Where is the S&P500 High?

6 minutes for reading

The last week Fed meeting decided on the key short term interest rates. The market players are always eying this event, focusing on the future economic outlook commentary.

Monetary policy of Donald Trump

President Trump is all for low rates: this boosts the stock market, which Mr. President sees as one of his major successes. To that end, he even replaced Janet Yellen, the old Fed governor, with Jerome Powell. The latter, however, is also for hawkish policy, for which he got a few times criticized by Trump.

Rate hikes usually lead to dollar spikes, the greenback already being near its highs against all major currencies. Tariffs against some countries lead to those countries depreciating their domestic currencies against the dollar. The expensive dollar is thus very bad for the exported goods, as those goods lose the competition against similar ones coming from other countries. In this light, large corporations start opening factories away from the US. Tesla is one of the best examples here. While the US and China are fighting their trade wars, Tesla is already manufacturing electric cars in Shanghai in order to avoid the tariffs.

Trump is overall successful in controlling the rates, which allows the stock market to rise further, but for how long this is going to continue yet remains to be seen.

From 2009 to 2015, the Fed rate was permanently at zero. The US economy, meanwhile, went up drastically like an athlete that took a boosting drug right before the race.

The Fed then had to hike the rates in order to cool things a but it down. In other words, the booster stopped working, and the athlete slowed down.

The first hike came in 2016, but the traders did not react much; the market yet slowed down, probably because of the presidential election. Then, Trump, as a businessman, started supporting his peers. This boosted the market again, with the loaned cash still very cheap.

The prices did not rise at the same pace as before, though. From 2009 to 2016, the cheap money boosted the S&P500 by 260%, while in 2016-2018, it rose by only 30%. In 2018, the rise finally stopped, even while the Fed stopped the rate hiking. Meanwhile, the investors reacted negatively to the latest Fed meeting results, although there was no hike and a hint for no hikes till 2021. The S&P500 ended the trading session with a fall. What happened is probably the following: the athlete already reached the finish and is having rest before a new race.

Earnings boost for the US largest companies

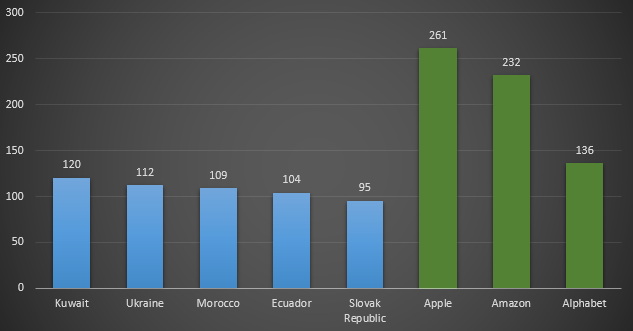

See how the largest companies' earnings have been boosted. For instance, Amazon (NASDAQ: AMZN) got $34B in 2010, and over $232 in 2018. Alphabet (NASDAQ: GOOG), meanwhile, has $29B against $136B, and Apple (NASDAQ: AAPL), $76B vs $261B. The list goes on and on, the point being that some company's earnings are already higher than the GDP of many countries.

The companies have spent a record amount of money on their shares buyout, which means the cash is redundant. For instance, Delta Air Lines (NYSE: DAL) spent $1.30B in 2019, while Chevron I (NYSE: CVX) plans to spend $4B, and eBay (NASDAQ: EBAY), $7B. The stocks may thus be up just because there are fewer outstanding shares.

The companies are virtually unable to beat their own earnings records, so they have to limit the number of outstanding shares in order to increase the EPS. When a company runs an IPO, it sells only around 10% or 15% of the total amount of shares, so when the investors buy them out they get only a tenth of the total company's yield. When a company runs a buyout, however, the bought securities are deemed void, which means the yield for the investors increases. So even while the indices stop rising and slow down the companies, the major shareholders won't suffer too much.

Getting back to our athlete example, the situation is the following: the athlete has already crossed the finish line, but they tell him to continue running, while the boost drug is already out and there's no energy left. In this case, one had better left the athlete alone rather than make him continue the race.

Growing crisis

Since 1990, a financial crisis occurs every 10 years. Those 10 years have already passed since 2008, and next year the US are having president election again, which puts the market under additional pressure. As it turned out, people don't pay so much attention to the Fed rates anymore. Even if it were dropped to 0.25 percent once again, the effect would be very short term, after which the market would soon recover.

With the dotcom crisis in 2000 and the mortgage one in 2008, it was always due to a single sector. The speculators are much more experienced nowadays and don't put everything into a single niche; rather than that, they prefer inflate the overall economy with the cash. What will come out of it is a good question. Every time a crisis occurs, nobody is ready and knows how to deal with it, or at least so they say. In fact, those who can control the situation just don't want to do so: every crisis makes the rich even richer, and the poor, poorer, so why ever change that?

Now let us look at the S&P500 chart. 2018 was a very difficult year for the major index. In early 2018, the S&P500 lost 11% and it was not until October when it recovered. Another fall followed, this time by 21%, and the market has not recovered yet. Meanwhile, we can also see the volatility increased over 2018, which means the uncertainty is great. The S&P500 has some chances to test 3,000, but even in case it happens, this would not be the best time to go short.

Conclusion

While the Fed rate is not at zero, the regulator is unlikely to plan any hike before 2021. When the dotcom crisis occurred, the rate was at 6.50%, while during the mortgage crisis, it went from 5.25% to 0.00. Currently, it's at 2.50% and the Fed is definitely not going to take it down. This all does not mean you should just go and sell out your portfolio, but being ready to do so at some point in time might be a reasonable idea.

Even while the stock market is getting ready for a plunge, one may find some small companies that are able to make a good bounce. If you are interested, you can start from those with low P/E and PEG.