Cloudflare: Technology Company Preparing IPO

8 minutes for reading

Speed is, perhaps, the one thing that can yield millions in the modern world. Speed lets us save our most important resource, which is time. As for business, every saved minute allows earning millions. Let us go, say, 15 years back and imagine that there emerged such an Internet shop as AliExpress. At that time, my Internet speed was about 1 Mbit/sec, access via DSL (landline). Finding a product and checking its characteristics would require no less than 5 min; remember that then we had to pay for the time spent online. In the end, it would turn out to be cheaper to buy the product offline than on the net. For the business, this means losing clients and restricting the number of purchases a day by the speed of the Internet. As the Internet speed grew, online shops started capturing the market and creating a serious rivalry with offline shops, which made the latter create their own websites for selling their goods.

We are so used to fast Internet nowadays that if a website takes 5-10 seconds to open, I can change my mind and choose another seller. In the end, the one who can provide the quickest Internet access to their website gets the client. Well, the Internet speed has grown but certain websites take longer to open than others, though everything about them seems the same. It turns out that even at high speeds there is a possibility to reduce the time that a website takes to open. And here, Cloudflare appears on the scene.

Cloudflare Inc.

Cloudflare Inc. is an American company founded in 2009. Its business is web safety and web infrastructure, content delivery network services, protection from DDoS attacks and access to DNS servers and resources. Cloudflare stands between website visitors and the hosting provider of the Cloudflare user, acting as a reverse proxy server for websites. According to the data of the SolveDNS website, Cloudflare has one of the highest speeds of DNS search in the world, which allows the client to access the website as quick as possible. Cloudflare provides its services to more than 20 million websites, reducing the response time to less than 100 milliseconds for 98% of users in the developed countries. To imagine this speed, just blink. It will take you 4 times longer than the response time. For businesses, such a speed increases conversion and, hence, profit.

Additionally, the company provides protection from DDoS attacks. In 2013, the company managed to protect the Spamhaus project from an attack as powerful as 300 Gbit/sec, which at that moment was the largest DDoS attack in the history of the Internet. All in all, with Cloudflare a company gets a high speed of access to its website and protection from DDoS attacks, often used by its competitors.

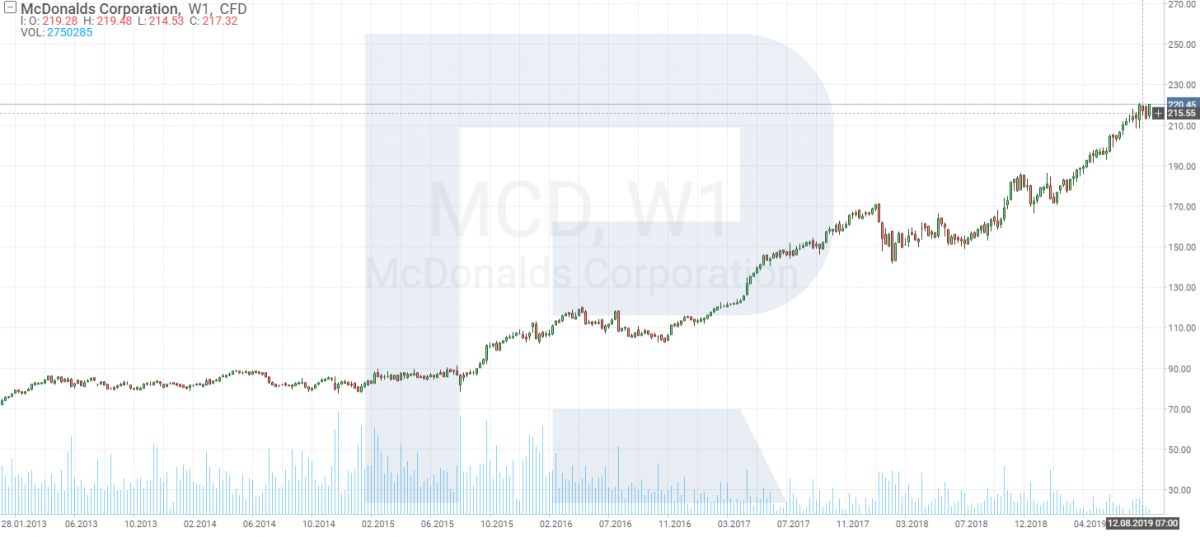

As for the speed of client services, a good example will be McDonald's (NYSE: MCD). They do everything to reduce the time of serving food to the client. Finally, the client came to be the weak link, and the company is now offering sets, analyzing your previous orders, time of the day, the weather, etc. The stock chart demonstrates the efficacy of such an approach.

If Cloudflare works in the same sphere (increases the speed of access), it is highly probable that the company will develop further and increase the number of paying clients.

Democracy with Cloudflare

Now let us have a look at the principles of democracy, followed by the company management. Democracy has good aims but the reverse side of the medal is chaos. The company has always been devoted to the principles of freedom of speech, giving a word to everyone and not interfering with the process. In other words, Cloudflare provided technical support (DNS routing and DDoS protection) to everyone who asked, regardless of the content on the supported website. I will not name certain websites here in order not to advertise them, but I will say that freedom of speech may be of various nature. Some speakers are benevolent while others are acting out of hate, however, all have the right to speak up.

As a result, the company has been providing its services to hackers, neo-nazis, terrorist groups, and other threatening organizations. According to company management, law-enforcement agencies have never required to stop providing services to this or that organization. The situation became acute when one of the company's clients started posting some materials with mass shootings in the USA, mosque shooting in New Zealand and child pornography. The company had to break its own rules and stop working with some of such websites. However, later it started highlighting that Cloudflare is not responsible for any of the content on the websites and have no right to decide which is good and which is bad as this is the responsibility of law-enforcement agencies and the justice system.

Anyway, companies are managed by people who have their own views and opinions. As a result, certain corporate clients refused to work with Cloudflare just because it provides services to some organizations they do not want to work on the same platform with. However, more important steps of Cloudflare, aimed at helping those who are eager to deliver their information to the public with noble goals, are also worth mentioning. Cloudflare has launched Project Galileo, protecting "socially important" projects from periodic DDoS attacks for free.

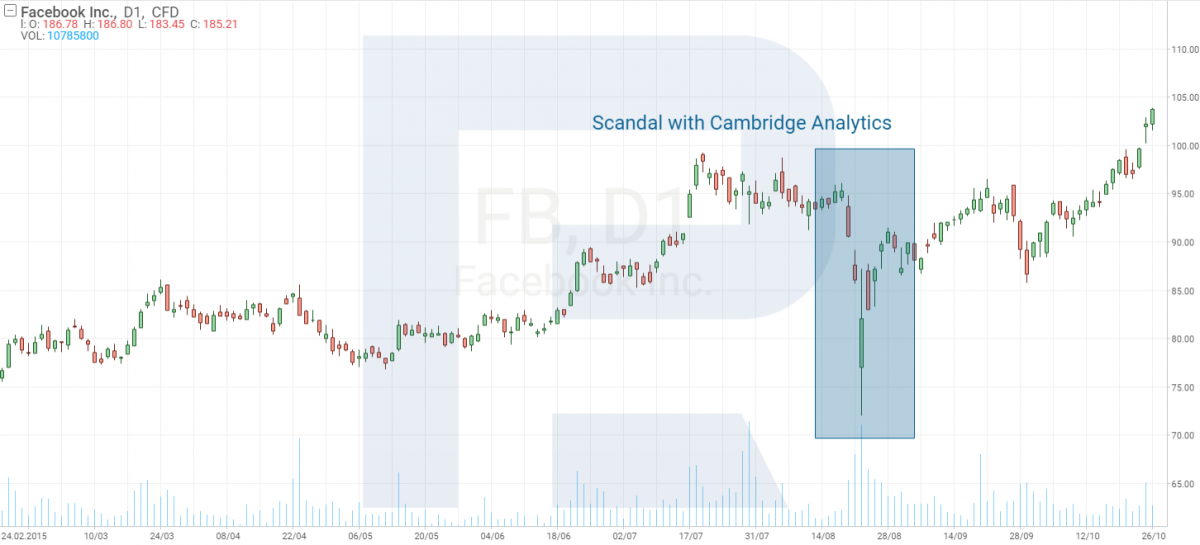

Time will show, how the company is going to develop and whether it will change the idea of democracy. For now, such "democracy" is harmful to the company's reputation. However, we know that investors are more attentive to the profit rather than the reputation. The scandal around the data leak on Facebook (NASDAQ: FB) was used by the investors as a good opportunity for buying its stocks at a lower price.

IPO and the financial indicators of Cloudflare

So, on August 15th Cloudflare submitted an application for an IPO to the US committee on securities. Lately, the issuers carrying out IPOs, are very indirectly connected to new technologies. Though WeWork states it works with technology, it, in fact, works with real estate. It would be equally fair to call Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT), which carried out their IPOs in 2019, "tech companies"; actually, it is a slightly different sphere of business. That is why the IPO of Cloudflare can be called special, and investors will probably get interested in such a company as this one.

Cloudflare currently has the status of a developing company, that is why it is in need of new investments, at present remaining losing. According to the S-1 form, the company's income has been growing since 2016. In 2016, the company had an income amounting to 84.7 million USD; n 2017, it was 134.9 million USD, in 2018, it grew to 192.6 million USD, and during the first 6 months of 2019, the company had an income of 129.1 million USD. With such dynamics, the income of Cloudflare may overcome 200 million USD by the end of 2019.

Along with the income, the losses also grew, but there is nothing to surprise at. Such are the circumstances of almost any developing company. It is, however, worth noticing that the speed of losses in Cloudflare has started to decrease. At the end of 2016, the losses were 17.3 million USD, in 2017 — 10.7 million USD, in 2018 — 87.1 million USD and in the first half of 2019 — 36.8 million USD, which is 4.4 million USD less than in the first six months of 2018. The company has carried out 6 rounds of financing, attracting more than 320 million USD in total. Among the investors, there are Baidu (NASDAQ: BIDU), Qualcomm Ventures, Fidelity, Microsoft Accelerator, etc. There are 12 investors who have participated in financing Cloudflare at the early stage. The IPO is planned on the NY stock market NYSE under the ticker NET. The data is unknown yet. The underwriters are Goldman Sachs, Morgan Stanley, JP Morgan, Wells Fargo Securities, RBC Capital Markets and Jefferies.

Summary

Cloudflare is a company literally working with technology. A successful IPO can create another fast-growing techno company on the world scene. Lately, such companies have not had an opportunity to carry out IPOs as they get merged with giants of their field while working. Here, we are contemplating an independent company entering the market. The question is not whether to buy stocks on the day of the IPO. Here, we may consider investing in Cloudflare for several years and receiving good profit from the growth of its price. The price of the IPO is of great importance. If the underwriters overprice the stocks, they will take the opportunity to invest in the company away from a part of potential investors.

The news before the IPO is mostly good for the company, which will also support a successful IPO. In the current situation, even those who do not plan to keep the stocks in the portfolio will have an opportunity to make a profit on the day of the IPO.

All we have to wait for is the announcement of the day of the IPO, planned for 2019, and be ready to make a profit on the company's stocks.