Mobileye Global IPO: The Largest Offering Since Early 2022

4 minutes for reading

The development of autonomous vehicle control technology that does not require a driver is one of the most promising developments in the global automotive industry today.

The shares of companies that research in this area are sought after by a wide range of investors. Today we will tell you in detail about one of these firms. Mobileye Global Inc. went public on October 26 on the NASDAQ with a ticker symbol of "MBLY".

What We Know About Mobileye Global

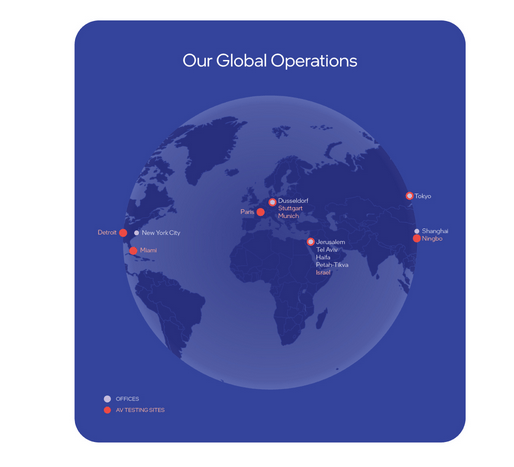

Israel-based Mobileye Global Inc. was founded by Amnon Shashua in 1999. It is the market leader in innovative in-car driver assistance systems. The same technology is also actively used in autonomous cars.

Mobileye Global Inc. had already gone public in 2014. However, in 2017, the company was acquired by Intel Corporation for USD 15.3 billion.

Mobileye Global is also developing a fully autonomous robotic taxi. The company has promised that the project will be implemented in Tel Aviv and Munich by the end of this year. It was stated that the cost of one such autonomous vehicle would not exceed USD 6,000

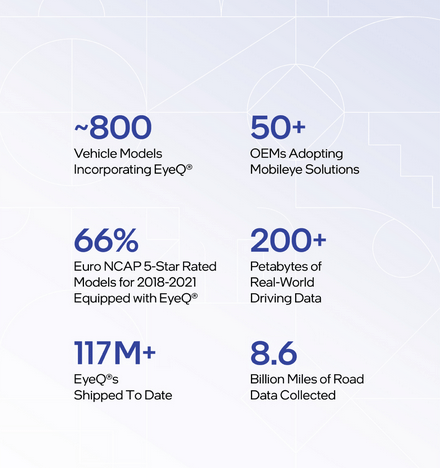

In 2021, more than 40 million cars were produced equipped with autopilot systems. Mobileye Global's products were installed in 28 million cars. Separately, the issuer cooperates with more than 50 automakers worldwide.

As of the 2nd of July 2021, the amount of investment received by Mobileye Global from Intel was as high as USD 11 million.

What are the Prospects for the Mobileye Global Target Market?

According to Allied Market Research, the global market for autonomous vehicles was valued at USD 76 billion in 2020. By 2030, the estimate is expected to reach USD 2.16 trillion. The projected compound annual growth rate (CAGR) from 2021 to 2030 is 40.1%.

Main competitors:

- Argo AI LLC.

- Cruise LLC.

- Aurora Innovation Inc.

- Motional Inc.

- Waymo LLC.

- Zoox Inc.

- AutoX Inc.

What is Mobileye Global’s Financial Performance?

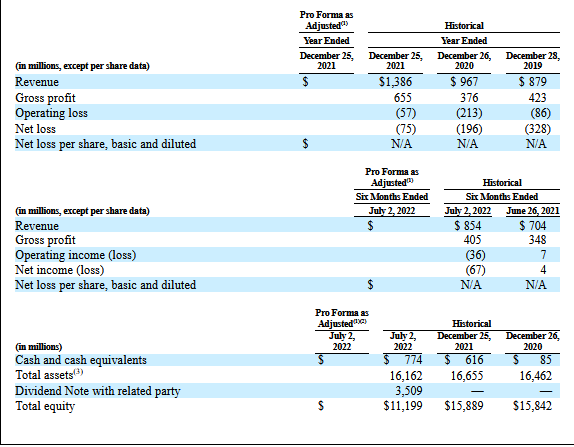

Mobileye Global had no net income at the time of going public, so let's start our analysis of the company's financial position with revenue. In 2021 it amounted to USD 1.39 billion, which is 43.33% more than the previous year's statistics. At the same time, the net loss decreased by 67.73% to USD 75 mln.

As of the 2nd of July 2021, the company had USD 774 million in accounts, with total liabilities of USD 4.96 billion.

What are Mobileye Global’s Strengths and Weaknesses?

Advantages:

- A promising target market.

- High rate of revenue growth.

- A modern, forward-looking product.

- Unique development technology.

- Significant investment in the development of their product.

Disadvantages:

- High competition.

- Lack of net profit.

What Do We Know About the Mobileye Global IPO?

Mobileye Global Inc.'s IPO underwriters were Morgan Stanley & Co. LLC, Jefferies LLC, Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, Barclays Capital Inc., China International Capital Corporation Hong Kong Securities Limited, BNP Paribas Securities Corp., Siebert Williams Shank & Co.

The issuer sold 41 million ordinary shares at the offered average price of 21 USD per unit. Gross proceeds from the sale of the securities amounted to approximately 861 million USD, excluding the sale by the underwriter of the ordinary options. At the time of writing, the firm was capitalised at USD 20.73bn. The IPO of Mobileye Global Inc. was the largest of the year.

We use the P/S (capitalisation/revenues) ratio to value this company. The issuer's P/S value is 14.91. Under current market conditions, the P/S multiple in the technology sector rarely reaches the 20 mark during the lock-up period. However, given the market potential and the company's revenue growth rate, such a scenario must be considered.

Participating in this IPO is a classic venture capital investment unsuitable for all investors. At the time of writing, it is still possible to buy the issuer's securities at a price that is only slightly higher than the IPO price.