EA Test Drive: Greed Advisor

5 minutes for reading

Greed Advisor is, no doubt, a pretentious name. According to the developer, this advisor is meant for especially greedy traders. However, the similarity of “greed” in the name to a “grid” is also worth mentioning, because its algorithm includes forming a grid-like series of trades.

Greed Advisor is a flexible grid advisor, the principle and the goal of which is reaching your set and desired everyday profit. It is also worth remembering that in order to make a profit the robot uses Martingale principle to escape slumps for its aim is to finish a series of trades with a profit. The risks of the Martingale to be kept in mind. In other words, this advisor suits those who do realize what is going on and what they need the advisor for.

Short description of the Greed Advisor

- Name – Greed Advisor

- Price – free

- Year of issuing – October 2017

- Recommended currency pairs – any

- Recommend timeframe – H1 (other possible)

- Working hours – 24 hours

- Recommend broker – RoboForex

- Recommended deposit – 10,000-20,000 cents, i.e. $100-200

- Recommended leverage – from 1:100

- Minimal lot – 0.01

- Revenue – 50-100% a month

Peculiarities of the EA

- Grid, martingale

- Stable

- Does not require constant control

- Suitable for beginners

The advisor algorithm logic

A standard signal for the advisor to start working is a breakaway of the previous day maximum or minimum by the price. It may not happen every day, so orders do not open every day either.

When the price movement overcomes the previous day maximum, an order to buy opens. The best result of this trade will be reaching the level of planned profit that can be specified in the advisor settings, but this does not happen all the time. Realizing the risk (probability) of a trade (series of trades) result in a profit, the robot places a suspended order (series of orders) right after the initial one was open at a distance set by the trader. The purpose of this is to ensure the trader’s deposit if the trade goes in the opposite direction. In other words, the second (follow-up) trade, moving in the direction of the initial one, may not only help compensate for the slump from the latter but also reach the planned profit. It should be noted that the advisor settings allow for placing up to 12 supplementary trades for averaging and subsequent bringing of the series to a profit.

Apart from this, for any subsequent order, you can specify the distance and the direction of the trade as well as the multiplier, i.e. the Martingale model may be applied. What else is curios in the work of the advisor is that it will keep working until it reaches the desired profit, processing new signals on and on. You only have to care about the sufficiency of your resources. What lacks in the advisor is the possibility to work with differently directed trades. This means that after a breakaway of the previous day extreme and opening a trade, the direction is fixed and will not be changed until the set goal is reached, while other trades will be just ignored by the advisor. Of course, this might be considered a drawback, but some will say it is an advantage, reducing potential risks.

While the general principle is easy to capture, setting up the grid of orders needs a more detailed talk.

Example #1

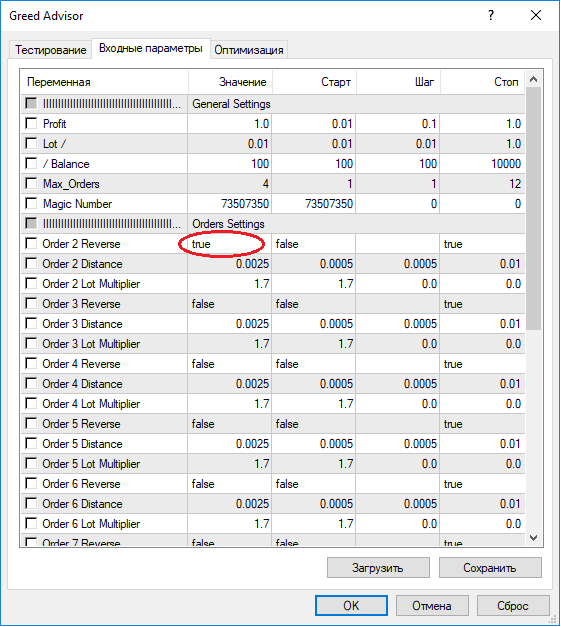

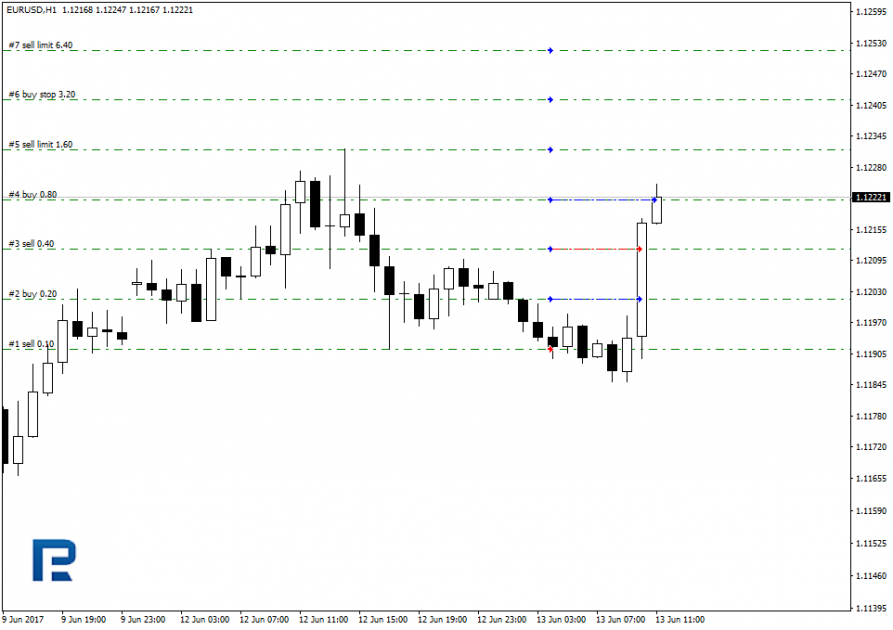

The price has overcome the maximum of the previous day, a selling trade is open, a k number of orders is placed at the n distance from one another, each order may be given a multiplication factor in relation with the volume of the previous trade as well as each order may be given a direction either the same with the initial trade or opposite. This is a general principle. In our example, upon opening the trade, some sell limit orders were placed above it, the multiplication factor for each next order being 1.7 of the volume of the previous one.

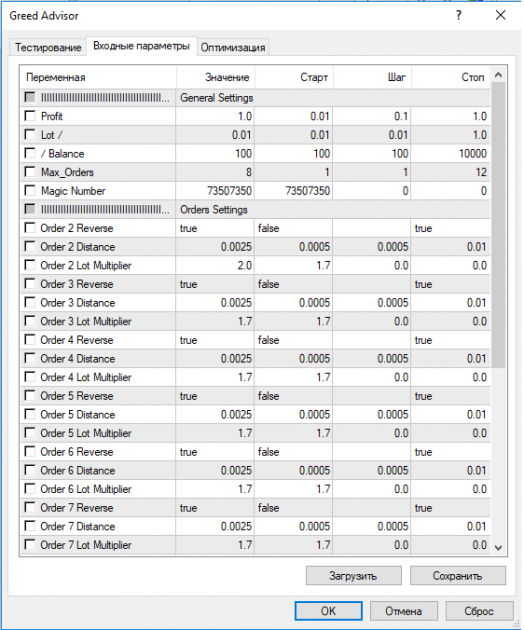

Example #2

After a breakaway of another day maximum and opening a buying trade, a series of pending orders were placed below, the volume of each next order being larger than that of the previous one, but all of the orders are directed not “up” but “down”, to selling.

This has become possible after we changed the value of the setting Order 2 Reverse from “false” to “true”.

This way, subsequently setting Order Revere as “true”, we can get a series of orders with changing directions of trades. In other words, the changeable parameters Order Reverse, Order Distance and Order Lot Multiplier are based on the parameters of the previous trade in accordance with the Martingale principle.

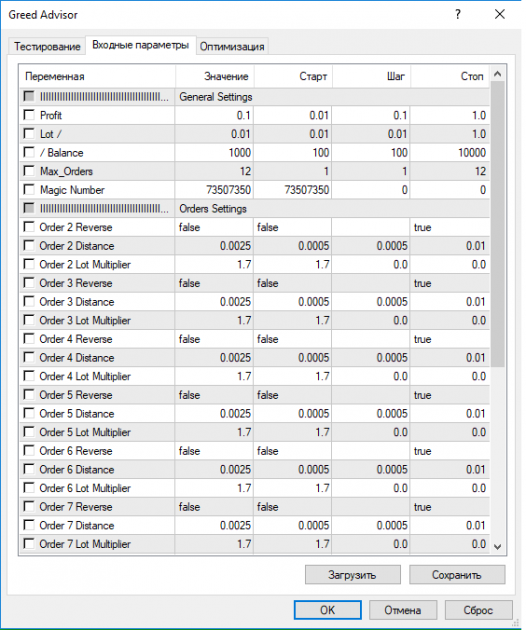

Example #3

Greed Advisor Settings

- Profit – objective daily revenue in % of the deposit (1=1%)

- Lot – the initial lot on each Balance of deposit units (0.01…)

- Balance – the size of the deposit meant for a Lot ($100…)

- Max Orders – maximal number of simultaneously open orders (1-12)

- Magic Number – the unique number of the orders of the advisor

- Order (#) Reverse – to open an order in the same (false) or opposite (true) direction with the previous one.

- Order (#) Distance – after which number of points an order is to be opened (0.0001 = 1 Point)

- Order (#) Multiplier - lot multiplier

- Testing and optimization of the advisor

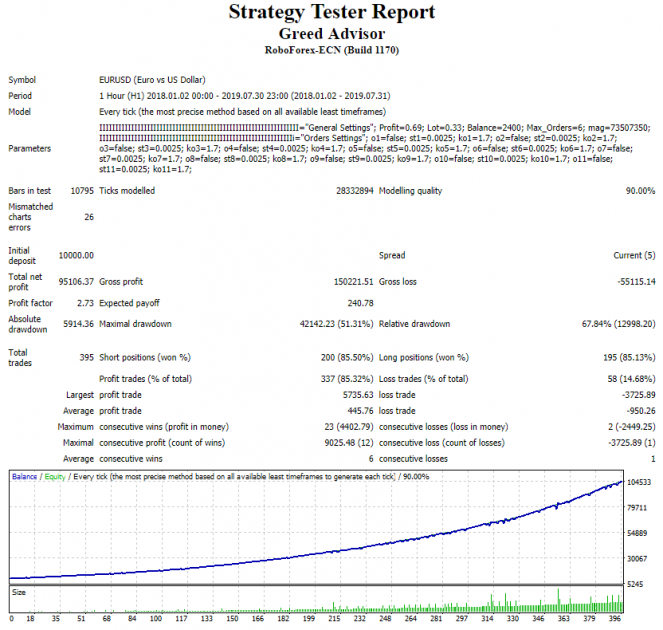

- After testing the advisor with default settings

the following dynamics of the deposit growth might be seen

however, such a result may be unstable in the long run. To find more optimal parameters of trading, the settings and variables of the advisor should be revised

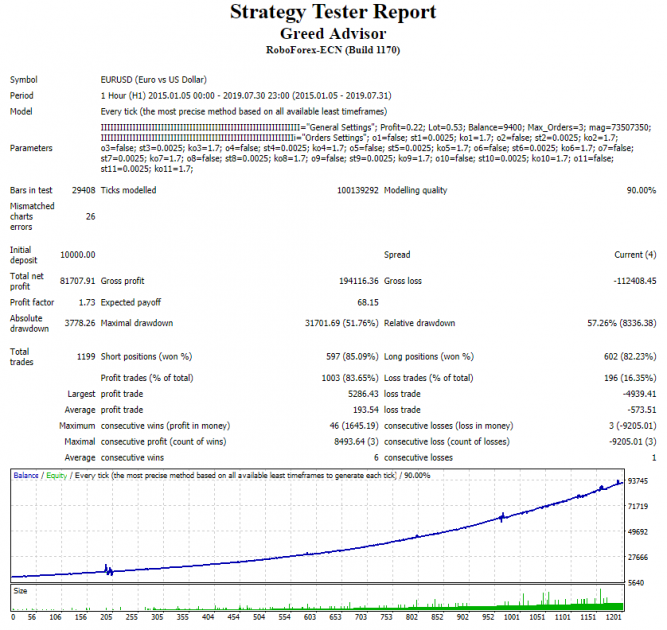

On a longer timeframe, testing yielded good results, which do not guarantee but may have a positive influence on trading. The level of the maximal slump should be noted – it is slightly over 50%. So, before using the advisor in real trading, test it on different instruments and timeframes carefully.

We wish you successful trading!