When to Buy Stocks? The Falling Market and Your Actions

9 minutes for reading

The crisis provoked by the coronavirus devaluated the stocks of many companies, and now investors have a unique opportunity to buy stocks at distress prices. In this article, we will find out what companies are attracting investors’ attention.

90% of stocks on the market are now trading in a downtrend; i.e. the market is bearish, and many are making money on short positions. Hence, it is very important to tell the difference between the growth provoked by closing short positions and the growth based on new purchases of the stock.

To do it, we need to analyze the price chart.

Making up long positions

As an example, let us discuss the papers of Boeing Company (NYSE: BA).

When large investors, most often hedge funds, start buying the stock, they never do it by one trade in a session. They set a range inside which they will buy the stock; otherwise, if they by the whole volume at once, the stock price may grow steeply. This will attract other market participants who will either support the growth or consider it groundless which in the end will lead them to opening short positions. Then volatility will grow in the paper, which might hinder all plans of the hedge fund to make a profit on this paper.

Large investors buy the stock, remaining unnoticed by other market players. In other words, they keep the volume of trades at the medium level or just above it, and the stock price moves in the framework of daily fluctuations. However, they cannot hide their activity completely, and quite often, we may notice the level on which they buy the stock.

Pay attention to the chart of Boeing Company. Before the stock price grew by more than 50 USD, for 15 days the stock had been trading inside a narrow range, never declining below 280 USD. I.e. some very large investor was buying the stock, and then the price, being at its all-time high already, started growing steeply. In 8 days, the stock price grew by 20%, then the volume of traded stocks also sky-rocketed, which could be interpreted as that investor closing the positions.

This is the simplest way of finding a large investor in a stock to work in the same direction with them.

Closing short positions

And now I will show you how investors trading on a decline close their short positions.

Trading declines differs from trading growth. These are just two different ways of making a profit on the market.

First of all, the trade volume of a short position is much smaller than that of a buy. Making up of a position is very hard to detect, while an open trade may be held for no more than a day (it seems like that is why such positions are called short).

Trading declines is very risky because your profit is limited by the zero level of the price, while a loss may amount to the largest deposit in the world. Hence, investors are very cautious here and ready to leave their positions at any moment; this behavior is characterized by sharp increases and decreases in the stock price. In other words, an investor having a short position is ready to close it at any moment at the market price. For them, the most important thing is to escape the position, no matter if this will lead to steep growth of the market price. A delay may cost too much.

Have a look at the chart of Sunnova Energy International Inc. (NYSE: NOVA).

In 9 days, the stock price declined from 21 USD to 7 USD per stock and then in two days it grew from 7 USD to 12.50 USD, i.e. by almost 80%, out of which, 60% were covered in one trading session. This was closing of short positions, additionally confirmed by a sharp increase in the volume.

Let us draw a conclusion. Closing of short positions do not signal long-term growth o the stock price. Hence, such situations on the chart do not indicate an increase in the interest towards the company; thus, such stocks cannot be regarded as having a potential for growth.

The levels of support and consolidation in a certain range indicate the interest of large investors towards the company. This signals possible further growth of the stock, hence such a stock are of interest to us.

The Boeing Company stocks

Now, let us have a look at the companies that attract investors. I would like to start with air carriers, but, unfortunately, the situation here is drastic, and there is no interest to the stocks of this sector. However, the stocks of the largest aircraft producer do attract investors. The Boeing Company’s problems began before the crisis, and now its stocks are trading three times cheaper then they used to several months ago, and it must be the rice that attracted so much attention.

Currently, the stocks are trading in a narrow range at about 100 USD per stock; the volume also seems to be growing, which means large investors are making up their positions. In this situation, a decline below 90 USD per stock will be used as an additional entry point at a lower price.

Oil and gas sector

In the oil sector, the things are becoming lively. The oil price has dropped under 30 USD per barrel, which threatens small US companies by bankruptcy, especially those of them that produce shale oil. However, they are hoping for another portion of US sanctions against Saudi Arabia, which may entail an increase in the barrel price. That is why some stocks in the sector are already trading at the support levels.

Archrock Inc stocks

Archrock Inc (NYSE: AROC) works in the energy infrastructure and offers its services to gas and oil companies. Its stocks are trading at the price of 3.60 USD. A drop under 3 USD was used by investors for additional buys.

Something similar may happen to the Boeing stocks, i.e. the price will go down from the previously formed range and then restore abruptly.

Exterran Corporation stocks

Exterran Corporation (NYSE: EXTN) also serves gas and oil companies, providing them with equipment. Since December 2019, the stocks have not declined below 5 USD, even the coronavirus situation failed to influence their position. The support formed at 5 USD demonstrates that investors are buying the stock at this price.

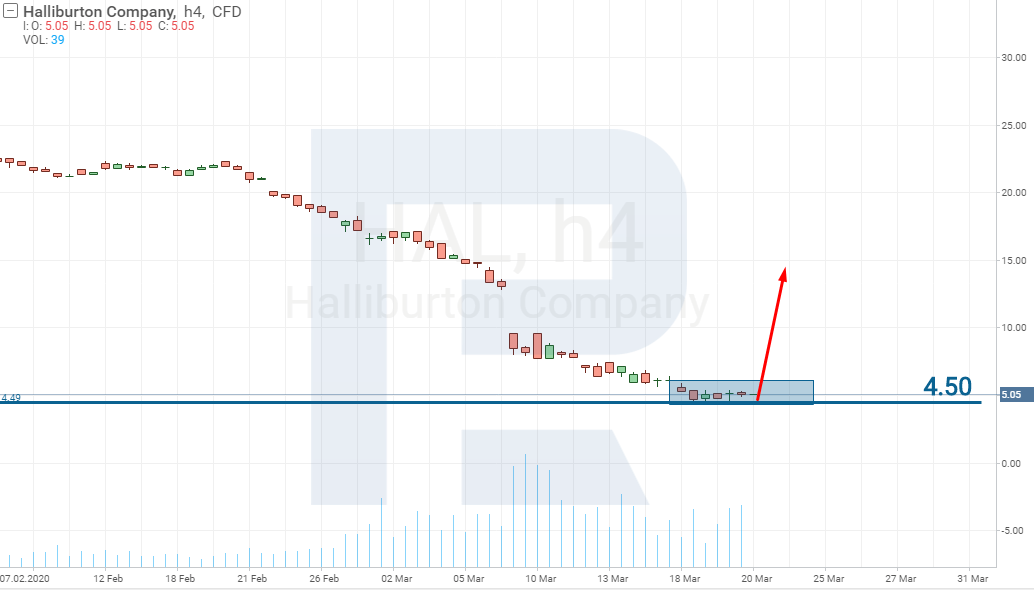

Halliburton Company stocks

The last but not least is Halliburton Company (NYSE: HAL). This company offers a wide range of services to oil and gas companies all over the world. The falling of the stock price stopped slightly under 5 USD per stock. Currently, the price is trading in a narrow range, which might mean that a large investor is buying the stock for their portfolio.

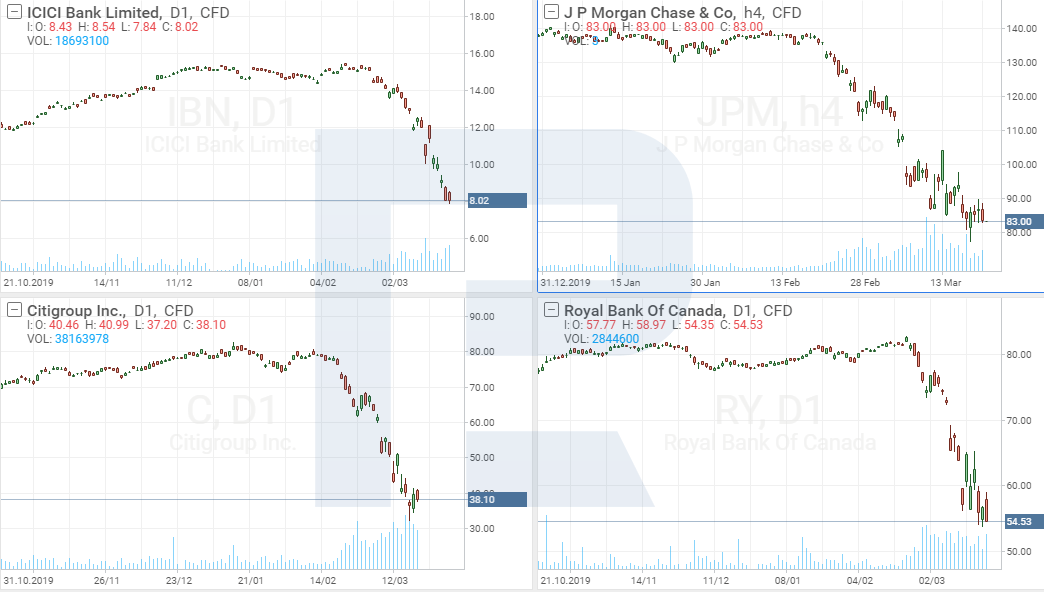

Banking sector

Now, let us switch to the banking sector. The European and American government has decided to support business by low rates and go on pouring billions of dollars into the economy. Naturally, this money will pass through the banking sector, and a part of them will “sink” there as a profit.

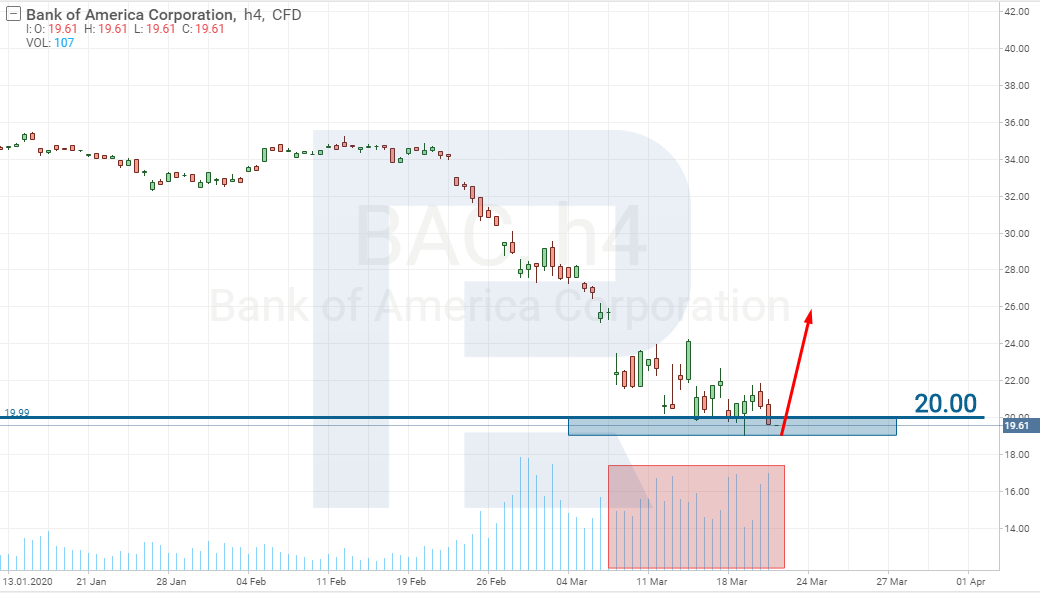

Bank of America Corporation stocks

The stocks of the largest US banks the Bank of America Corporation (NYSE: BAC) are already trading at the support level of 20 USD. In the last 10 days, the price has bounced off this level several times, which indicates buys; growth of the volume is also present.

Renasant Corporation stocks

The second bank to attract investors’ attention is Renasant Corporation (NASDAQ: RNST). Here, at the level of 21 USD, a support has also formed, which the price has bounced off three times; same as with the stocks of the Bank of America Corp., the volume is also growing.

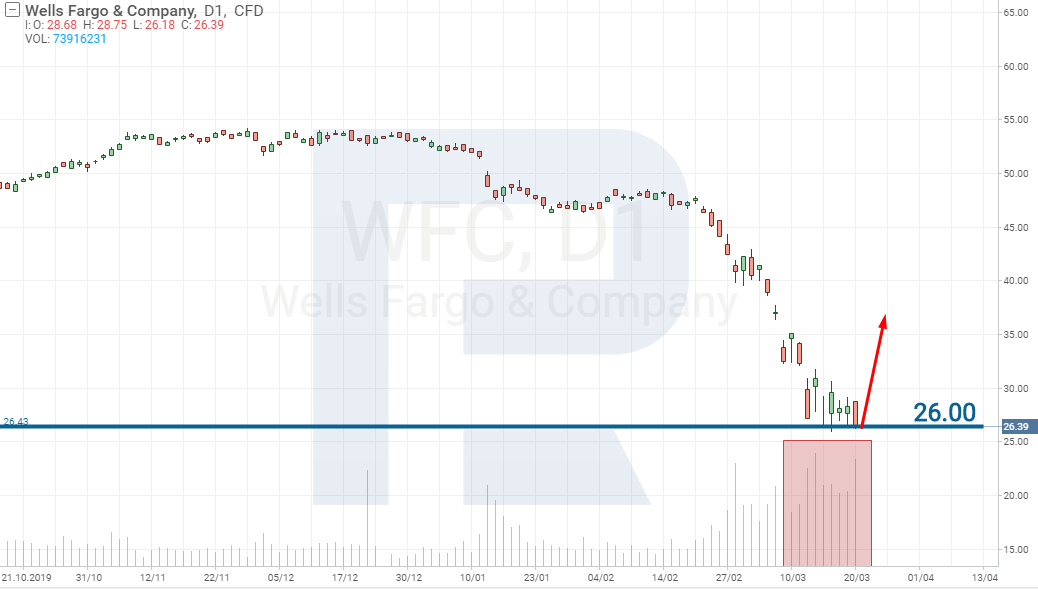

Wells Fargo & Company stocks

The last but not least is Wells & Fargo Company (NYSE: WFC). The level here is not as strong because it formed 5 days ago, however, trade volumes are rather high. Since December 2019, the price per stock has become two times lower, thus the stocks of this bank are worth watching.

In the stocks of other large banks, there are no clear levels yet, unfortunately, so nothing signals possible buys of large investors.

There are thousands of stocks trading on the market but investors always behave the same. This means you can scrutinize other sectors of the economy yourself and, as shown above, find indications of which stock might grow in price soon, helping you make a larger profit.

Closing thoughts

To my mind, we have not reached the peak of the coronavirus crisis yet. The epicenter of the disease is now moving to Europe. This will aggravate the economic problems in the region and will most probably lead to another wave of decline but a smaller one, with more modest volatility, because the stocks of many companies already cost very little.

Speaking about the situation on the whole, worse times are yet to come, and to blame for it is not the virus but people.

A singer never knows whether their song will become popular all over the globe. However, by the reason unknown, the simplest and most ordinary song becomes world-popular. Simultaneously, many masterpieces of extremely talented people are passing by unnoticed.

With the coronavirus, the situation is the same. The death rate of this disease is about 2%; at the same time, radiation form mobile phones, TVs, NPPs, and hazardous waste provokes cancer, which killed 9.8 million people in 2018, according to the World Healthcare Organization.

There is another version of the coronavirus called atypical pneumonia, which death rate reaches 40%. There is no vaccine yet. However, there is no global panic about it – as about nuclear plants that keep appearing, working, and exploding.

The coronavirus, same as a piece of music, has become world-known, and the humanity will be fueling tension for as long as possible, and know one knows where the limit is. We have begun realizing the scale of the problem that we have created but it is too late.

The economic consequences will be much graver for the humanity than the consequences of the virus. The current buys of stocks are merely an attempt of investors to close their eyes at the situation.

Hence, I do not recommend looking for long-term investments now. The current situation may be used for speculations only.

For some time, the market will keep receiving news about the support of the economy which will lead to a short-term increase in stock prices. This is the profit you may make on the papers being bought by investors now. The situation may only change after the coronavirus is taken under control.