Trader's Checklist for Successful Trading

5 minutes for reading

For successful work on financial markets, it is important to collect a set of rules that will help think soberly in any situation and stick to one's trading system. Most often, traders draft a plan on paper for no steep movements on the market to make them turn away from their goal. What is more, experienced investors advise to make a sort of a checklist with several questions, the answers to which will show if the time is good for opening a position or the trade is better skipped.

Why should I plan my trading?

It has been proved in practice that most mistakes and losing positions emerge in situations when the trader tries to act intuitively and avoid stocking to their own rules.

For example, the trader has chosen the Head and Shoulders pattern for trading but it does not appear on the market for a long time, and they decide to enter a trade on a breakout of the support line. As long as they used to trade only one pattern, the trade might be compromised.

Of course, such a loss depends only on the trader and their devotedness to their rules. That is why planning and sticking to the plan is so important.

How to create the checklist?

For example, if we return to our Head and Shoulders pattern, we have several rules for the pattern to form.

The neck must head along with the movement, the right shoulder must be no higher than the left one, which will signify the weakness of the current trend. Then, we may pay attention to the fact of whether the pattern complies with the trend from D1; and finally, we must evaluate the risks for the deposit.

Based on the data above, we can create a checklist for trading Head and Shoulders patterns; the answers will help decide upon the fate of your open positions. You should remember that questions can be created for any system you work with.

An example of a checklist for trading the Head and Shoulders pattern

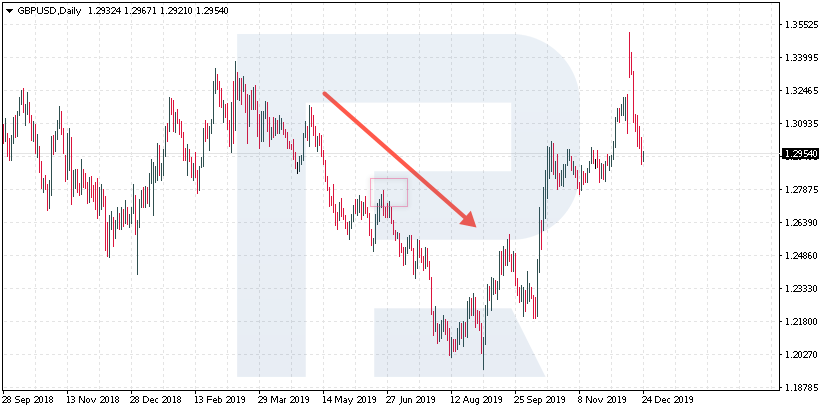

Is the pattern headed along with the daily trend?

To evaluate this, we need to look at the direction of the trend on D1. For example, if the price on D1 has been falling for a long time, you had better wait for the beginning of an ascending correction, and at the end of this movement the reversal pattern will form.

Many authors point to the importance of trading along with the prevailing trend. What is more, from my personal experience I could point out that such patterns will be executed by the market with more force.

So, if the situation is as needed, we move on to the next questions.

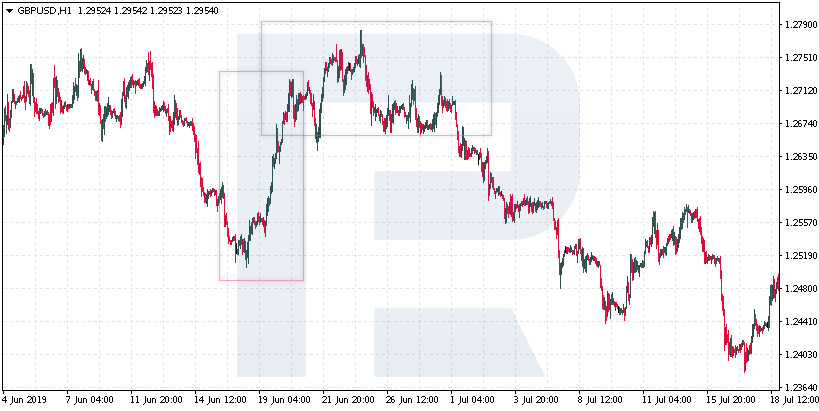

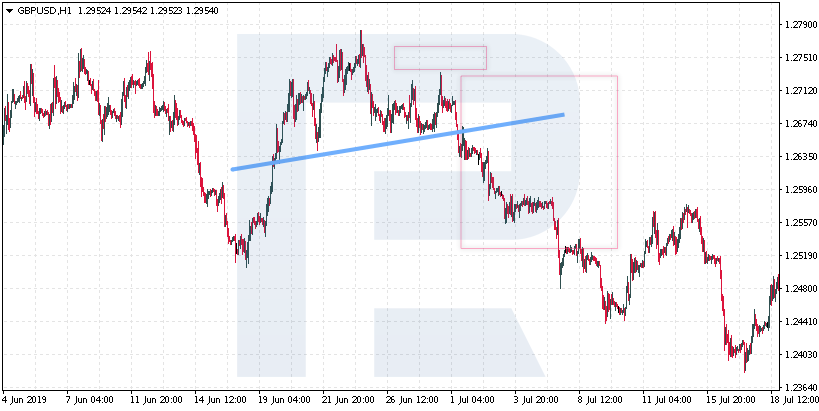

Is the previous movement larger than the pattern?

It is considered that the pattern cannot be larger than the movement that precedes it. If the pattern is the same size, it is unlikely that it will be executed.

So, if the answer is no, we should better wait for another entry to the market to form.

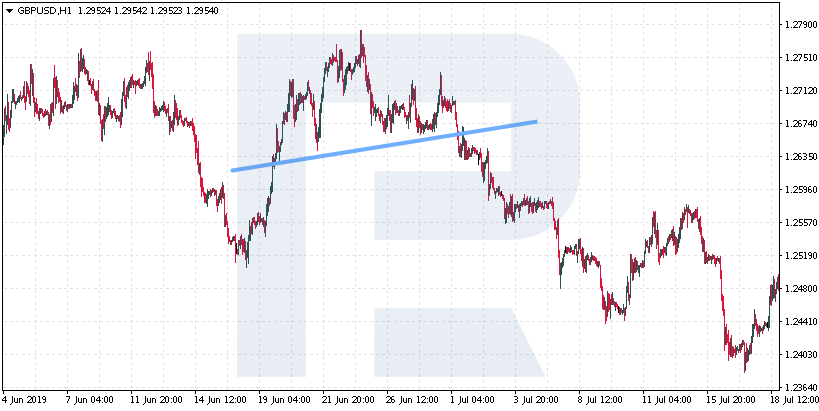

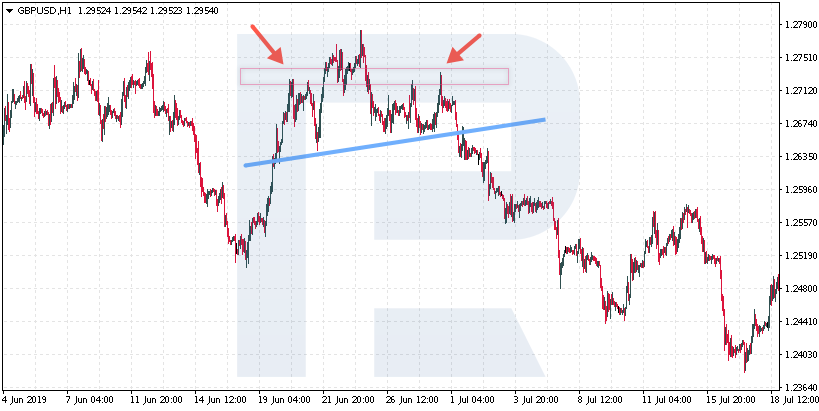

Is the neck headed in the direction of the pattern forming?

This is a very important point: for some reason, many traders ignore this and draw the pattern with a completely wrong line.

If the price is growing, and we see a neck pattern forming, it must be headed upwards. If the line looks down, this is not a Head and Shoulders, this is more of a Wolfe Wave.

If the price is falling, and we can see the pattern forming, the neck must be headed downwards. If the pattern is forming following the rules, we answer yes and move on.

Is the right shoulder not higher than the left one?

This is another important indicator of the strength of the trend. Many authors and tech analysts note that the right shoulder should not be higher than the left one, ideally a bit lower than it.

This factor shows the weakness of the current trend and the unwillingness of the market to move on. In most cases, traders open positions at the level of the shoulder; but the price keeps crawling, and most likely such a pattern will be ignored by the market.

So, if the price is growing, the right shoulder of the pattern forming must not be higher than the left one. If the price is falling, the right shoulder must not be lower than the left one.

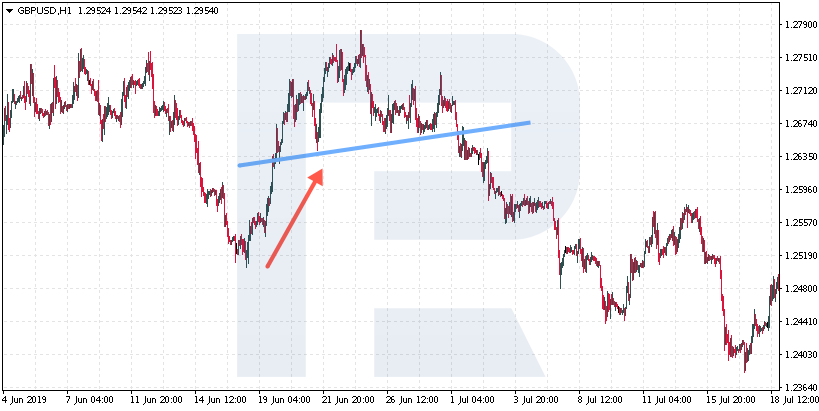

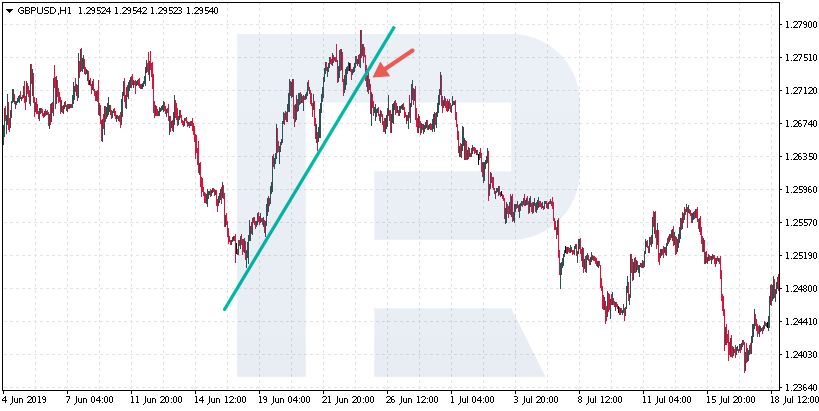

Has the trendline been broken out?

A breakout of the trendline itself can be a good signal for market entry. Here, we can see both a reversal pattern forming and a trendline breakout, which enforces the signal.

What is more, after a breakout of the trendline the right shoulder is completed. Sometimes the completion of the shoulder may be a test of such a line, after which the price reverses.

Is the potential profit at least 2 times larger than the potential loss?

Money management is an important part of any system. So, we cannot ignore this in our checklist.

Situations can be different, patterns can emerge that do not comply with the profit to loss ratio. That is why, it is important that one pattern executed could cover for two, better three losing ones. But if we somewhat missed the moment to enter the market, and the potential goal is equal to the potential loss, we should better skip the pattern.

Closing thoughts

Any system is better than the lack of it, experienced traders say. A checklist for successful trading is a set of rules that the investor must stick to in their work. In the article, we have discussed the example of such rules for a reversal pattern, and the same can be done for any other system of everyday trading.

It should also be remembered that the majority of losing positions are opened as experiments or when the trader does not fully understand the market situation. A checklist will help avoid such moments completely.