Should We Buy Boeing Stocks?

7 minutes for reading

The larger becomes a company, the less it reacts to the screams of the yellow press. The financial stability of such companies attracts the attention of investment funds worldwide, and their stocks become conservative investments.

The probability of some scandal influencing the global market is extremely low. Normally, negative news leads to a minor correctional decrease in prices that investors use for buying stocks cheaper.

However, even in stable companies sometimes happen events that throw a long dark shadow on both the stock price of the issuer and its revenue. Boeing (NYSE: BA) has just faced such an event.

Boeing 737 MAX 8 brought to the ground

In 2019, there were two crashes of Boeing 737 MAX 8 that led to the airplanes of this series being banned from flights. Clearly, such news harmed the stock prices that dropped by 18% after several days.

Then investors started estimating the scale of the problem for such a large company; anyway, no one was selling the stocks on emotions anymore, which means the existing risks were already incorporated in the price of the security. We only had to wait for the solution to the Boeing 737 MAX 8 problem, and the stock price was sure to go on growing.

Airplanes have always been crashing from time to time, and investors know what to do in such cases. However, this time, things went too negative.

The COVID-19 pandemics and a decrease in orders

Boeing was still solving its problems when the coronavirus came to the scene and brought all airplanes worldwide to the ground. Planes were staying idle, requiring maintenance, so there was no need for buying new boards. By the end of the second quarter, air carriers called back 186 orders, which meant millions of dollars of losses for Boeing.

These two problems together sent a huge blow on Boeing that the company has not still recovered from. The stock price fell by 67%.

Stocks reaching the bottom

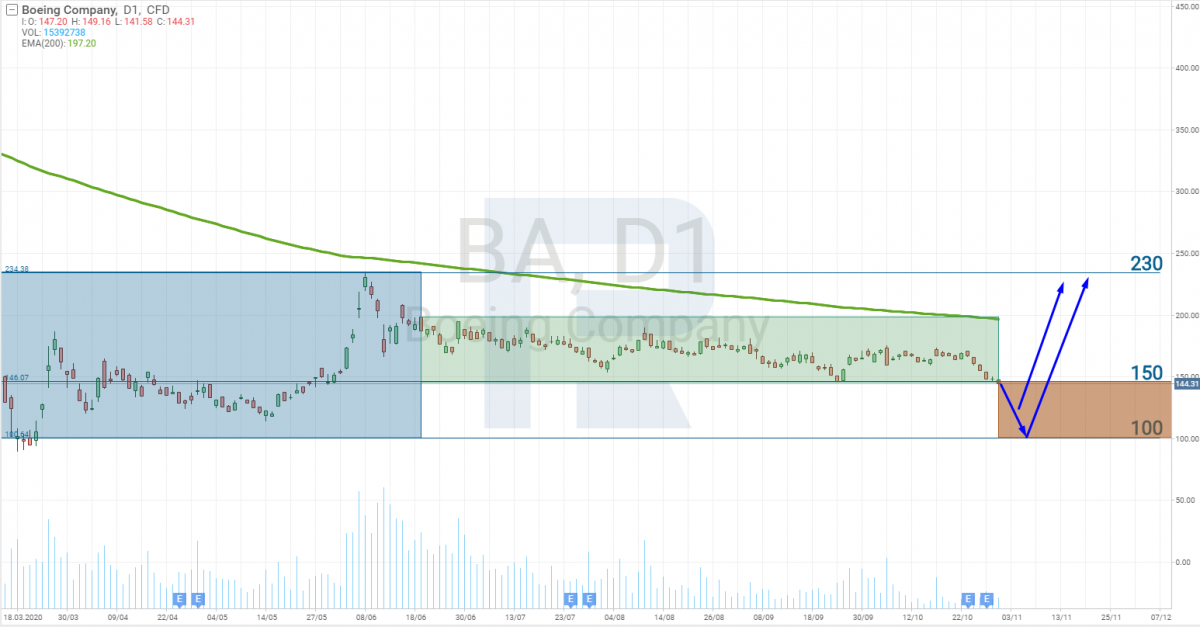

However, note the price chart. The stocks have reached the bottom at 90 USD and never went deeper down. Since March, they have been trading between 90 and 230 USD; recently, the range has narrowed down to 150-200 USD.

We may conclude that the risks connected to 737 MAX 8 and COVID-19 are already included in the price, and the latter can be brought down only by some additional negative events. This means we can already consider investing in Boeing stocks at these levels. As soon as the general situation improves, the stocks will also start growing.

However, this analysis is on the surface. To see the whole picture, look at the financial reports and the comments of the management. Let us check the performance of Boeing in the third quarter.

The report for the third quarter

The losses of the company started to decrease gradually. While in the second quarter they amounted to 4.79 USD per stock, currently they are 1.39 USD per stock. The gross revenue grew from 11.8 to 14.1 billion USD.

The net loss amounted to 466 million USD, however, in the previous quarter, it was 2.376 billion USD.

These improvements became possible because the company optimized its expenses. In spring, they launched a campaign of voluntary sacking the personnel. Then, after a part of the employees left, the firing became compulsory and are still happening. Currently, the company plans to free 30,000 workplaces more, to employ 130,000 people at the end of 2021 (according to Finviz.com, the company employs 161,100 people).

In the third quarter, Boeing supplied 28 airplanes for the commercial sector, which is 34 planes fewer than a year ago, due to which the return of the commercial department fell abruptly by 56% to 3.6 billion USD.

The tests of Boeing 737 MAX 8 harm the financial situation of the company: the expenses on this plane in the third quarter amounted to 590 million USD.

In the defense sector, things are much better: the return fell by only 2% to 6.8 billion USD. However, director-general Dave Calhoun suspects that the fight with the coronavirus will make the government decrease its expenses on defense services, which will harm the contracts between Boeing and the US government.

Transportation restores too slowly

Transportation in the civil sector is not restoring as fast as it used to be expected. The forecasts for returning to the pre-crisis levels have shifted to 2023, though we expected those levels to be reached in spring - 2020.

Inner flights now reach 49% of the level of 2019, but international flights — 12% only. Airlines use only 25% of their planes. For Boeing that deals with aircraft production, the situation will get better only when companies will start using 60-70% of their planes. Until then, the demand for airplanes will remain low.

The return of 737 MAX 8 is postponed until 2021. At the beginning of 2020 flights of this plane were expected this summer, but alas! If the regulator lets 737 MAX 8 fly, Boeing will be able to sell the planes it keeps — there are 450 of them now. Anyway, this is the civil sector where the demand is unexpectedly low.

Will Boeing be able to sell all the planes in the store quickly? No answer.

The situation becomes even more disappointing because of the answer of the executive director Greg Smith during a press conference. Namely, he gave no clear answer to the question of how many potential buyers are there, ready to buy 737 MAX 8 in 2021 and 2022.

Competition with Airbus A320

The situation is worsened by rivalry with Airbus. Airbus A320 has long been the rival of 737 MAX 8. Boeing plans to go on with 737 MAX in 2022 only, producing 31 planes a month. Meanwhile, Airbus plans to produce 47 A320 planes in 2021, increasing its presence in the market.

Anyway, the problem with 737 MAX 8 is not the delay in production but the ban for flights. The later it is lifted, the more planes Airbus will sell, which means its share in the market of post-sale maintenance will also grow.

Boeing has 57 billion USD of debts

Last but not least, Boeing has a huge debt that is growing. Moreover, it is not just "growing", it has sky-rocketed from 20 to 57 billion USD. This is, perhaps, the most worrying part of the whole situation, because the debt needs maintenance. For it, Boeing attracts finance via bonds. However, on October 29th, a rating agency Moody's Investors Service rated Boeing bonds ad Baa2 with a "negative" forecast, which means in the future it may be revised for worse.

Baa2 means debts with moderate risks. They are treated as debts of the medium category but may feature certain speculative traits able to lead to the growth of the interest under which Boeing lends money.

With such a rating, the company can go on attracting investments and working; however, if the passenger flow takes longer to restore, the increased debt will remind of itself more and more often because the sums necessary for its maintenance will grow faster than the company's revenue.

Summary

Judging by the revenue that has started to grow, the company has already pushed off the bottom, which was on 90 USD per stock, as the chart goes. This was the level that the price hit in the midst of the pandemics in spring.

If the Covid-19 problem had been solved by autumn, the stocks would have traded above 200 USD. However, no miracle happened. Now the company has to work with low profits and large losses, and all this is the long run, which is even more difficult. Hence, Boeing needs a constant inflow of investments, which worsens the perspectives of long-term investments and increases the financial load on the company.

Fortunately, the Fed is now buying corporate bonds and assumes the risk. This gives Boeing hope for financial support in the future and even a possibility to restructure the debt if needed.

Finance decides a lot in the company: if it is available, problems can always be solved. We can see that for Boeing, it is still available. In the end, the stocks are rather likely to grow above 150 USD again and even try the area of 180-200 USD.

Currently, Boeing stocks do not suit for long-term investments. The risk is the debt, growing fast, that is why I advise considering this stock a short-term investment, buying it at the support line.