Pfizer Stocks Decline by 10%. Are They Worth Buying?

8 minutes for reading

Falling of Pfizer stocks in April 2019 was used by investors as a good chance to buy them. This time the stocks have fallen again, so let us try to figure out the reasons for this as well as the perspectives of long-term investing in them.

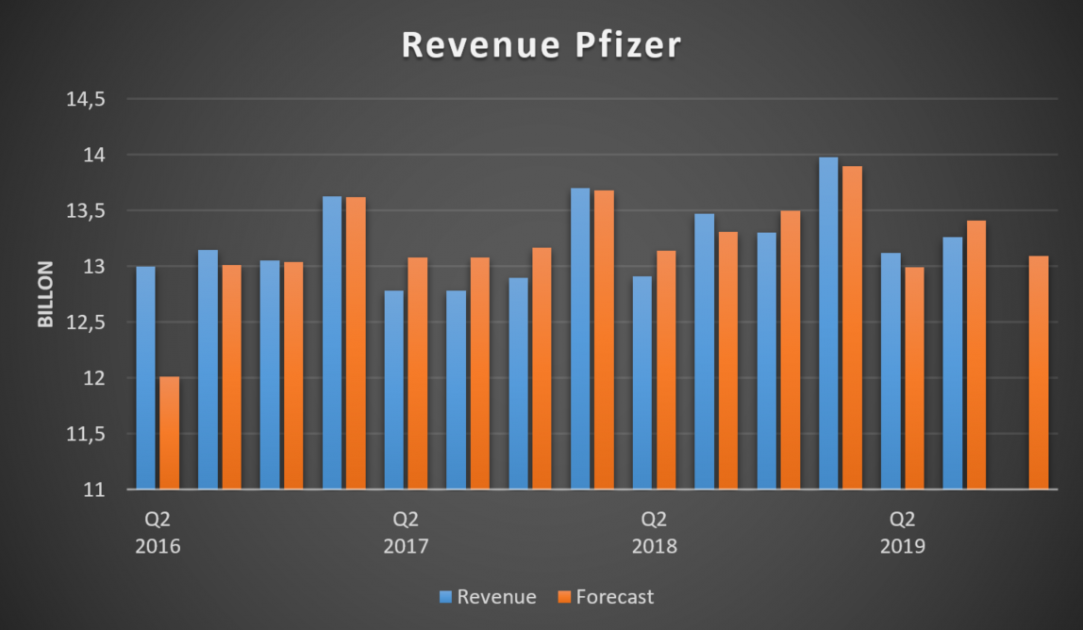

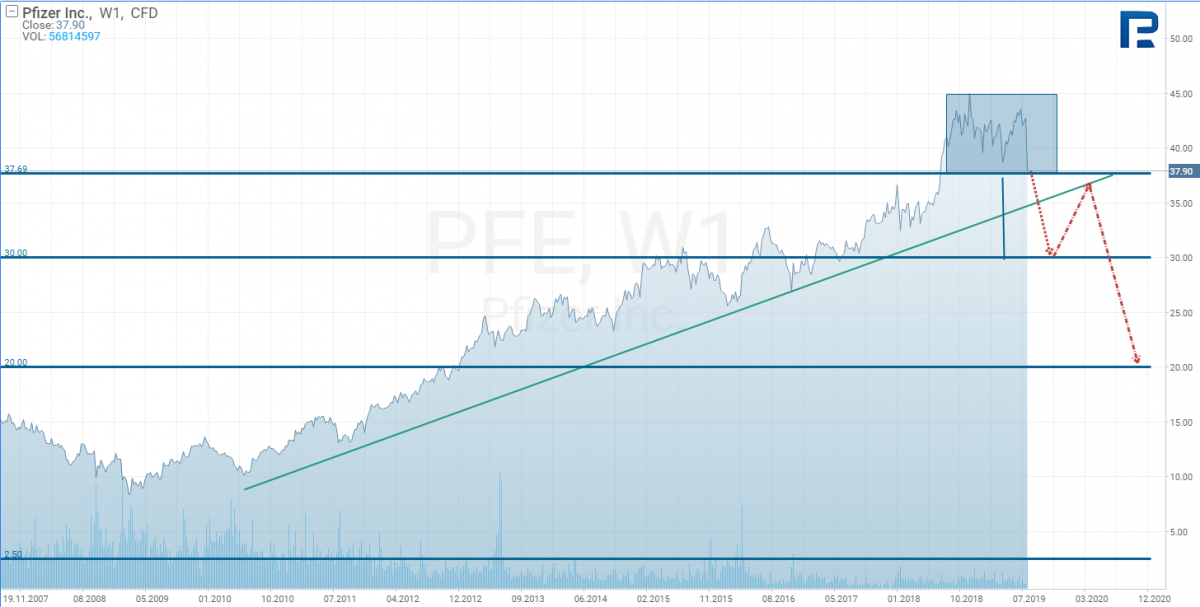

Last week Pfizer (NYSE: PFE) stocks dropped in price abruptly. The day when the decline started was the day when the company reported the results of its financial activity in the second quarter of 2019; the income of the company reduced to 13.26 billion USD, compared to 13.47 billion USD in the same quarter of 2018; the return on stock reduced from 0.81 to 0.80 USD. The company's revenue was declining before, but the market has never reacted on it so acutely as now.

The current situation was also influenced by the fact that the company failed to meet the market expectations of its income. As a result, the present decline may be explained by this as well as by the forecasts for the next quarter, where further decline is expected. In the end, the current price of the stock does not look attractive for purchase; however, we should better look at the situation from a wider perspective.

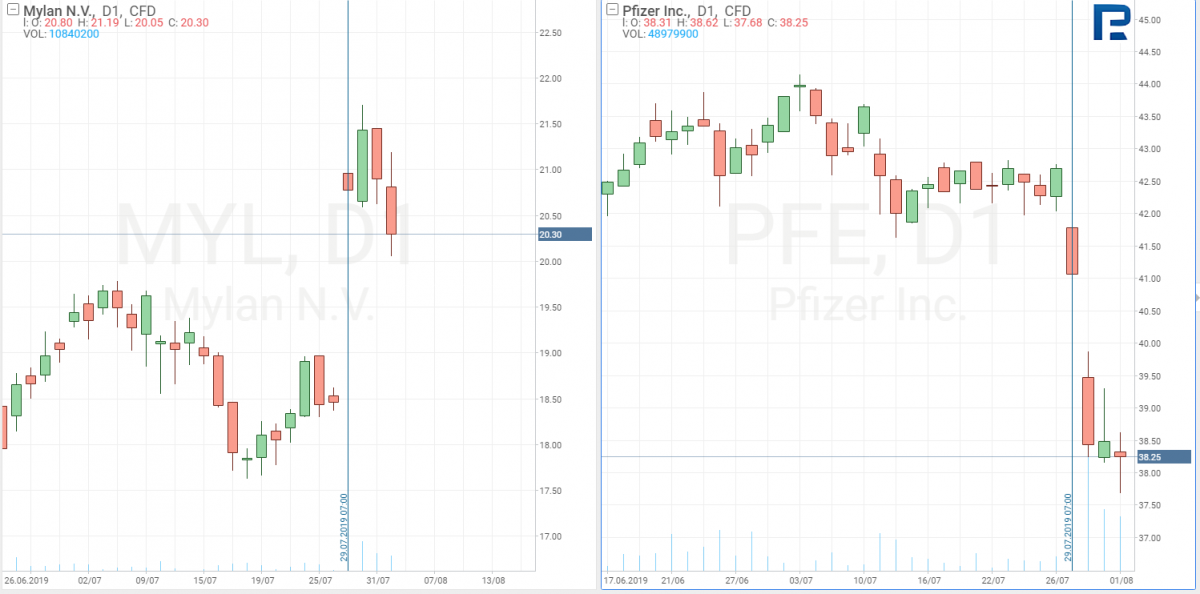

While Pfizer stocks keep declining by more than 3% after each trade session, Mylan (NASDAQ: MYL) stocks that were experiencing a long-term decline since 2015, have begun growing abruptly.

If we have a look at the Mylan revenue, we may say that here it has also become the catalyst of growth after it surplussed the forecasts, which were around 2.81 billion USD, while in reality, the company earned 2.85 billion USD. However, in fact, the two rivals, Pfizer and Mylan, have become strongly connected, attracting public attention; this was the major factor of the changes in the stock prices. But let us proceed step by step.

Pfizer and Viagra

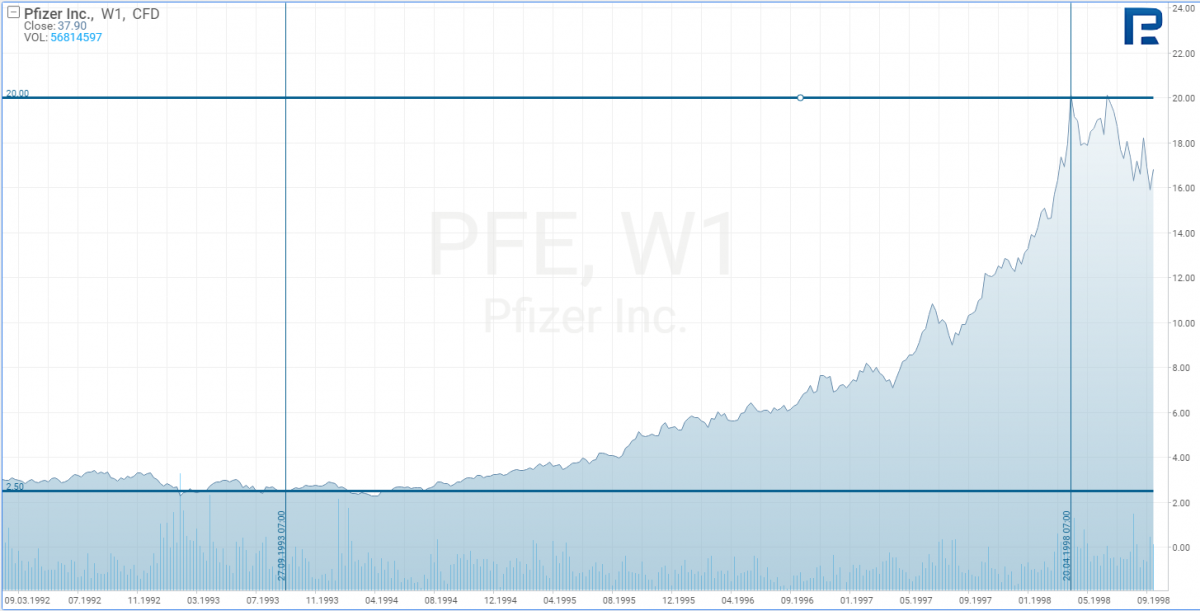

The steep growth of Pfizer stocks began in 1993 when the public heard about the company's development of the Viagra drug. This was the drug that made Pfizer famous, becoming a catalyst of the stock price growth, which was by more than 800% in the 5 years.

However, the patent for Viagra has expired, and rival companies have started creating their analogs, competing with Pfizer. They have managed to capture their part of the market thanks to lower prices, and Pfizer revenue dropped. Yet another blow was the expiry of the patents for Lyrica, Lipitor and Celebrex. All in all, the competition became tougher on the company, as smaller enterprises are now able to produce similar drugs with lower expenses.

Upjohn

Lately, the countries of South-Eastern Asia have been generating the biggest part of Pfizer income; however, there emerged a lot of fake drugs under same names, and the clients failed to distinguish them from original ones. In the end, Pfizer decided to rely on the original product with a recognizable name, which will help clients recognize fake drugs. So, Pfizer created a branch company called Upjohn with the headquarters in China, that devoted itself to packing older medicines which patents expired. However, the price turned out the major factor for the clients, and the Upjohn income in the second quarter of 2019 also dropped by 7%. In other words, the idea did not come true as it had been expected by the Pfizer management, and they are now uniting Upjohn with their competitor Mylan. As a result of this merging, there will appear another global pharmaceutical company on the market with the estimated annual revenue about 20 billion USD, while Pfizer stockholders will keep 57% of stocks of the merged company. By this uniting, the Pfizer management is planning to take some load off the company. It reminds of an athlete who was running with a 20-kilo load, and then they allowed him to take it off. In the short term, this should help the company; unfortunately, investors took the news negatively as they look in a farther perspective. As a result, Morgan Stanley, Merril Lynch, JP Morgan and Credit Suisse changed the position of Pfizer stocks from "buy" to "hold". We do not know whether the Pfizer management expected such reaction, but in their talk to investors, they mentioned that the company is experiencing adverse effects of competition, strong dollar and the strained relationship between China and the USA. That is why the company is trying to diversify its business, buying other enterprises.

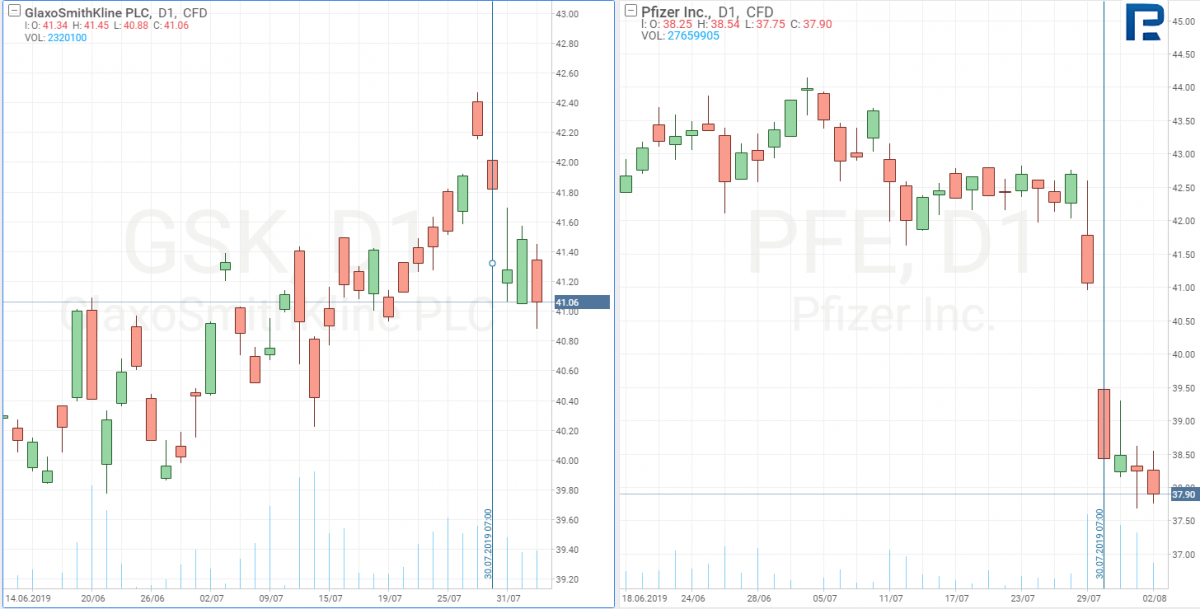

Merging with GlaxoSmithKline

On July 30th Pfizer has completed merging with GlaxoSmithKline (NYSE: GSK), the enterprise owning such brands as Sensodyne (toothpaste), Voltaren and Panadol (pain killers) as well as Centrum and Caltrate (multivitamin complexes). Annual revenue from these brands amounts to 11 billion USD. Pfizer will own 32% of the united company, which may enhance its financial results in the future. However, investors took this news negatively, too, which was reflected by a further decline of Pfizer stocks and falling of GlaxoSmithKline stocks as well.

Anyway, the merging of Upjohn with Mylan was taken by the Mylan investors and shareholders with genuine joy, which was reflected in the short-term growth of the stock price. At least, support at 17 USD per share was formed, and later the growth was followed by increased volumes.

Mylan N. V.

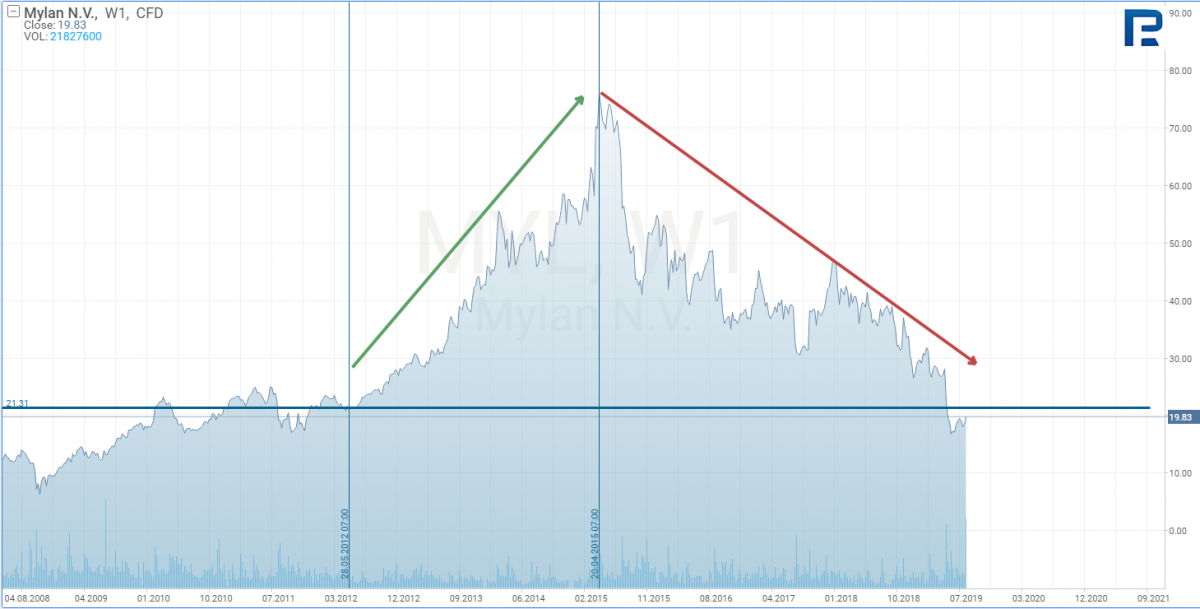

Mylan has been in multiple trouble lately, which is obvious if we have a look at the stock price chart.

The swift growth of the price for the drug EpiPen, as well as an investigation of the overpricing in the genetic medicine industry, has had an adverse effect on Mylan. In 2012 Heather Bresch, daughter of Senator Joe Manchin III became executive director of the company. Most probably, having acquired her father's support, she started raising prices for drugs at once. For example, the price for the anti-allergy drug EpiPen, that could save the life of a person in case of an acute reaction, grew from 94 USD to 600 USD; however, even with a price that high its sales did not drop, because sometimes a human life depended on this drug. Thus, people had just to increase their spending. Naturally, the company's revenue increased, and its stocks began steep growth, their price tripling from 2012 to 2015.

However, at the end of 2016, the Congress began an investigation of the price formation in Mylan, resulting in a 465 million USD fine. In 2015 the stocks stopped growing and a downtrend began, bringing the price to the level of 2012 when Ms. Bresch came into office. Call it a coincidence, but she is resigning now, her place taken by the head of Upjohn Michael Goettler. The merging of Upjohn and Mylan could have no effect if Ms. Bresch remained in office, that is why her resignation at the moment of the merging was taken positively by the stockholders who had not always been happy with her managing strategy. For example, her decision to move the headquarters from Pennsylvania to the Netherlands just to cut down the tax expenses and block the merging of Teva Pharmaceutical Industries Limited (NYSE: TEVA) had a strong effect upon the stockholders' trust to the executive director.

Technical Analysis of Pfizer

For Pfizer, the situation is quite sad: the decrease of revenue, the increase of competition, the decrease in the ratings of the leading banks are pressing upon the stocks, and it is really dangerous to try to buy at this decline. On the chart, there has formed a reversal pattern Double Top. A breakthrough of 38 USD may signal further decline of the stock price, aiming at the support at 30 USD per share.

Technical Analysis of Mylan

The Mylan stocks are trading in a downtrend, the news about the merging did not change much on the chart. In the current situation consolidation of the price in the range between 22 and 17 USD is possible. However, a breakaway of the descending trendline may signal the growth of the stock price, aiming at the resistance around 28 USD.

Summary

In 2020 there will be presidential elections in the USA. Judging by the previous years, the stock exchange indices may trade in the range until it is clear who will come into power. The current election race will be tough for pharmaceutical companies, because some of the candidates, Bernie Sanders being one example, may base their campaigns on the reform of healthcare. His speeches have already sent the whole sector down. What is more, Donald Trump keeps trying to reform the system, though he is yet unable to find an alternative to Obamacare. It is hard to predict future statements, anyway, it is going to be really risky to buy stocks from the healthcare sector. Hence, the investors are likely to try to avoid the risk, selling the stocks, which may entail their decline. During the last 6 months, the healthcare sector stocks are trading at the 8th place out of 9 with regard to the revenue. That is why at the present moment it is too risky to consider the current decline of the Pfizer stocks as a good entrance point for buying. As for Mylan, we had better waited for the report on the third quarter, as the upcoming months are going to be a probation period for the new executive director. The investors will evaluate the efficiency of his managing style, so I would consider a possibility to work on the declining of the healthcare stocks.