Inflation Advancing: How Will This Influence the Stock Market?

8 minutes for reading

Janet Yellen’s indiscreet statement scared off markets, and stock indices headed down. Or had things been planned in advance, so this was merely a “reconnaissance in force”? This article explains what was special about the speech of the US Treasury Secretary, and what should market players be prepared for.

What did Janet Yellen say?

In her speech on the summit on the economy of the future, Yellen touched upon the issue of interest rates, though this is none of her competence. In the USA, interest rates are managed by the Fed, and Jerome Powell, the chairman of the Reserve system, is the one to give comments on this.

Anyway, Yellen said that higher interest rates might be needed to keep the US economy from overheating.

Investors’ reaction to Yellen’s words

The reaction was immediate: the S&P 500 stock index dropped by 1.2%. Later Secretary Yellen tried to somewhat calm investors down as they rushed at selling stocks, and said that she was giving no recommendations to the Fed or any forecasts of the interest rate in the nearest future. Yellen thinks that inflation troubles are temporary, and no increase in the interest rate will be needed.

What is going on, after all?

Why are investors worried?

We know that as soon as the economy slows down, monetary authorities start stimulating demand and business by low interest rates. This lets people take loans for buying goods and also helps businesses loan money for future development at lower rates.

However, the main reason to introduce low interest rates is the small profitability of bonds. As a result of the latter, investors lose interest in investments in reliable treasury bonds, and they head for the real sector of the economy. This might include corporate bonds, commodities, stocks, etc., i.e. investors look for more profitable investment options.

The method of regulating the economy by rates was efficient until the mortgage crisis in 2008.

Quantitative easing

After the crisis, just decreasing interest rates became not enough. Then monetary politicians decided to resort to quantitative easing (QE). Before that, the Fed used QE in 932 during the Great Depression.

The reason for using this method was the unwillingness of investors to put money in companies when treasury bonds were poorly profitable, while banks preferred to allocate money for investments in commodities rather than crediting business.

In the end, corporations had to issue bonds to attract money, and as long as the demand for them was low, their rates started growing; the debt burden on the issuer grew accordingly, and the risk of default also grew.

To solve the problem, monetary authorities started buying troublesome assets and bonds of companies, increasing demand and decreasing the rates.

For companies, this was a breath of fresh air. They could now refinance old debts and loan money for development at lower rates. And as long as the interest rate on loans was low, people kept loaning money, supporting positive dynamics of the demand for products.

What is the risk of simultaneous use of low rates and QE?

1. The main danger of using these methods at once is the growth of inflation, potentially above planned levels.

2. Inflation drags down the national currency, making imported goods more expensive; if the country depends seriously on imports, like the USA, this will affect the business, which can provoke a new span of inflation. The USA is now working hard on import substitution.

3. The devaluation of the national currency affects the attractiveness of investments in the country. The demand for treasury bonds grows, the rates on them grow, and debt maintenance becomes burdensome for the state. The US state debt has reached the record level of 28 trillion USD.

4. Another risk of such a situation is the actions of banks: they might slow down the crediting of people and small businesses. In this case, the efficacy of QE will be zero, so the stock market will inflate bubbles because companies will increase their debt burden while their revenue will not grow.

Is inflation actually growing?

Market participants are now worried about inflation only, closing their eyes to other risks. What is going on with the inflation chart? Is it growing?

It shows that in 2021 inflation has reached 2.6%. Might it rise higher anyway? We need to figure this out now.

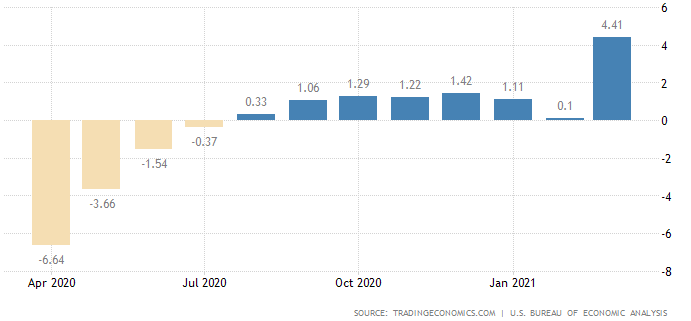

The primary source of inflation is the demand for goods and services. If the state gives money out to people, and they just put it under the pillow, there will be no inflation. Hence, check whether the people’s income is growing. The main source of their income is salary. According to the website “tradingeconomics”, in March, the salary of US citizens leaped up by 4.4%.

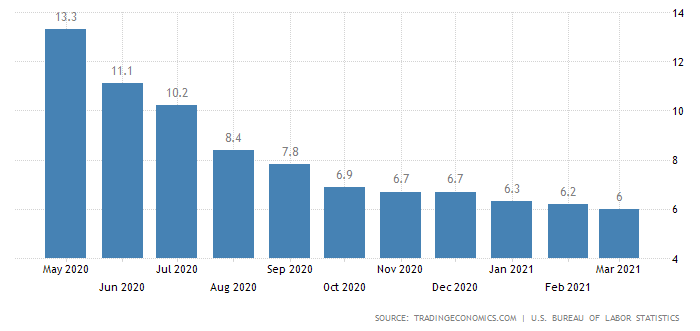

Then check the unemployment rate. If it has not reached the pre-crisis level yet, the government will do everything to increase employment and bring it back to normal. The history of the last 25 years shows that a decrease of the unemployment rate below 5% means the economy has recovered and stimulation measures are to be wrapped up.

The unemployment rate is now 6%, while the pre-crisis level was 4%.

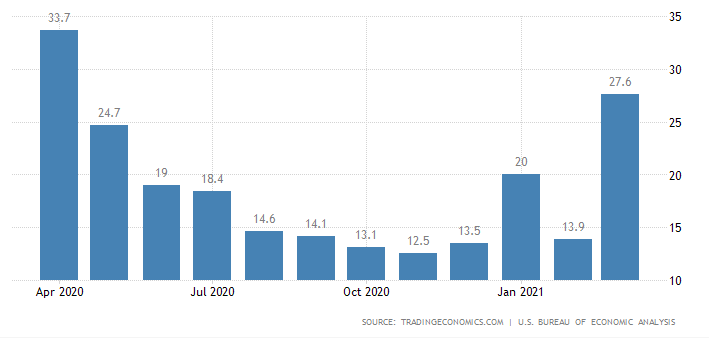

Another important indicator is the personal saving rate. If consumers increase savings, demand for goods drops, and vice versa. On the diagram, you can see the savings of Americans grow again.

We could go further into statistics but what I have shown you is enough to make conclusions.

Summing up the data

Wages are growing, which means the demand for goods and services is likely to grow.

The unemployment rate has not reached the pre-crisis level yet, which means every month, the government will try to increase employment. This will augment the solvent population and be a good influence on the economy.

The increase in the US personal saving rate shows that there is a supplementary source of income that might increase the demand for goods and services in the future.

Hence, there are factors of further inflation growth, which makes it clear why investors are so nervous.

Why is further growth of inflation dangerous?

The growth of inflation will make the government either wrap up the QE or increase the interest rate. The latter looks more logical because it influences inflation directly. Loans become pricier, demand gradually decreases, commodities become less expensive, and so do goods.

The other side of the medal is the debt burden on companies that have loaned a lot. The rate of previously receiver loans grows, which might make companies in debt go bankrupt. The pandemic has made huge companies employing dozens of thousand people increase loans to stay afloat. As a result, increasing the interest rate is dangerous.

Wrapping up the QE

A way out of this puzzle will be wrapping up the QE. In his case, interest rates will remain as they are, which means companies will have access to cheap financing via loans from financial entities, but banks will be choosing trustworthy loaners.

Money will never more be handed to anyone. This way the horizon will be clear up from obviously weak and unprofitable companies that have no actual influence on the market.

Yellen “probes the soil”

This is a theory, while in practice, things might develop in quite a different scenario, so you need to check the reaction of investors to avoid mistakes.

Most probably, Janet Yellen said what she said on purpose to see how market players will react if the Fed speaks about increasing the interest rate. Yellen is not the head of the Fed anymore but she is not completely outside the entity because she used to be in that position. Hence, they had expected investors to pay attention to her speech, and this is exactly what happened. As a result of the speech, investors got somewhat scared.

How did hedge funds drop the S&P 500 quotations?

Why did I mention the fear of speculators, not hedge funds? In March, the S&P 500 stock index dropped by 3.2%. The reason for the decline was investment trusts re-balancing their portfolios by selling shares and investing the money in bonds.

They just made the proportion of their portfolios reach the ratio of 60/40: 60% of the money in bonds and 40% - in stocks. Sales were technical but they disturbed the market. If hedge funds had reacted to Yellen’s speech by selling stocks, we would have seen a more significant decline.

Bottom line

In the nearest future, inflation will be growing, so investors have good reasons to worry. Jerome Powell insists on the inflation growth being temporary, needing no increase in the interest rate.

The printing machine is on, and the increase of money supply in 2020 reached 24%, which is an all-time high. This money influenced the market, and while the QE is on, shares will be growing, while any decline in them will be bought away by investors as it happened on the day of Yellen’s speech.

In our case, avoid companies will a large debt burden, airlines among them. During the pandemic, their debt reached the size of their assets, and in the nearest future, their income will be spent on paying off debts.

Do not forget about what Yellen said. She made it clear that the authorities are discussing ways of fighting inflation back, and most probably, the first step will be wrapping up the QE. As soon as officials mention this, the growth of shares in the market will slow down. Hence, keep an eye on speeches and be ready for corrections.