IPO of Shengfeng Development: A Contract Logistics Services Provider in China

4 minutes for reading

In this article, we will talk about Shengfeng Development Limited and its IPO on the NASDAQ, which is due to take place on 23 March. Shengfeng Development Limited, a provider of contract logistics services in China, is one of the leaders in the industry.

We will look at the features of the issuer’s business model, the outlook for its addressable market, its main competitors, its financial situation, strengths and weaknesses, and the details of its initial public offering.

Shengfeng Development in brief

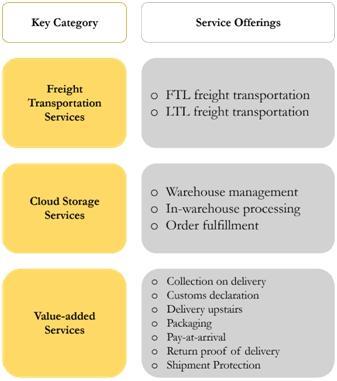

Shengfeng Development Limited provides contract logistics services in the Chinese market. The issuer undertakes the management of all logistics processes for its clients: warehousing, security, forwarding, customs clearance, transportation of goods, etc. The firm is fully responsible for the storage, packing, and loading of cargo, the selection of the optimum delivery route, and the necessary equipment and transport.

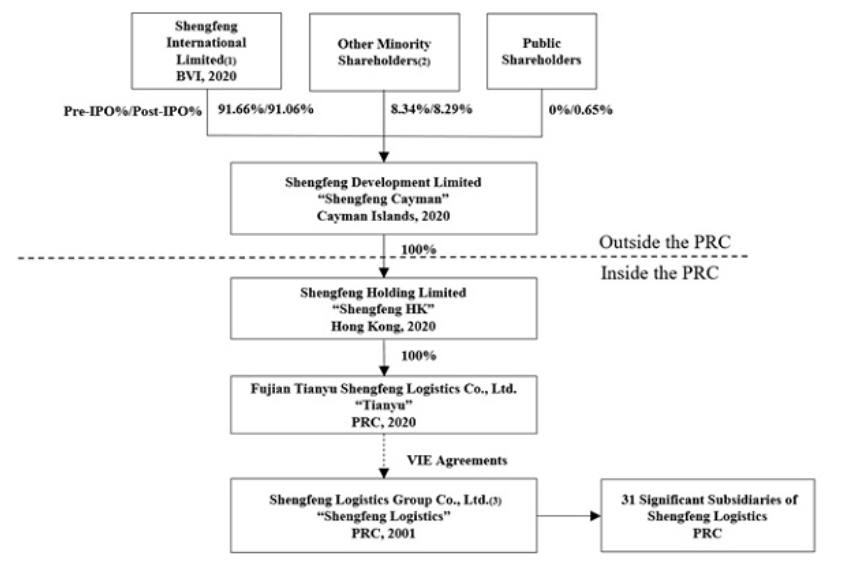

Shengfeng Development Limited was established in 2001 and registered in the Cayman Islands in 2020 to optimise taxation costs. Its head office is in Fuzhou, in the Chinese Fujian Province. Yongxu Liu is the CEO, having previously served as head of the vehicle management department at Shenghui Logistics Group Co., Ltd.

Shengfeng Development Limited operates in China through a number of subsidiaries. The issuer's customers include more than 4000 firms, the largest of which are: JD.com Inc., Contemporary Amperex Technology Co., Limited, Xiaomi Corporation, Schneider Electric SE, and Bright Dairy & Food Co.

The company has been operating for 22 years in 341 cities in 31 provinces across China, where it is operating 35 sorting centres, 42 customer offices, and a fleet of more than 600 trucks.

The China Federation of Logistics & Purchasing (CFLP) ranked Shengfeng Development Limited among the top fifty transport companies in the country. Separately, the CFLP highlighted the issuer's successful performance during the COVID-19 pandemic.

Outlook for Shengfeng Development’s addressable market

According to 360 Market Updates, the global logistics contracting market was estimated at USD 180.1 billion in 2022. It is expected to reach USD 242.5 billion in 2028. The projected compound annual growth rate (CAGR) from 2022 to 2028 inclusive is 3.9%.

Main competitors:

- Yunda Holding Company Limited

- Qingdao Zhongchuang United Investment Development Co.

- Kerry Logistics Network Limited

- YTO Express Group Co.

- Quanzhou Ansheng Shipping Co.

- ZTO Express (Cayman) Inc.

Shengfeng Development’s financial performance

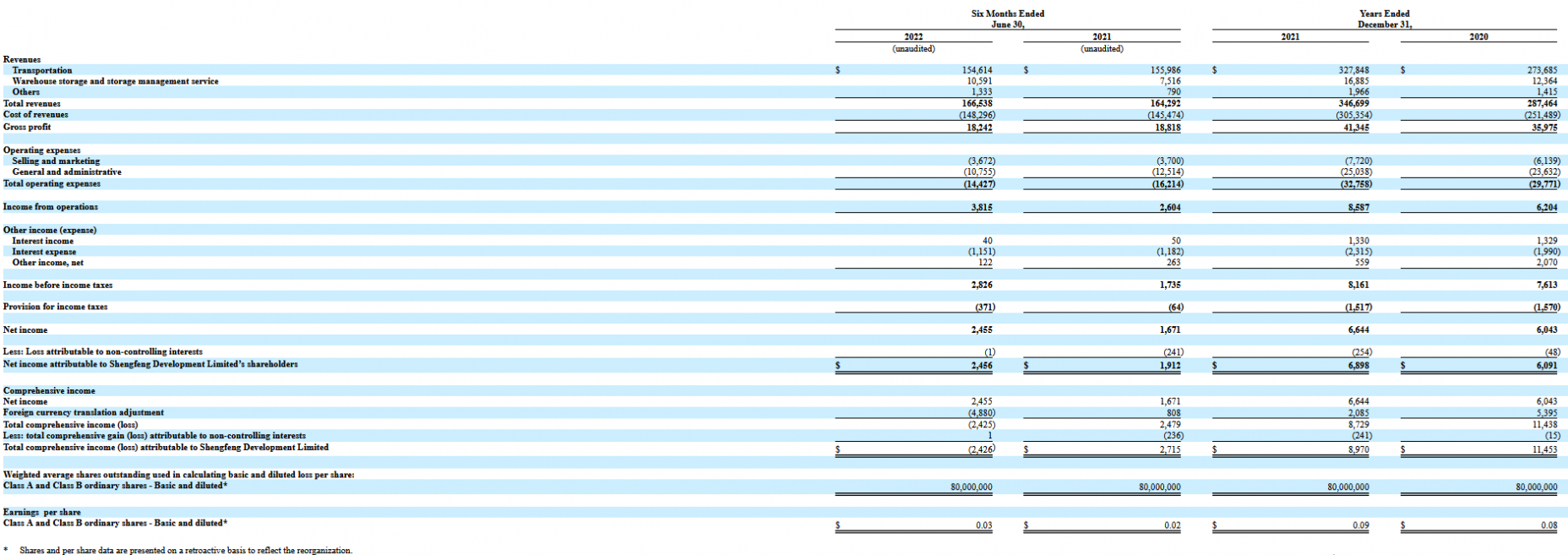

Shengfeng Development Limited's 2021 financial results presented on Form F-1 show a 9.9% increase in net profit, to USD 6.6 million, compared to the 2020 statistics. For the first half of 2022, the figure increased by 46.9% to USD 2.5 million. From July 2021 to June 2022 inclusive, net profit reached USD 7.4 million.

The issuer's revenue for 2021 was USD 346.7 million, up 20.6% from the 2020 result. For the first half of 2022, the figure increased by 1.4% to USD 166.5 million. From July 2021 to June 2022 inclusive, revenues reached USD 348.9 million.

As of 30 June 2022, Shengfeng Development Limited's net cash flow was negative and had reached USD 2.4 million. In the same period, the company had USD 13.9 million in its accounts, with total liabilities of USD 135.2 million.

Strengths and weaknesses of Shengfeng Development

Strengths:

- A promising addressable market

- A client base of regular customers

- Qualified management

- Revenue growth

- Increasing net profit

- Collaboration with well-known and large companies

Weaknesses:

- Fierce competition

- Dependence on the legal framework of the PRC

- Dependence on fuel prices

What we know about the Shengfeng Development IPO

The underwriter of the IPO is Univest Securities, LLC. Shengfeng Development Limited plans to sell three million ordinary shares at the offered average price of 4.5 USD per unit. Gross proceeds from the sale of the shares will amount to USD 13.5 million, excluding the sale of options by the underwriter. However, the firm's market capitalisation could reach USD 185 million.

There is a possibility that the issuer's P/E multiple (capitalisation/net profit) will reach 25, which P/E value is considered excessive for the sector. The issuer's P/S (capitalisation/revenues) multiplier could reach 0.53. The average P/S of competing logistics companies is 1.5. By this indicator, the stock of Shengfeng Development Limited has a growth potential of 183% ((1.5/0.53-1)*100%).