IPO of TELUS International (Cda) Inc: Efficient Business Digitalization

6 minutes for reading

The trend that has been prevailing in the area of business-to-customer communications for the last five years is the transition away from face-to-face communications. Most of the time, we talk to chatbots and voice-activated digital assistants of all kinds. At first, they performed common functions but now they are able to deal with the issues that require comprehensive answers.

On Wednesday, February 3rd, 2021, TELUS International is going to hold an IPO at the NYSE (under the TIXT ticker). The company’s shares will start to be traded the next day, on Thursday. TELUS provides companies from any sphere with communication digitization services – the company soared to considerable success in this area and this article will tell you about it.

TELUS business

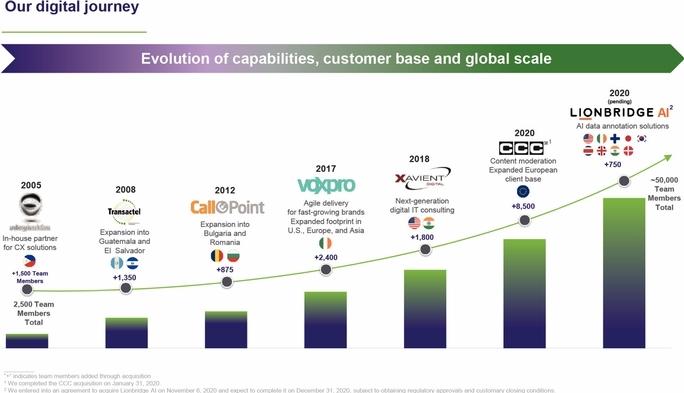

The company was founded in 2005 as a subsidiary of TELUS Corporation, a national telecommunications company in Canada

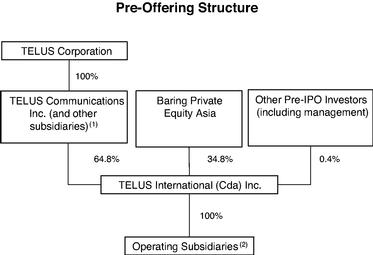

The company is headquartered in Vancouver. In total, TELUS has about 50 offices in more than 20 countries all over the world. The company’s structure prior to and after the IPO is shown below:

TELUS’ President and CEO is Jeffrey Puritt, who started his career in the parent company as far back as 2001. Now, Puritt has over 50,000 employees working under his command. TELUS became a pioneer in the business digitalization segment; its products offer the company’s clients the opportunity to quickly implement all cutting-edge digital technologies for intensifying their business.

TELUS offers complex follow-up support by developing images and strategies and searching for their growth point. Over the last 15 years, the company has accumulated pioneer experience in solving the matters that different businesses (even world-famous brands) face when they transit their communications to digital.

Apart from that, TELUS also may provide assistance services for the implementation and transformation of digital customer experience management. Amidst the COVID-19 pandemic, this came in very useful for many companies out of objective necessity for the provision of distant services. TELUS created two IT products for a comprehensive approach to problems for its clients: the “DX” module for digitizing previous customer experience and the “DCXM” module for further customer experience management.

The company attracts clients by means of direct sales and consulting-marketing approach, thanks to which they build long-term relations and create the money flow.

Relatively recently, TELUS Corporation paid $939 million for acquiring Lionbridge AI from Lionbridge Technologies. Since this branch was earlier specializing in data automation, the company is planning to use it to improve opportunities for machine learning.

All this allows the company to generate net profit, increase earnings, and company’s share in the fast-growing market.

The market and competitors of TELUS

According to Grand View Research, the global customer experience management market will reach $23.6 billion by 2027. From 2020 to 2027, the average annual growth is estimated at 17.7%.

Such development pace is set by the clients themselves, who ask for an increase of the speed of simplicity of services in any sphere. Every extra mouse click or screen tap/swap when clients use the company’s application in any sphere reduces its potential earnings. Another incentive is an increase in usage of social networks and online shopping (analog businesses are looking for their niche in this segment).

Nowadays, an official social network page of any brand and the opportunity for direct communication are a common thing. A post by a public figure in their own blog containing negative feedback on some product or service may result in huge losses and customer outflow for a company.

TELUS’ major competitors are Endava (DAVA), TaskUs, Webhelp, EPAM (EPAM), Cognizant (CTSH), WNS (WNS), and Accenture (ACN). As one can see, many of these companies have already gone public, so we can use their multipliers for assessing TELUS’ potential capitalization.

TELUS International financial performance

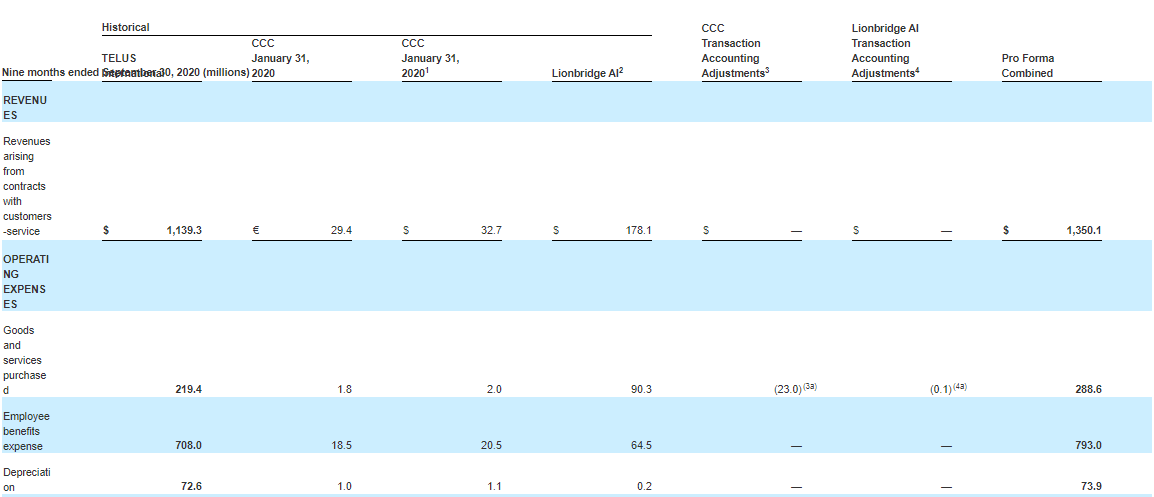

According to the reports provided by TELUS International to the Securities and Exchange Commission, the company’s net profit over the last year was $120.2 million, while its earnings over the same period were $1.41 billion. The free cash flow over the last 12 months since the report date was $154.5 million.

Over 9 months of 2020, the company’s earnings were $1.14 billion and that’s a 50.5% increase in comparison with the same period of 2019. The net profit over the same period of 2020 was $81.9 million, a 96.4% increase when compared with the previous year. The latter indicator has almost doubled and may exceed 100%.

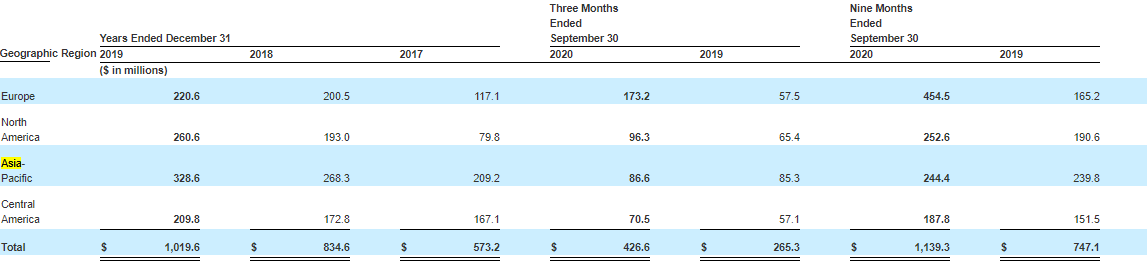

The company’s business is well diversified and that can be seen in revenue distribution by microregions.

The company’s major market in 2020 was Europe (40% of sales). The runner-up was North America (22%) followed by Asia and Pacific (21%). We believe that Asia is the growth point for TELUS. As of September 30th, 2020, the company had a $1.8 billion debt, while the amount of cash on its accounts was about $139 million.

Strong and weak sides of TELUS

As a mini-summary, let’s talk about the company’s strong and weak sides. The former are:

- The company is profitable and generates free cash flow.

- Fast earnings growth speed. Since 2017, the annual growth rate of sales has been 39.42%.

- Many years of experience and a steadily growing customer base.

- Cooperation with world-famous brands.

- Sound management with solid experience in the industry.

- Complex approach to customer solution.

- The company operates in the fast-growing market with an annual growth rate of 17.7% until 2027.

Weak sides of TELUS International are:

- Strong competitors with huge financial and human resources

- The company’s market is constantly changing and new niches are appearing, where TELUS might not be able to take the lead.

- Earnings growth rate may reduce after the global vaccination and removal of quarantine restrictions.

IPO details and estimation of TELUS capitalization

The underwriters of the IPO are leading investment banks and companies, such as BofA Securities, J.P. Morgan, Morgan Stanley, Barclays, CIBC Capital Markets, Citigroup, TD Securities, Credit Suisse, RBC Capital Markets, BMO Capital Markets, and National Bank of Canada Financial Markets. As of the IPO, TELUS’ capitalization will reach $5.37 billion. The IPO is expected to attract $799.9 million by selling 33.3 million shares at $23-25 per share. This money will be used for repaying loans contracted by the company to buy Lionbridge AI.

To assess a potential capitalization of TELUS, we use two multipliers, the Price-to-Sales (P/S Ratio) and the Price-to-Earnings (P/E Ratio). Based on competitive environment analysis, the average P/S value for the market is 6.1, while the company’s P/S is 3.8. This multiplier gives share upside by 57.1% (6/3.8*100%).

The average P/E is 77.9 (TELUS’ 44.98). In this case, a potential upside for the company’s shares will be 73.2% (77.9/44.98*100%).

The company has excellent potential for growth during the Lock-up period, that’s why we recommend to include it in a long-term investment portfolio.