Caliber Home Loans IPO: Over 50 Years In US Mortgaging

6 minutes for reading

The leader of the US mortgaging market, Caliber Home Loans, Inc., is planning an IPO in the NYSE exchange under the ticker HOME. Trades were expected to start on October 29th, 2020; unfortunately, the underwriters decided against the date due to bad market conditions.

Caliber Home Loans is a fintech company because for lending it uses the data and analysis on its platform. The company was founded in 1963 in Coppell (Texas, USA) and has offices in more than 40 states.

In 2016, Caliber Home Loans became number two in terms of mortgages given, according to independent sources. Three years later, the company remained the leader in the mortgaging sector — the only one out of the top-10. Its unique advantage is the diversified platform. I suggest looking closer at the company's business, its strong and weak sides. This analysis will help us understand how profitable it is to include the company's stocks in your investment portfolio.

The business

Caliber Home Loans is a mortgaging agency that gives loans on the security of residential property. Additionally, the company refinances such loans. The company's assets are estimated as 9 billion USD.

The housing market develops in cycles and is normally the first one to drop in the times of recession. However, the business model of Caliber Home Loans maximally decreases the negative effects of the economy slowing down. The company sells credit contracts quite fast, significantly increasing the quality of its assets. Such loans do not remain long on the company's balance.

To sell its services, the company uses two main channels: the direct and local ones. As for the latter, there are 341 crediting spots working in 46 states. The employees of the crediting spots sell their services via real estate agents and developers. Moreover, they interact with credit brokers. Some 60% of mortgages in the USA are signed this way.

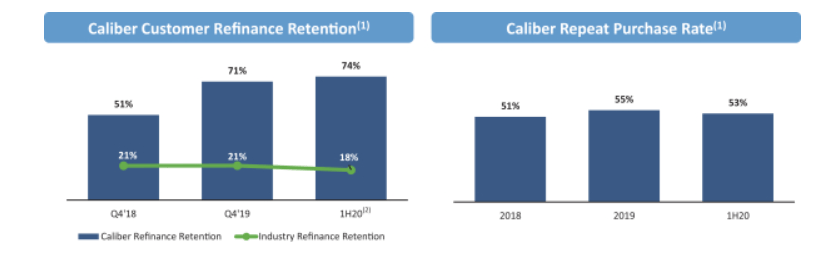

Caliber Home Loans directly contacts with its clients only on the questions of loan refinancing under the security of residential property. A larger part of the operations are made via a special servicing platform. By this, the company keeps the rights for servicing loans and accumulates the information about future needs of its clients for refinancing. Thus the company makes its clients more loyal and its business — more profitable. On the diagram below, see the comparison how many clients the company keeps — and the average number in the sector:

As you see, the level in the sector on the whole in the first quarter of 2020 is 18%, while fot Caliber Home Loans, the digits grow up to 74%. Moreover, in 2019, 55 clients out of 100 came back to the company to buy again. This index makes the company an unfisputable leader in its segment. Now let us have a look at the US mortgaging market in more detail.

US housing market

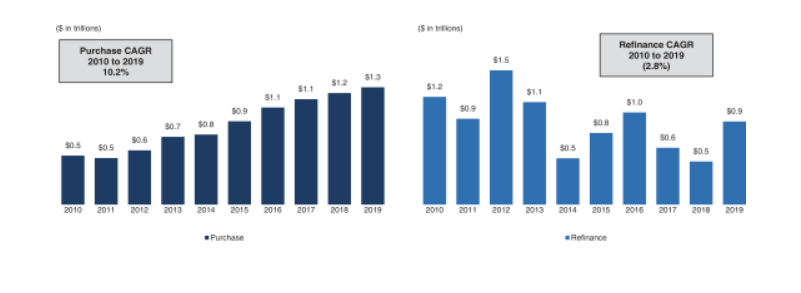

In the USA, crediting on the security of real estate is one of the most profitable businesses. In the last 10 years, the US mortgaging market has been growing faster than the GDP — by 10.2%. At the end of 2019, the market was estimated as 2.2 trillion USD. It is split into two segments: loans for buying new houses (1.3 trillion USD) and refinancing (0.9 trillion USD).

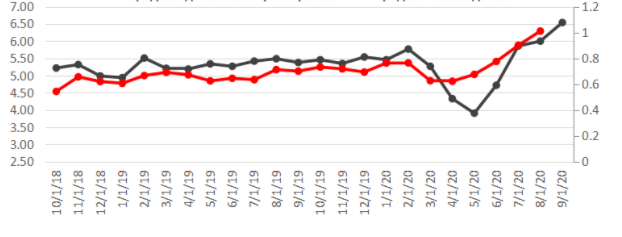

The latest data on the housing market shows that sales in the primary (red line) and secondary (black line) markets have already exceeded their own levels of before the crisis. Prices are growing thanks to the record-low interest rates, which is a most benevolent monetary regime for the niche.

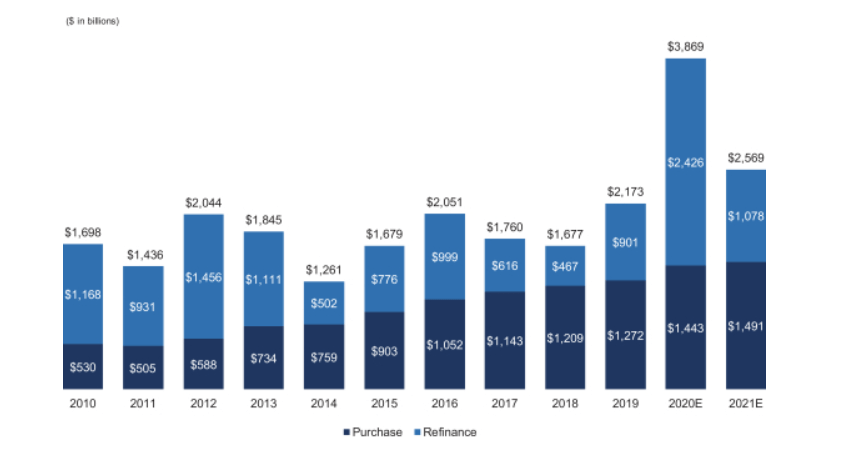

In 2020, the mortgaging market is expected to reach 3.87 trillion USD. See below the forecast of the analysts of the segment — MBA and Fannie Mae.

That is why the business model allows the company to improve its financial results noticeably. As we will see below, Caliber Home Loans does already have things to be proud of. Let us analyze the S-1/A form filed to the SEC.

Financial performance of the Caliber Home Loans

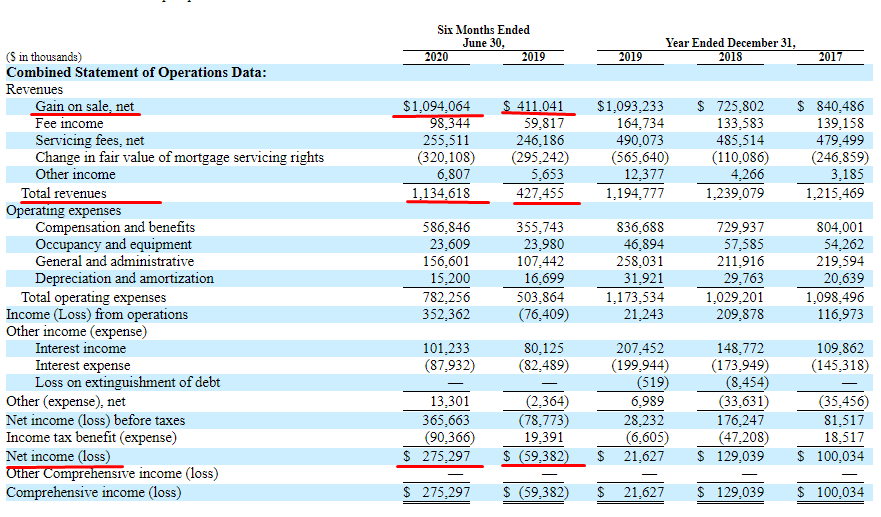

In the first half of 2020, the company increased its net profit significantly compared to the same part of 2019 thanks to the growth of the revenue from selling loans. On June 30th, 2020, its overall return amounted to 1.13 billion USD, which means relative growth of 165%, compared to the same period of 2019.

The net profit of 6 month of 2020 amounted to 276.3 million USD, against a net loss of 59.4 million USD; compared to the same period of 2019, the growth amounts to 166%. The major part of it is again thanks to selling loans and bonuses over their balance prices.

The gross expenses in the first two quarters of 2020 amount to 782.26 million USD against 503.86 million USD in the same period of 2019; the relative growth is 55.25%. This means the revenue grows three times quicker than the expenses. In the last 12 months, the company's return amounted to 1.78 billion USD. It is expected at the level of 1.97 billion USD at the end of 2020. Hence, the capitalization of 10 billion USD looks fair.

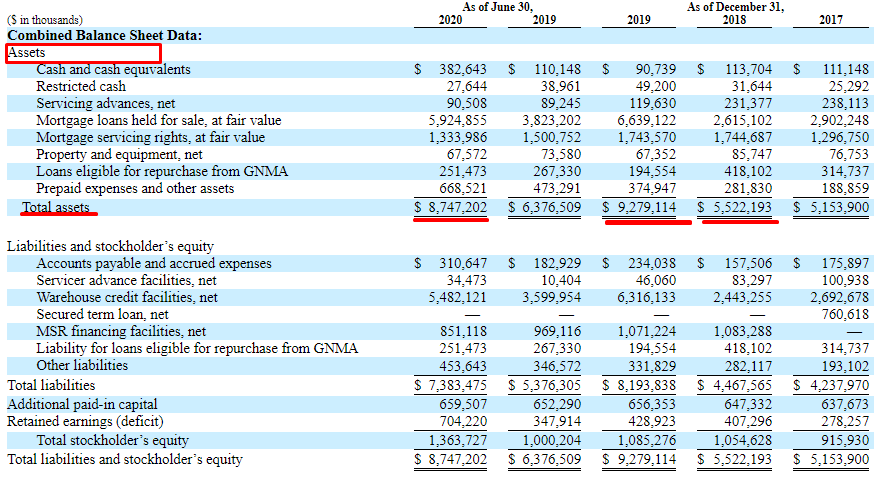

In 2019, the company's assets reached 9.3 billion USD against 5.5 billion USD in 2018. After the first 6 months of 2020, the index rose to 8.75 billion USD. By the end of the year, the assets might have reached 12.7 billion USD. The assets are distributed the following way: 70% are mortgages, 20% are the rights for servicing mortgages. Judging by the above-mentioned, let us conclude on the perspectives of the Caliber Home Loans IPO.

Perspectives of the Caliber Home Loans IPO

The underwriters of the company are UBS Investment Bank, Wells Fargo Security, Barclays, Goldman Sachs, Citigroup, BofA Securities, Credit Suisse, and others. The IPO was rescheduled, and the new date is unknown. Most probably, the IPO will happen after the presidential elections. The placement price is between 14-16 USD per stock; the sum planned to be attracted is up to 345 million USD. The company puts 23 million normal stocks on sale.

The company has strong fundamental values: the net profit of 275 million USD after the first 6 months of 2020 and the growth of the return by 165% compared to 2019. The market of the company has been growing by 10.2% annually for the last 10 years; its volume in 2020 is estimated as 3.87 trillion USD.

Major risks

- The pandemics of COVID-19 influenced the company's performance noticeably: the demand for homes dropped, the share of troublesome loans increased. The business of Caliber Home Loans depends on the regulations of such federal associations as Fannie Mae, Freddie Mac, or Ginnie Mae. Lawful chabges in their activities influence the financial performance of the company.

- High correlation between the asset prices and the dynamics of the Fed's interest rate.

- Low liquidity of assets.

In the nearest 2-3 years, the Fed's policy is expected to be soft, hence, in the medium run, the prices in the housing market are unlikely to fall, while the pandemics are an irregular event. That is why I advise considering this company as a part of your portfolio.