McAfee IPO: Attempt No 2

6 minutes for reading

McAfee Corp. carried out an IPO in 2006 already, and its stocks remained in the market until 2011. That year, it was bought by Intel for 7.7 billion USD.

In 2016, 51% of McAfee stocks were sold to an investment company TPG Capital for 3.1 billion USD, while Intel kept owning 49% remaining. TPG additionally invested in McAfee Corp. 4.2 billion USD.

In 2016-2020, McAfee bought a VPN service called TunnelBear and the leader of cloud storage safety Skyhigh. McAfee Corp. carried out its second IPO in NASDAQ on October 21st, 2020. The stocks started trading on the next day (October 22nd, 2020) under the ticker MCFE.

The company has been around in the cybersecurity market, facing tough rivalry, for about 30 years. I suggest trying to understand how has McAfee managed to remain the leader of the sector and whether it is worth adding to your portfolio.

Business model

Since the company was founded in 1987, it has been pursuing the goal of protecting PCs from viruses.

Surfing the Internet without an antivirus nowadays is like a bayonet charge against machine guns: the probability of your PC being “infected” is rather high.

That is why McAfee enjoys a stable demand for its products, especially keeping in mind that they are of high quality. Depending on the level of protection you would like to have, you can subscribe to one of the following packages:

- McAfee AntiVirus Plus

- McAfee Internet Security

- McAfee Total Protection

- McAfee LiveSafe

There is nothing innovative about this algorithm of work. The main advantage of McAfee is the reliability of its software and the handiness of its complex solutions. Simultaneously, this is the company’s weak spot because if any slightest problem emerges, most clients will leave for the competitors.

The driver that pushed McAfee forward is the constant appearance of new millions of new computer viruses. McAfee software develops accordingly. Another strong side of the company is its resistance against the consequences of the real virus COVID-19. We might say that the current crisis has not influenced the performance of McAfee at all.

All in all, there are no questions to the developers – in contrast to the financial department. Another negative factor is the influence of Intel on the operational processes of the company. For more details, see below.

Financial performance of McAfee

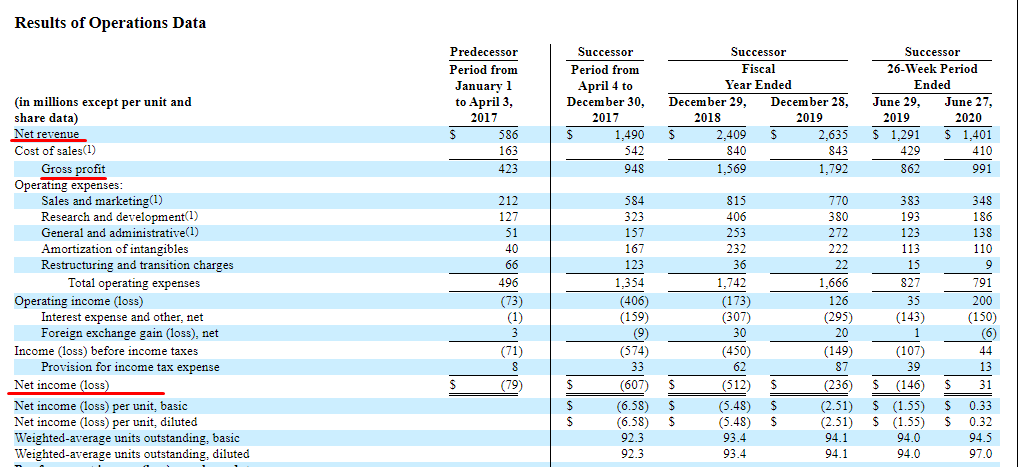

When I started analyzing the company, I was surprised to find out that McAfee was suffering losses for three years in a row. According to its reports, it managed to generate some profit in the first two quarters of this year only.

The net loss was shrinking since 2018: first, by 16% to 512 million USD, then, in 2019, - by 54% to 236 million USD. At the end of June, the company noted a net profit of 31 million USD.

During the last 12 months, the company generated 2.75 billion USD of revenue. The income forecast for the end of 2020 amounts to 2.86 billion USD if the growth rate of 8.5% (as in 2019) presumes.

The company is considered fast-developing: its revenue grows by 25% and more every year. In 2017-2018, the speed of the growth reached 60%. Meanwhile, the gross margin of return reaches 70%, which is rather impressive.

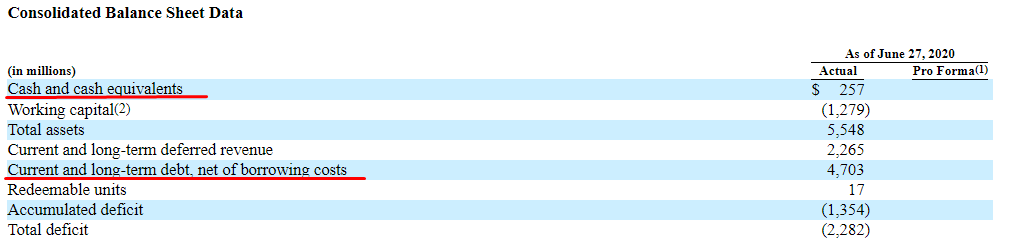

The greatest problem of the company is its large debt, amounting to 4.7 billion USD, while the company’s cash reached 257 million USD only. This flaw is smoothed out by the growing money flow and low debt interest due to the situation in the corporate debt market.

The main task for the financial management of the company is to increase the net profit and decrease the debt. The low debt interest policy will be over sooner or later, while the number of rivals with a higher profit and smaller debts will not decrease.

Now for the company’s potential market and its competitors.

Market perspectives and rivals

According to Grand View Research, in 2019, the world market of software amounted to 157 billion USD. The current market share of McAfee is evaluated as 1.82%. The same research forecasts growth of the market to 300 billion USD until 2027 with an average speed of growth of over 9%. Hence, if McAfee keeps its market share, its potential profit will grow to 6 billion USD.

The company itself states that in 2020, its software protects some 600 million gadgets all over the world. Quality is no less important than quantity, and it is also remarkable here: 86% of the company’s clients are on the Fortune 100 list, 78% - on Fortune 500, and 61% - on Global 2000. This means the company can boast high levels of clients’ trust.

Among the main rivals of McAfee, there are:

- Norton

- Avast

- Kaspersky

- Bitdefender

- Cylance

- ESET

- Trend Micro

Tough competition makes the company’s tariff policy rather flexible and loyal. In the corporate sector, McAfee is the indisputable leader (see the data above). The main rivalry happens in the mass market, where the company has some parity with the competitors. According to the Risk-Based Security report, in 2019, there were over 7,000 leaks of personal data with a general volume of more than 15 billion files. In January-April 2020, cloud storages experienced 630% more threats compared to the same period of the previous year. Thus, the above-mentioned estimates of the market growth and, hence, the profit of McAfee might turn out noticeably higher.

IPO perspectives and estimates of the company’s

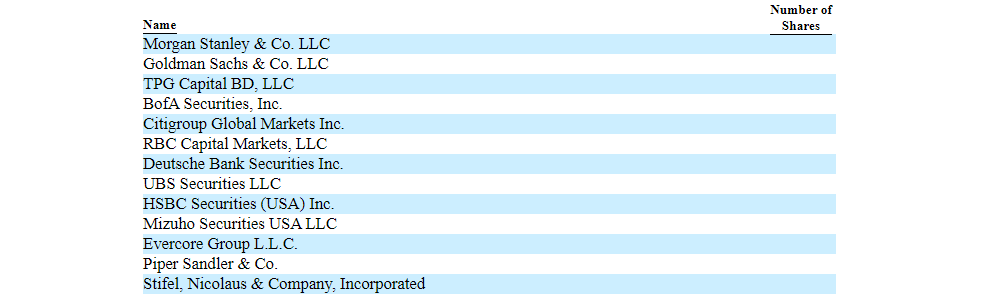

Among McAfee underwriters, there are the leading investment banks.

The leader is Morgan Stanley that earned 52% of the invested capital on exchange rate difference during the last 12 months. They are unlikely to participate in a weak IPO.

McAfee placed its stocks at the upper border of the range – 22 USD per stock – and attracted 752 million USD. Its capitalization amounted to 9 billion USD. Hence, the company will be trading for 3.5 returns.

For this sector, the average capitalization-to-gain ratio is 18.5. Thus, the upside before the lockup period will be 77-200%. In the long run, the company may grow by 700% of the current values.

Advice

The main risks for the company are rivals and some errors in the leading product. If these risks are avoided, the company has all chances to become the leader of the sector not only in terms of the number of clients but also in the volumes of its annual revenue.

Judging by the above, I recommend adding this company to your portfolio, expecting boosted growth in the nearest 3 months.