What Is Consumer Price Index (CPI) and How to Use It in Forex Trading?

5 minutes for reading

This article is devoted to one more financial index that can influence the quotations of foreign currencies — the CPI (Consumer Price Index). In reflects Price changes for a group of socially important goods and services over the reporting period, which is usually a month. The CPI value is announced in the second half of the month following the reporting period.

Like most statistical indicee, the CPI is calculater in percent. If the factual result is different to the forecast, it can influence the currency of the issuing country significantly.

The CPI is calculated by special indices and published on news portals and in the economic calendar.

The CPI and its types

The CPI is a complex phenomenon that is comprised of several indices:

- The Core CPI is the base CPI that does not include energy and foods.

- The CPI, n.s.a. does not account for seasonal Price fluctuations.

- The CPI, s.a. accounts for seasonal fluctuations of prices.

The volatility in Forex is mostly influenced not by the complex CPI but by its Core part.

The CPI and inflation

Anyone who knows something about economics would say that high inflation is bad while low inflation is very good.

Is it, indeed, true, and what does the CPI have to do with it?

For developed countries, the average CPI is 2.0-2.5%. If the CPI lies in this range, the economy is doing well, in balance with production, purchas ing power, and inflation. The task to the government of the country and the Central Bank is to hold the prices within this range, avoiding any negative outcomes.

If the CPI is below 2.0%, the economy is doing bad, and the national currency might suffer or d evaluate. In such circumstances, the CB interferes with the economy and takes certain measures to stabilize it. If the CPI is zero or negative, this might end up in negative inflation (deflation), which is even worse for the economy.

If the CPI rises above 2.5%, this is also quite harmful for the economy. The job of the Central Bank bis to track the CPI and support the economy in time.

The CPI is closely connected to other key economic indices: the GDP and unemployment rate. If the economy does all right, we have a high employment rate and low unemployment. Hence, the GDP is high and the income of citizens is acceptable. People of the country are confident about tomorrow and start spending more, making money participate in the economic process. Demand generates supply, and prices grow, so does the CPI in the reporting period.

If people of the country are not confident about the future and feel something bad coming, they start saving money, buying just the essentials, avoiding luxuries or putting money in the jar. Hence, production shrinks, the unemployment grows because less people are involved in the economy, as a result — the CPI also falls.

Influence of the CPI on Forex

When the CPI is published, now should trade carefully. If you are a beginner, track the economic calendar and avoid opening positions when important news is due. Do not hope that you will be lucky this time, volatility might surge, and you might suffer losses.

For experienced traders who know fundamental analysis, the CPI might yield profit.

How to use the CPI

If you decide to make some profit on the publication of the CPI, keep in mind the following:

- Previous CPI

- Forecast CPI

- Price dynamics and market reaction to the CPI previously

- GDP and unemployment rate (comparing to the previous values)

- Your money management rules

Example:

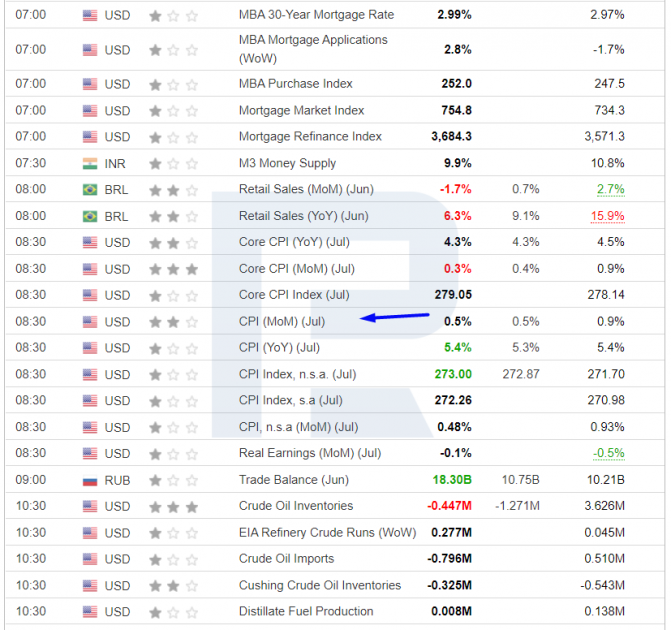

Checking the economic calendar, you see that on August 11th, 2021, a package of US financial news was published, including the CPI.

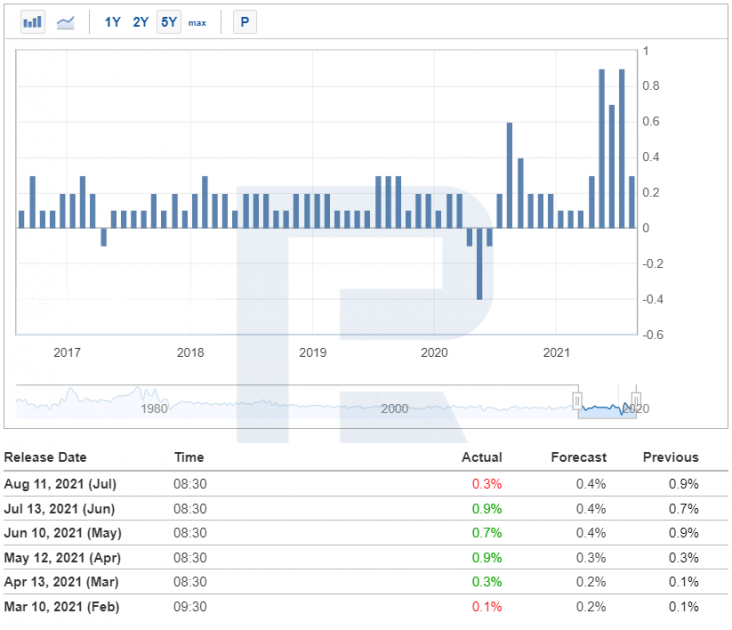

In the previous reporting period the indicator value amounted to 0.9%, and the forecast new index was 0.5%. This is what happened: the current CPI is 0.5%, exactly as forecast.

In the next picture, see the dynamics of the CPI over previous periods.

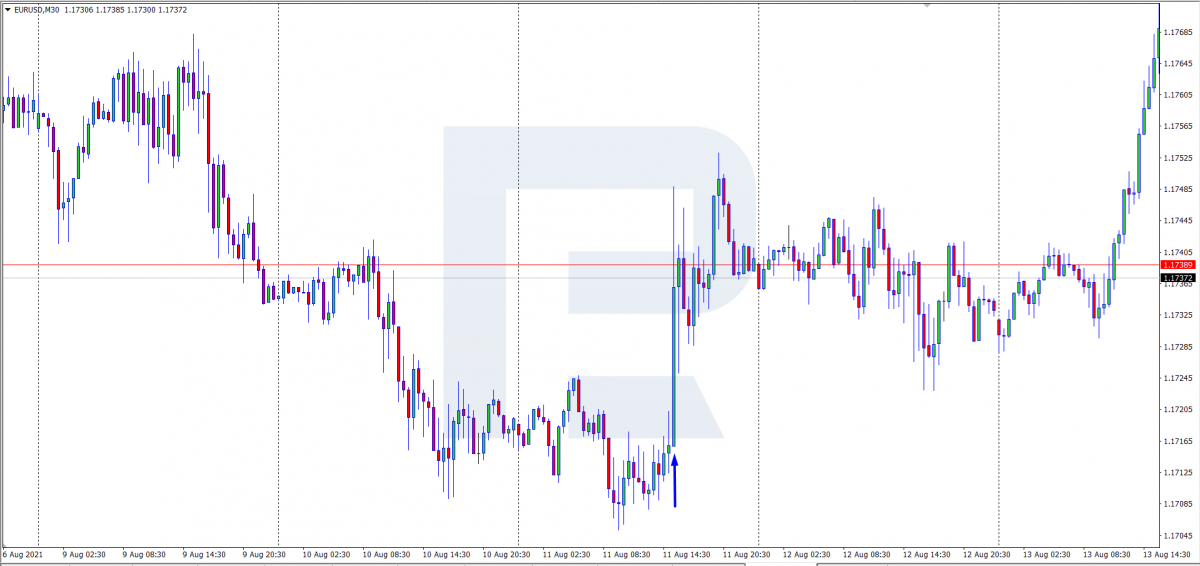

On the EUR/USD chart below you can see this candlestick very well, it stands out among all others as it is sized over 300 points. Also, before the publication of the news, the quotations decreased volatility, and the market was awaiting. After the publication, when market players saw the result, they started being active.

As long as that day the CPI was published alongside other statistics, the whole package influenced the dynamics of EUR/USD significantly, and the quotation rose. The CPI dropped, and this means people started spending less, so the unemployment rate might grow and the GDP might fall.

If the CPI value had been higher than forecast, the currency of country would have grown.

Bottom line

As long as the CPI is published alongside other indices, market volatility might surge.

If you trade the CPI by fundamental analysis, US and Chinese news is the best because European indices do not always influence the quotations significantly.