What's Going on With Meta Platforms Stock?

6 minutes for reading

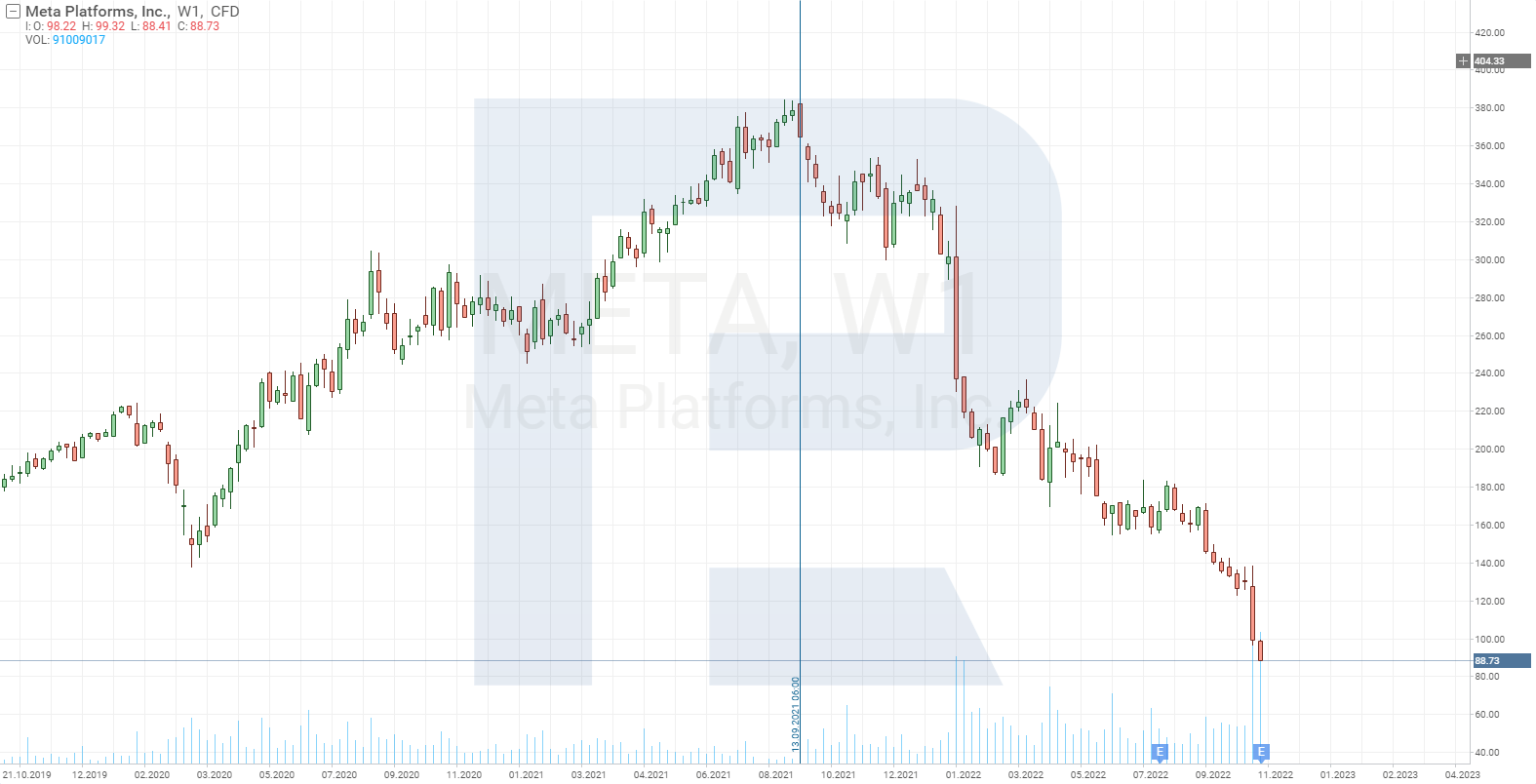

Since August 2021, Meta Platforms Inc. (NASDAQ: META) has lost more than 75% of its value. In today's article, we will analyse the reasons behind this decline, and what Mark Zuckerberg is now betting on and why.

The reason behind Facebook’s success

When launching Facebook, Mark Zuckerberg's focus was not on making profit but on capturing market share. It was a risky move, but it worked.

The company made its first profit in 2009, five years after it was founded. In 2021, it reached USD 39.3 billion, with the number of active users of the social network exceeding 2.5 billion.

In comparison, Twitter, which was founded two years after Facebook, has 229 million active users. Its loss last year exceeded 221 million USD.

As we can see, Mark Zuckerberg's far-sighted strategy of not rushing to monetise the social network so as not to scare off his audience proved to be more effective.

The meta-universe in the spotlight

Zuckerberg is now concentrating on developing the metaverse, which has led him to face misunderstanding from shareholders and investors. However, since they do not have a majority vote, they cannot stop the head of Meta Platforms Inc. But why would he want a metaverse?

The vulnerability of the existing business model

Nearly half of the world's population use Facebook and Instagram, with the vast majority doing so via their smartphone. This suggests that if smartphone apps were to be removed from the App Store or Play Market, Meta Platform's business would suffer greatly and the market would be taken over by competitors.

The dependence on companies that own and operate smartphone and tablet software is a major flaw in the business model of Meta Platforms Inc. and other firms that make money from selling digital advertising.

In April 2021, Apple Inc. (NASDAQ: AAPL) revised its privacy policy for users of iOS devices, making them choose whether or not to allow apps to collect details of their actions.

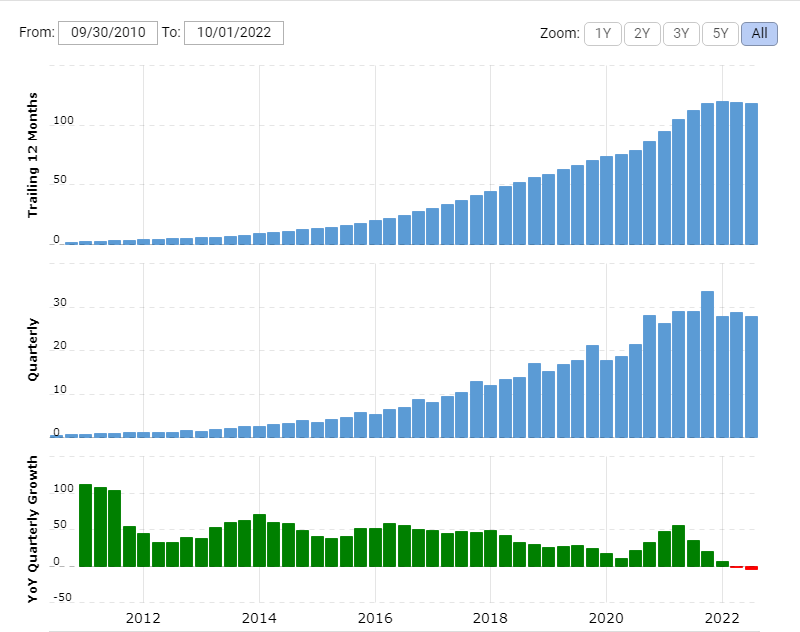

These changes were a big blow to Meta Platforms Inc. and numerous other companies. In 2021, the social network's revenue growth came to a halt, and in 2022, it went into decline. This happened for the first time in the history of the company.

The actions of Apple Inc. led to the financial results of Meta Platforms Inc. for the third quarter of last year falling short of forecasts. Investors began to worry about the consequences of Apple's innovations even before the report was published, which affected the value of the social network's stock.

New name – new strategy

According to Mark Zuckerberg, a virtual world is a way out of the difficult situation in which his company has found itself. The main purpose of the metaverse is to create a new ecosystem for the corporation's products, and to move away from the dependence on other technology giants.

After the publication of a weak quarterly report, it was announced that Facebook Inc. would be renamed Meta Platforms Inc., and that it was taking a new direction in the development of the virtual world. At the presentation, Mr. Zuckerberg talked about future technologies, a new vision and concept for the upcoming changes, and warned that it would take five to ten years to realise the vision.

Investors were left with the decision to either believe in the realisation of what was presented or to take their money by selling their shares. Many of them chose the second option, which led to the price of Meta Platforms Inc. plummeting as a result.

The head of the company is in a better position now than 18 years ago, because the quarterly revenue of the corporation exceeds USD 27 billion. This means that Meta Platforms Inc. can invest in itself.

Market leadership in VR headsets

Meta Platforms Inc. has a market share of about 90% of the VR glasses, which people use to immerse themselves in the virtual world. Over the last year, the global supply of virtual reality headsets has increased by more than 200%.

Meanwhile, the VR headset Meta Quest 2, which is developed by Facebook Technologies, is the most popular product in the virtual reality accessory market. Separately, it is worth noting that the corporation is selling the headset at a price that's lower than its production cost for the purpose of increasing its market share.

As we can see, Mark Zuckerberg is willing to spend billions of dollars to attract as many users as possible to the metaverse.

Investing in Meta Platforms carries a high level of risk

So far, investors do not believe in the metaverse, and this is not surprising, considering that the majority of the big investors are from the older generation, while the product is aimed at younger users.

There is no worldwide enthusiasm for the virtual world yet, but this can be remedied. Meta Platforms Inc. controls a social network with over 2.5 billion users. As soon as the corporation prepares the technology for mass use, it will begin a huge advertising campaign on social networks, with the popularity of the metaverse only being a matter of time.

Ambitious investors willing to take big risks will then invest in Meta Platforms Inc. stock, but these investors do not represent the majority. The likelihood that the downtrend will reverse in the near future is, therefore, very low.

However, it is likely that with every new presentation and update, investors will get a stronger impression that things can work out for Zuckerberg. And in this case, we will not only see a trend reversal, but a repeat of the company's 10-year rising stock price history.

Nevertheless, the doubts are still very strong as to whether the head of Meta Platforms Inc. will be able to effectively implement all his plans within the next five to ten years, as stated.

Conclusion

Mark Zuckerberg could take over smaller competitors, expand his monopoly, and increase revenue. But this strategy would mean that for each new deal he would encounter even more resistance from regulators. Eventually, Meta Platforms Inc. would face the threat of unbundling just like with John Rockefeller's Standard Oil.

Zuckerberg has taken the riskier route, which now makes it difficult to believe in the implementation of the new strategy, just like one could not possibly imagine back in 2004 that billions of people all over the world would be using Facebook.