Apple and Tesla Will Have Stock Splits

7 minutes for reading

It’s become known recently that two world-famous companies Apple and Tesla are planning their stock split. As a result, this move will provide a lot of investors with the opportunity to but these company’s shares at lower prices.

What is a stock split?

A stock split (or a share dilution) is an increase in the number of outstanding shares due to a proportional split of every initial share.

The most important aspect here is that in the case of a stock split companies do not issue new shares, hence splits do not lead to a dilution of shareholders at a company. In the case of a split, capitalization and percentage shares of shareholders remain intact.

The purpose of stock splits

Before making an IPO, a company defines what number of shares will be outstanding. After an IPO, an issuer gets financial recourses from selling shares on a stock exchange and starts investing them in development. As time goes by, a company expands, its profit increases along with the number of investors, who would like to buy its shares.

The number of outstanding shares remains unchanged and the investors who bought shares are in no hurry to sell them, thus creating a deficit of supply on the market and leading to a rise in the share price. The more actively a company develops, the faster its share price grows, and if no actions are taken, the price may reach several tens or even hundreds of thousands of dollars.

Berkshire Hathaway share price

An excellent example of this might be shares of Berkshire Hathaway (NYSE: BRK.A). Warren Buffett intentionally didn’t split his company’s stock. As a result, one share costs more than $310,000 while the average share trading volume doesn’t exceed 500 a day. In comparison, the average share trading volume of Apple in more than 36 million.

When shares cost that much, the number of investors who can buy them is extremely limited.

What is the negative side of too expensive shares?

When developing and entering new markets, companies always require additional financing, which may be received by issuing and selling its shares on a stock exchange. In the case of a high price, the number of investors that can afford to buy shares is reducing. As a result, a company can’t get a targeted amount of funds, while the excess of shares on the market will lead to a decrease in their price and (quite rarely) profit-taking by investors who bought shares earlier, thus creating additional pressure on the stock.

How stocks split in practice

For example, you have 100 shares of Apple (NASDAQ: AAPL). The cost of each of them is 200 USD, so the total amount of your investment is 20,000 USD.

The company announces a 2-for-1 stock split, which means that an additional share is given for each share in a portfolio held by a shareholder. In this case, your shares will be doubled and your portfolio will now contain 200 shares with their price half that equal to 100 USD. However, after all these activities, the total amount of your investment will remain at 20,000 USD.

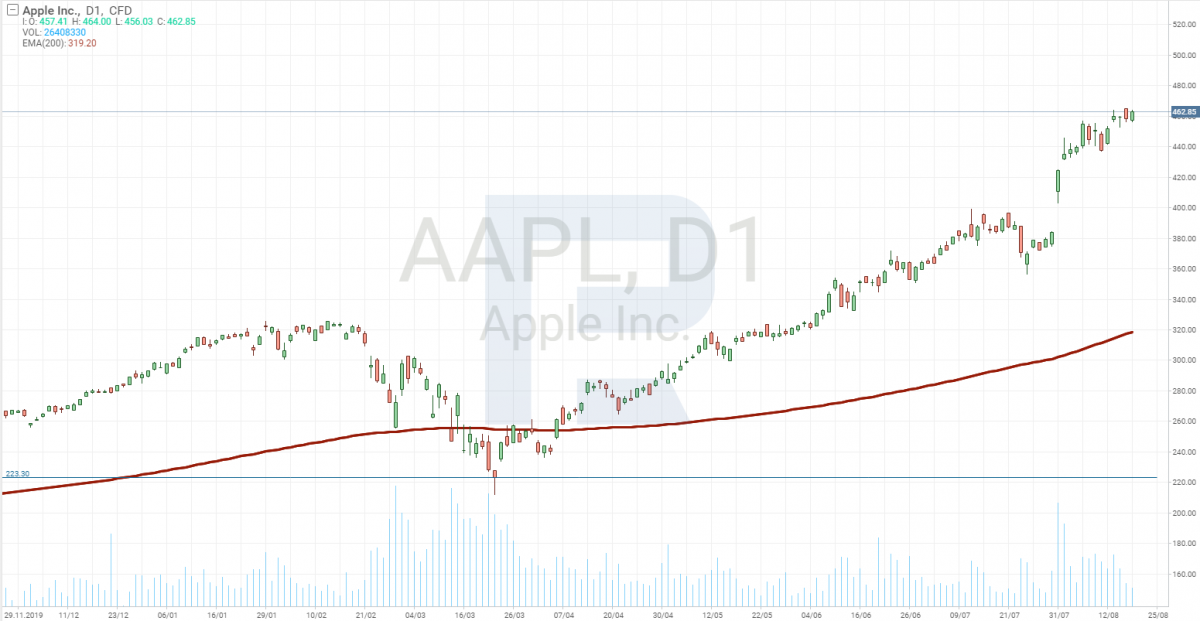

Apple stock split

At the end of July, Apple was the first to announce a stock split. Currently, the price of one Apple share is more than $460. Over the last 5 months, the company’s shares have added more than 100%, while the market capitalization has exceeded 2 trillion USD.

The split will take place on August 24th, when the procedure of registering shareholders, who have the right for additional shares, will be over. The number of shares in shareholders’ portfolios will be multiplied by 4 times. Stock trading will resume on August 31st.

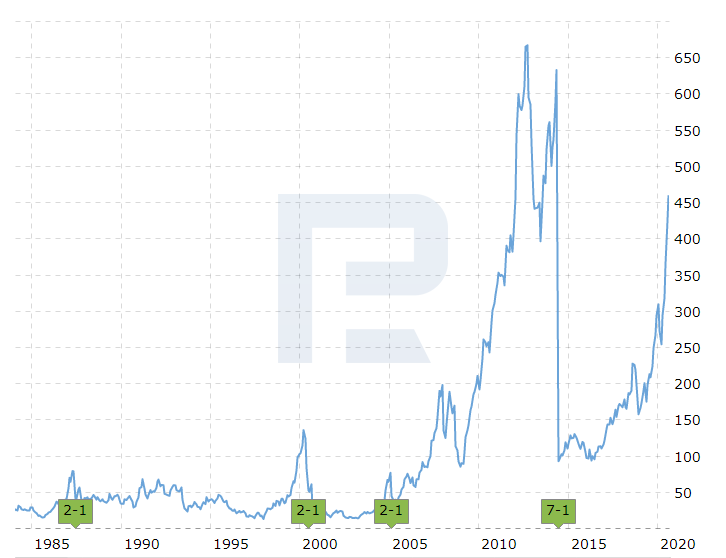

It’s not the first time Apple splits its shares but every time it happens, their price increases in the course of time. Over the last 40 years, the company split its shares 4 times.

The first time it was a 2-for-1 stock split in June 1986. The price was reduced from $80 to $40 per share. By the year of 2000, shares cost $135 each.

In June 2020, there was another 2-for-1 split. However, several months prior to the split, there was a “dotcom crisis”, which resulted in the decline of all stocks on the market. By the date of the split, the price of Apple shares dropped to $95 and after the split, they cost $47. But the crisis pressured continued and the price plummeted to $14 per share. In 2001, the stock started recovering slowly and by the year of 2005, the price had reached $89.

The split of February 2005 decreased the price from $89 to $45 but by 2012 it had reached $650 per share.

In June 2014, Apple had a 7-for-1 split and reduced the price from $650 to $92, which was the last one until now.

At the moment, the company’s shares are trading by 400% higher than the price recorded at the previous split.

The history of the price behavior after splits says that now it’s the high time to invest in Apple if you are into long-term investments.

And now let’s talk about the second company that is planning a stock split soon.

Tesla will have a stock split

On August 11th, Tesla (NASDAQ: TSLA) executives announced a 5-for-1 stock split. Registration of shareholders will be over on August 21st and the split procedure will take place on August 28th. For each share in a shareholder’s portfolio, they will get 4 additional shares. Trading is expected to resume on August 31st. for tesla, it will be the first split.

In 2010, the company made an IPO with the starting price of $17. A month later, the price fixed above $20 and hasn’t gone lower ever since. Prior to 2013, shares were trading in the range between $40 and $20 USD but in April 2013 the price broke the range and started skyrocketing.

Companies always need money to ramp up facilities, that’s why they issue new shares to sell them on stock exchanges later. During such periods, Elon Musk almost always bought shares of hi9s company.

The last time new shares were issued was in February 2020. At that time, Musk bought 13,037 shares at $767 and in several months tweeted that the price was too high. The day before his tweet shares traded at $850. Today, they cost $1,785.

Funny to say but a lot of people had been predicting the company’s bankruptcy for 10 years because of a huge debt load and concerns about Musk’s inability to control the company. Bears lost billions of dollars by staking on the depreciation of shares. Now Elon Musk himself states that the price is too high and after his words the price doubles.

What is really happening? Who manages the process? Is the Tesla stock out of control?

Demand for shares is so high that it’s very difficult to stop it. And now the company announces a stock split, hence the price must go down to $500-600. In this situation, it looks like a present to those, who haven’t bought Tesla shares yet.

In comparison with Apple and the number of its outstanding shares (after the split, it will exceed 50 billion), Tesla has a lot of splits ahead. Just to let you know, there are 180 million Tesla shares on stock exchanges and after the split, their number will be just 900 million.

Closing thoughts

Stock split is a good opportunity to invest in the world’s largest companies at reasonable prices. In our case, splits are made by Apple, Warren Buffett’s favorite company, and Tesla, which is considered as one of the most promising developing companies.

There is a choice and both companies are leading their areas.