The IPO Market Trends in 2022

7 minutes for reading

This year has been one of the most difficult periods for the Initial Public Offering market. The global economy is heading toward a recession and major Central Banks are pursuing tight monetary policy. Because of this, many investors turned their attention to the bonds, precious metals, and dividend company markets.

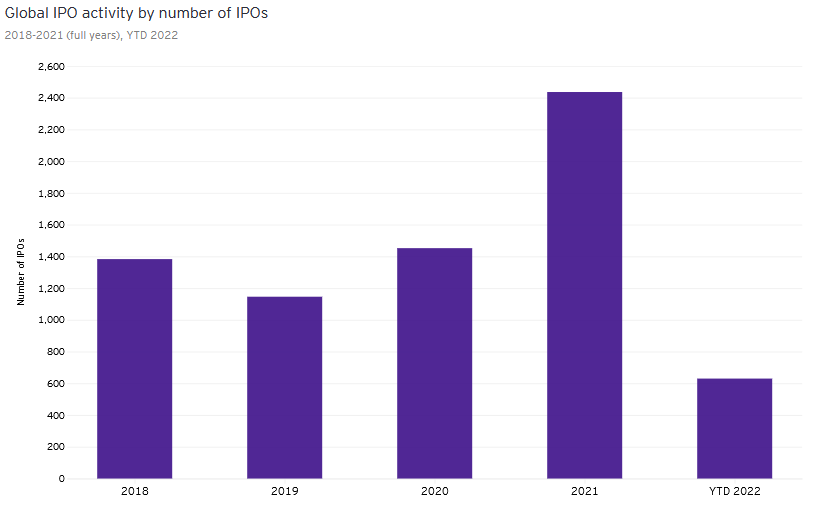

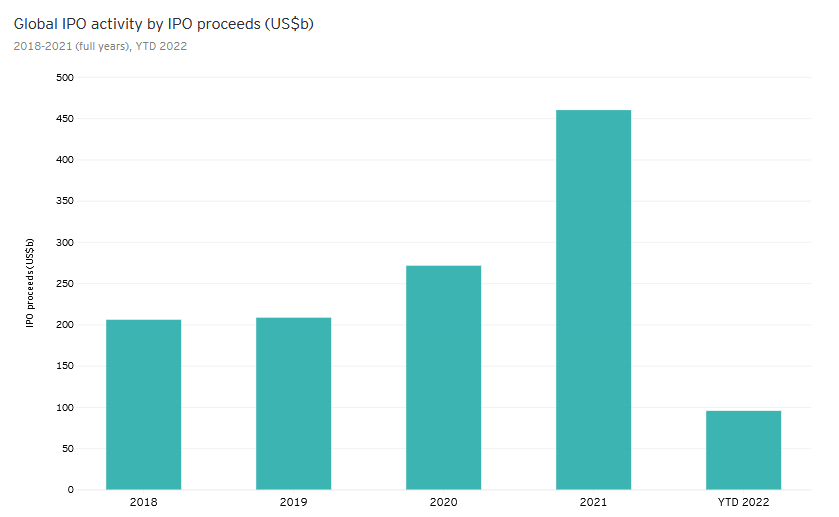

On the other hand, last year was pretty successful for the IPO market – we saw a huge IPO “boom” with 2,850 companies going public, raising a record-breaking sum of money in the last 15 years, over $600 billion. A lot of beginner investors get the wrong impression that the IPO market always goes up. In today’s article, we’ll take a closer look at how a recession influences the sector and what prospects the IPO market might have.

The IPO market and a recession

The global IPO market is experiencing a significant drop in 2022, especially after a record-breaking year of 2021. Market intensity continued to fall in the first and second quarters, resulting in the reduction of both the number of IPOs and revenues.

Increased volatility caused by political turmoil and macroeconomic factors, deterioration of forecasts, and awful dynamics of stocks after they went public – all these factors led to the postponement of many IPOs in the second quarter.

In the second quarter of 2022, there were 305 IPOs for the total sum of $40.6 billion. If compared to a similar period of 2021, it should be noted that both the number of IPOs and the sum dropped 54% and 65% respectively.

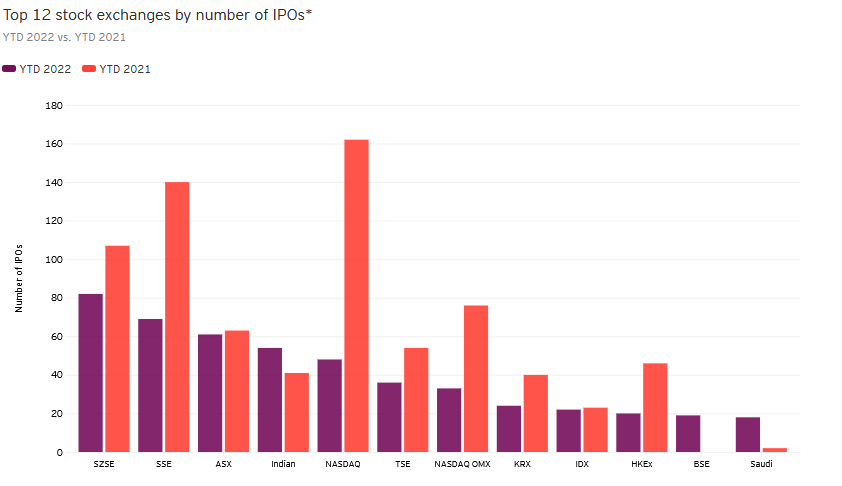

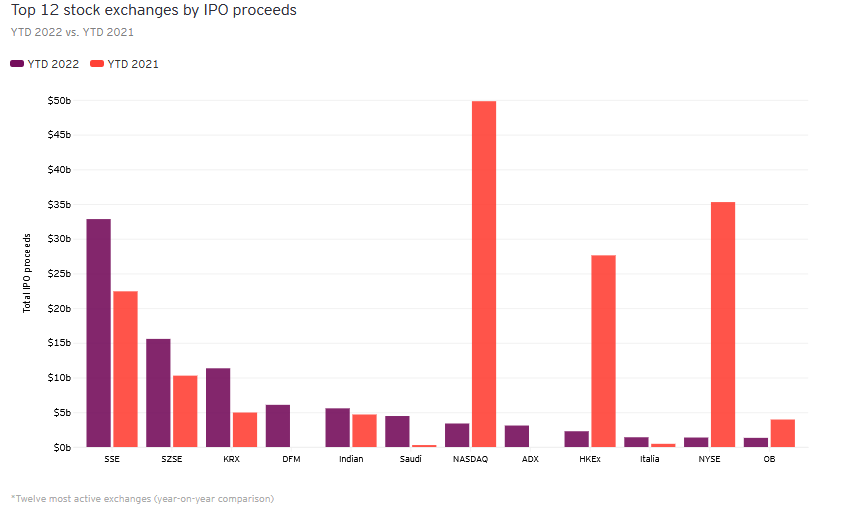

Starting in January 2022, the market saw 630 IPOs raising $95.4 billion. In comparison to the first six months of 2021, these numbers plummeted 46% and 58% respectively. New companies went public more often on Asian stock exchanges than on American ones.

In the US alone, there were 41 IPOs in the second quarter of 2022 for the total sum of $2.5 billion. These statistics indicate a 73% drop in the number of IPOS and a 95% decrease in revenue. As for the Asia Pacific region, the market saw 181 IPOs raising $23.3 billion. In comparison to the second quarter of 2021, these readings plunged 37% and 42% respectively.

The IPO market regionalisation

Along with the weakening of the global IPO market, there is a significant decline in transborder activities caused by geopolitical pressure and the toughening of requirements imposed by national regulators on companies that are planning to go public abroad.

This problem has been pretty much highlighted in China where local regulating authorities forced domestic companies to go public on the Shanghai Stock Exchange. Companies from other countries in the Asia Pacific region also experienced similar pressure.

How are things going with SPAC?

SPAC deals are less popular than traditional IPOs. This year, this segment is pressured by investor sentiment, macroeconomy situation, changes in monetary policies of global Central Banks, uncertainty in regulations, and increase in recession concerns.

There is a record-breaking number of SPAC deals right now and many of them might expire the next year. That’s why a vast majority of such companies are actively looking for partners for M&A deals. If regulation is changed and improved, as well as other market conditions, it might have a positive influence on both new SPAC and M&A deals.

Recession and recovery period: what companies might be popular and attractive

Experts from Barclays are expecting the global economy to gain 3.3% in 2022 against their previous forecast of 4.4%. As we can see, the expected global growth rate is not exactly stable, but the tendency remains alarming.

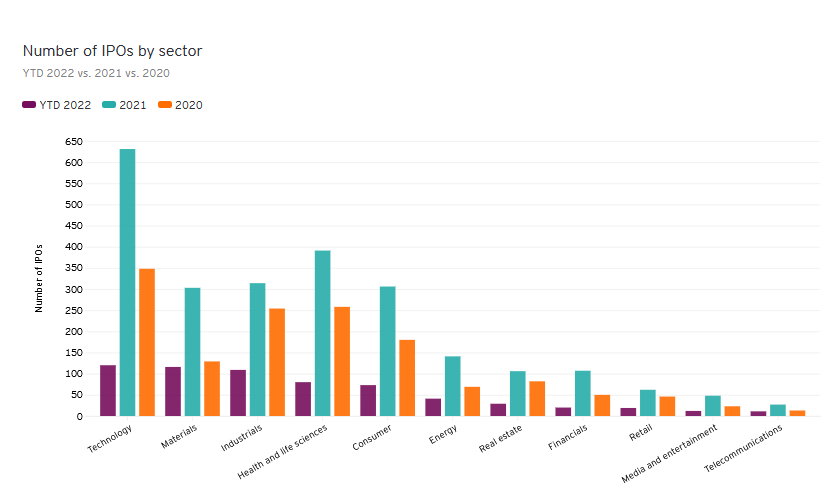

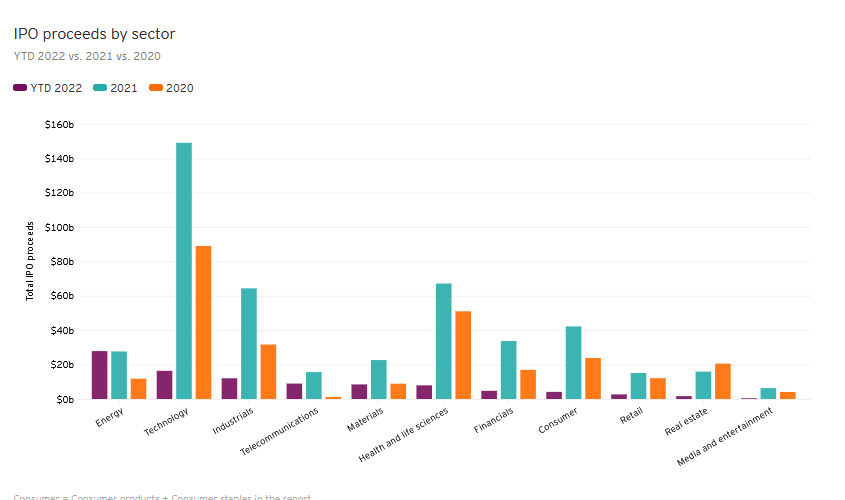

The list of the “highest-grossing” IPOs for the first six months of 2022 shows that representatives of the energy sector are driving out tech companies. At the same time, the tech sector is leading in the number of deals, but their average sum fell by more than a half. On the other hand, the energy sector earned more money and the average sum more than trebled.

The tech sector will probably continue leading the IPO market in the number of companies going public. However, considering a greater attention to renewable energy sources amid a global oil price surge, the energy sector is expected to rank first in terms of raised sums.

Just like before, ESG is highly likely to be the key topic for investors and companies filing for an IPO, regardless of a sector. As global climate changes and restrictions on energy get tougher, companies that integrate ESG into their key business processes will attract more investors and receive higher grades.

Should one take part in IPOs of companies with small capitalisation?

The IPO sum depends on an underwriter, a financial institution that helps a company go public.

An underwriter assesses the company’s growth prospects and attracts investors to its shares. The more famous and influential the underwriter is, the more confidence in its “protege” investors will have.

The IPO success also depends on the overall market situation. Big-time underwriters try to stay away from IPOs of companies with small capitalisation to minimise reputational damage.

Retail investors, who follow their risk management rules and invest relatively small amounts of money, have a good chance to add some really prospective stocks to their portfolios. There is a possibility that a potential profit might cover losses from their less successful investments. Before investing, one should carefully consider the issuer’s financial performance and its target market potential.

What risks can IPO participants face in the existing market environment?

A lot of IPOs were postponed in the first half of 2022 due to an unstable market situation. All these companies will probably go public after the financial markets become less uncertain and volatile.

However, so far it is assumed that this level of volatility won’t go away in the near future, and there are several reasons for that, such as geopolitical tensions, macroeconomic factors, under-performance of capital markets, and an influence of the pandemic on global tourism and other travelling-related industries.

The prospects of the IPO market

Probably, the risks of a recession will increase and the IPO market might stagnate. Participants of Initial Public Offerings, especially beginners, won’t consider them a strategy to receive “easy money” like it was in 2021. Investors will have to be more experienced and have more knowledge and skills in analysing financial performance and the target market of a company that is planning to go public.

Tech and energy sectors are likely to remain the top priority areas for investments. In the next stage of the commodity cycle, “green” companies might get more popular – buying these stocks will be considered a long-term investment in the future, with an eye to an exponential growth of their capitalisation.

It’s important to stick to rather conservative risk management rules: at a time of financial turbulence and increased volatility, the number of bankruptcies skyrockets. As a rule, it’ s possible for investors to reduce the risks of losses if they are extremely careful in choosing issuers and do not invest a substantial share of their portfolios in new IPOs. In most cases, investments in IPOs of different companies are driven by the necessity to keep the purchasing power of investors financial savings that is pressured by inflation.