IPO Inhibikase Therapeutics: a contribution to control of the Parkinson disease

5 minutes for reading

Among the companies that are filing for an IPO, there are some with ready-to-use products and services, while the others have theirs under development. Actually, such companies don’t have any earnings as they receive their money by means of grants from funders. By investing in such companies, you invest in your future. Of course, these investments are highly risk-bearing but might bring excess returns in case they succeed.

Inhibikase Therapeutics, Inc., which is scheduled for an IPO on December 22nd, 2020, at NASDAQ (IKT), is one of such companies. The company stock will start to be traded the next day, December 23rd. Let’s get deeper into the operations and activities of Inhibikase Therapeutics, Inc.

The uniqueness of Inhibikase Therapeutics, Inc.

The company is into research for creating a medicine against Parkinson's disease and its gastrointestinal complications.

The company’s “top-of-the-line” medicine, IkT-148009, is scheduled to be tested on volunteers the next year. By now, the product has come a full cycle of testing on animals.

A distinguishing characteristic of IkT-148009 is that it enters the brain at a molecular level and directly fights degradation processes of neurologic mechanisms. During trial injections to animals, IkT-148009 showed effectiveness in slowing down the development rate of Parkinson's disease and partial recovery of lost brain functions. However, it’s important to understand that there might be no such positive results with tests on humans. Also, there is a risk of an opposite effect, when a medicine only boosts the development rate of a disease.

Nowadays, doctors are trying to treat Parkinson's by removing protein plaques, which are believed to be a reason for this neurodegenerative disease, from the brain. However, such approaches didn’t prove successful in practical work. Inhibikase Therapeutics, Inc. specialists took a different tack and are ready to test their medicine on humans. During the research, they found the key protein agent, c Abl, and that’s exactly what IkT-148009 is fighting, allowing not only to slow down the disease development rate but also revert some of its negative consequences.

Moreover, another medicine called IkT-001Pro is also in development. Apart from Parkinson's disease, it is planned to be used against myelogenous leukemia, a form of cancer blood cells and bone marrow. As a result, the company is planning a significant expansion of its potential market.

Market perspectives

During the first stage, the primary market for the company is believed to be the USA. As of today, there are from 700,000 to 1,000,000 people suffering from Parkinson's disease in the USA, and this number increases by 60,000 every year. According to the World Health Organization, there are about 3.7 million people with Parkinson's disease in the world, with an annual increase of 300,000 every year.

According to various estimates, the Parkinson disease control market in the USA will reach $6 billion by 2025. The global demand may be as high as $22 billion.

The strategy of Inhibikase Therapeutics, Inc. for capturing the market is based on the following principles:

- Researching biochemistry of proteins, which act as catalysts of the disease.

- Active implementation of the patented treatment method on volunteers.

- Developing of the leukemia treatment area.

Due to the lack of data on human trials, it’s difficult to predict the company’s market share. Now, leys dig deeper into Inhibikase Therapeutics finance.

Inhibikase Therapeutics, Inc. financial performance

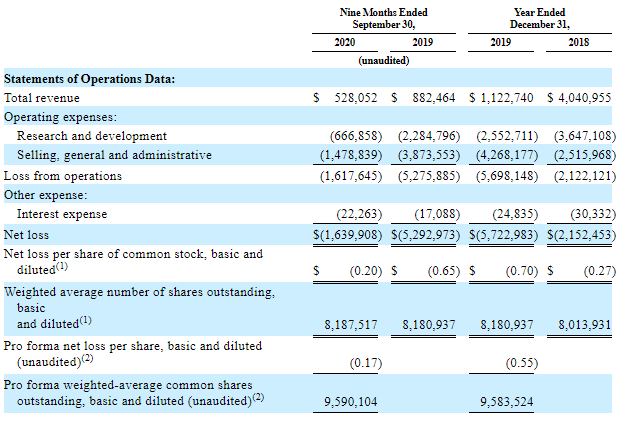

Inhibikase Therapeutics, Inc. doesn't generate profits and barely has any earnings.

The key part of the company’s finance is grant financing.

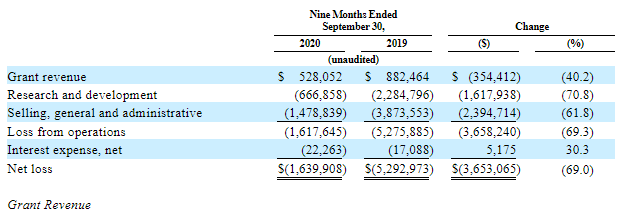

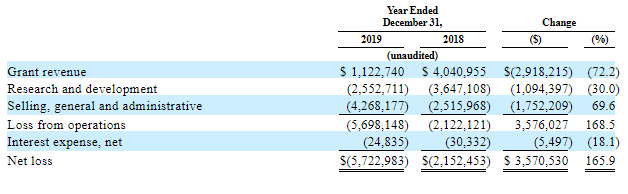

Over 9 months of 2020, earnings from grants have decreased by 40.2% in comparison with the previous year (from $882.46K to $528.05K). This decrease was caused by the slowdown in scientific and research activities and it can be seen in a 70.8% drop of expenditures for Research and Development over 9 months this year against the same period of 2019 (from $1.62M to $666.86K).

As one can see from reports, this tendency started two years ago, in 2018, that’s why the following conclusion can be made: the decrease in grant financing resulted from the degree of medicine availability but not its clouded outlook on the market.

More information about the company’s strong and weak sides can be found below.

Strong and weak sides

When we have exact information on the company’s business model, financial health, and market outlook, it’s time to identify its strong and weak sides. The following factors are in favor of investments in Inhibikase Therapeutics, Inc.:

- The company is developing a unique method for the treatment of Parkinson's disease.

- The potential market will increase up to $22 billion by 2025.

- Research conducted by the company implies anti-leukemia therapy, which allows diversifying its business.

On the other and, risk factors marked by Inhibikase Therapeutics in IPO prospects are:

- Lack of earnings, hence no net profit

- Lack of guarantees that IkT-148009 will be registered and go on sale.

- Potential deficit of the company’s shares liquidity, which may be a problem when selling them if necessary.

IPO details and estimation

The Inhibikase Therapeutics IPO will take place at NASDAQ on December 22nd, 2020. The price range is from $10 to $12 per share. The company is planning to receive 21.2$ - 24.7$ million. After the IPO, the capitalization is expected to be $116 million. The underwriters of the IPO are ThinkEquity and Paulson Investment Company, LLC.

The money attracted will be used for the first phase of clinical trials of IkT-148009 on healthy elderly patients. In addition to that, the company is planning to clear debts and finance corporate expenditures.

In case the clinical trials are successful and the medicine goes on sale, the potential market in the USA alone will be $6 billion by 2025. The companies’ upside may be about 1,000% if the market estimates Therapeutics at 5 operating revenues ($1.2 billion/$116 million*100%).

Investments in this company are of social nature because investors’ funds are planned for financing a unique method of fighting a yet undefeated disease, Parkinson. With all that said, we recommend this company for long-term investments but not more than 5% of youк working capital.