How the Crisis in the Financial Sector Has Affected US Bank Profits

5 minutes for reading

March 2023 brought the collapse of Silicon Valley Bank (SVB), caused by a decline in the value of its treasury bonds that had been bought in 2021. As a result, customers of other banks who were concerned about the safety of their money withdrew their funds en masse and transferred them to large financial institutions in the US. Consequently, this disrupted the stability of the financial market and increased the risk for other banks with large amounts of treasury bonds.

However, Federal Reserve Chair Jerome Powell said that the collapse of SVB was caused by the failure of its management to manage risks, not by weaknesses of the country’s banking system. According to Powell, the Federal Reserve and other authorities had taken all necessary measures to ensure the stability of the financial system and the protection of depositors’ interests.

Despite Powell’s statements, the stock market was anxious about banks’ stability, which manifested itself in a sharp fall in their stock prices. Moreover, reports that the banking crisis may grow worse began to circulate.

With the first quarter of 2023 over, some banks have already released their reports; so we can now analyse the data supplied to understand how financial institutions are really doing and whether the Federal Reserve Chair was right or not.

Reports of the largest US banks

The analysis of the financial reports covers the three largest US banks by market capitalisation, namely JPMorgan Chase & Co. (NYSE: JPM), Bank of America Corporation (NYSE: BAC), and Wells Fargo & Company (NYSE: WFC). At the time of writing, they were capitalised at 412 billion USD, 239 billion USD, and 156 billion USD, respectively.

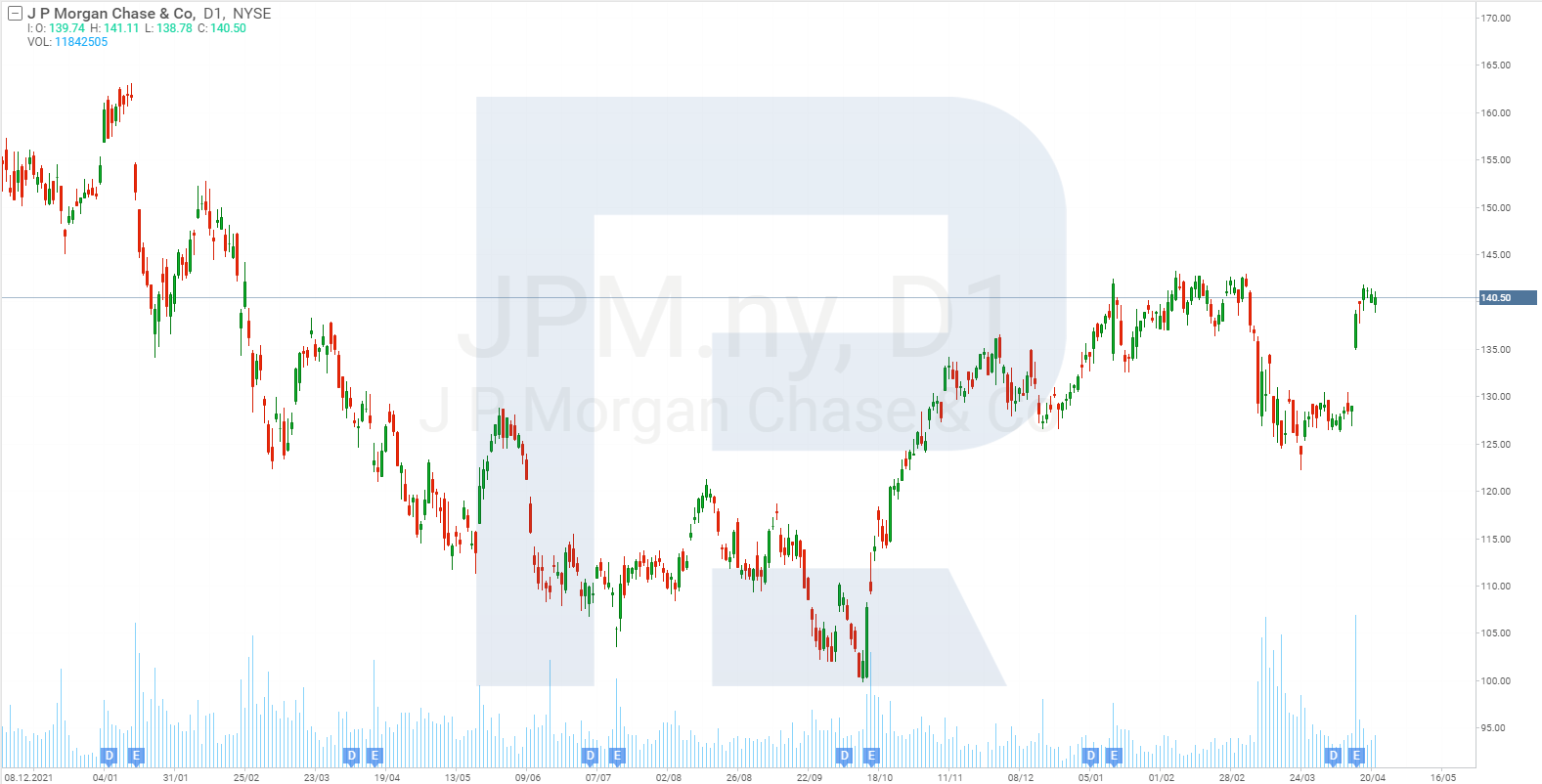

JPMorgan Chase

JPMorgan Chase & Co.’s revenue for the first quarter to 2023 increased 25% to 38.35 billion USD compared with the statistics for the same period in 2022, and the net profit surged 52% to 12.62 billion USD or 4.1 USD per share. The interest income, which depends on the Fed’s discount rate, rose 24% to 20.8 billion USD.

Comparing the volume of deposits with the Q4 2022 results to trace the cash flow performance amid the situation with SVB, JPMorgan Chase & Co.’s indicator increased by 33 billion USD to 1.9 trillion USD.

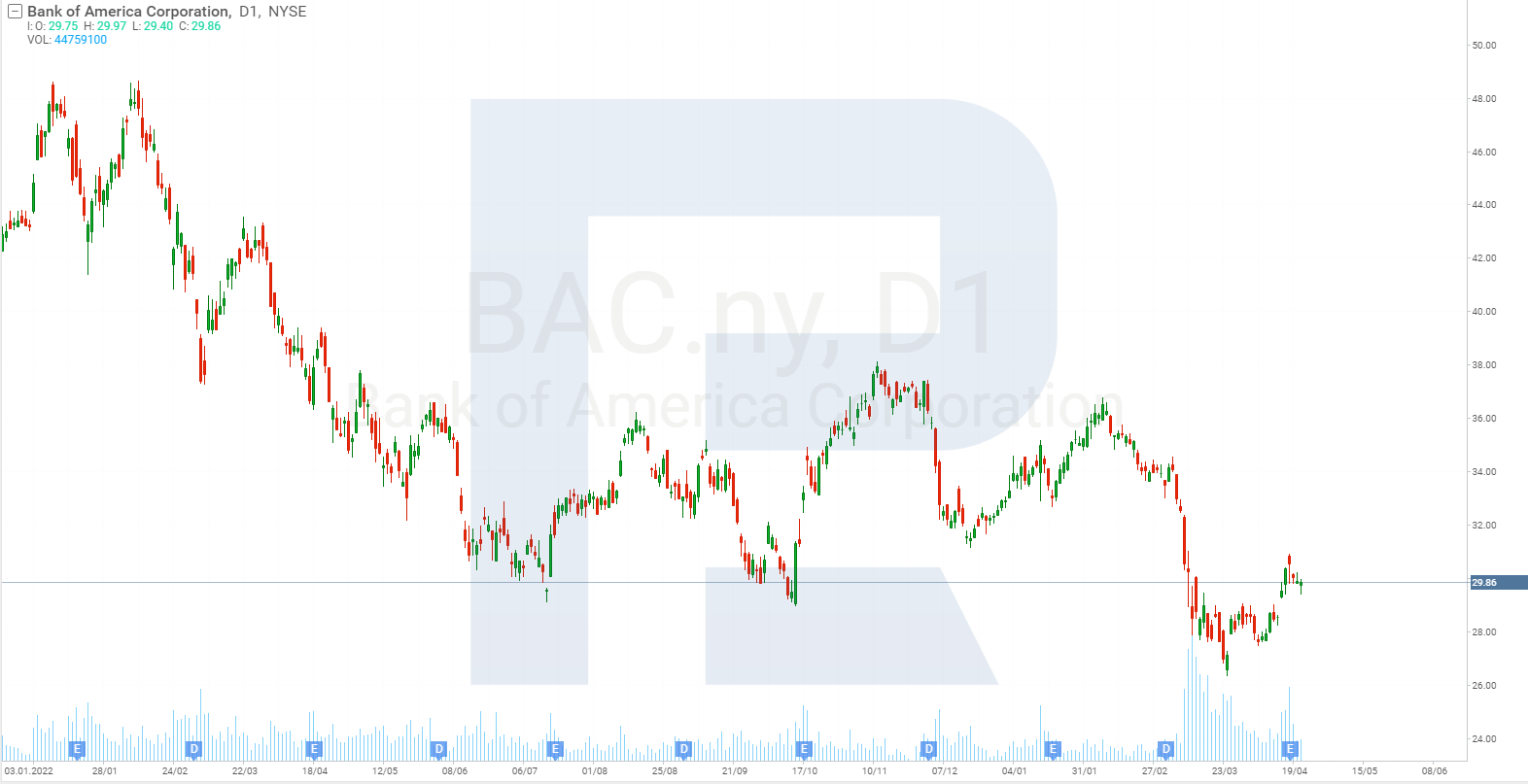

Bank of America

Bank of America Corporation’s January - March revenues increased 13% to 26.39 billion USD this year, net profit was up 15% to 8.2 billion USD or 0.94 USD per share, and interest income increased 25% to 14.4 billion USD. The volume of deposits dropped by 20 billion USD to 1.9 trillion USD.

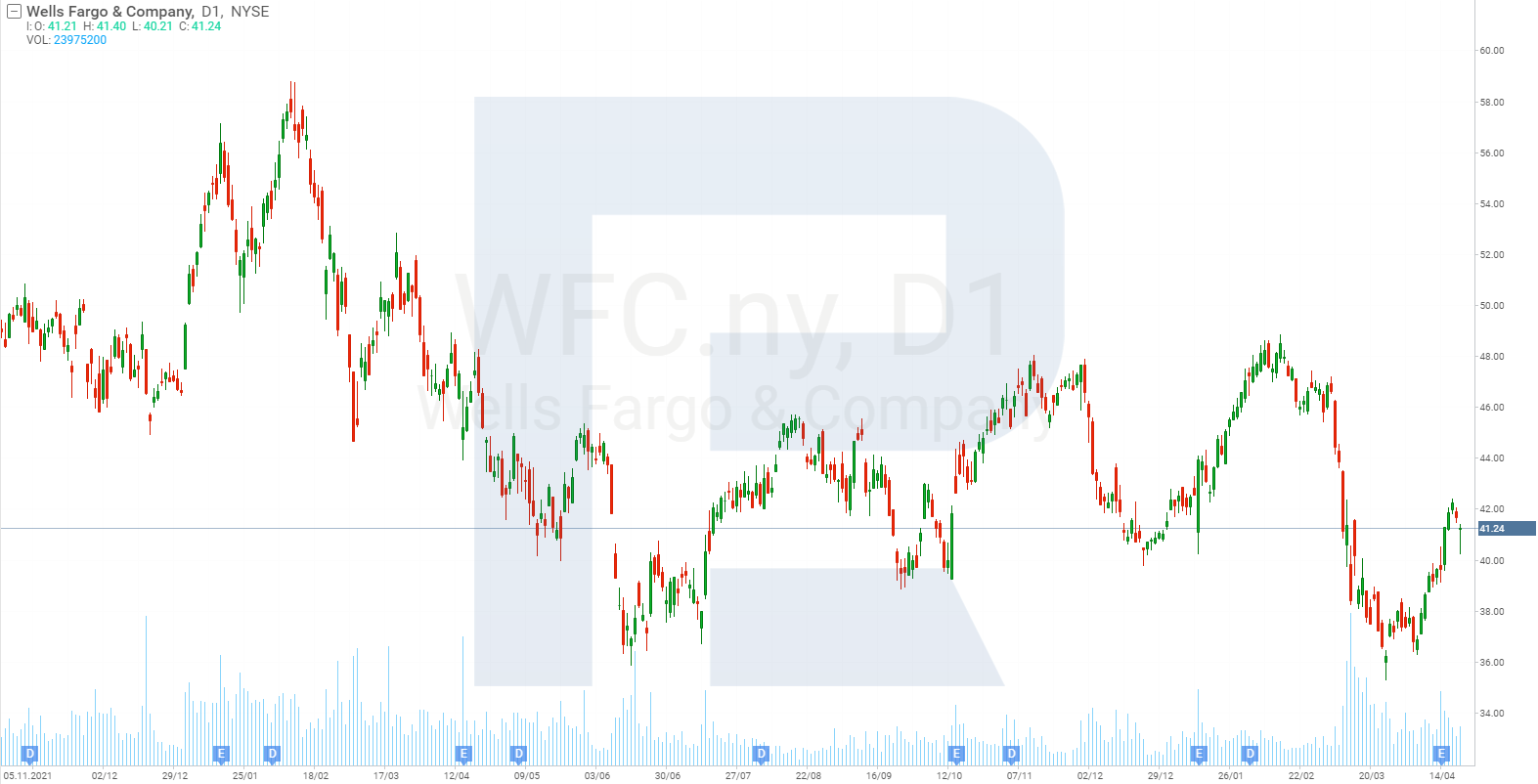

Wells Fargo

Wells Fargo & Company’s revenue climbed 17% to 20.73 billion USD in the first three months of 2023, net profit soared 58% to 4.99 billion USD or 1.23 USD per share, and interest income rose 45% to 13.3 billion USD. The volume of deposits saw a decline of 28 billion USD to 1.4 trillion USD.

Reports of US regional banks

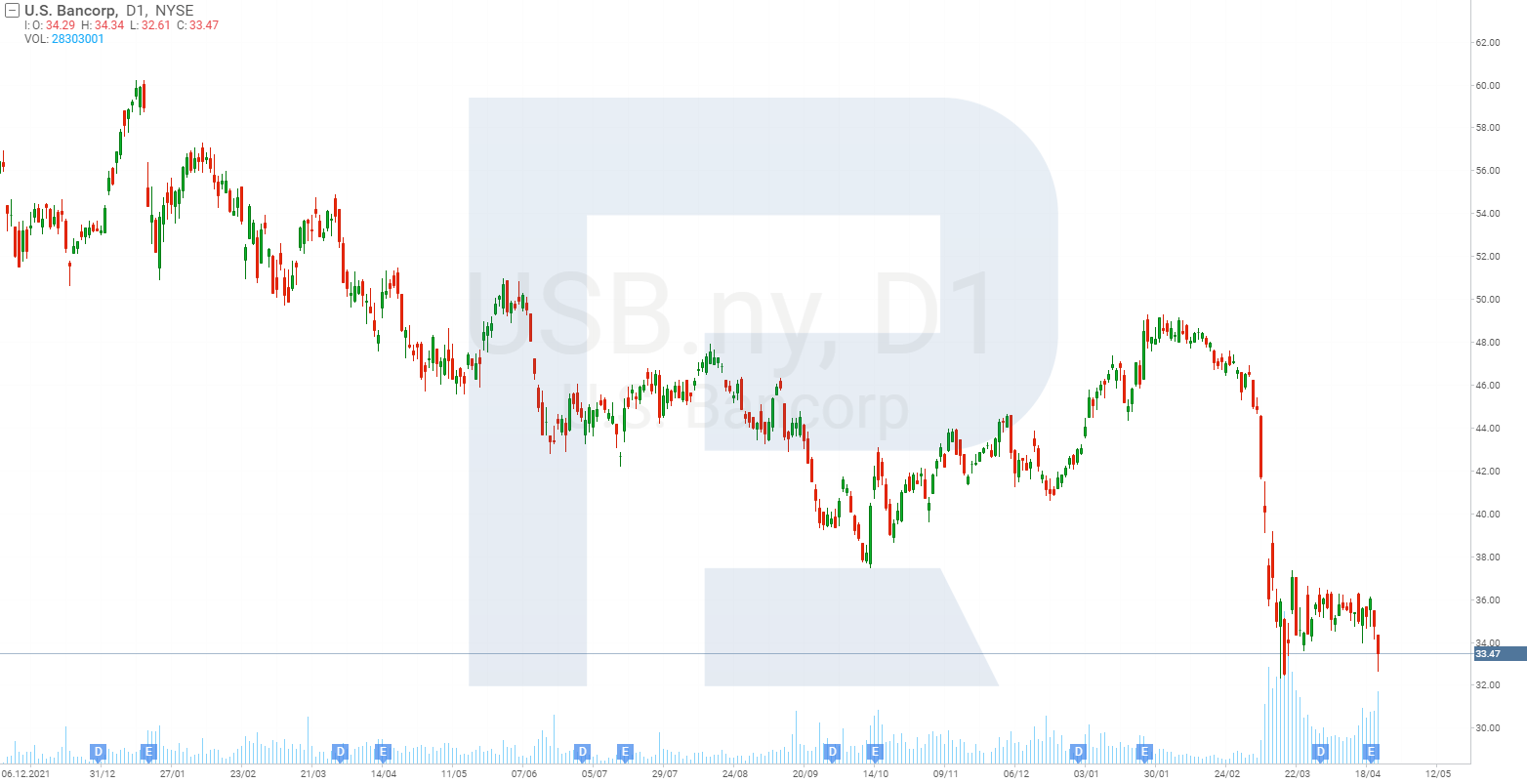

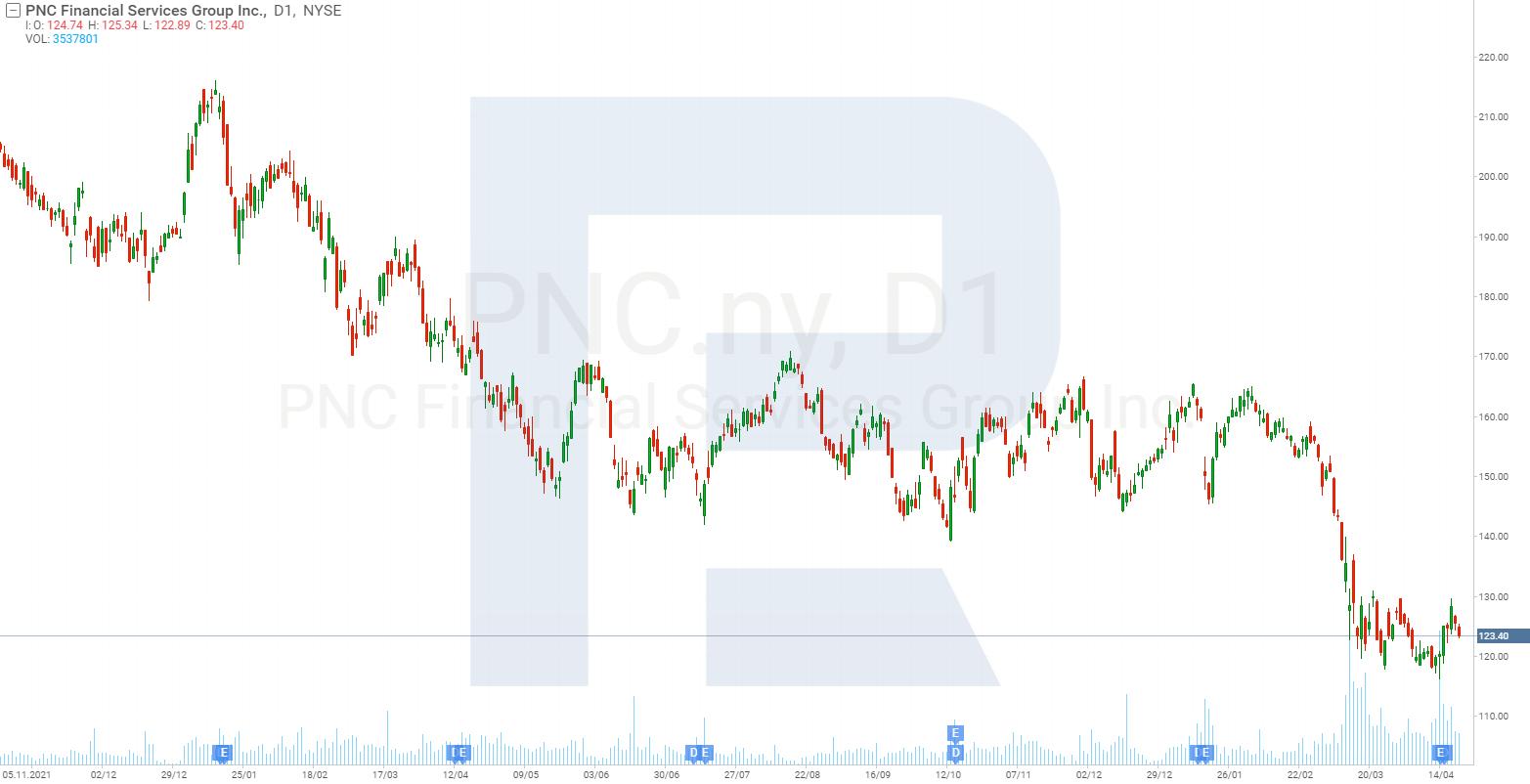

We have selected three of the largest US regional banks by market capitalisation, operating in more than twenty states, and with their shares traded on US stock exchanges. These are U.S. Bancorp (NYSE: USB), PNC Financial Services Group Inc. (NYSE: PNC), and Truist Financial Corporation (NYSE: TFC). At the time of writing, they were capitalised at 51.35 billion USD, 49.68 billion USD, and 41.9 billion USD, respectively.

U.S. Bancorp

U.S. Bancorp’s revenue in Q1 2023 saw an increase of 28% to 7.18 billion USD compared with the statistics for the same period of 2022, net profit added 9% to 1.7 billion USD, EPS rose 17% to 1.16 USD, and the interest income gained 22% to 3.92 billion USD. The volume of deposits for Q1 2023 increased by 49 billion USD to 426.5 billion USD compared with the Q4 2022 results.

PNC Financial Services Group

PNC Financial Services Group Inc.’s revenue rose 19% to 5.6 billion USD for January - March, net profit went up 18% to 1.69 billion USD, EPS gained 23% to 3.98 USD, and interest income rose 15% to 4.2 billion USD. The volume of deposits increased by 1.3 billion USD to 436.2 billion USD.

Truist Financial

Truist Financial Corporation’s revenue increased 13% to 6.15 billion USD in the first three months of 2023, net profit was up 6% to 1.41 billion USD or 1.05 USD per share, and the interest income saw an increase of 22% to 3.92 billion USD. The volume of deposits dropped by 5.7 billion USD to 408 billion USD.

Summary

To gain a a better understanding of the situation in the US financial market, we have reviewed the quarterly reports of the three largest US banks by capitalisation, which also operate outside the country, as well as three large regional banks. The first three are JPMorgan Chase & Co., Bank of America Corporation, and Wells Fargo & Company; and the second group comprises U.S. Bancorp, PNC Financial Services Group Inc., and Truist Financial Corporation. It should be noted that all the above companies have seen an increase in revenue, net profit, EPS, and interest income for January - March this year.

As for the volume of deposits, the behaviour of this indicator is of an ambiguous nature. The mass media has repeatedly reported an active outflow of funds from regional banks to the largest representatives of this sector following the collapse of Silicon Valley Bank. However, given the statistics for January - March, this statement seems ambiguous. Of the top three banks, only JPMorgan Chase & Co. recorded an increase in deposits, and of the second three banks, Truist Financial Corporation was the only one to see a decline in this indicator.

The interest rate in the US reached 5% in April 2023, with the same value seen in 2006, and it was followed by a rise in stocks of financial institutions. If we refer to historical data, we can assume that Jerome Powell was right: SVB’s problems were caused by its management’s inability to manage risk.