Unity Software Game Engine Planning IPO

7 minutes for reading

Unity Software, a US company from San Francisco, founded in 2004, is carrying out an IPO on September 17th, 2020; the stocks will start selling on September 18th in NYSE under the ticker U.

About Unity Software

Unity Software Inc is the developer of the leading platform for creating, and managing interactive 2D and 3D content real-time. The main mission of the company is to make game development as available to everyone as possible. The company employs over 3,000 people. It has created a relatively cheap game engine that can be used for creating games for mobile phones, tablets, PCs, consoles, VR, and AR.

Hence, the platform has become widely used in many spheres, from video games to movie-making. The platform features rendering, graphic, sound, and animation instruments. Users may drag pictures and textures to the work area and animate them by the physics of motion real-time. Available operating systems include Xbox, Nintendo Switch, Android, PlayStation, Windows, Mac, and iOS – about 24 OSs. It was the first game engine to support the iOS platform by Apple.

Main investors and partners of Unity Software

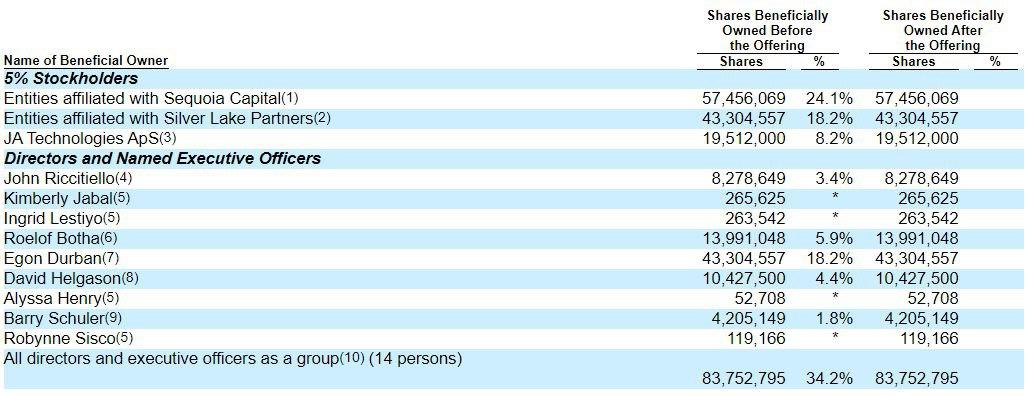

The main investors of Unity Software are:

- D1 Capital Partners Master LP with a share of 5.8% (after the IPO, it will decrease to 4.8%);

- Silver Lake with a share of 18.2% (after the IPO, it will decrease to 16.4%);

- JA Technologies ApS with a share of 8.0% (after the IPO, it will decrease to 7.2%);

- Sequoia Capital with a share of 24.1% (after the IPO, it will decrease to 21.8%).

The largest clients of the company are Take-Two Interactive, Nintendo, Tencent, Zynga, Electronic Arts, and Ubisoft.

On June 30th, 2020, Unity Software had 1.5 million users in 190 countries; some 15,000 projects are done daily. In 2019, Unity platform-based apps and games were downloaded over 3 million times to 1.5 million unique gadgets. That year, 53% of 1,000 most profitable games in Apple Store and Google Play, console and PC games were created on Unity. Over 120 million players used the services of the platform for text and audio messages.

Market perspectives and main rivals

Unity Software estimates its target market as 33 billion USD. The potential is calculated with regard to the segmenting of game genres and outer branches. The growth of revenue is expected to decrease from 42% in 2019 to 12% in 2029, with the average annual growth of 32%. Unity Software started facing rivalry with Cocos2d (Chukong Technologies), Google, Microsoft, Amazon, Facebook, Unreal Engine (Epic Games), and Tencent. The risks remain the same: errors in the work of the platform and a decrease in the speed of the extension of the client base.

Details of the Unity Software IPO

The underwriters of the company are:

- Goldman Sachs & Co. LLC.

- Credit Suisse Securities (USA) LLC.

- BofA Securities, Inc.

- Barclays Capital Inc.

- William Blair & Company, L.L.C.

- Oppenheimer & Co. Inc.

- Piper Sandler & Co.

- Stifel, Nicolaus & Company.

- Incorporated, Wedbush Securities Inc.

- Academy Securities, Inc.

- Siebert Williams Shank & Co., LLC.

This is quite a respectable collection, which means the IPO will be carried out at a high level. The company plans to sell 25 million stocks and attract up to 1.05 billion USD. The range of the placement is expected to be between 34.00 and 42.00 USD per stock.

With the highest price of the IPO, the company’s capitalization will amount to 11.06 billion USD. 263.36 million stocks are planned to be left in circulation.

Unity Software financial results

The report presented by Unity Software makes the company attractive for both investments at the primary stages of the IPO and long-term investments.

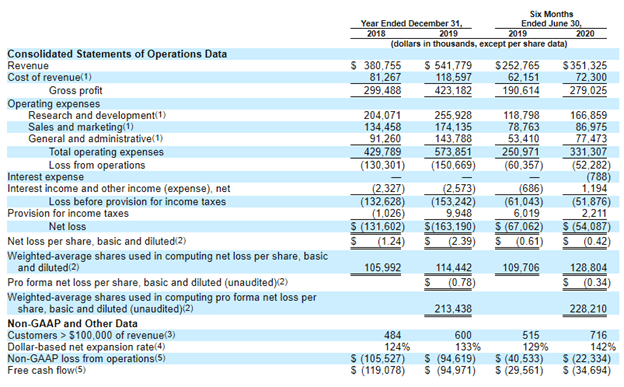

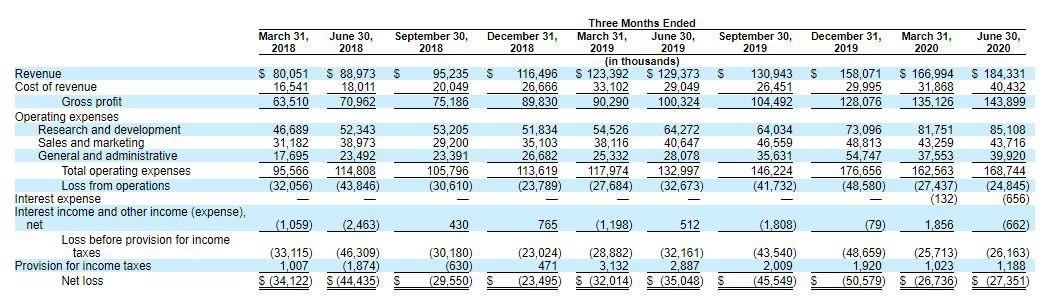

In 2019, the company’s income grew by 42%, compared to 2018. We also can compare the data from the first six months of 2019 and 2020; we can conclude that the speed of growth has shrunk to 38.99%. During the last 12 months, the company yielded 640.34 million USD: thus at the start of the IPO, Unity Software is offered for 17 yearly revenues. The forecast income in 2020 amounts to 753.05 million USD. The forecast for 2029 may rise to 4.59 billion USD. In this case, the capitalization of Unity Software may be between 23 and 46 billion USD with the highest price of 174 USD per stock.

In 2019 compared to 2018, the net price of services grew by 45.93%; during the first six months of 2020, compared to the same period in 2019, this index decreased to 16%. You see, the income grows much faster than the net price.

Then let us have a look at the operational expenses that grew in 2019 by 33.5%, compared to 2018. Comparing the same index for the first six months of 2019 and 2020, we see almost the same speed of growth: 32%. Let us look at the efficacy of expenses in more detail. In 2019 against2018, the company spent 25.42% more on research; in the first six months of 2020 against 2019, the expenses grew to 40.45%. Craving for constant improvement looks like good quality.

Now, to the marketing budget: in 2019 against 2018, it grew by 29.5%. In 2020 against 2019 (the first six months of each year), the expenses grew slower – by 10.42%. Administrative expenses increased by 57.55% in 2019 and 45.05% this year. We may conclude that Unity Software is focused on the development of its leading product solely and does not need additional marketing support.

The company makes no net profit as yet, only generates net losses. Let us have a look at the dynamics of this index: in 2018-2019, it grew by 24.02%, but in 2019-2020 (the first six months of each year) – decreased by 15%. Of course, we would like to see a larger decrease but the very tendency is cheering.

This index experienced a breakthrough in the first quarter of this year when it fell by 47.14% against the fourth quarter of 2019. Thus, the report about the third quarter of 2020 will be extremely important: will the net loss go on decreasing? Then we will be able to forecast how soon Unity Software will start making a net profit.

Closing thoughts

Unity Software Inc is a leading company in the sphere of developing, creating, and managing interactive 2D and 3D content in real-time. Unity game engine is widely used in many segments: from movie-making to creating games for mobile phones and consoles. At the end of 2019, the company had about 1.5 million active users from 190 countries. More than half of the most profitable apps in Apple Store and Google Play have been created on Unity, which enhances the commercial reputation of the brand. The reason for the popularity is the simplicity of the product and its compatibility with any developer.

The potential market of Unity Software reaches 33 billion USD, with the average annual growth of the company’s profit of about 32%. Thus, the potential capitalization of the company may have reached 46 billion USD by 2029, with the forecast stock price of 174 USD. No surprise that the company has Goldman Sachs & Co. LLC, Credit Suisse Securities (USA) LLC, BofA Securities, Inc., Barclays Capital Inc., and others among its underwriters. During the last 12 months, the company’s revenue reached 640.34 million USD; as for the net loss, it started decreasing in the first quarter of this year.

At the Unity Software IPO, it is planed to place 25 million stocks at the price of 34-42 USD each and attract about 1 billion USD. Even at the highest stock price, such financial results and market perspectives make the company attractive for medium- and long-term investments.