How and Why the US Government is Promoting Green Energy

6 minutes for reading

Today we will talk about the government's economic stimulus packages for clean energy in the US. We will look at the American Recovery and Reinvestment Act signed by Barack Obama in 2009, and the Inflation Reduction Act signed by Joe Biden in 2022. Let's analyse the impact of these laws on the development of green energy in the US.

America’s Recovery and Reinvestment Act

The US economy was harmed by the financial crisis in 2008. By 2009, unemployment had reached 10.2%, which marked the highest level in 25 years. The US government needed to take urgent measures to jumpstart the economy and create new jobs. In response to the 2008 Great Recession, the American Recovery and Reinvestment Act (ARRA) of 2009 was drafted and passed by the US Congress.

This act provided for investments of 90 billion USD in clean energy. At that time, this was the largest investment in the energy sector in the history of the United States. This economic stimulus package laid the foundation for dramatic changes in the energy system, such as massive electrification of land transport and an increase in the amount of energy from renewable sources.

Electrification of the automotive industry

In 2008, Elon Musk's Space Exploration Technologies Corporation (SpaceX) and Tesla Inc. (NASDAQ: TSLA), which were on the verge of bankruptcy, were rescued by NASA contracts. In 2010, the US Department of Energy granted Tesla Inc. a USD 465 million loan to back it up.

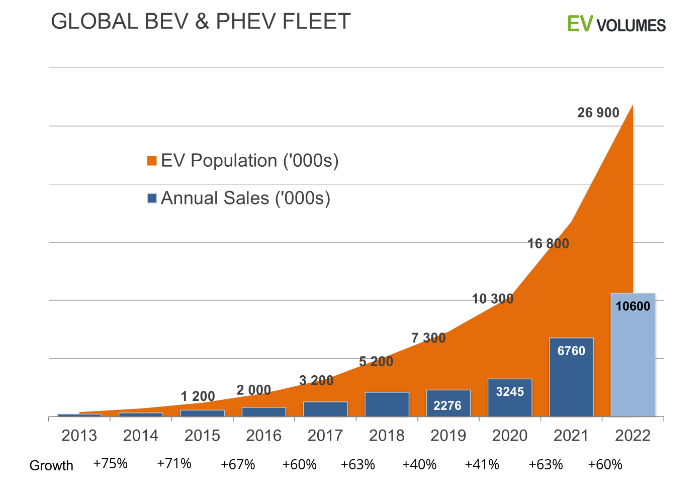

It can be assumed that the active development and growth of this car company have triggered accelerated electrification of the global car industry. Many manufacturers have supplemented their model ranges with electric and hybrid cars. According to EV-Volumes, the number of environmentally friendly cars on the road has increased from a few hundred thousand to nearly 27 million units over the past ten years.

In 2010, Tesla Inc. was the only publicly traded company in the US that focused exclusively on electric vehicles. The return on investment in this corporation by 2020, before the COVID-19 pandemic-induced crisis, exceeded 5500%.

Promoting alternative energy sources

According to the Energy Information Administration (EIA), from 2011 to 2021 inclusive, wind power generation increased by more than 200% to 132,753 MW. Solar power generation increased 88-fold to 93,151 MW. In addition, solar photovoltaic modules, which are capable of producing 1 W of energy, have fallen in price from USD 2.15 to USD 0.27.

At the time of writing, the largest US solar energy companies by market capitalisation were Enphase Energy Inc (NASDAQ: ENPH), First Solar Inc (NASDAQ: FSLR), and Sunrun Inc (NASDAQ: RUN). They were valued at USD 33.4 billion, USD 18.7 billion, and USD 5.9 billion, respectively.

With energy-saving technology becoming widespread, the classification of household appliances according to their energy efficiency level has emerged. Fluorescent lamps, which were previously used mainly in industrial plants, were introduced for home use. Moreover, less efficient and more energy-intensive incandescent lamps were gradually replaced by more economical LED lamps.

Why a law to reduce inflation was passed

The situation in the US today is very different from what it was after the 2008 crisis: unemployment is at a low level and inflation is in positive territory – there was deflation in 2009. However, the government was now facing a new challenge: the likelihood of continued high inflation.

This has been facilitated by reduced investment in conventional energy sources, which has led to a reduction in hydrocarbon production and a substantial rise in the cost of hydrocarbons. With hydrocarbons being used to generate electricity and transport products and components, their cost constitutes a significant part of the cost of many products.

To help reduce these costs, a national green energy investment plan has been developed. This includes increasing the amount of electricity from renewable sources, modernising existing electricity networks, and increasing the share of green transport in total land transport.

Where the money will go

The Inflation Reduction Act is not just about investing in green energy: it also covers health care, tax, and budget deficit reduction. However, the largest amount of money – USD 391 billion out of USD 738 billion – is allocated to energy modernisation and climate savings.

Development of renewable energy sources

The amount of 260 billion USD is earmarked for clean energy development. The funds are allocated in the form of tax subsidies and credits for those working with renewable energy sources. The aim of the investment is to make it more cost-effective for utilities to build green power plants than conventional energy facilities.

The beneficiaries of such investments might be the manufacturers of solar panels, batteries, and wind turbines. The leaders in power plant turbines are General Electric Company (NYSE: GE) and Siemens Energy AG (XETR: ENR), and the leaders in wind turbine blades are TPI Composites (NASDAQ: TPIC). In the solar energy sector, the leading positions are held by the already familiar Enphase Energy Inc. and First Solar Inc.

Development of electric transport and modernisation of the electricity grid

Under the Tax Reduction Act, there are a number of credits and deductions such as a tax credit worth up to $7,500 for buyers of new all-electric cars and hybrid plug-ins. The sum of USD 80 billion is allocated for incentive rebates for the purchase and installation of home solar panels, the renewal of the home electric grid, and the purchase of induction cookers and electric cars It can be assumed that this will have a positive impact on the business of producers and sellers of the above-mentioned products.

The largest electric car companies in the US are General Motors Company (NYSE: GM), Ford Motor Company (NYSE: F), and Tesla Inc. Note that the first two companies are increasing their electric car production while decreasing the production of internal combustion engine vehicles.

Tesla has not reached the peak of its production yet and is still increasing its production space. Consequently, the total number of electric vehicles sold at this company still depends on production volumes. In this respect, it is worthwhile mentioning the smaller US electric car makers Rivian Automotive Inc. (NASDAQ: RIVN) and Lucid Group Inc. (NASDAQ: LCID).

ETFs for investing in green energy

- First Trust NASDAQ Clean Edge Green Energy Index Fund (NASDAQ: QCLN) invests in US companies that work with renewable energy sources

- iShares Global Clean Energy ETF (NASDAQ: ICLN) invests 80% of its assets in stocks of clean energy-related firms

- Invesco Solar ETF (TAN) – its portfolio is based on the MAC Global Solar Index, which includes stocks of solar energy companies

Conclusion

Environmental, Social, and Governance (ESG) investments gained popularity in the stock market a few years before the COVID-19 pandemic crisis, with pollution reduction as one of their three parameters. The coronavirus crisis shifted the focus away from this important topic for a while, but the public is likely to revisit it in the near future.

The recent laws to help reduce inflation mark the need to reinforce climate change adaptation and enhance the importance of global environmental measures. In addition, this economic stimulus package suggests that the next decade could be a good time for companies associated with clean energy.