Hydrogen: Investments for Those Ready to Risk

10 minutes for reading

Yes, in the headline of this article I mention hydrogen, yet we shall get started with something else — with electric cars. How can we avoid this topic if it is everywhere?

The end of 2020 and the beginning of 2021 were, indeed, remarkable for investors. At that time, the stocks of marijuana makers leaped up in price alongside the stocks of electric car makers (though they have been in an uptrend since the beginning of 2020). Moreover, Reddit users made a mess in the stock market and made grow the stocks of companies that had been on the verge of bankruptcy. All in all, that was a curious season for making a profit and building up trading experience.

Meanwhile, at the same time, the stocks of companies dealing with hydrogen fuel also grew noticeably, though this sector had always been somewhat neglected by the media. A question emerges: why did they grow? Were investors just buying all they could get their hands on, or is this sector objectively attractive? Let us dig in this issue and discuss investments in hydrogen companies.

Modern energy sources: is there a place for hydrogen?

Why did I recall electric cars? This is simple: they are associated with zero impact on the atmosphere, but is this true?

An electric car itself does not harm the environment — unlike the production of electric energy it is charged with. It emerges out of the warmth from burning carbon fuels transformed into mechanic energy that rotates the generator of electricity.

To decrease the environmental impact of combustion products, humanity actively develops renewable energy sources, such as wind or sun. The main drawback of such energy is that it appears periodically. Hence, this technology lacks energy storage that will give out energy when the sun has set, for example.

So, we get the following:

- Carbon combustion pollutes the environment, and this technology has low efficacy, because electricity is received via mechanic energy.

- Hydro electric stations also transform mechanic energy into electricity.

- Atomic plants are too dangerous for human because even modern technology cannot guarantee safety.

- Solar and wind energy is periodic.

The use of hydrogen for producing electricity helps to exclude mechanic energy from the process (which increases efficacy), is harmless for people (its side products are water and warmth), and electricity is produced constantly.

Hydrogen: from production to making energy

You can get hydrogen from water by electrolysis, i.e. physical and chemical reaction. Water is impacted by electricity, so that it breaks down to hydrogen and oxygen. There are other ways of producing hydrogen but this one is the most environment-friendly.

Getting electricity from hydrogen

Hydrogen produced this or some other way is put into a fuel tank, the fuel tank gets connected to a container (fuel cell), which is filled by oxygen from atmosphere. As soon as hydrogen gets inside the container, it reacts with oxygen and hydrogen, producing electricity and warmth and water (H2O) as two side products. This scheme implies no rotation or composite equipment. All we need is hydrogen and oxygen, while the environment is "polluted" by clean water.

Why do not we use hydrogen energy yet?

Earlier, hydrogen was produced by electricity made by old "dirty" methods, and the primary cost of an element was enormous. However, the development of renewable energy sources allowed reducing the cost of hydrogen production.

Solar energy creates enough electricity to produce hydrogen, which makes its production clean. At daytime, excess hydrogen can be stored in a container and used later at night.

Hence, time has come for hydrogen to become an energy source. The development of the idea is hindered by the primary cost of hydrogen production — it is still much higher than that of natural gas or hydrocarbons.

Hydrogen energy and technology

No matter what, developed countries inspired companies to work actively with the technology of hydrogen electricity.

On December 20th, 2020, 7 world's largest companies producing hydrogen and equipment for working with them announced the creation of a global coalition that in the nearest 6 years would speed up the scaling and production of hydrogen 50 times. Those companies were ACWA Power, CWP Renewables, Envision, Iberdola (BMAD: IBE), Orsted (NASDAQ Copenhagen: ORSTED), Snam (BIT: SRG), and Yara (OSE: YARA).

Their goal is to decrease the primary cost of hydrogen production to 2 USD per kilo. This price can become a turning point after which hydrogen will become the most preferable type of fuel for labor-intensive production and transport.

Apple patented a hydrogen accumulator

Apple (NASDAQ: AAPL) patented hydrogen fuel cells for their gadgets that can work for weeks on one charge. However, some key issues have not been cleared up: how to store enough hydrogen in the cells and what to do with the water that appears as the side product.

Bosch designing fuel cells on hydrogen

Bosch is planning to enter the market of car fuel cells where it plans to make a technological breakthrough in designing energy storage for cargo and passenger electric cars.

Toyota launches serial production of electric cars on hydrogen

In 2013, Toyota Motor Corporation (NYSE: TM) presented a hydrogen-based Toyota Mirai electric car. The company launched serial production of the car and got updated in 2019.

Hydrogen-based train launched in Germany

In 2018, in Germany, the first hydrogen-based train was set on rail. They planned to launch 14 more by 2021.

Hydrogen-fueled yacht

In 2017, the world's first hydrogen-fueled boat called Energy Observer. It not only fueled by hydrogen but also produces it. In 2020, it became known that Bill Gates had ordered a boat working on liquid hydrogen.

Where else is hydrogen used?

Hydrogen stations are also used on spaceships, in places where electricity cannot go by wires; in the healthcare system, hydrogen is contained in reserve energy sources, etc. Hydrogen would be actually used in car industry all over the world if there existed an infrastructure for it.

Hydrogen and electric cars

If we think a little, we will see that modern cars use outdated technology. There is a battery that accumulates electric energy and then transfers it to the consumer. Engineers try to increase the capacity of the battery so it could store more having the same size and weight.

For example, a battery of Tesla Model S contains 7,500 small batteries, linked in one chain. If we make them smaller but leave the same capacity, 8,000 batteries will fit in. This way the overall capacity of the battery will increase and so will do the way you can cover on one charge.

A modern electric car presumes the presence of a fuel cell that produces electric energy. You only need to charge the car with hydrogen, which is comparable to charging it with usual fuel only that it is much faster.

Stocks of hydrogen companies

If hydrogen takes the leading place Their goal is to decrease the primary cost of hydrogen production to 2 USD per kilo. This price can become a turning point after which hydrogen will become the most preferable type of fuel for labor-intensive production and transport.

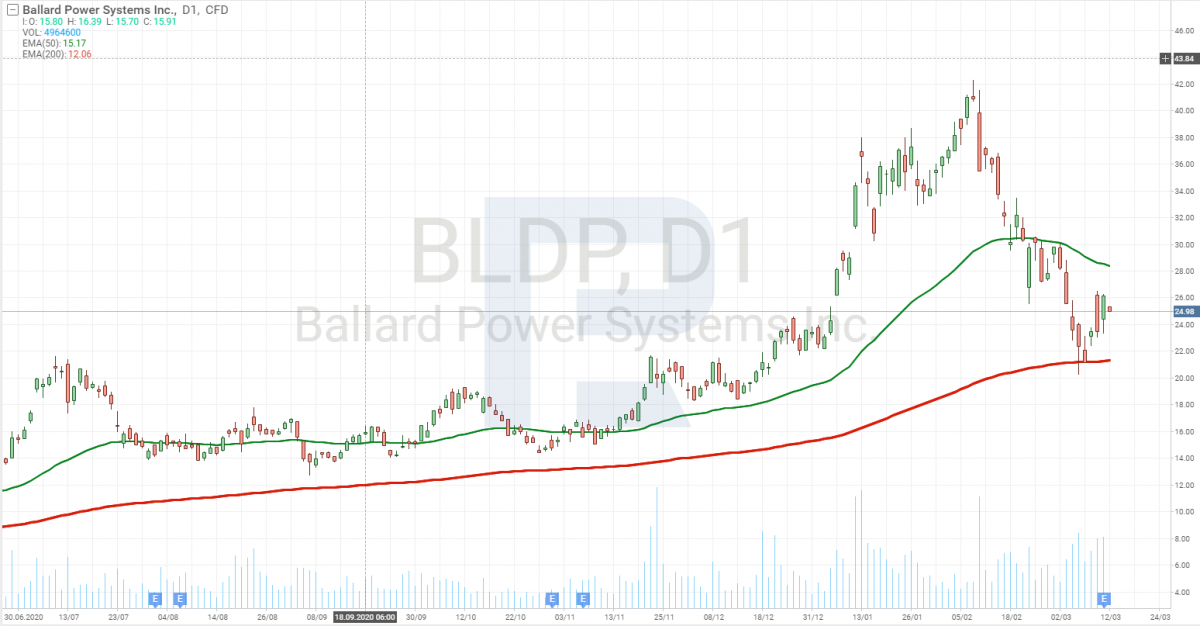

Ballard Power Systems Inc

Ballard Power Systems Inc (NASDAQ: BLDP) was founded in 1979 by Geoffrey Ballard. It produces fuel cells and products for them.

Ballard Power designed a liquid chemical that can be poured into the fuel tank of a car, and then a special reactor will produce hydrogen from it, thus producing electricity, in its turn. This chemical can be stored in containers from gas stations. The only problem is production volumes.

In 2018, Ballard Power signed a contract with a Chinese company called Weichai Power. Now it will sell its products in the Chinese market. In November 2020, the company got an order from Van Hool for 10 fuel cell modules for Van Hool A330 buses that will be driven down by the roads of the Netherlands. In 2020, the price of the company's shares grew from 6 to 40 USD; now the shares have corrected and are trading at 25 USD each.

Unfortunately, Ballard Power Systems is a losing company, and the management does not promise any net profit.

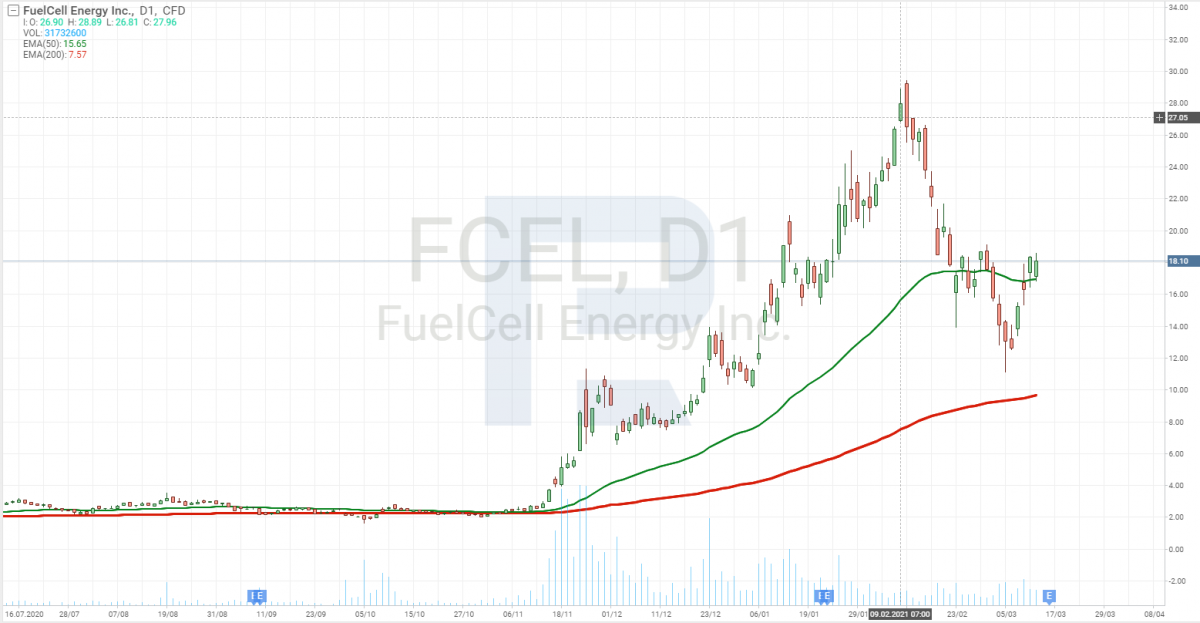

FuelCell Energy, Inc.

The next company you should pay attention to is FuelCell Energy (NASDAQ: FCEL). The company specializes in producing environment-friendly hydrogen and fuel cells.

With clean hydrogen, things are more complicated than with the liquid by Ballard Power. Hydrogen is explosive and volatile. It must be stored as a liquid or in compressed form, which requires additional equipment. On the other hand, if active gas stations get modernized, containers for methane and propane will do.

FuelCell Energy is also a losing company, and all the hopes are on the future development of the sector. The shares of the company have corrected by 40% from the peak reached in February 2021. It might be a good opportunity to buy the shares for long-term investments.

Plug Power Inc.

Another bright representative of the sector is Plug Power (NASDAQ: PLUG). Its shares sky-rocketed by over 1,300% during 6 months. The company develops systems of hydrogen fuel cells that replace normal electric batteries on equipment and transport.

The shares fell by 48% from the peaks, which made the market react negatively, and now, investors are filing class actions against Plug Power, stating that the management was misleading. If you look at the feed of Yahoo Finance, you can only see the warnings of law firms about the time of filing suits against Plug Power.

As the two companies above Plug Power is also losing. According to macrotrends.net since 2006, the company made a net profit sized 4 million USD in 2014 only; at any other time, the company remained losing.

Nikola Corporation

Speaking of hydrogen, you cannot avoid the notorious Nikola Corporation (NASDAQ: NKLA) that is trying to make a hydrogen-powered van.

In 2016, it presented a concept of a van working on hydrogen fuel cells that produce electricity necessary for the car. On one charge, the van calked Nikola One can cover 1,200 miles (1,900km), which is yet not reached by Tesla vans. However, serial production has not started yet, and Nikola got suspected of a fraud. It is accused of not really owning the technology for making such a van.

It is hard to tell whether this is true. Information on the net is controversial. But if Nikola does create this van, it can become the car of the future. The scandal dragged the stock price down by 85%, a now you can buy a Nikola share for 15 USD.

Other companies

There are other companies that work with hydrogen, and the development of the branch can enhance their income. Such companies are:

- Air Products&Chemicals (NYSE: APD)

- Bloom Energy (NYSE: BE)

- Linde PLC (NYSE: LIN)

- DuPont de Nemours Inc (NYSE: DD).

Closing thoughts

Hydrogen has long been trying to become the leader of the energy market, but each time interest towards it growth, agitation subsides with time, and hydrogen gets forgotten for some time.

Bill Gates states that hydrogen will be the main energy source in the future. Meanwhile, Elon Musk claims that hydrogen energy has nowhere to develop.

Summing up, I would say that investments in hydrogen are currently extremely risky. If things get right, profitability might be over thousands percent; if not, you will have to wait for another wave of growth in the segment.

P.S. Hydrogen is the most widespread chemical in the Universe.