CopyFX: Your Helper on Forex

5 minutes for reading

In this article, we will discuss a popular platform for copy trading CopyFX designed and supported by RoboForex. Copy trading is a popular means of investing. It implies copying trades of experienced traders on one’s trading account.

Why CopyFX?

Copy trading implies the interaction of the two sides: the Trader and the Investor. The Trader opens a trading account in the CopyFX system and trades, demonstrating certain results. The Investor, in its turn, chooses the most successful Traders in the rating by the results they demonstrate and the subscription conditions and starts copying the Trader’s trades.

The CopyFX platform has a simple and clear interface, and a balanced complex of conditions for successful trading and investing. You can use expert advisors and a large number of payment systems for depositing/withdrawing money. The platform also features cent accounts, which allow traders to check their abilities without losing their money.

Functions of CopyFX

The CopyFX platform, being up-to-date, allows normal trading on your account and simultaneously sharing your experience with other people for additional income.

Trading conditions and types of accounts

The Trader works on the popular MetaTrader 4 terminal; they can create several accounts with different strategies. The Investor can copy trades on any MT4 account, apart from the Trader’s. You can choose any type of account that suits you: ProCent, Pro, ECN and Prime. To subscribe to a Trader or set up the subscription, your account must be deposited for 100 USD (or the equivalent sum in your currency).

The trade is copied at the moment the Trader makes it; in the situation of strong movements, slight fluctuations in the price of execution might occur. RoboForex does not charge any additional commission fees for using CopyFX.

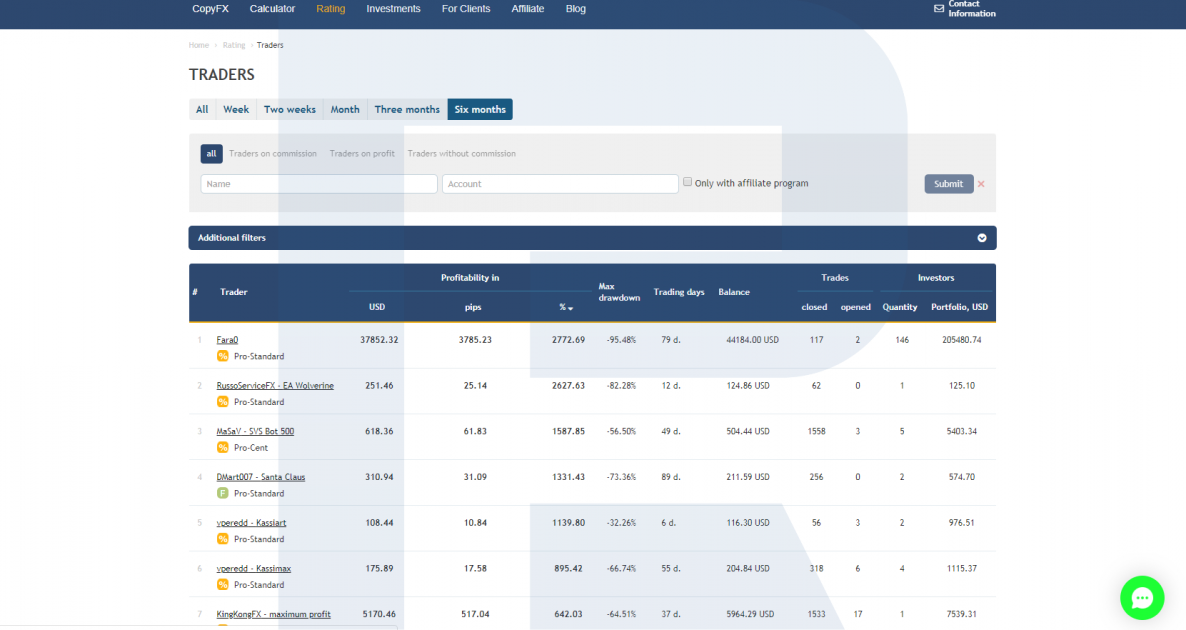

Rating of Traders

For the Investors to make good choices of Traders, there is a special instrument called the rating of Traders. In the rating, the following parameters of the Traders’ work are represented:

- Profitability

- Term of trading

- Maximal drawdown

- Current capital

- Investors subscribed

- The number of trades

For a trading account to get in the rating, its balance should be no less than 50% of the limits for the subscription conditions. The accounts with the profitability below 90% during 10 days are automatically withdrawn from the rating. Also, the account will not appear on the list if you have chosen the “At application” option in the subscription settings and have not activated the “Show in the rating” option.

Each Trader has their participant card that can be accessed from the rating or directly. In the card, all the history of the Trader’s active accounts, including the story of subscriptions and trading, is stored.

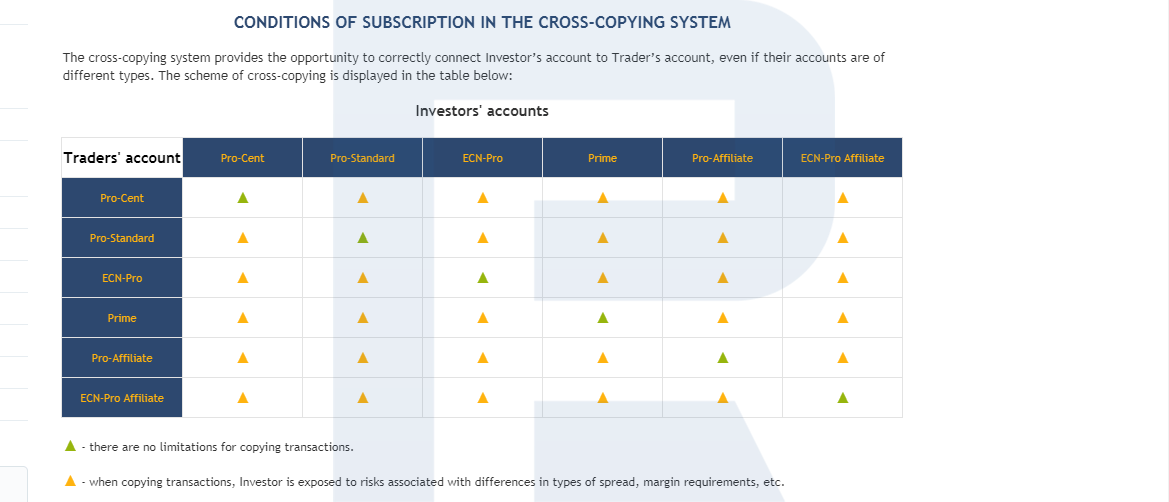

Cross-copying

Cross-copying is a special system, created for the users of the CopyFX system to extend the partnership. The system allows for connecting different types of accounts of a Trader and an Investor. For different account types, the conditions also differ, such as the size of the average spread, the broker commission fee, the maximal leverage, the available instruments.

Types of copying and fees

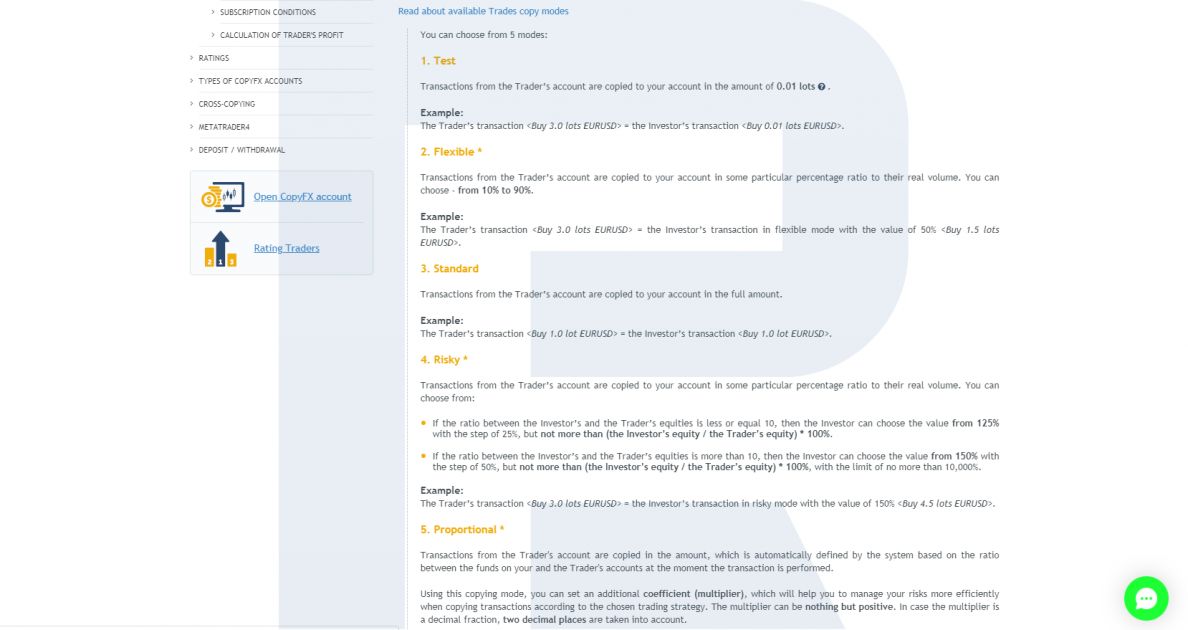

There are 3 types of copying on the platform:

- Proportional mode copies the trades automatically at the rate of the Investor’s deposit and the Trader’s one.

- Classic mode. Transactions from a Trader's account are copied to Investor's account with the volume defined as a product of a Trader's initial transaction and the value of the parameter set by the Investor. In this case, account equities are disregarded.

- Fixed mode. All Transactions from a Trader's account are copied with the same fixed volume set by the Investor in the parameter. In this case, the parameter indicates a physical quantity (in lots) of the volume to be copied by CopyFX to an Investor's account regardless of the volume of a Trader's initial transaction and regardless of the ratio of funds in Investor's and Trader's accounts

In their turn, there are three ways to reward the Trader:

- By profit – the Trader receives a fixed percentage of the Investor’s profit.

- By commission – the Trader receives a fixed sum for each profitable trade of the Investor.

- Without commission – the Trader receives nothing. This mode helps beginner Traders show themselves and attract Investors.

Trader’s Partner Program

On the CopyFX platform, the Trader’s Partner Program works. The Trader can set the conditions of partner reward on their account and attract even more investors. Anyone can become a partner and attract additional investors, increasing the Trader’s income and receiving a commission fee.

Closing thoughts

To my mind, CopyFX is a useful service that allows Traders not only do their job but receive additional income from their subscribers (Investors) without much effort. The Investor, in their turn, can choose the most successful Traders from the rating.

The key point here is to set up copying properly. For example, if you subscribe to several Traders, your deposit must withstand their aggregate drawdown. Also, you must take into account the difference in the trade balances, the currencies, the leverage. In the subsequent articles, we will discuss how to become a Trader and an Investor step by step.