How to Calculate Return on Assets (ROA) Ratio: Formula and Examples

5 minutes for reading

This article is devoted to the market ratio called Return on Assets (ROA): what it is necessary for, how Return on Assets is calculated, what peculiarities, drawbacks, and advantages it has, and how it can be used.

What is Return on Assets (ROA) ratio

ROA (Return on Assets) is the ratio that shows the profitability of assets. It expresses the ratio of the net profit and the average-weighted size of the assets, demonstrating the efficacy of using the capital of a company. It is expressed in percent.

Calculation formula of the Return on Assets (ROA)

ROA = Net Profit / Average Assets

Where:

- Net Profit is the net profit of the company over the calculation period. The latter is usually a year or a quarter.

- Average Assets is the average-weighted size of the assets of the company.

Average Assets calculation formula:

Average Assets = (Assets 1 + Assets 2) / 2

Where:

- Assets 1 is the size of the assets at the beginning of the calculation period.

- Assets 2 is the size of the assets at the end of the calculation period.

Nowadays it is hardly necessary to calculate the Return on Assets ratio formula manually because this information is available in open sources and everybody can use Return on Assets ratio calculator.

Peculiarities of ROA

The ROA differs depending on the sector in which the company works and the nature of its business. For example, in services, the ROA will be higher than in the oil industry.

The reason is the working capital that companies need for functioning and production. The more the company spends on development, the smaller ROA it will have over a calculation period.

The intermediate conclusion is that comparison by the ROA can be accurate and correct only for companies working in one sphere of business. And the higher the ROA, the better for the company and its investors.

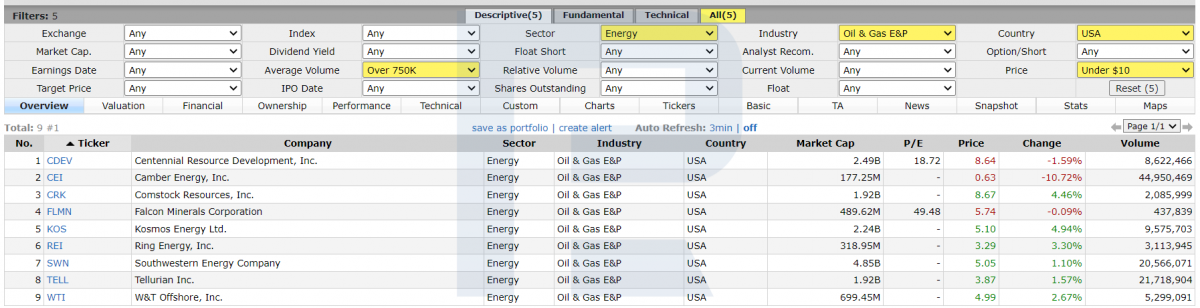

Examples of using Return on Assets (ROA) in oil and gas sector

- Go to the stock screener page.

- Choose the sector, for example, energy.

- Choose the industry – oil and gas, exploration and mining.

Also, other selection criteria can be added. Stocks will be sorted out by price and average trade volume to exclude non-liquid instruments: less than $10 and more than 750,000 shares, respectively. Choose place – the US. The selection result is a list of 9 companies.

4. Go to the page with the financial characteristics of the companies and compare the ROA.

Two entities have a positive ROA: FLMN – 5.8% and CDEV – 6.6%. Others have negatives ROAs. This does not directly show they are losing but calls for more detailed analysis. Looking briefly, a company with a positive ROA looks more attractive for the investor.

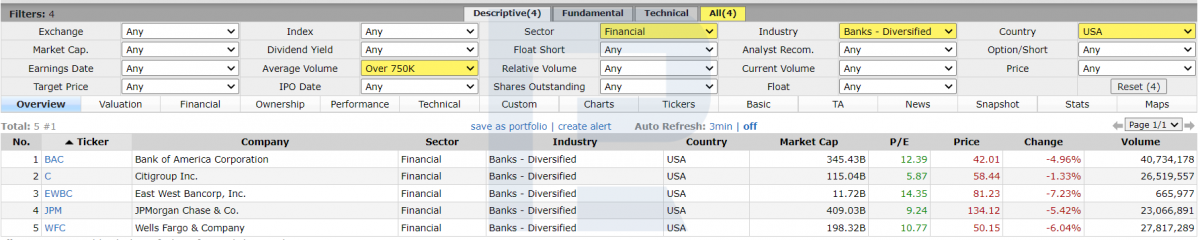

Examples of using ROA in the sector of finance

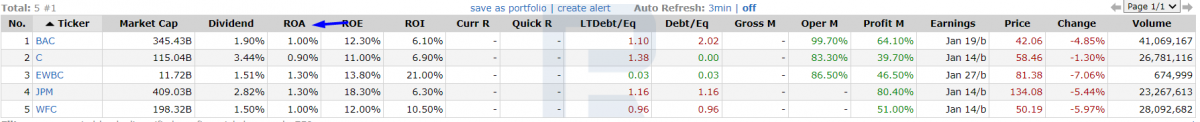

On the screener page, specify the following: sector – finance, industry – banks, average trade volume – over 750,000 stocks, place – US. The selection result is a list of 5 companies.

All the companies for analysis have positive ROAs – from 0.9% to 1.3%. The prelim conclusion is that all the banks are good for investments.

Note that investment decisions should not be made just based on one ratio. Complex analysis, including comparison of several ratios and the financial history of companies is necessary.

Advantages and drawbacks of ROA

Advantages of the Return on Asset ratio:

- Simple Return on Assets calculation formula, all data is provided in the financial report of the company.

- Availability of ready-made results in open sources.

- Transparent logic. When the ROA declines, this means finance is used inefficiently; when the ROA grows – vice versa, the finance is used rationally, and the profit may also grow.

Drawbacks of the ROA:

- Comparison is correct only for companies that work in one sphere.

- Dependence on financial reports of the company. The money allocated for maintenance might not coincide with the actual depreciation of the equipment.

- Non-transparent conclusions. A negative ROA does not always mean that the company is losing. Instead, the company might have bought some new equipment that has not been included in production.

- To understand the dynamics of the ROA for the sake of accurate comparison, all ROAs for several previous reporting periods should be taken into account.

Closing thoughts

As many other financial ratios, the ROA has its drawbacks and advantages. The ratio can only give a prelim evaluation of the return on investments in the company, Optimum analysis should include several ratios and financial reports of the company.