USD in 2021: Hoping for Best, Ready for Worst

6 minutes for reading

👋 The topic for this post was suggested by one of our readers.

If you would like to read about a particular thing on investments or trading here, let us know via the form at the end of this post. 👇

We will publish the most interesting suggestions this month.

As a result of 2020, the USD fell by 10% in pair with the EUR. Strategically though, the dollar grew by 10% in pairs with all world currencies, winding up a cycle of growth.

Strengthening mostly happened in the second half of the year when the world became less fear of COVID-19, realized that the pandemic could be taken under control, and got inspired by the idea of total vaccination. Then capital markets stopped using the dollar as a protective asset. Other currencies got a chance to recuperate and grow, while the world switched to hoping for the effect of the vaccination and soon economic restoration.

The Federal Reserve system decreased the intetest rate only once in 2020, in March, to the all-time low target level of 0-0.25% per annum, where it remains now. Soft credit and monetary policy works against the dollar in the long run, as well as talks about further stimulation. A new wave of the latter is expected in quite the nearest future, alongside the activation of trading between the USA and its partners, and vigorous growth in all key branches of economy. However, what will happen to the dollar?

How much will the dollar cost in 2021?

It is quite possible that 2021 will not be the most comfortable year for the dollar for several reasons. The first one is the Fed's soft credit and monetary policy. The package of stimulation measures will put more pressure on the dollar but support the whole system. Moreover, the need for the dollar as a safe-haven asset will decrease as soon as the pharma sector will find some cure for the coronavirus, and the global vaccination will show its effect. Also, do not neglect the foreign and domestic policy of President Biden that can play against the dollar as well.

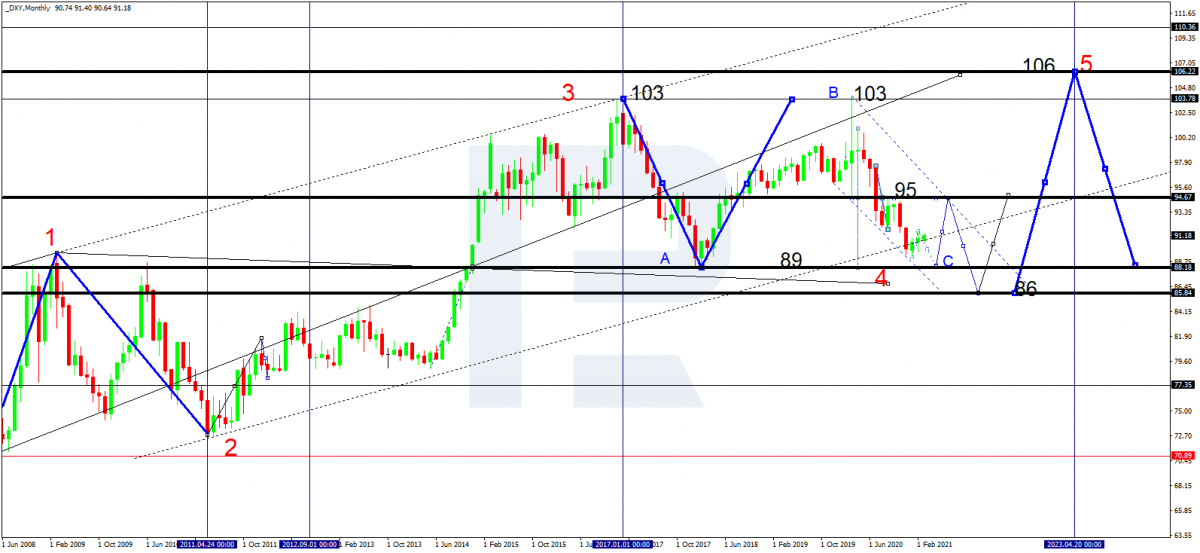

The chart of the dollar index itself shows a complete third wave of growth to 103. Today, the market is trading parts of a classic A-B-C correction. A five-wave structure of wave A aiming at 89 is complete. Earlier, in 2020, the market completed wave B, performing a structure of growth to 103. Thus it has almost formed a Double Top pattern. If we get deeper into detail, the technical picture of the Double Top is interpreted as a consolidation range between 103 and 89. Now the whole wave of decline that started in March 2020 is lokked upon as a cycle of wave C. The aim of 86.

Now let us discuss things in due order.

The Fed: plans for the future

By March 15th already, one of the measures of the previous stimulation wave will have expired in the USA — there will be no more additional unemployment benefits sized 300 USD and other additional payments for the unemployed. And if politicians will have agreed on all the details of new support, the stimulation might start a month later.

The stimulation program in question is sized 1.9 trillion USD. It is known that next week, the democrats are ready to agree on it and get it signed by President Joe Biden. On the whole, after a chain of discussions by the Senate, the Upper House, the House of Representatives, and President himself, the package is likely to be agreed on.

It is possible that at the level of the Fed, after the package will be accepted, credit and monetary conditions will be somewhat softened. For example, the Fed can always increase the volume of buying back assets, which will increase money supply.

The influence of the US government on the dollar in 2021

The dollar can also get influenced by the government — indirectly, of course.

Firstly, note Biden's domestic policy that is just becoming noticeable. We mean green technologies that were a part of the election campaign. Biden's administration needs this: the technology will help optimize expenses on the infrastructure, make the US economy more progressive, and pump huge loads of money into the developnent of alternative energy sources. The White House will need money — hence, it might be printed again. This puts the stability of the dollar under risk.

The foreign policy is also somewhat risky for the dollar in the part of relationship with China. Restoring global alliances and stable relations with China by diplomatic norms and talks instead of pressure preferred by Donald Trump will form moderate foreign policy. This, in turn, will support currencies of developing countries and weaken the dollar.

And if Biden finds ways to improve relations with the EU, the dollar will get in trouble because the euro will grow.

Clearly, these are just scenarios based on our guesses. Things might go differently, so that the dollar wins in all the fuss, as usual. However, this us also just a supposition.

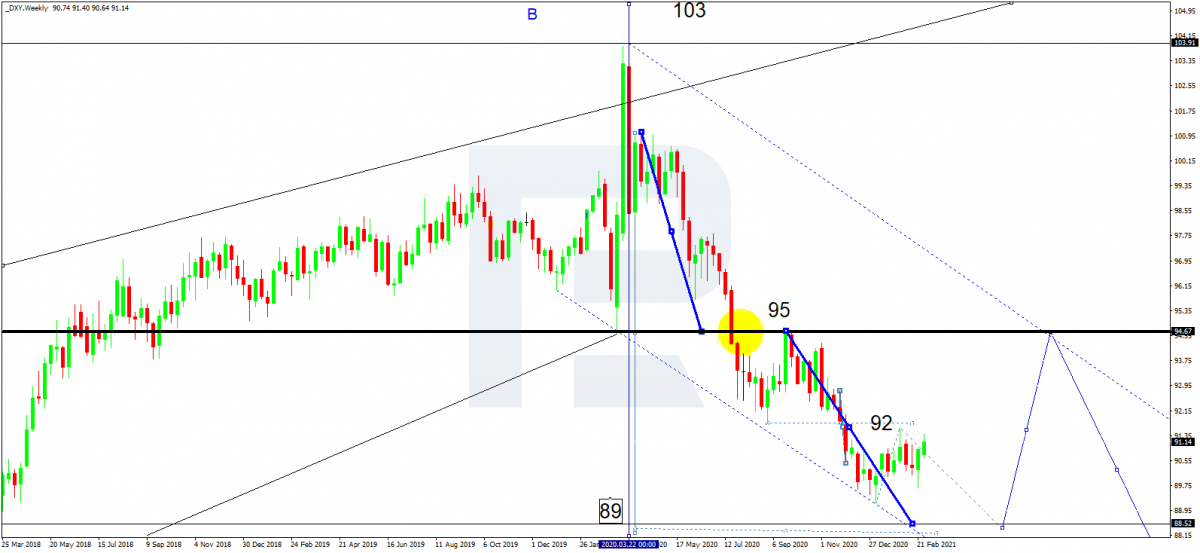

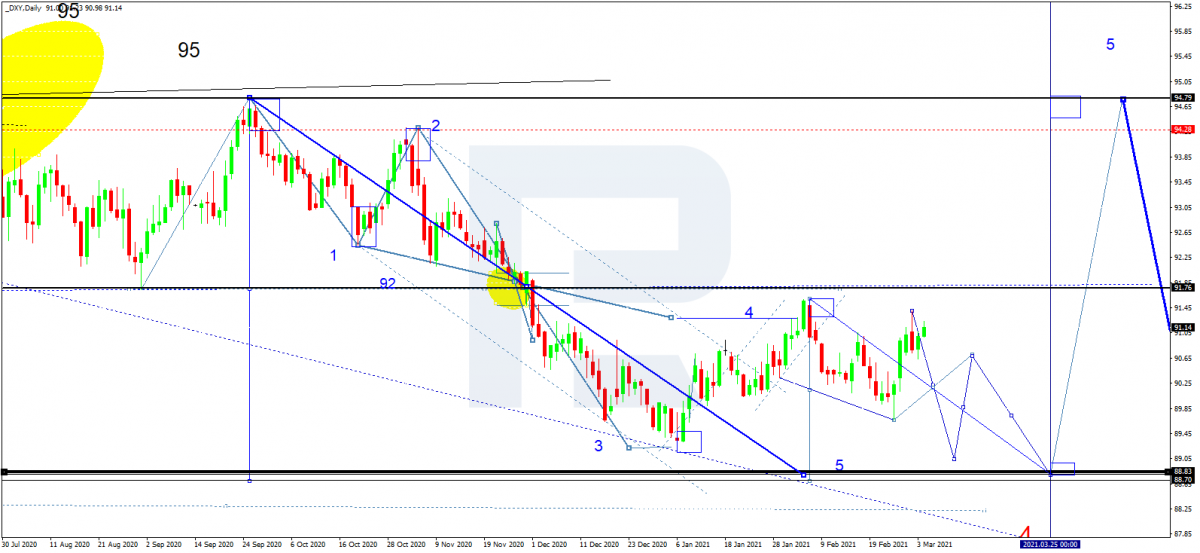

The tech picture of the dollar index keeps developing a declining cycle and completing wave C. The market is declining to 95. If this level gets broken away downwards, the third wave of the cycle might extend to 89. This goal can be reached at the end of March, 2021.

How does COVID-19 influence the dollar in 2021?

It might happen that both domestic and foreign political courses will get in the shadow of the pandemic until the coronavirus issue gets solved strategically. The world has minimum three efficient vaccines, and the vaccination campaign goes on stably and aggressively. The faster goes the vaccination, the faster collective immunity will form. This means that the economy of the US will return to normal without lockdowns, social restrictions, and constant viral disturbances.

For now, the dollar is stable in this regard, but as soon as the risks of the coronavirus fade, the dollar will also step back.

Technically, this picture on the chart will look as the end of the second half of the declining wave, aiming at 89. When this level is reached, we expect a new wave of growth to 95 to develop. This aim can be reached at the end of May, 2021.

What can be a positive driver for the USD?

Any complications of the process might support the dollar: arguments between the Republicans and Democrats, pauses in the stimulation, scandals, arguments with foreign counterparts.

Moreover, do not forget about the market trend being usually unstable and the dollar — volatile. The market is a living and mobile phenomenon, reacting to all things around. However, for now, 2021 looks like a complicated year for the USD.

Let us have a look at technical issues. Tge chart suggests that another fifth wave in the declining cycle might start developing. Bouncing off 95, a new declining wave to 86 might start developing, winding up the potential of the A-B-C formation. This scenario might be completed in September.

When this level is reached, the technical picture will suggest a new wave of growth to 95 at the end of 2021, and by 2024, the wave might reach 106. This takes us back to the very first chart in the article.