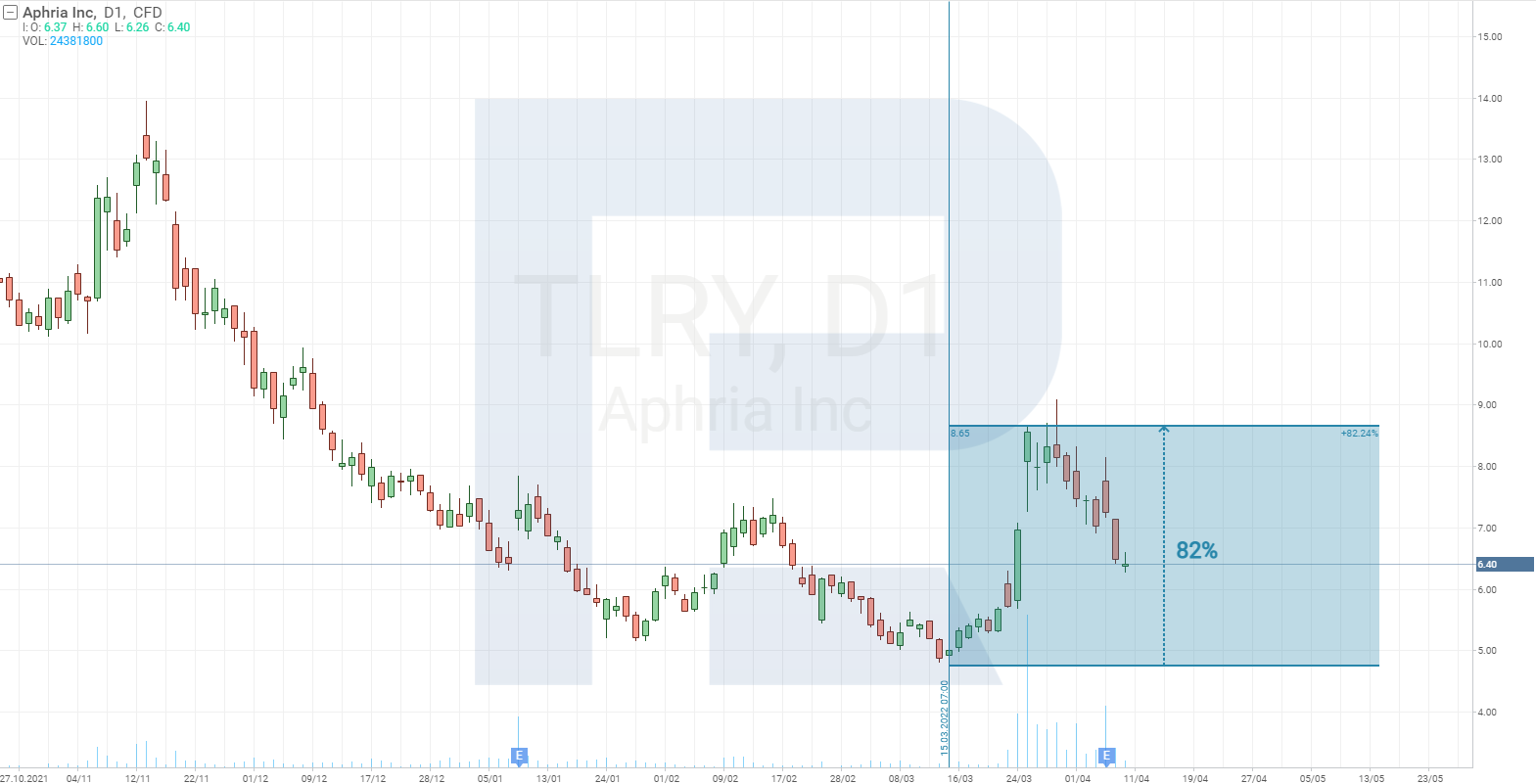

Why Tilray Brands Shares Grew by 82%

6 minutes for reading

On 15 March, the shares of Tilray Brands Inc. (NASDAQ: TLRY) sky-rocketed and grew by 82% over 9 days. Note that this is not the first such bright and impressive swing of the shares of this company.

Investors periodically get interested in Tilray Brands shares but the history of trades demonstrates that after each surge on the chart the shares return to their previous levels and go on moving by a downtrend.

This time, the scenario has all the chances to repeat itself because the shares have already dropped by 25% from the recent high. However, mind that the cannabis market in the US might change dramatically, having a good influence over the whole of the sector.

The share price of Tilray Brands has neared its all-time low, mostly completing the decline. According to the recent report, the company has become profitable. However, the perspectives are not that bright, which will be further described in this article.

Quarterly report of Tilray Brands

In Q1, 2022, the revenue grew by 23% compared with Q1, 2021, and reached 152 million USD. Net profit amounted to 53 million USD, while last year, loss was 340 million USD. The revenue from selling marijuana, compared to the results of last year, increased by 32%, and from selling spirits – by 64%.

Companies that Tilray Brands bought for expanding its business – such as Manitoba Harvest, SweetWater Brewing, or Breckenridge Distillery – have already started to make a profit and contribute to Tilray Brands business. Overall sales volume in Europe, Africa, and the Near East grew by 37%.

Partnership with Whole Foods Market

Tilray management has announced partnership with Whole Foods Market Inc. that owns a chain of supermarkets selling organic foods without artificial preservatives, colorants, flavor enhancers, sweeteners, and transfats.

By the contract, a subsidiary of Tilray Brands – Manitoba Harvest – will be supplying its products to certain supermarkets of the Whole Foods Market chain. The company produces foods from cannabis. Tilray Brands management forecasts that by 2024, the yearly revenue will have reached 4 billion USD.

Possible rivals of Tilray Brands

The quarterly report of Tilray Brands was not a sensation because the revenue failed to exceed Wall Street expectations, yet certain points were quite interesting. Take a look at the sales of beverages CBD. Such a promising segment can attract dreadnoughts like Coca-Cola Company (NYSE: KO) or PepsiCo Inc. (NASDAQ: PEP).

These days, CBD beverages are the main support for Tilray Brands, and the corporation needs to increase production powers to take up the niche, otherwise they will have trouble competing with Coca-Cola and PepsiCo. These two will quickly capture the market because they have well-known branding and huge production powers for satisfying the demand.

What Tilray management expects

The company and its subsidiaries have become profitable, and now they need to increase their market share by acquiring new companies, increasing production powers and sales volumes.

The latter is yet a problem: a federal law blocks marijuana consumption in the US, and this market is now Tilray’s priority.

Whether the federal ban will be lifted

This issued has been discussed for several years, and the most recent piece of news here appeared on 1 April. The House of Representatives of US Congress supported the marijuana legalisation draft.

This is great news, but why is the share price of Tilray falling still? The reason is, the decision of the House of Representatives is just the beginning, the draft has now to be approved by the second House of Congress – the Senate.

If senators support legalisation, the document will be presented to President. The law will come into force only if Joe Biden signs it.

However, mind that for now, chances for approval of the draft bill in the Senate are tiny. There have already been two attempts to pass it, but every time the draft bill was sent back for improving.

For the bill to be passed, it must be supported by 60 senators out of 100, i.e. all the democrats and 10 more republicans. Mind that in the House of Representatives only few republicans supported the initiative, and among democrats there was no unity.

Whether Tilray Brands shares are able to grow

If we focus on the Senate and the draft bill, chances for growth of Tilray Brands shares look quite small. However, if we take a look at the corporation on the whole, assess its perspectives, investments in it look quite reasonable. Its shares cost little, it has a profit and a possibly bright future.

However, what if the Senate turns the draft back? Most probably, the shares will not drop because the market has already learnt from two previous attempts to pass the bill.

In summer 2021, when the second attempt was made, the quotes never surged down, declining gradually. So the scenario can repeat itself this time. By the moment of voting in the Senate, the quotes will have returned to 5 USD and started trading in a narrow range because the probability that the law will get stuck is already inside the price.

Even if the third attempt fails, new ones will follow, one after the other, until the bill is passed. There are hints on it already, because in many states the ban on marijuana has already been lifted.

Also, even without the US market, which is financially very promising for Tilray Brands, the corporation is actively developing in Europe and the Near East. Investments in this company can be looked upon as long-term.

Alternatives to investments in Tilray Brands

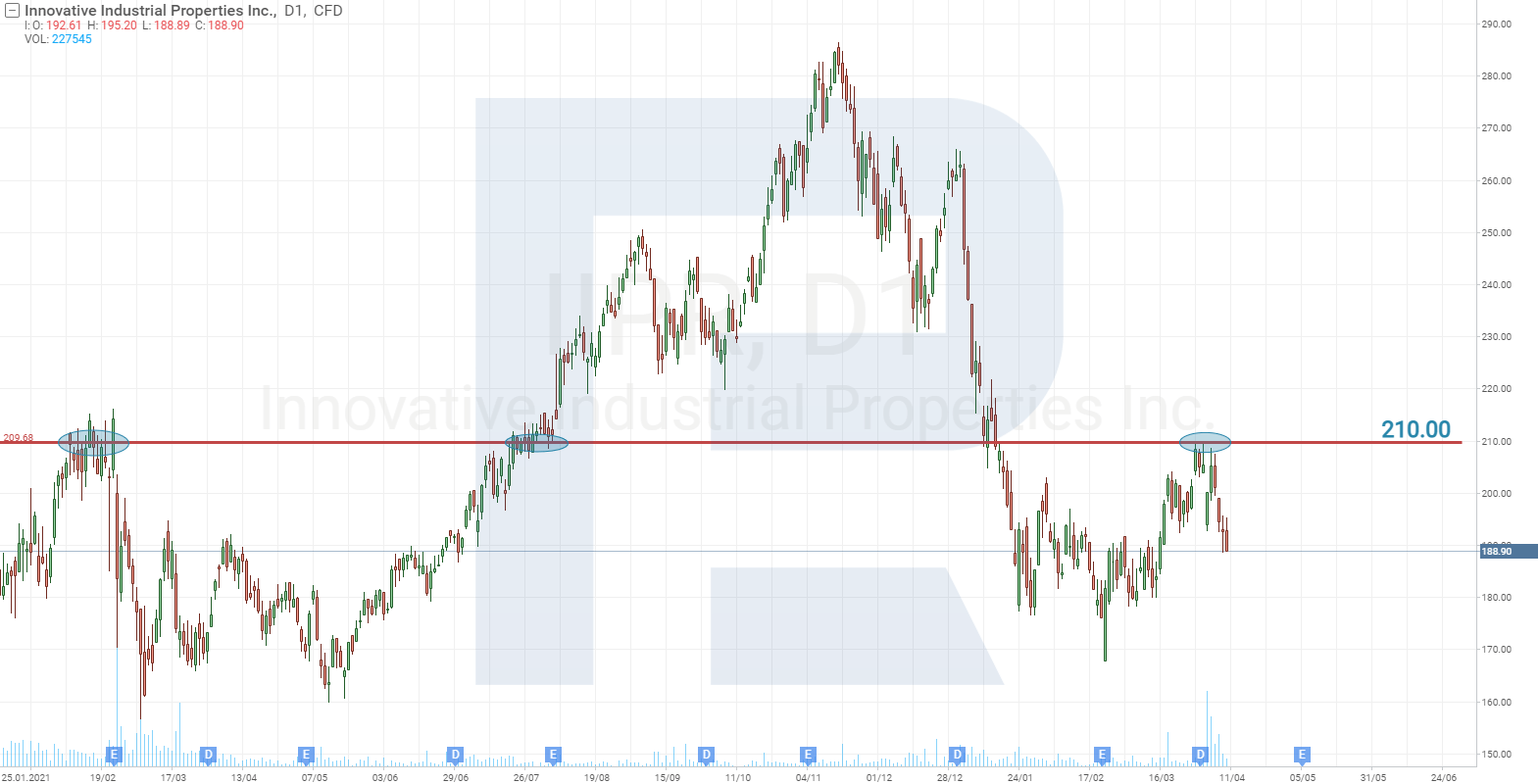

Counting on just one company, one can always make a mistake, so it would be wise to take a look at ETF in the marijuana sector - Innovative Industrial Properties Inc. (NYSE: IIPR). Its quotes are now at 190 USD.

Do not rush at buying these shares – wait for them to give any signs of growth. The first signal will be a breakaway of 200 USD.

Closing thoughts

The cannabis market is growing gradually, impacting the revenue of companies working in this sector. When the whole sector is growing, first ones to look at are its leaders.

Tilray Brands is the largest company of this sector in terms of capitalization, which means it is likely to become a beneficiary of the large-scale growth of the marijuana market after the ban on it will be lifted in the US. The main thing is for the management to avoid serious mistakes.