Elliott Wave Theory and Practice. Part 1

7 minutes for reading

Good day, dear readers!

If the market were a linear structure, and we could detect the end of one trend and the beginning of the next one with 99% exactness, as well as to detect the target area of its development, then trading would be the easiest and most profitable business in the world.

Unfortunately, things are quite different. Of course, a long history of trading and market studies has taught us to define reversals more or less precisely, as well as calculate the expected length of the trend; however, for many traders, this is not enough. A great number of analysis techniques and methods helps a trader or analyst feel confident on the market; however, problems emerge when it comes to one's personal ability to apply those techniques to practice. Many do it well, but the majority, with their primitive remakes, end up stuck in a network of locks, trying to get untangled from useless positions.

Having studied several methods and applied them to practice, many get disappointed, not receiving the desired result, but never give up and keep looking for that one precise method. Sooner or later, many come to the Elliott Wave Theory because, in it, they see that method of market structure analysis that can virtually predict the future with a high level of precision. Their hopes are not void, as experts in the theory have repeatedly demonstrated astonishing results in trading and analysis.

So, this article is devoted to Wave market analysis and the Wave Theory. We will get acquainted with the history of its appearance and development, its main statements and rules of analysis.

History of the Elliott Wave Principle

In the preface to his book about the Elliott Wave Principle, Hamilton Bolton wrote that he noted the efficacy of the Elliott Wave Principle in such unpredictable economic events as the depression, the great war, the recuperation after the war and the subsequent significant growth. Hence, he became sure that the Principle had fundamental significance.

The one to discover the wave principle of market development and formation was a US economist Ralph Nelson Elliott. Due to an illness that made him remain in bed, he could not find a decent occupation for a long time and got interested in technical analysis for trading on the stock market.

After a long period of studies, in 1938, he published a book called "The Wave Principle", in which he described the basics of the principles of market movement formation that he had discovered.

Elliott took the main data for his market studies from the charts of the DJIA. Thanks to his scrupulous and precise observations, he managed to describe all market movements that happened before the 1840s. At that time, the index was near 100, and Elliott forecast serious growth in the upcoming decades. It was against the expectation of most investors, who thought that the index will not renew the results of 1929.

The Wave Principle states that the behavior of the market crowd develops and changes by certain clear patterns. Using the charts of the stock market, Elliott stated that the path of the stock market price dynamics can be described by a structural pattern reflecting the harmony of nature.

Based on the data he had discovered, Elliott designed a logical system of market analysis, singling out 13 types of "waves" that are repeated in the price movements but may differ in terms of their shape, lifespan, and amplitude.

In his work, the author described the interrelations of all the structures, their dependence on one another and their ability to interchange. We can say that the Wave Principle is a set of patterns and the explanations of where and which models are likely to emerge in the course of a market cycle or tendency forming.

Main principles of Elliott Waves theory

A market movement can be described by a strictly structured sequence of repeated patterns; hence, it may be forecast. Sequences of the patterns reveal the essence of the directed wavelike movement.

Every market movement is not only the result of the emergence of some important information: it also creates a new aspect of important information.

Five-wave pattern

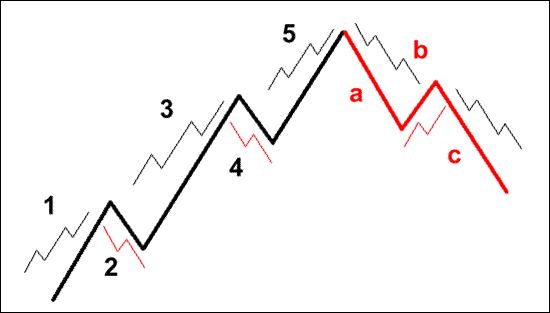

The main pattern of market movements is shaped as a five-wave structure. Three waves in the structure are called motive because they make a directed movement; in analysis, they are marked 1, 3, and 5. These waves are separated from one another by countertrend interruptions, which are waves of opposite (correctional) movement marked 2 and 4. These pullbacks are an intrinsic part of the market movement.

Wave modes

There are two types of wave development: motive and corrective; it should be noted that motive waves have a five-wave structure while corrective ones - a three-wave structure.

Full cycle

A full cycle of a market movement consists of eight waves that develop in two phases: motive (five waves numbered 1-5) and corrective (3 waves marked a, b, c). The "a, b, c" sequence corrects the "1, 2, 3, 4, 5" sequence.

After one cycle ends, a similar cycle of five waves up, three waves down follows. The third stage of the five-wave movement completes a wave of a higher level. At the peak of the fifth wave, a pullback of a higher wave level starts, consisting of three waves. These three waves of the next wave level "correct" the movement upwards of the five waves of the same level.

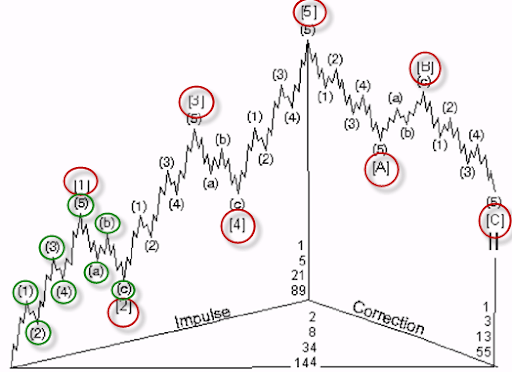

The crucial moment here is that each sub-wave 1, 3, and 5 is motive and can be sub-divided into inner "fives", while each sub-wave 2 and 4 is called correctional and can be sub-divided into sub-waves a, b, and c. This is called the nesting principle.

The multi-level structure of market movements is organized in such a way that two waves of the same wave level are sub-divided into eight waves of a lower level, and these eight waves are, in their turn, subdivided into thirty-four waves of again lower wave level.

So, the Wave Principle reflects the fact that the waves of any level and direction can be again and again subdivided into waves of a lower level; simultaneously, any wave is an integral part of a wave of a higher level.

Main structure

Inside the correctional pattern, the waves a and c aimed downwards, consist of five sub-waves: 1, 2, 3, 4, and 5. In its turn, the wave b aimed upwards consists of three waves: a, b, and c. This construction shows that motive waves are not always aimed upwards and corrective waves - not always downwards. The type of the wave is defined not by its absolute direction but mostly by its relative one.

A wave is called motive if it is moving in the same direction that a wave one level higher (which includes the first wave) does; it is called corrective if it moves against the "older" wave. The waves a and c that are developing in the same direction with the wave 2 are motive. The wave b is corrective because it corrects the wave and develops in the opposite direction with wave 2. The essence of the Wave Principle is the fact that at any wave level a movement in the same direction with a higher wave movement develops in five waves while a pullback against the wave of a higher level develops in three waves.

Elliott himself never suggested why the main market structure consists of five waves of growth and three waves of decline. He just stated this. If we think a little about it we may conclude that this is the minimum required for the market to develop.

To progress in one direction regardless of the length of the pullback, the movement in the main direction must consist of at least five waves just to surpass the three-wave pullback and contain those pullback waves. Though there might have been more waves, the most rational progressive pattern is 5-3.

Closing thoughts

The Wave Theory is a serious and complicated work. In the current market situation, one cannot do without a comprehensive analysis of the market structure. I hope that the first part of our discussion is not overloaded with information; however, without the basics, we will not be able to proceed to details.

In the next part, we will share with you certain nuances of the market dynamics from the point of view of Ralph Nelson Elliott. To be continued.