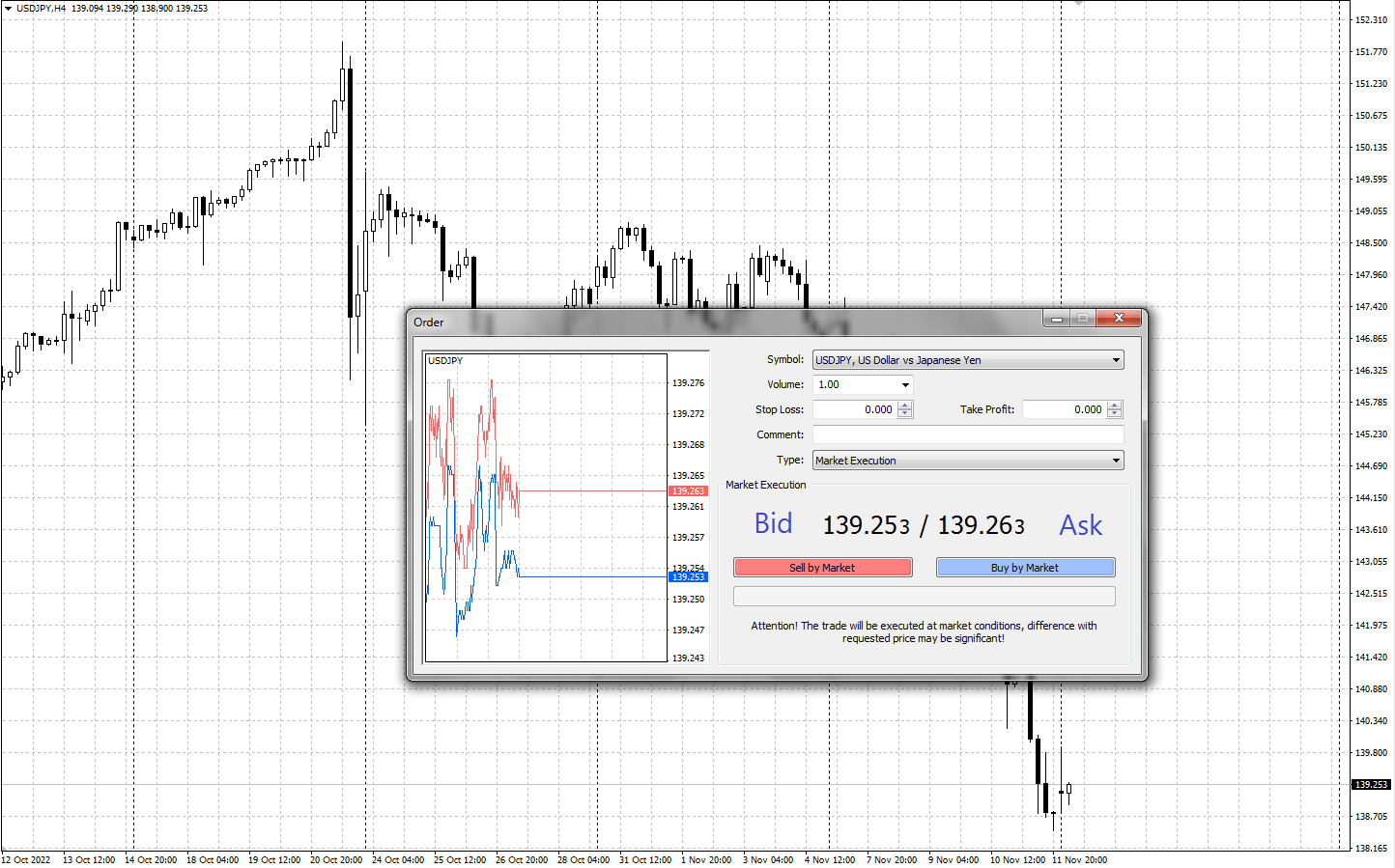

Example Bid, Ask and Spread for USD/JPY

Forex is an international foreign exchange market that reflects the current dynamics of foreign exchange trading. One of the popular and sought-after currencies in international trading is the Japanese Yen (JPY). At the time of writing, the currency pair USD/JPY was quoted at 139.253 / 139.263. The Bid price is on the left, and the Ask price is on the right.

Spread = Ask - Bid = Spread

139.263 - 139.253 = 0.01 JPY

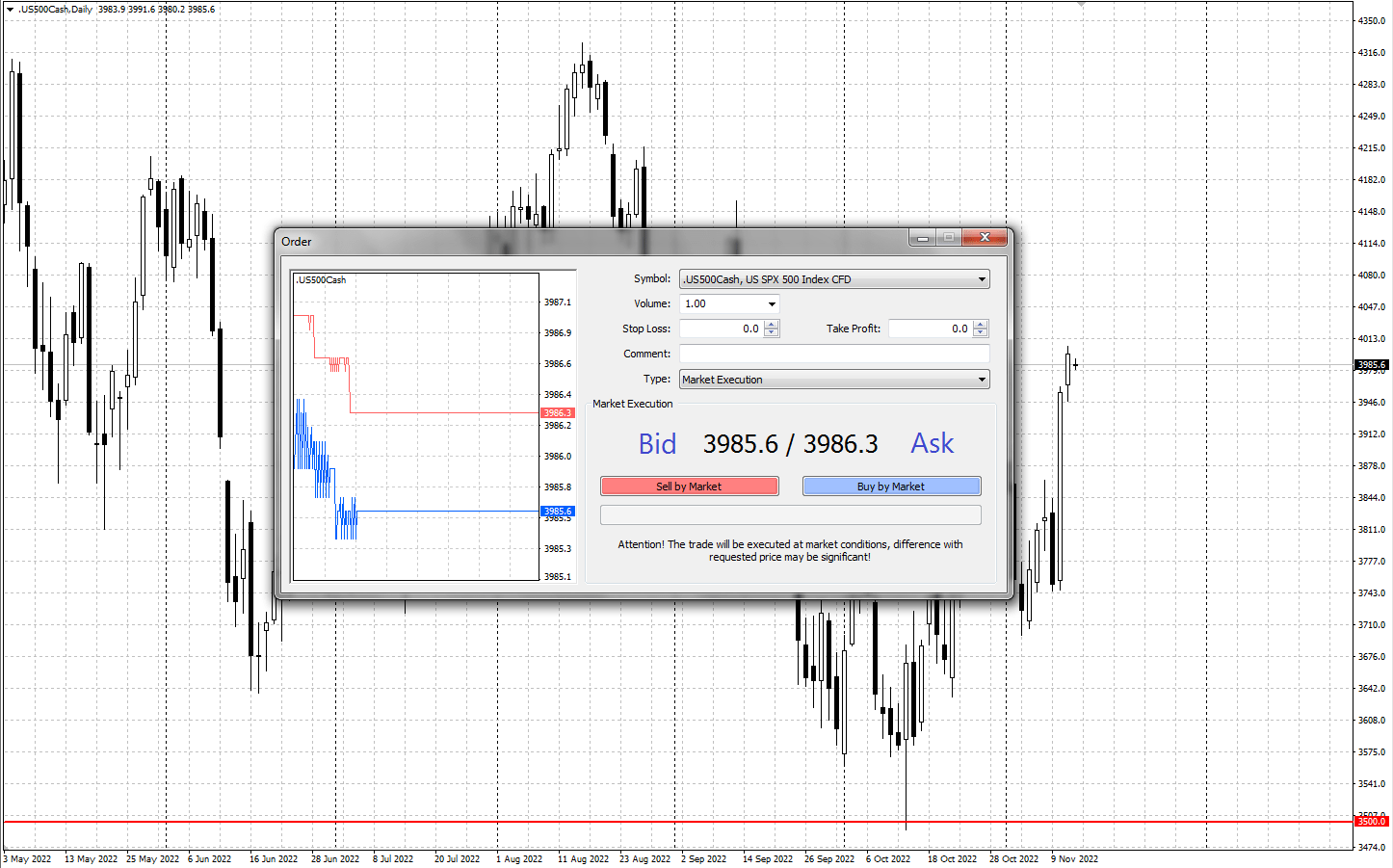

Example Bid, Ask and Spread for the S&P 500

Another popular financial instrument in global trading is stock indices. They are traded as futures, options, ETFs and CFDs. At the time of writing, the popular CFD on US stock index S&P 500 is quoted at 3985.6 / 3986.3.

Ask - Bid = Spread

3986.3 - 3985.6 = 0.7 USD