Sunstroke: Should We Invest in Development of Solar Energy?

9 minutes for reading

In the election race, Joe Biden spoke a lot about the development of green energy, which entailed growth of the shares of the sector. As long as Biden has become President, it is high time to fulfill promises.

Strange as it might seem, after the elections, orientation on renewable energy became even stronger. At the beginning of September, the US government presented a plan, by which solar energy must reach 50% of all energy produced by 2050.

For you to see the actual picture: now solar energy amounts to only 4% of all energy produced in the country. Judging by this, the sector needs much more investments.

Which companies can benefit from the growth of the solar power sector? I will be talking about one today and about the niche on the whole.

Time of active investments in solar energy

To tell you the truth, the plan presented by the Ministry of Energy looks somewhat weird. It says that by 2035, solar power must amount to 40% of total energy, and by 2050 – grow by 10% only, reaching 50%. In other words, the transition process should have an active and passive phase.

By the plan, energy production must grow by 30 gigawatt a year; 2025 through 2030 – by 60 gigawatt a year, and by 1,000 gigawatt starting 2035. Hence, the nearest 14 years must become the most active phase of development.

Lucky we, aren’t we? We can buy some shares now and become billionaires in 10 years. Who will risk?

I am sure many will try it. Question is which stocks to buy.

Solar power sector

Along with the development of the solar power sector, new companies appear that will struggle for their share of the market. However, there is a chance that companies already in the business will have secured their positions by then and will benefit more from the growth of the segment.

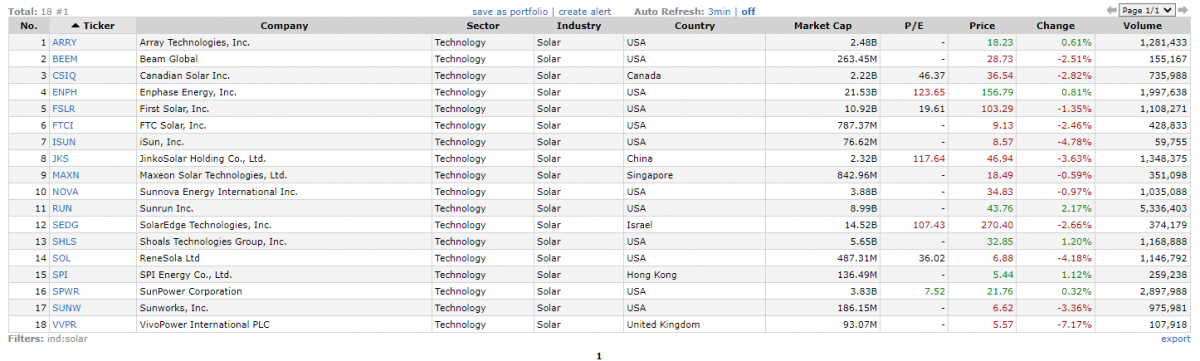

Currently, there are 18 companies from the solar power sector, trading in the US stock market. Only 7 of them are profitable.

When does such a company start making a net profit?

Let us talk a bit about the profitability of such companies. The solar energy market is not as young as you might think. There have been many attempts to introduce this type of energy in the general energy system. However, the price of such a kilowatt is the main obstacle.

Companies that plan to succeed in a new sphere invest in research from the start. With all the expenses, the final product becomes very expensive, which hinders it popularity as there are cheaper alternatives. No green trends will persuade the consumer (except for such radical measures as a total ban on hydrocarbons).

With the development of technology, the product becomes more affordable. Finally, its price reaches the point in which traditional energy sources do not look as cheap as before. The demand for solar power starts growing gradually, and the company that produces it starts making a net profit.

40% of companies in the solar energy sector are making a profit. This means that the segment has almost reached the stage at which solar energy can compete with energy from traditional sources (with subsidies though) and bring a profit to companies that produce it; the companies, it turn, will be able to use the money for further research without taking loans.

The conclusion that we are coming to is that as long as there are profitable companies already, other companies can start making it, too. And if billions of dollars will be poured into the sector, it will be hard to miss the chance. Such unlucky companies will not deserve any attention.

All in all, the companies that are now losing are very likely to start making a net profit quite soon.

Choosing a company for investments

Well, there are seven profitable companies but how do you choose “the one”?

Today I am driving your attention to the most undervalued company by P/E – perhaps this is the hero we are looking for. The average P/E in the sector is 49. The most undervalued company by this index is SunPower Corporation (NASDAQ: SPWR).

SunPower Corporation

As I have mentioned, solar energy production is not unusual anymore. This is confirmed by the time when the company was founded. SunPower Corporation has been around for 36 years. It was founded by two engineers – Richard Swanson and Richard Crane. Initially, it was called EOS Electric Power, becoming SunPower in 1998.

Mergers and splits of SunPower

In 2007, the company started merging with other entities to enlarge its production powers and enter new markets. The last merger happened in 2018: the company bought SolarWorld Americas, securing its position in the US market. By 2019, it had optimized the business and split into SunPower (NASDAQ: SPWR) and Maxeon Solar Technologies (NASDAQ: MAXN).

SunPower now sells solar energy in the housing and commercial sectors, as well as stores energy.

Maxeon Solar, in turn, produces premium-class solar panels under the brand SunPower. By the agreement of the split, SunPower will be buying housing panels from Maxeon only for two years and commercial panels – for one year. The agreement can be extended. Maxeon, in turn, promises to work with SunPower only in the US market.

Thus SunPower kept for itself a profitable niche in which it sales electric energy produced on Maxeon panels, while the costly production process now lies on Maxeon, which is now losing.

SunPower and Maxeon owners

SunPower holds 71% of Maxeon shares. From this point of view, Maxeon has a trustworthy investor. But who will help SunPower in the case of a crisis? It turns out that the company also has support of a mighty corporation. 51.25% of the its shares are held by a French oil company Total (NYSEL TTE) that in 2020 became number 29 in the Forbes Global 2000 rating of the world’s largest public companies. Many issuers are sure to be craving for such support in the energy market.

Debts of SunPower grow smaller

SunPower is a financially stable company. Its long-term debt has been growing smaller since 2016 and now amounts to 480 million USD, while its free money flow reaches 519 million USD. After the split, the amount of free cash has started to grow sharply because the company did not have to invest it in costly production anymore.

SunPower is in a very profitable position between the manufacturer of solar energy and the consumer. From this viewpoint, growing consumption of sun energy will become a good influence on the company’s income.

Influence of US elections on SunPower share price

The presidential election did not pass by unnoticed for the company: as long as it works in the sphere on green energy, investors noticed it. As a result, over several months, the share price grew from 10 to 55 USD.

Naturally, such growth had a good reason. As you remember, at the end of 2020 and the beginning of 2021, it was hard to buy a stock and not make a profit on it. When the dust settled, and investors had only shares left in their portfolios, not free money on their accounts, shares started falling in price.

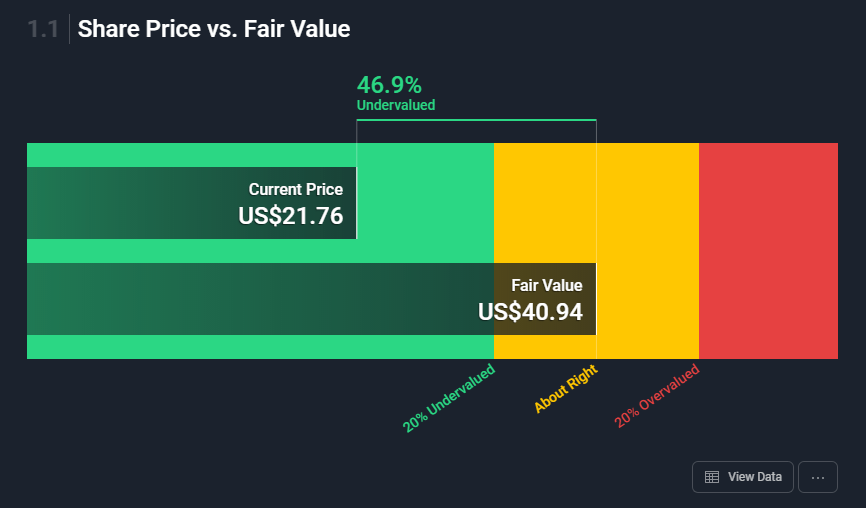

This was the case of SunPower as well. Its share price fell from 55 to 20 USD. This made the share noticeably undervalued as its P/E turned out much lower than the average in the sector.

At the https://simplywall.st/ website, the fair price of companies is calculated based on their financial performance and its future income. There it is also said that SunPower shares are traded 47% below the fair price.

In other words, buying the share now, you may count on a 100% profit in the nearest future. What happens to the share price in 10 years, when solar power consumption will also grow 10 times, and the profit of the company will beat records? Unfortunately, we do not know it for sure, we can only make guesses. However, chances are the stock price will grow.

ETFs for solar energy

It is risky to rely upon one or two companies because the chances for a mistake are quite high. Hence, an ETF for solar energy would be a much more reliable investment option.

Unfortunately, there are pretty few ETFs in this particular sector of economy. I only managed to find one called Invesco Solar ETF (NYSE: TAN).

This fund invests in the companies included in the MAC Global Solar Energy Index. The latter contains companies that work in the sphere of sun power solely and have a capitalization of no less than 150 million USD.

Other ETFs are working with companies that specialize in renewable energy sources in general, which include wind power, hydrogen power, tides power, etc. This makes such ETFs more diversified.

My article only ponders on the development of solar energy by the plan presented by the US government, hence, Invesco Solar ETF is a perfect option.

Closing thoughts

Time has come for transition to alternative energy sources. The pandemic only sped up the process, lifting prices for traditional energy carriers.

A simple example: gas price in Europe reached 960 USD per 1 thousand cubic meters. Individual consumers do not feel the change yet, but in winter, as soon as they see their heating bills, they will immediately start thinking about an alternative.

With such high prices for traditional energy carriers, alternative sources will become competitive. For people, however, the growth of prices will not become so obvious because governments will not reveal the whole growth. However, businesses will feel this at once and will queue for wind and sun power.

Hence, solar energy is a promising sector of economy, and investments in it can bring a good profit.