Kymera Therapeutics IPO: New Attempt to Conquer Cancer

7 minutes for reading

A biotech company Kymera Therapeutics carried out an IPO on August 20th, 2020, and on August 21st, its stocks started trading in the Nasdaq exchange under the ticker KYMR.

About the company

The company was founded in 2015, in Cambridge, USA. It works on drugs that cure inflammatory diseases by low-molecule proteins. Kymera Therapeutics is implementing a new method of healing – a protein breakdown system that is suitable for treating cancer and other immune diseases. No wonder that at the IPO, the stocks enjoyed incredible demand. The main focus of the company rests on atypical dermatitis and hidradenitis suppurativa, alongside other skin and immune system diseases.

Kymera Therapeutics promotes its system of targeted protein breakdown called Pegasus searching for high-selective, low-molecule breaker protein that would be highly efficient against harmful proteins that cause various inflammatory processes in the organism.

Drugs by Kymera Therapeutics

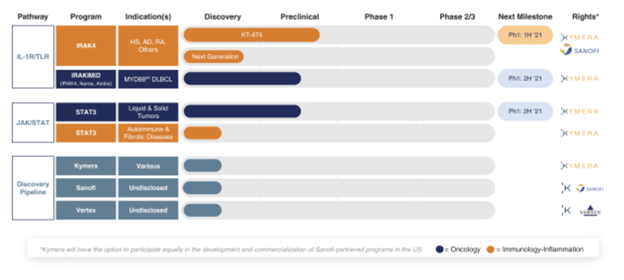

All the five drugs by the company are undergoing pre-clinical tests, though it is already 5 years old. The leading drug of the company is KT-474, which is undergoing pre-clinical tests like others. The company is planning to send it to the first phase of testing on both healthy adult volunteers and those suffering from atypical dermatitis and hydradenitis suppurativa in 2021.

This drug is meant for breaking down a destructive protein IRAK4, which may be the cause of the development of a malignant growth. Moreover, this program will entail serious progress in curing rheumatoid arthritis and inflammatory diseases of the skin.

In the second half of the year 20212, Kymera Therapeutics is planning to launch a drug called STAT3, aimed directly at curing malignant growths, autoimmune diseases, and fibrosis. Also, the company is planning to further develop IRAK4 to the IRAKIMiD version for treating B-cell lymphoma.

The platform Pegasus itself unites biological, chemical, and processing powers for generating destructive proteins suitable for satisfying a lot of medical needs in this sphere. This forms a really strong base for the company’s future.

Main investors and partners of Kymera Therapeutics

On July 7th, 2020, Sanofi made a strategic agreement with Kymera Therapeutics on IRAK4, according to which the latter company hands the former exclusive rights of designing, licensing, and commercializing their joint research. The sum of the prepayment was 150 million USD. Later, Kymera may receive 700 million USD more. Earlier, on May 9th, 2019, the company agreed with Vertex, planning to cooperate in promoting the degradation of low-molecule proteins. Vertex got the right to commercialize and license the products of their joint research. Kymera Therapeutics will get some 170 million USD from this trade.

Other investors, taken together, invested in the company up to 197 million USD. The most famous investors would be Atlas Venture Fund, Lilly Ventures Fund, Pfizer Inc., Bessemer Venture Partners, and Dimensions Capital.

Rivals and market perspectives

The main rivals of Kymera are companies that are also researching breaker proteins. As well as Kymera drugs, their drugs are also undergoing pre-clinical tests. There are four such companies: Nurix Therapeutics, Arvinas, C4 Therapeutics, and Vividion Therapeutic.

The company that is breathing down Kymera’s neck is Nurix but it is Arvinas that has advanced farther than the other four in developing its drug. Arvinas has been public and trading in the exchange since 2017. All four rivals also have eminent partners in the healthcare sector. They are united by the fact that it is hard to adequately carry out a fundamental analysis of their results because most of them are aiming at future achievements. That is why we can say that investments in such companies are speculative.

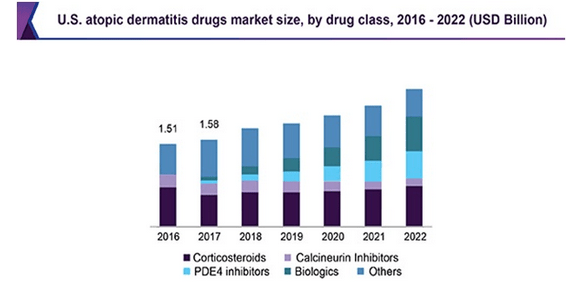

According to the research by GlobalData issued in 2019, the global market of treating hidradenitis suppurativa in 2018 amounted to some 898 million USD. It is expected to have risen to 1.8 billion USD by 2028.

The area of growth for the company is also the market of treating atypical dermatitis which reaches 5 billion USD and grows by 6% annually on average. The forecast volume of this market in 2027 is 18.3 billion USD. It is not the largest market ever but if the company captures leadership in it, it will make the business rather stable.

Financial results of Kymera

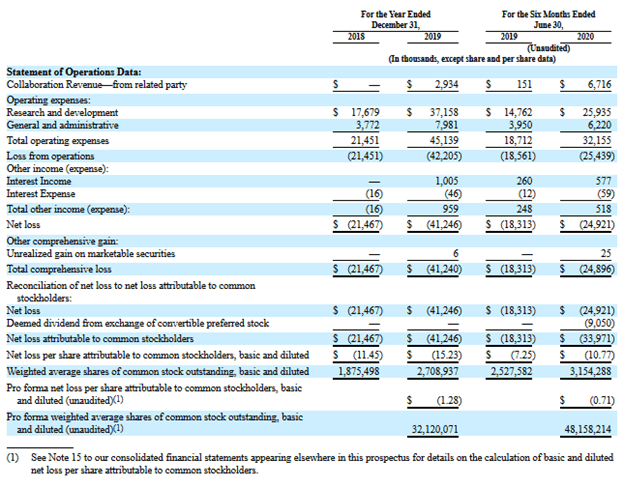

Those were the financial results of the company that made investors anxious. Speaking ahead of myself, the number of applications for the stocks was five times larger than the supply. The revenue during the last 12 months amounts to 9.5 million USD. As we see, there is large room for growth, compared to the drug market. However, if we look at the speed of growth based on the first six months of 2019 and 2020, we will see an increase by 4447,68%: 151 thousand USD against 6.716 million USD. If such speed of the growth preserves, we might see an income of 130.49 million USD at the end of the year.

The speed of growth of the net loss in 2020 decreased significantly, compared to 2019 against 2018: 36.08% against 92.14%. If the net loss meets the expectations, we may see some net profit at the end of the year.

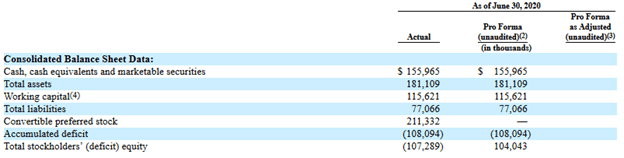

At the moment of the IPO, the company had about 156 million USD and equivalent assets on its account. This will be enough until 2025. By the IPO, Kymera Therapeutics attracted 147.2 million USD, which, in essence, became just another round of financing. For now, the company is suffering losses and is functioning on investments.

The underwriters of the IPO were Morgan Stanley, Bofa Securities, Cowen, and Guggenheim Securities.

Kymera is planning an additional emission of 0.5 million stocks. The income from the IPO will be distributed in the following way:

- 27 million USD will be used for bringing IRAK4 to the completion of the clinical tests of Phase1;

- 24 million USD will be spent for bringing IRAKIMiD to Phase 1 of clinical trials;

- 28.9 million USD will be allocated to financing STAT3;

- the remaining money will be used for maintaining the business and further development of the Pegasus platform.

Bottom line

Because of high demand, the IPO price amounted to 20.00 USD per stock, which is much higher than the announced range of 16.00-18.00 USD.

Kymera Therapeutics works in quite a promising market, though not the largest one in the healthcare sector, which grows by 6% annually. The company has already attracted some 197 million USD by 4 rounds of financing.

The Pegasus platform for point protein degrading allows finding breaker proteins with higher precision. Kymera states that their molecular breaker proteins go far ahead of contemporary healing methods and allow working on almost the whole human genome. Traditional methods cannot boast such efficacy.

Pegasus decides on collaboration with rivals as well in its research and developments. The platform is now used in immunology, oncology, and treatment of inflammatory diseases. The company plans further research in the sphere.

Moreover, Kymera has such products as IRAK4, IRAKIMiD, and STAT3 focused on separate critical spheres of therapy. They help define the pathogenesis of a large range of immune, inflammatory, and cancerous diseases. All the drugs are at the phase of pre-clinical tests, and the money attracted by the IPO will be allocated to their development. The company’s management made strategical agreements with Sanofi (NASDAQ: SNY) and Vertex (NASDAQ: VRTX), which indirectly creates positive reputations for Kymera Therapeutics.

Among the investors of Kymera Therapeutics, we see such eminent companies as Atlas Venture Fund, Lilly Ventures Fund, Pfizer Inc., Bessemer Venture Partners, and Dimensions Capital. The IPO was underwritten by large banks Morgan Stanley and Bofa Securities, which is also good for the reputation of the company.

However, the main thing is the financial results of the company – and they give much hope, especially in terms of the profit, yet do not let us call the company a stable business. In your portfolio, this stock will be a venture high-risk investment. As for trading after the lockup period ends, short positions seem appealing. Anyway, we recommend individual investors against participating in the IPO, especially if your portfolio is moderate or conservative. That is why we decided to speak about this company after the trades started.