NZD/USD Forecast: Will the Decline Continue in 2023?

8 minutes for reading

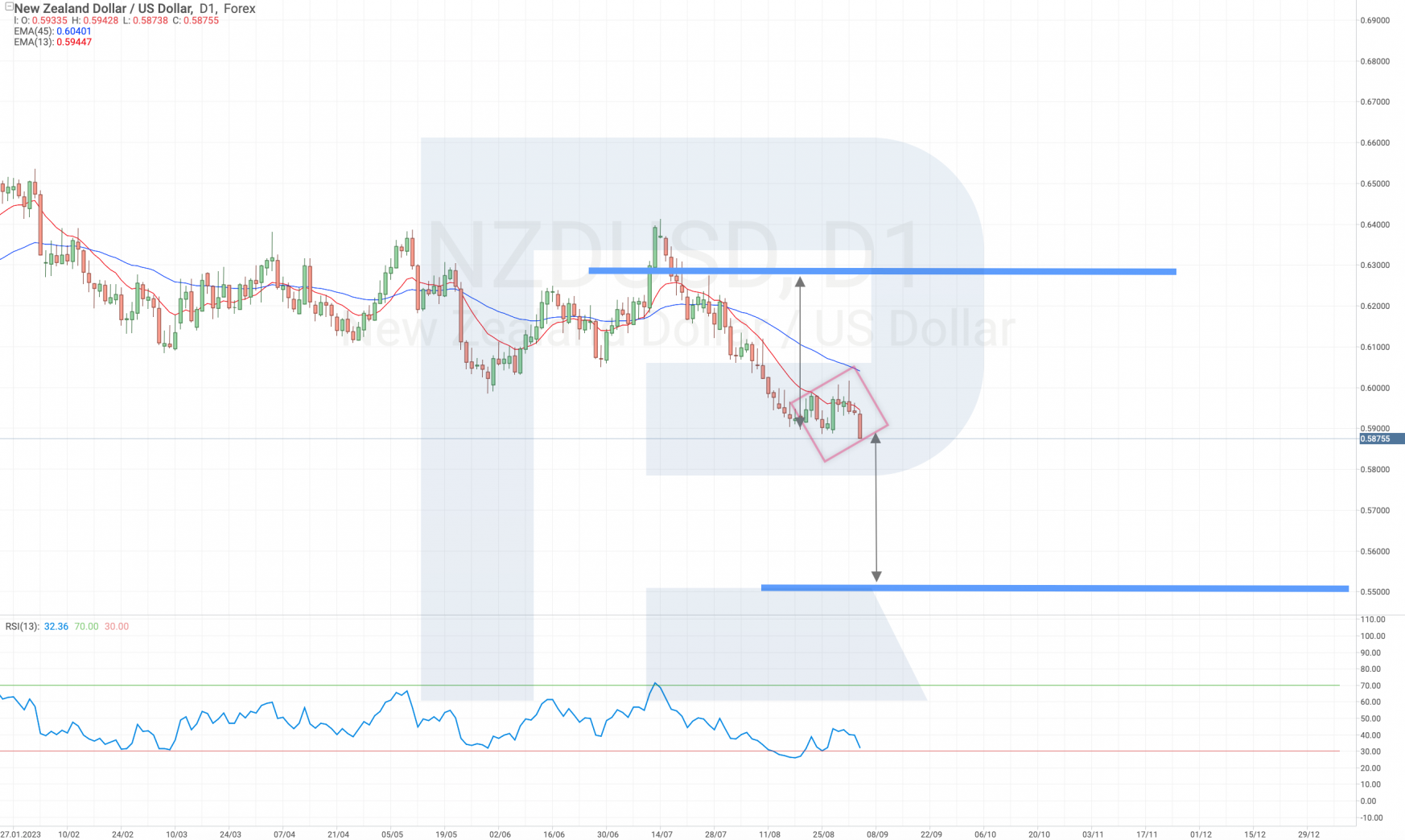

NZD/USD (New Zealand Dollar to US Dollar) has been on a decline since the beginning of 2023. On 2 February, the pair reached a yearly high at 0.6534, followed by a gradual drop in price and eventually hit a low of 0.5887 on 29 August. At the time of writing, the quotes are within a correction phase at the level of 0.5979.

In this article, we will examine the key factors affecting the NZD/USD movements. We will conduct a technical analysis of the chart, share expert NZD forecasts for 2023-2024, and aim to understand whether the decline of the pair will continue.

You can visit the RoboForex Market Analysis webpage for the latest NZD/USD forecasts.

Overview of the NZD/USD currency pair

NZD/USD is one of the major currency pairs, with the New Zealand dollar ranking as the 14th most traded currency in the world according to a survey by the Bank for International Settlements (BIS), published in October 2022. It has held the number 10 spot since 2010 but was eventually overtaken by the Singapore dollar, Swedish krona, Korean won, and Norwegian krone.

The base currency in the NZD/USD pair is the New Zealand dollar, the country’s monetary unit and the quoted currency is the US dollar. The behaviour of the pair’s quotes depends on economic and political events in the two countries.

Trading characteristics of the NZD/USD pair

- The currency pair is traded round the clock from Monday to Friday, with the highest activity observed between the American and Asian sessions

- The pair is characterised by low average daily volatility within the range of 700-1,000 pips, with maximum movements in 2023 reaching 1,600 pips per day

- It is considered quite liquid in the foreign exchange market, which is why the spread for NZD/USD is minimal

Dynamics of the NZD/USD currency pair in 2023

The NZD/USD currency pair has been demonstrating a moderate downward trend, starting the year at the 0.6337 mark, and hitting an annual high near 0.6534 on 2 February. By March, the quotes had reached 0.6084, which was followed by a prolonged correction that lasted for 5 months. During this correction phase, the upper boundary was at the 0.6380 level, while the lower boundary hovered near 0.6065.

In July 2023, following the third test of the 0.6380 level, the NZD/USD quotes headed downwards and gained a foothold below 0.6065 on 11 August. At the time of writing, it can be concluded that the New Zealand dollar has been experiencing a gradual decline against the US dollar from January to August inclusive.

Factors influencing the NZD/USD price

Economic data

According to an economic review by the New Zealand Parliament, the country’s economy contracted by 0.1% in Q1 2023. Data for Q4 2022 was revised upwards with the contraction value increasing from 0.6% to 0.7%.

According to Stats NZ, in Q1 2023, 9 out of 16 industries saw a decline in economic activity, with the business services sector shrinking by 3.5%. It is worth noting that the country’s economy has been contracting for the second consecutive quarter.

This is primarily driven by high inflation. For example, prices of fruits and vegetables rose by 18.4% over a year, while prices of meat, poultry, and fish added 11.7% with inflation on food products remaining over 12%. According to economists, other reasons include reduced consumer spending and a weakening real estate market.

Monetary policy of the central bank of New Zealand

The Reserve Bank of New Zealand, the country’s central bank, raised the official cash rate to 5.5% in October 2021. This has been the most aggressive tightening of the monetary policy since 1999. The regulator’s aim was to combat inflation, and it succeeded in reducing the rate from the 30-year high of 6.7% to 6%.

BNZ analysts expect inflation to decrease to 1-3%. The central bank is poised to achieve these values by the second half of 2024. On 16 August 2023, the Reserve Bank of New Zealand kept the rate unchanged, stating that it could be reduced in early 2025.

Paul Bloxham, chief economist for HSBC in Australia and New Zealand, noted that economic activity has slowed, and the full impact of the introduced monetary tightening has yet to be reflected in the country’s economy.

Forbes experts also believe that the interest rate differential plays a pivotal role in currency valuation. Therefore, the decision of the New Zealand regulator to halt the rate hike cycle amid continuous increases by other central banks does not have a positive influence on the NZD.

Milk powder prices

According to Stats NZ, the largest export commodities from New Zealand to China in Q2 2023 were milk powder, butter, and cheese with exports totalling 1.8 billion USD. Based on ANZ research, dairy prices in New Zealand decreased by 3.1% in July and 20% year-over-year.

Global milk production is slowing due to high operating costs and falling prices for farmer milk. New Zealand’s largest milk producer, Fonterra, lowered its milk payout forecast for the upcoming season by 12% due to reduced demand in China. Miles Hurrell, chief executive officer of Fonterra, said that China's procurement share remained below average levels.

Wigram Capital principal Rodney Jones stated that China’s economic downturn will have a significant impact on consumer spending and with it a reduced demand for dairy exports that underpin New Zealand’s economy. The main risk is that the price of powdered milk continues to drop. As reported by interest.co.nz, the Reserve Bank of New Zealand shares this concern and warns that China’s economic downturn may affect commodity prices and New Zealand’s overall export earnings.

NZD/USD technical analysis

NZD/USD has been following a strong downtrend. On 2 August, exponential Moving Averages (EMA) crossed each other in support of a bearish trend. The buyers managed to prompt the development of a bullish correction several times, but the quotes failed to gain a foothold above the fast EMA line. Such a price behaviour indicates the strength of the sellers.

At the time of writing, the NZD/USD quotes secured below the lower boundary of the bearish channel. This signals a further price drop by the width of the channel. The target of this movement is the 0.5500 level.

An additional signal indicating a price drop is a rebound from the long-term resistance line on the RSI. This line has been tested several times before the downward breakout on 3 August 2023. On 30 August, the RSI values restored and tested this line from below, thereby confirming its importance.

It is worth noting that the Diamond trend continuation pattern is forming. Typically, a downward breakout of this pattern leads to a decline by the distance of the previous movement. In this case, the starting point of the movement is the 0.6273 mark dated 27 July 2023, and the end point is the 0.5887 mark dated 29 August 2023, with the pattern target at 0.5505.

A positive scenario for the sellers can be cancelled by a breakout of the resistance area with the price gaining a foothold above 0.6065. This movement will indicate increasing pressure from the buyers and a return of the price to the descending channel. In this case, a scenario is possible when the quotes rise further to the upper boundary of the descending channel at 0.6300.

NZD/USD market sentiment and NZD forecasts for 2023-2024

- Citibank analysts expect the NZD/USD exchange rate to drop to 0.59 within the next three months, followed by sideways movement near 0.60. The long-term NZD forecast suggests growth to 0.67 by 2024. Analysts emphasise that New Zealand’s economy is already in a recession, and the tightening of financial conditions will aggravate the situation

- Westpac experts provide forecasts for NZD against USD to reach 0.62 in September 2023 and 0.63 in December 2023, and thereafter rise to 0.66 by the end of 2024. They believe that the remarkably reduced demand for dairy products from China may recover by the end of 2023 and the beginning of 2024, enabling the pair’s quotes to move upwards

- BNZ research suggests that NZD/USD will reach a strong resistance level at 0.64 and break it by the end of 2023

Summary

The NZD/USD currency pair is experiencing a decline in 2023, and at the time of writing, the daily chart is showing a correction near the key resistance level. New Zealand’s central bank has ended the interest rate hike cycle and is ready to consider gradual reductions once inflation reaches the target level.

However, Federal Reserve System representatives have not yet explicitly discussed the lowering of the interest rate, which can exert pressure on the NZD/USD exchange rate in the short term due to the value differentials of the indicator. New Zealand’s weak economic data and subdued demand from China for dairy products could push the pair’s rate down to the 0.59 mark and lower.

Technical analysis of the NZD/USD currency pair also suggests a price decline to 0.5500 while completing the Diamond pattern. However, the situation can change by the end of 2023 if China’s demand recovers, as suggested by forecasts of major banks.