Investing in Online Education

7 minutes for reading

Now matter how much we crave for putting things in place and living like before the pandemic, this would be hard to achieve. The coronavirus has made many corrections to our lives, and the businesses that have flourished during the pandemic keep developing because their services are still highly demanded.

Zoom Video Communications

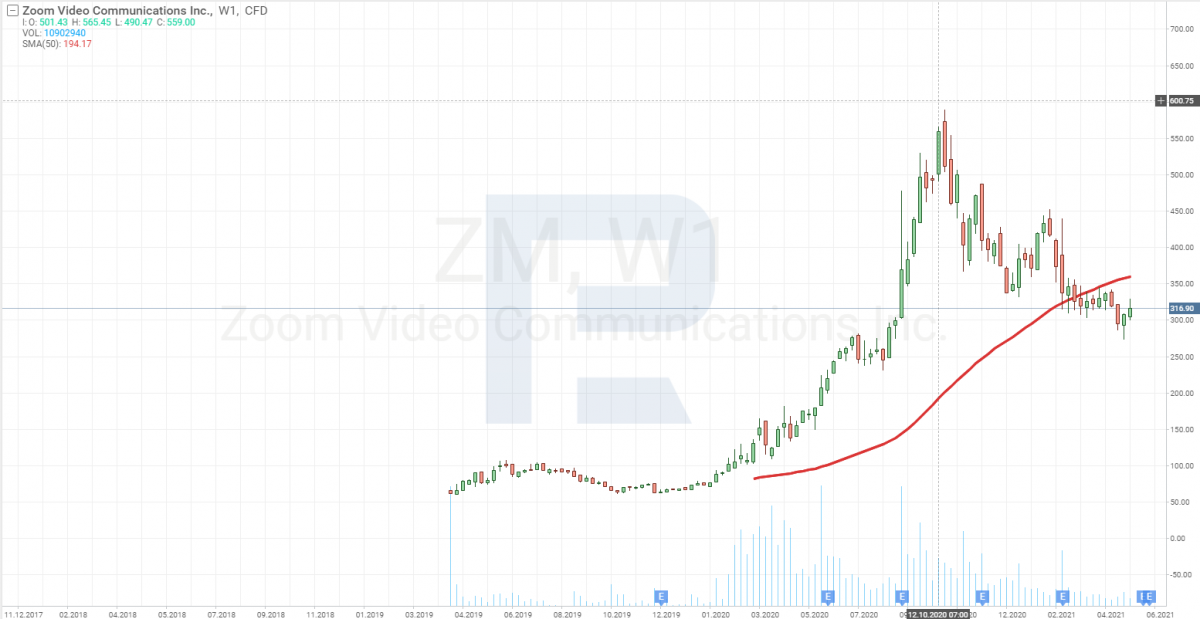

The brightest example of a coronavirus beneficiary is a company called Zoom Video Communications, Inc. (NASDAQ: ZM). It provides services of group communication via videochats.

Via Zoom, people started to organize online learning at schools, colleges, universities, etc. The service also got popular in business: meetings of shareholders, daily meetings with employees working from their homes, etc. are now also carried out online. The pandemic made everything online, and Zoom was the most popular option among rivals.

It took Zoom shares less than a year to grow from 60 to 590 USD.

Online learning becomes popular

During the pandemic, companies providing services of online learning also had their revenue grow noticeably.

While more and more people over the world get connected to the Internet, the number of those learning online is also growing. The market of online learning would have grown regardless of the crisis. However, the speed of its expansion increased because of quarantine measures taken in many countries.

On the whole, experts say that 2020 through 2025, the market of online learning will be growing by over 8% a year and will reach 375 billion USD.

The USA is the leader of online education

The market leader is the USA, holding 41%of the market. This is explained by developed infrastructure, highly qualified employees, and increased demand from corporate clients.

According to analytical websites, over 90% of the population in the USA has Internet access, which makes this country a perfect place for developing online learning business. Hence, we will be looking for investment options in this country.

Coursera, Inc.

The leader in terms of capitalization in the US online education market is Coursera, Inc. (NYSE: COUR).

Coursera is an American company that offers a platform for organizing online courses. It was founded in 2012 by IT professors of Stanford University Andrew Yan-Tak Ng and Daphne Koller.

Coursera works with 150 universities and offers over 4,000 courses, including those for degrees at a price much lower than in case of learning offline.

The company focuses on developing such education programs that help students find well-paid jobs. To hit this goal, the company has contracted with Amazon (NASADAQ: AMZN), IBM (NYSE: IBM), and Alphabet (NASDAQ: GOOG).

Financial performance of Coursera

The pandemic was good for the company’s revenue: in 2020, it increased by 59%. However, its losses grew as well. This was connected to expenses on creating the infrastructure that would satisfy the increased demand for Coursera services.

Judging by the results of Q1, 2021, the revenue keeps growing fast. Compared to Q1, 2020, it grew by 64% and reached 88.4 billion USD. Coursera management forecasts that in Q2, the revenue will keep growing and might reach 93 million USD.

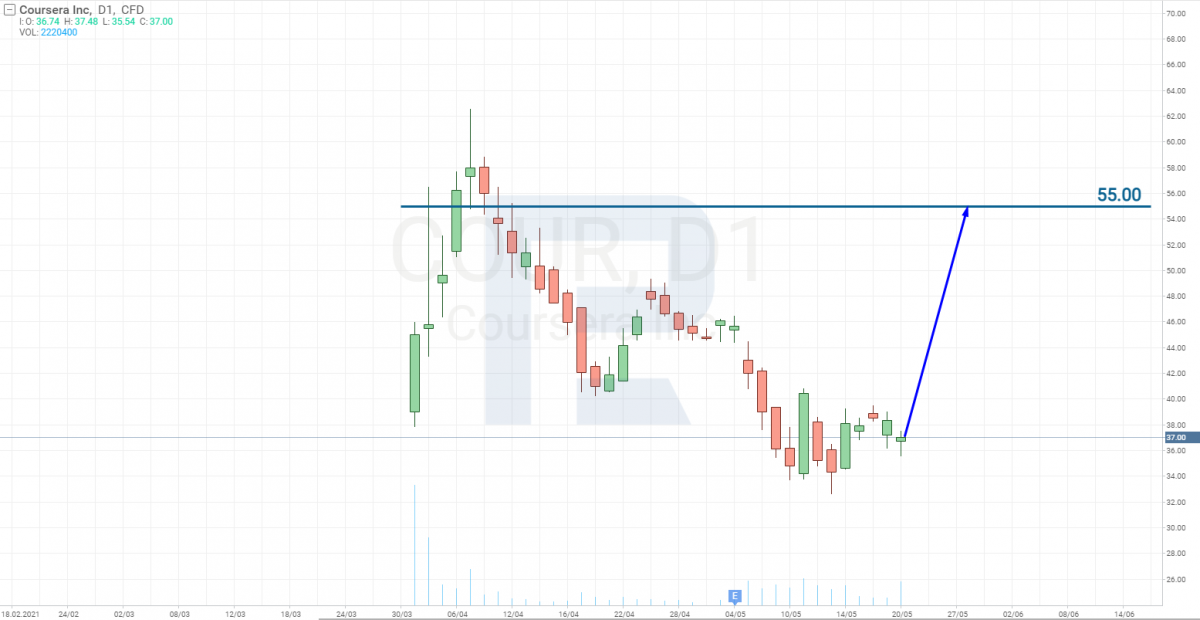

In March 2021, the company carried out an IPO. Shares started trading for 39 USD each. The IPO was more than a success; after 5 days, the shares grew by 60%; however, later the agitations subsided, and the stock price started falling.

Now you can buy Coursera shares for 37 USD each. Morgan Stanley and Goldman Sachs analysts claim the shares are underpriced. They claim the fair price is 55 USD, which means the current price is a 48% discount.

Stride, Inc.

The next company that is worth our attention is Stride, Inc.(NYSE: LRN). Stride, Inc. is a commercial education company that provides an online alternative to traditional offline learning.

The company is a leading provider of K-12 programs to students, schools, and districts, including vocational training services or middle and high school. For grown-ups, the company also provides vocational training necessary for working in Fortune500 list companies.

Stride was founded in 2000 by a former banker Ronald J. Packard. At early stages of its development, former US Minister of education William Bennett was invited as the chairman of the board of directors. However, by now, the management has changed, and the founder left his post in 2014, reating a new educational company.

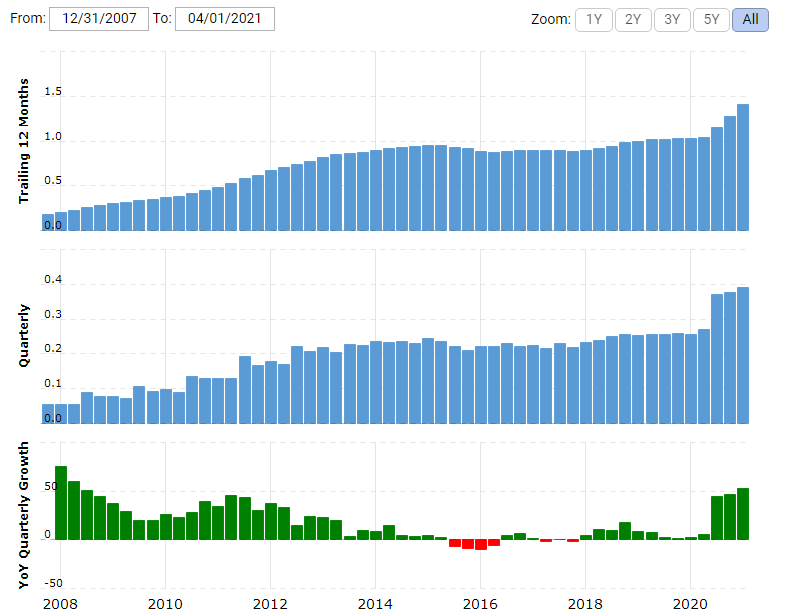

Financial performance of Stride

The pandemic was a good influence for the revenue of Stride. In Q1, it grew by 52% compared to Q1, 2020, and reached 392 million USD. Operational profit amounted to 38.6 million USD, which is 165% more than a year before.

The number of students entering programs in Q1 reached 155 thousand people. In Q1, 2020, it was 108 thousand people.

The management forecasts further growth of the revenue. They expect it reach 385 million USD in Q2, which means an over 40% increase. Stride shares are trading far away from their all-time highs while its income is at record levels and keeps growing.

I would say the shares have a vast potential for growth. They are now trading at about 30 USD each while their all-time high is 52 USD, which presumes growth by 85%.

American Public Education

Another company that I would recommend as an investment option is American Public Education (NASDAQ: APEI).

American Public Education, Inc. provides online learning services for those having secondary education. It chiefly focuses for educating military people and civil servants. Its education program includes 87 degree programs and 69 certificate programs in various fields from national security to humanities. About 127,000 students are taking the courses.

Judging by the Q1 report, the revenue of the company, compared to that in Q1, 2020, grew by 18.7% and reached 88.5 million USD. The net return on stock grew from 0.16 to 0.49 USD. The number of new students also increased by 45%.

The management fears a decrease in the revenue

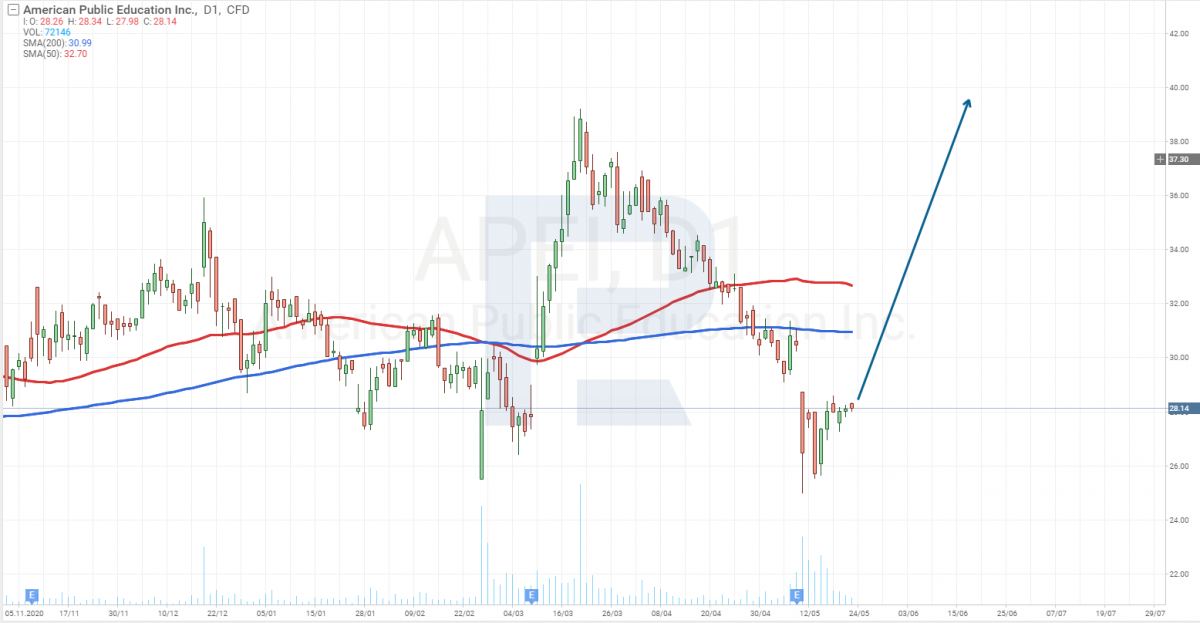

The company’s revenue is nearing its all-time high, but after the report was published, the shares dropped by 21%. The reason is that the management is afraid of a decrease in the income in Q2.

The reason is banal. Several websites of the US defense forces got updated, and the GoArmyEd portal via which about 25% of all learners used to register in American Public, was disabled on February 11th. It was substituted by ArmyIgniteED on March 8th, but several hours later, access to it was also disabled for technical reasons.

Military people are the largest group of the company’s students. Constant problems with the ArmyIgniteED portal entailed a steep decline of new registrations in April, the first month of Q2. Hence, a slow-down in the growth of the income is highly probable.

However, note that even with such force majeure, the revenue of the company is expected to reach 89.9 million USD, which is 9% more than in Q2, 2020.

As long as the negative event is temporary, the current stock price looks attractive for investments. On the chart, you can see investors buying American Public shares when the price falls below 26 USD. From this level, the price starts growing steeply.

Experts suggest a target price of over 40 USD, which means a current discount of 42%.

Closing thoughts

The pandemic was a good influence on the online learning market and sped up its development. Vaccination and open borders will not prevent it from growing. Hence, companies working in this sector will enjoy increased revenues, and their stock price will also be growing.