Carmakers Decrease Production: How to Make Money on This?

7 minutes for reading

These days, the media have been discussing the deficit of semiconductors. The situation got worse when carmakers started announcing a decrease in production or incomplete assembly of cars due to this shortage. Today I will speculate on the deficit of semiconductors in the car industry, explain the reasons for it, and suggest investment ideas for this situation.

The influence of COVID-19 on the demand for semiconductors

It has long been realized that the pandemic was a bad influence on production. Quarantine imposed, plants shutting down, an increase in unemployment rates – all this made production decrease and the demand for goods and semiconductors fall.

However, no crisis lasts forever, so the situation started improving. The demand for goods has somewhat livened up, which can be noticed by the growth of inflation. Plants opened, and those became the leaders who had planned in advance and got prepared for the economic recovery.

When production volumes got back to normal, the demand for semiconductors leaped up because apart from traditional consumers of these goods, carmakers also became in need of them.

Unfortunately, carmakers did not think enough about the possible shortage of semiconductors that might influence there production volumes. As a result, they became production outsiders and are now frantically trying to catch up.

Why did carmakers turn out the last ones in the queue for semiconductors?

The pandemic of 2020 somehow became the time when carmakers started switching actively from cars with internal combustion engine to electric cars. In 2020, lockdowns dropped the production of cars abruptly; by the end of the year, it turned out that it was high time to start producing electric cars.

Previously, carmakers did not need serious computing powers, hence, the demand for semiconductors from their side used to be minimal. Time has shown that they did not even think much about what was going on in that market.

Such famous concerns as Toyota (NYSE: TM) and Volkswagen (BATS: VOW) spend about 4 billion USD on semiconductors a year.

Compared to Apple (NASDAQ: AAPL) or Samsung that spend 58 and 36 billion USD on these products annually, carmakers turn out to be minor clients. In their turn, carmakers thought that if they needed larger volumes, they could just spend 6 billion USD instead of 4 on semiconductors, and their demand would be fulfilled. Such growth seemed minor in the overall framework of world suppliers of semiconductors.

However, things turned out to be different. Companies producing smartphones, TV sets, and other computing equipment planned in advance and took their place in the “queue” for semiconductors. Of course, they are served the first as large regulars, while carmakers went to the end of the “queue”.

Carmakers asked the government for help

To solve the problem, carmakers addressed their corresponding governments and complained that they could not buy semiconductors in required volumes. German carmakers call for the government to increase the production of electronic components in Europe; however, building and launching plants takes long.

As a result, German government addressed the Ministry of Economy of Taiwan where the largest plant producing semiconductors Taiwan Semiconductor Manufacturing Co Ltd (NYSE: TSM) is situated, asking them to increase the production of semiconductors.

The Taiwan Ministry of Economy asked Taiwan Semiconductor to increase its production volumes. The plant is already working with a 100% load, however, the management promised to think over the problem and try to find solutions.

Mind that Taiwan Semiconductor plans to build a plant producing semiconductors in the USA but this decision had been taken before and has no connection to the trade war between China and the USA. The launch is planned no earlier than 2024.

American carmakers also complained to the government. As a result, Intel (NASDAQ: INTC) gave 20 billion USD for building two semiconductor plants in the USA. All in all, the problem will be solver in the future but the demand exists now, and it is extremely hard to satisfy. Hence, carmakers might suffer a decrease in their income in 2021.

A decrease in the income of carmakers is expected

The business of carmakers is not, indeed, marginal. If we compare the profitability of Intel and General Motors (NYSE: GM), we will see the following: the profitability of Intel is currently 26%, that of GM – 5%.

As for Ford (NYSE: F), it has not even reached positive profitability after the pandemic: -1%. A decrease in production and higher expenses on semiconductors that have grown in price will additionally affect the income of carmakers.

Experts say that in 2021, General Motors’s profitability might fall to 3.4%, which is about 2 billion USD. Ford, in its turn, might lose 1.8% or 2.5 billion USD.

What is the investment idea?

Based on what was said above, we have to wait for the quarterly reports of carmakers that will reflect a decrease in their income. On expectations and on the day of the publication their shares might drop.

Anyway, we all know that this is a temporary phenomenon: in the end, the shortage will be compensated, and car plants will return to previous production volumes. As a result, the decline in the stock prices of carmakers in 2021 can be used to buy the stocks.

Which companies are we implying?

First of all, pay attention to American carmakers because their stocks are available for everyone. These are General Motors and Ford. Volkswagen AG shares will also be a good investment.

Volkswagen AG

Volkswagen is the largest European seller of electric cars with a market share of 24%.

Tesla is losing its leadership in the region; its market share has shrunk from 29% to 13%. Th advantage of Volkswagen compared to Elon Musk’s company is scaling. UBS forecasts that by the end of 2022, Volkswagen might win over Tesla in sales volumes.

The information that large carmakers had taken up producing electric cars made their stock prices grow, so that the shares currently look overbought. The shortage of semiconductors has somewhat calmed investors down, and the stock price began correcting.

In VW shares, the nearest support level is 273.00. The price is expected to break it away and decline deeper to 245.00. At this level and lower, the shares will again be attractive for long-term investing.

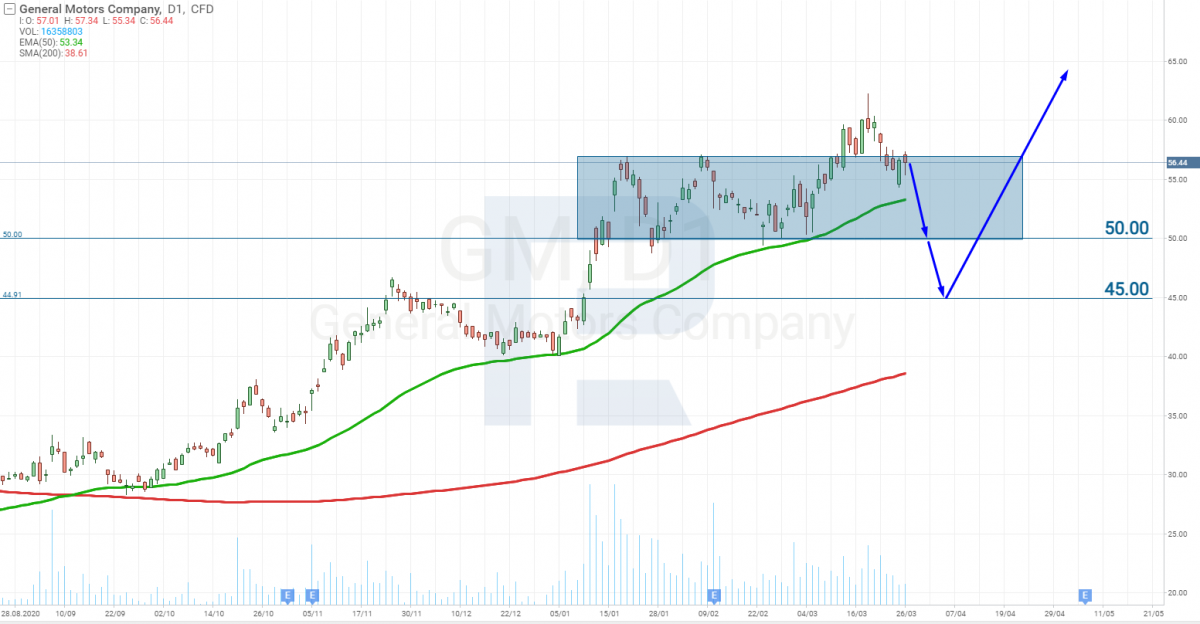

General Motors

GM shares also used to grow though not as actively as VW shares. Negative quarterly reports might draw the stock price down to the support level of 50.00. This level might even be broken away, and the quotations might drop deeper to 45.00. In GM shares, the price below 50 USD is attractive for long-term investments.

Ford

Ford shares cost 5 times less than GM shares. Hence, money-wise, corrections might look minor. Currently, Ford shares are trading slightly above 12 USD. We expect a breakaway of 12.00 and a decline to 11.30. The price below 11.30 is attractive for long-term investments.

Closing thoughts

While I was writing this article, I heard that a Chinese company NIO had to stop producing electric cars due to semiconductors shortage. Another carmaker is suffering from the deficit.

All in all, we know that the shortage of electric cars will harm the income of carmakers. Their shares are already correcting, which means investor account for the decrease in the revenue in the stock prices.

The investment idea will work if the stock prices keep falling, and quarterly reports will confirm the expectations.

However, as long as the market is working in advance, you can start buying the shares right after the publication of the reports.

In the end, the shortage will be overcome but there is no reason to wait for this to happen because by then the investors that bought the shares at the decline will have started to think about taking the profit, so the potential of growth will be scarce.