2021: Market Euphoria Continues

8 minutes for reading

The first trading day of 2021 began with the S&P 500 hitting its all-time high. This means that investors remain optimistic and are ready to go on investing their money in stocks. Playing short would be too risky but explicable.

Demand for gold and stocks is growing

I would like to draw your attention to two financial instruments that threaten further growth of the index, which is gold.

What do you do if the stock market is prone to a crisis and many companies are struggling to survive, losing up to 50-90% of their stock price?

In such cases, market players tend to invest in protective assets, which has always been gold and buy insurances against defaults of companies. Insurances are more complicated to check and track while with gold, it is simpler: there is a chart we can consult at any time.

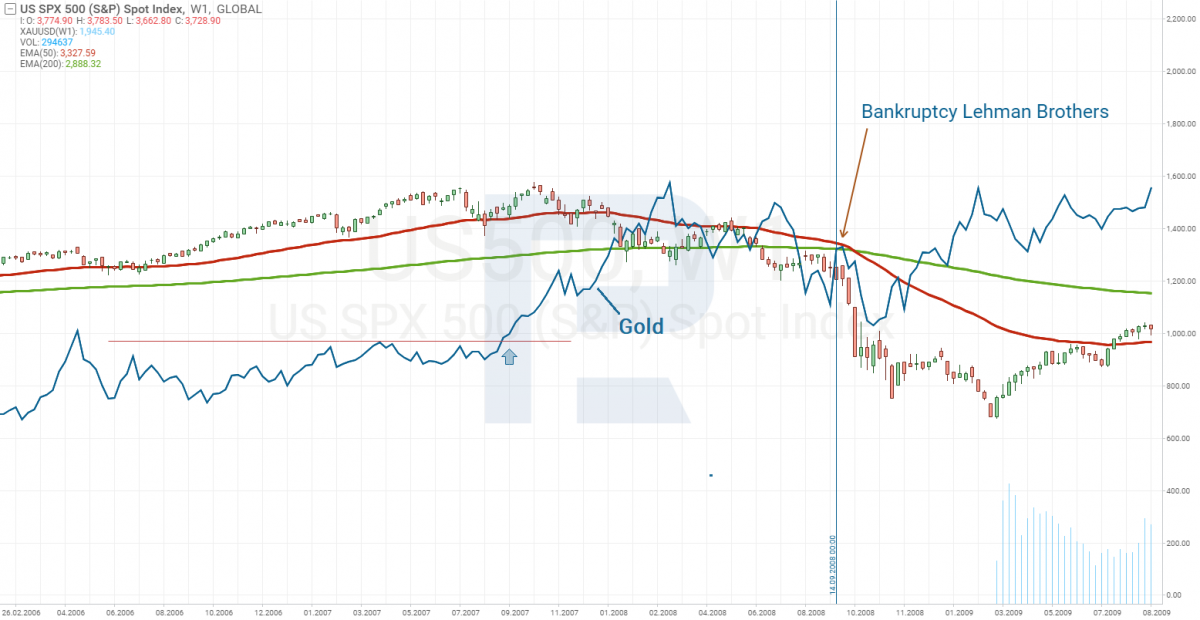

Mortgage crisis

In 2007, a year before the financial crisis began, gold quotations aimed up high, which means many investors had been suspecting a bubble growing in the mortgage market. To protect their finance, they started buying gold (see The Big Short movie if you are interested in the 2008 crisis).

The S&P 500 quotations also went down gradually, and by the time we heard of the bankruptcy of Lehman Brothers (which news was the starting point of the crisis), they were trading 18% below their all-time highs.

Why so optimistic?

The explanation is simple. At the end of 2020, people started getting vaccinated against the coronavirus, which is a hope for the recovery of the economy.

The next explanation is the unprecedented support of the economy by pouring in money. Joe Biden will only enhance the support as soon as he becomes President.

When might the growth in the stock market stop?

Europe and the US take support measures, pouring trillions of the USD and EUR into their economies. Low interest rates that allow cheap crediting also sustain businesses.

Now imagine a runner participating in a marathon. To help them, the team paved the road and got a huge fan to blow in their back.

What happens when the support is taken away? The runner’s feet get heavy, and the wind in their face might knock them down.

This comparison means that rumors about the support being wound up might fall as the first blow on the market, while an increase in interest rates will become the second one. This will make those who have bought stocks at a lower price take the profit, while those who have bought at the highs will become very long-term investors, expecting the price to get back. Those who used leverage will be the most vulnerable because a correction might trigger a Margin Call, which will even push the stock prices further down.

However, while money is poured in, stocks will keep growing. A part of investors will go on buying gold, diversifying risks, but this will be the smallest part. The larger part will continue investing in stocks, noticing smaller companies with stocks trading far from their all-time highs due to rather unstable financial performance. However, the euphoria will cause investors to buy anything.

Central banks are not planning to increase interest rates

Experts say that in the first half of 2021, neither Europe nor the US will increase interest rates (Goldman Sachs even forecast the Fed to lift the rate in 2024 only) or wind up the bond-buying program. Hence, stocks will go on growing. Hence, it is not the best of ideas to stay aside and watch them grow.

There are two ways of behavior in this situation. The first one is to invest in gold to protect your capital, while the second one is to try and find stocks that might grow further.

Electric cars makers reported sales

The beginning of 2021 was marked by not only the growth of the S&P 500 but also by good reports of electric car producers.

Tesla, Inc.

Say, Tesla (NASDAQ: TSLA) reported selling 189,750 electric cars at the end of the 4th quarter, exceeding forecasts by 15,750 cars. The report pushed the stock price 7% up, and the stocks keep trading at their all-time highs.

Tesla is the leader among electric car makers, and its report somewhat predicts subsequent reports of its rivals, i.e. if Tesla sales grow, other electric car makers will also enjoy increased demand for their products.

NIO Limited

This is exactly what has happened. NIO (NYSE: NIO) reports showed that sales of electric cars doubled in December 2020; they sold 17,353 cars in the 4th quarter, which exceeds the boldest expectations.

According to William Bin Lee, the director-general of the company, sales were significantly supported by the new “Battery As a Service” option, which means that electric cars are sold without batteries, which are leased to the client. This solution decreases the prices for electric cars noticeably, making them competitive.

NIO stocks keep trading in an uptrend at their all-time highs.

Li Auto Inc.

Li Auto (NASDAQ: LI) also cheered its investors up with good sales results in the 4th quarter of 2020. In December, electric car sales grew by 530%, and quarterly sales – by 67%, to 14,464 cars. Li Auto started mass production in November 2019 and managed to near NIO in such a short term, though NIO has been selling electric cars since 2017.

Li Auto stocks grew along with the stocks of other electric car makers, but they currently seem to be the weakest, too far from their all-time highs. On the other hand, this might be interpreted as a potential for growth.

XPeng Inc

Another Chinese maker of electric cars XPeng (NYSE: XPEV) also demonstrated results of the 4th quarter that exceeded expert expectations. In December, its sales grew by 326%, while quarterly sales – by 303%, reaching 12,964 cars. As with Li Auto, XPeng stocks are also far from their all-time highs, which makes them appealing for investments.

Anyway, the two latter companies have just entered the market and have not yet reached the sales volumes of Tesla or NIO, they have all the way ahead.

The growth of sales could be noticed in every electric car selling company, which indicates an obvious trend in the future. Hence, the whole of 2021 will be marked by favorable reports of electric car producers, which means you can choose a company for investments in this sector that has such growth potential.

Anyway, I would like to single out Tesla stocks. Many market participants think them to be overbought, and volatility in them is huge, so investments will entail increased risks.

Vaccination will restore passenger flow on airlines

Another sector that you should look at is air transportation. The vaccination is expected to stop the pandemics and open up borders, restoring the economy and the income of citizens. People, hungry for goof travel, will help the tourist sector recover and increase the passenger flow. Hence, the situation in airlines will get better, and so will their stock prices do.

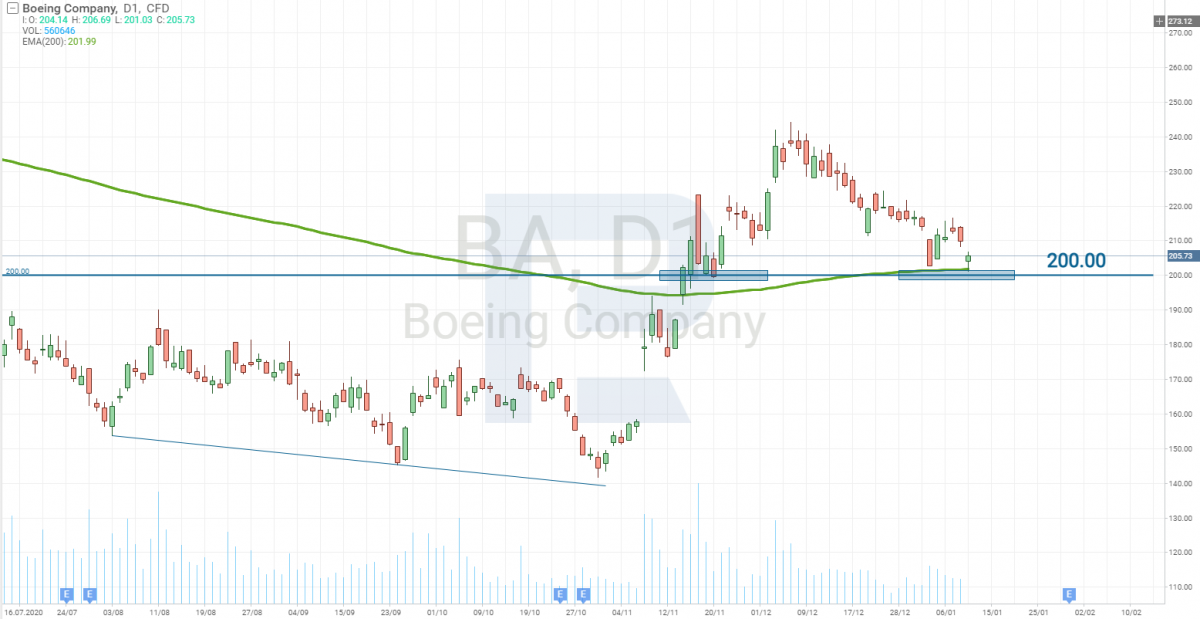

Boeing orders might recuperate

Of course, the main beneficiary will be The Boeing Company (NYSE: BA) for which the inflow of orders must restore after the slump of 2020. It is the first company for you to pay attention to this sector. Its stocks are completing the correction that started a month ago. The stock price might start growing from these levels.

You can also consider for investments the following airlines: American Airlines Group Inc. (NASDAQ: AAL), Southwest Airlines Co. (NYSE: LUV), Delta Air Lines, Inc. (NYSE: DAL), United Airlines Holdings, Inc. (NASDAQ: UAL).

Among them, the financial situation is most stable in Southwest Airlines. It owns 14 billion USD of free money, and most of its income is generated by domestic flights. Moreover, Southwest Airlines suffered a lot from the ban imposed on Boeing 737 MAX 8 in 2019, losing 435 million USD. And now Boeing 737 MAX 8 is allowed to fly again, which is yet another factor of growth for the company.

The weakest airline is American Airlines. A surge in its debt load made it reduce its expenses and fire a significant part of employees. Though it has paid off current debts and has no more large payments in 2021, investors tend to avoid its stocks, judging by the chart.

All in all, vaccination is expected to rescue airlines and enhance their financial performance.

Closing thoughts

2020 was packed with negative events, and 2021 is expected to be quite the contrary. The vaccination should make a noticeable impact.

However, there is one detail that can spoil everything. Currently, the stocks of many issuers are trading at their pre-crisis levels or higher. When the fuss around COVID-19 dies out, market participants will shed a look at the economy and find it in a worse state than before the crisis.

Then many will try to realize why stocks are so expensive. Hence, stay vigilant and never miss the time to take the profit.

Investing in ProShares VIX Short-Term Futures ETF (AMEX: VIXY), also called “the index of fear”, will be a great idea. When panic kicks off, its quotations will leap up by hundreds of percent.

As for now, look for undervalued stocks and buy them. The first half of 2021 is promising generous profits.