Uber IPO: What's the Price?

4 minutes for reading

The investors have been eyeing the Uber IPO, which will take place in the NYSE (ticker symbol: UBER)on May 9, over the last few weeks.

The starting price is somewhere between $40 and $55. With around 180M shares to sell, the company is going to raise about $9B. The lockup period, during which the investors won't be able to sell the shares, is set to 180 days.

This is one of the greatest IPO's run recently, although it won't of course break the records set by Facebook (NASDAQ: FB), VISA (NYSE: V), and Alibaba Group (NYSE: BABA), which raised 16B 18B, and 25B dollars, respectively. The Uber market cap may meanwhile reach $83.85B.

The largest investors are, currently, Softbank (16.30%)m Benchmark venture fund (11%), Garret Camp), the Uber co-founder that also manages Expa venture fund (6%), Travis Kalanick, another co-founder and the former CEO (8.60%), the Saudi Arabia State Investment Fund (5.30%), and Alphabet (NASDAQ: GOOG) (5.20%). Besides, the Uber management has also recently mentioned PayPal Holdings, which is ready to invest $500M. Another $1B will be spent by Toyota Motor (NYSE: TM), Denso Corp, and Softbank Vision Fund.

The first Uber's trading session may be quite successful, especially with many drivers getting loyalty bonuses that can be changed on shares. With lots of people buying Uber shares this way, the stock is quite likely to head up.

Uber has so far established its presence in over 70 countries, with around 91M users. Apart from taxi services, it also offers bike rentals, food delivery, and shipping. Uber's revenue has increased threefold over the last three years, from $3.80B to $11.30B. The company did not hit profits, however, suffering an operational cost of $3.03B in 2018.

In Russia, Uber partnered with Yandex.Taxi, with 59.30% share, but this also resulted in losses at around $42M.

What Are the Risks

In 2018, the active user increment slowed down by 20%. The Uber management says the operational costs will be getting higher, as the company is investing into driverless cars and is unlikely to start getting profits in the nearest future. Another risk lies in the regulations pressing on the business; namely, the government may force the drivers to become Uber employees: such laws are being developed in the US and some other countries.

Uber's reputation is also under threat, with the competition doing a lot of job to tarnish it. The point is that Uber's clients pay less, which drives a lot of users off other companies and services, the latter making every effort to get Uber banned in their country.

Conclusion

Uber gained global acknowledgment and is expanding its business. The shareholders are unlikely to be optimistic about the company's failing to get profit, and they will push Uber to increase the rates. Thus, those who are using Uber should get ready to higher prices that may get in place quite soon.

The company drove a lot of attention to its IPO, the drivers playing not the lesser part here. Meanwhile, Uber has around 3M employees, who also spread the information about the company.

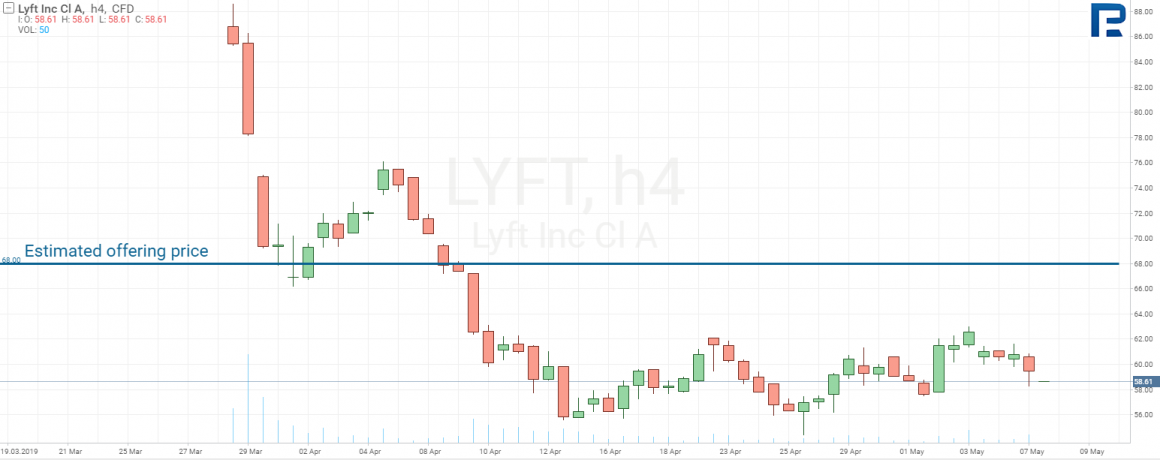

PayPal, Toyota Motor, Denso Corp, and Softbank Vision taking part in the IPO will motivate the investors, which is going to be quite positive for the stock. A too large price may also be not quite good, though. In March, one of Uber's competitors, Lyft (NASDAQ: LYFT) gos listed on the NASDAQ. While the start price had been supposed to be around $68, it was actually $87, which soon lead to the stock falling to $60. Now LYFT accuses Morgan Stanley of allowing some clients to sell the shares during the lockup period (which is strictly forbidden), while those were still expensive.

Therefore, it is important what the Uber start price is going to be. In case it's around $40 or $55, the stock may well rise, thanks to the large investors.

With a much higher starting price, the Uber stock may do the same what LYFT's did.

Uber Stocks in R StocksTrader

If you are interested in trading Uber Technologies Inc. stocks, then you can do it in the multi asset platform R StocksTrader. Uber stocks are available there from the very first trading session on May 9th 2019 .