Boeing Stock Analysis: Will the Company Generate Profit in 2023-2024?

7 minutes for reading

The Dubai Airshow 2023 kicked off on 13 November 2023 in Dubai. On the very first day of the event, The Boeing Company (NYSE: BA) secured a 52 billion USD order from Emirates, one of the largest airlines. By the close of trading, the shares of the aircraft manufacturer had risen by 4.01%, reaching 204.54 USD per unit following the positive news. However, it is worth recalling that Boeing has incurred losses since 2019. In 2020, the crisis triggered by the COVID-19 pandemic worsened the company’s financial position.

The Dubai exhibition will likely increase the US aircraft manufacturer’s order portfolio, which might positively impact its revenue. But is investing in the company’s stock worthwhile? Does it have the potential to reach 435 USD, the high recorded on 1 March 2019? In today’s article, we aim to answer these and other important questions and share expert forecasts for The Boeing Company’s stock for 2023 and 2024.

Boeing’s Q3 2023 report

The Boeing Company released its Q3 2023 report on 25 October 2023. Revenue from July to September rose by 13.46% to 18.1 billion USD compared to the same period in 2022. Net loss decreased by 50.48%, down to 1.64 billion USD or 2.70 USD per share.

The company’s profitability ratios for Q3 2023 are not likely to please investors and analysts: the operating margin was −1.93%, and the profit margin reached −3.74%. Expenses amounted to 18.7 billion USD, exceeding revenue by 687 million USD. The company must borrow funds to support its operations.

When and why did Boeing become loss-making?

The Boeing Company reported a negative annual profit in Q4 2019 and has been unable to return to positive territory since then. The financial challenges began after the crash of a 737 MAX 8 on 10 March 2019, leading to the ensuing ban on the 737 MAX aircraft in numerous countries. Subsequently, a crisis emerged due to the COVID-19 pandemic, pushing many air travel and aircraft industry representatives to the brink of collapse.

The Boeing Company had to borrow funds, thereby increasing the debt burden. In Q1 2019, its long-term debt stood at 11.3 billion USD; by Q4 2020, it reached the highest value of 61.9 billion USD. In Q2 2019, all debt obligations exceeded the company’s total assets, and the situation has not improved.

As for The Boeing Company’s stock, it headed down on 13 February 2020, losing nearly 75% by 18 March 2020 and dropping to a low of 89 USD.

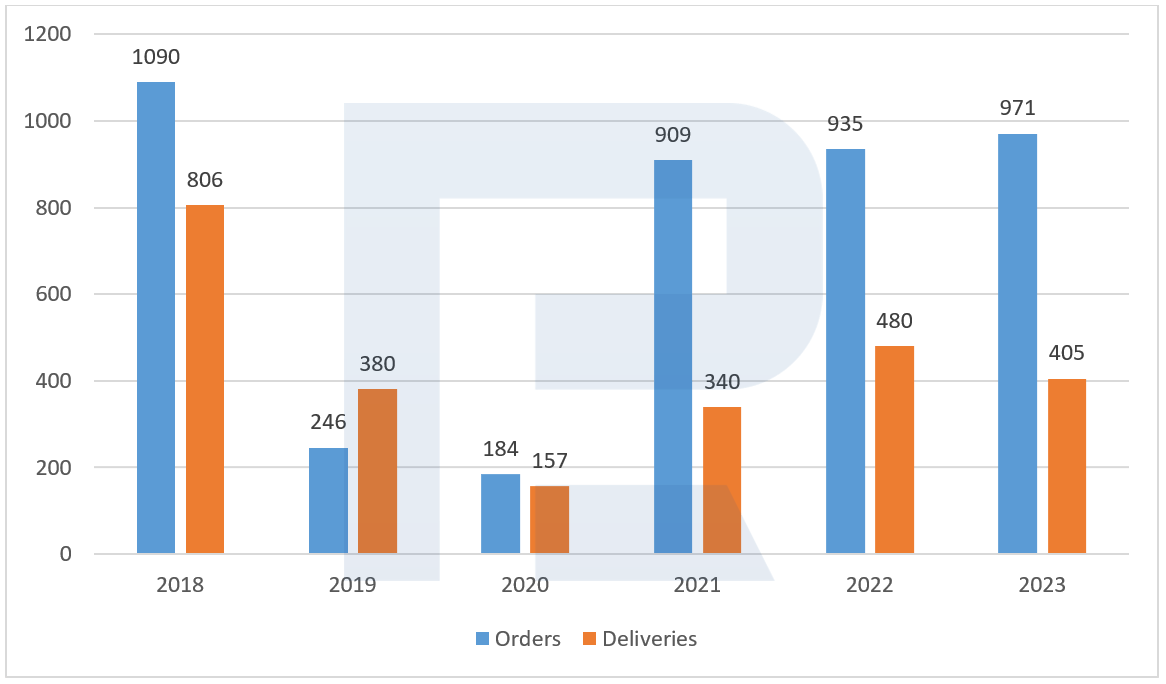

Dynamics of Boeing order volumes

To better understand the scale of challenges The Boeing Company has faced over the past few years, we will examine the statistics on airliner order volumes and deliveries from January 2018 to October 2023 inclusive.

In 2018, there were 1,090 orders for airliners, but the actual deliveries amounted to 806 units.

In 2019, the number of orders decreased to 246 aircraft, while deliveries surpassed the order figures, thanks to a large order in 2018, reaching 380 units.

In 2020, with the announcement of the COVID-19 pandemic, the number of orders decreased to 184 aircraft, and deliveries dropped to 157. In 2021, the situation changed dramatically, with orders reaching 909 units and deliveries standing at 340. The positive trend persisted in 2022, with 935 units ordered and 480 units delivered.

From January to October 2023 inclusive, 971 airliners were ordered. It is worth noting that this number does not cover orders received at the Dubai Airshow in November. Deliveries for this period reached 405 airliners.

New manufacturing defects in the Boeing 737 MAX may negatively impact financial statistics for Q4 2023. According to CNBC, these product quality issues have already hurt Q3 2023 deliveries and might adversely affect Q4 results.

Boeing received a 52 billion USD order from Emirates

The Dubai Airshow, one of the world’s largest aerospace exhibitions, took place in Dubai from 13 to 17 November 2023. On the inaugural day, Boeing secured six deals with airlines to deliver 269 planes.

The most significant order that day came from Emirates for 35 units of Boeing 777-8, 55 units of Boeing 777-9, and 35 units of Boeing 787. The total value of the order reached 52 billion USD, marking the largest deal in the commercial segment based on the number of planes ordered by one airline at the airshow. On the second day of the Dubai Airshow, the company received orders for another 36 units.

Who is Boeing’s main competitor?

Boeing’s major competitor is Airbus Group SE, a European multinational corporation that designs, manufactures, and sells civil and military aviation products worldwide.

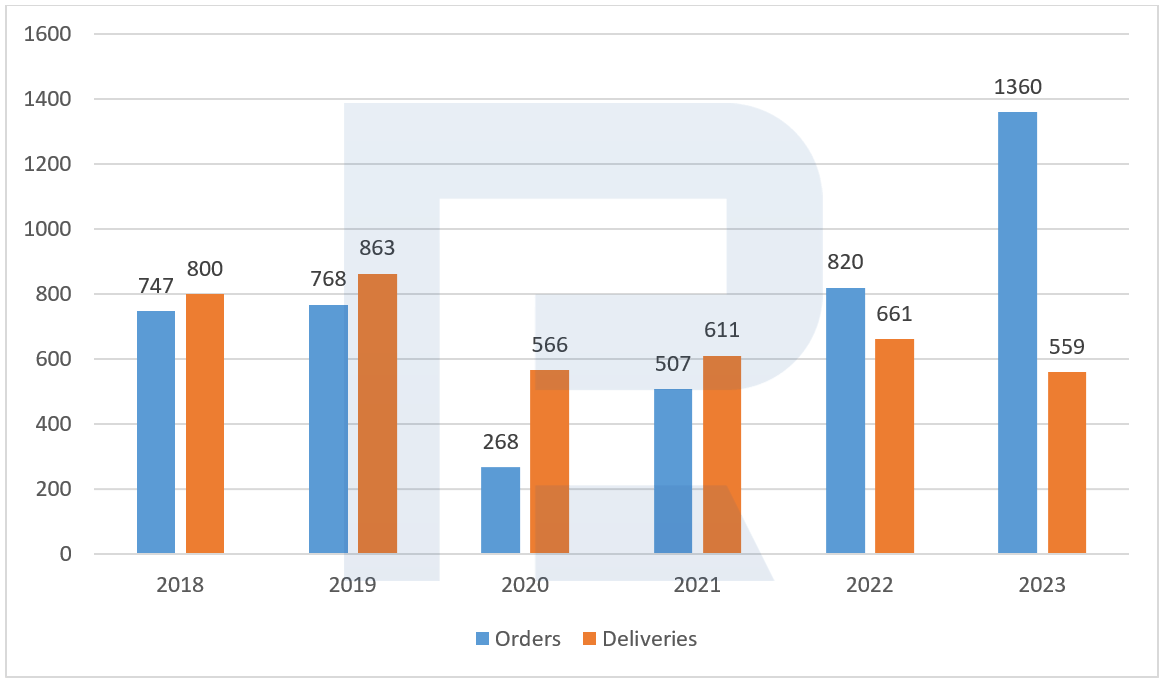

Below, we have provided an infographic of Airbus Group SE orders and deliveries from January 2018 to October 2023 inclusive.

Unlike The Boeing Company, which has a significant backlog of deliveries compared to orders, Airbus Group SE has seen deliveries exceeding orders from 2018 to 2022. The reason is the accumulation of old orders.

While these two aircraft industry representatives had their deliveries at nearly the same level until 2019, The Boeing Company began to lag behind in 2019 and still has not caught up with its competitor. Nevertheless, Airbus Group SE received orders for only 66 planes at the Dubai Airshow, considerably less than the US company.

Expert forecasts for Boeing stock for 2023-2024

- According to Barchart, on 20 November 2023, 13 out of 16 analysts rated The Boeing Company’s stock as Strong Buy, while three analysts rated it as Hold, with none giving a Strong Sell recommendation

- Based on Business Insider data, Goldman Sachs analysts recommend buying these shares and have set the price target at 258 USD. In their opinion, deliveries of new airplanes will increase by the end of 2023 and continue rising in 2024, with China potentially generating additional demand for airplanes

- According to Investing, Bank of America’s analysts cut the price target for the plane maker’s stock from 300 to 250 USD but maintained a Buy rating

- As Investing reports, Citigroup experts also reiterated a Buy rating for The Boeing Company’s stock with a price target of 271 USD

Boeing stock analysis

Since 30 March 2020, Boeing’s stock has been trading within the 120-240 USD range. When the price drops to 120 USD, investors actively buy these shares as they believe this price level is acceptable for investing in the company.

When the quotes approach 240 USD, the stock sees an increase in sales. With the aircraft maker’s debts exceeding its assets, investors believe that 240 USD is the maximum price for its shares.

If quotes break the resistance level of 240 USD and head towards the next resistance level of 300 USD, only then will investors believe that the aviation giant’s financial position is starting to improve. At the time of writing, The Boeing Company’s shares are trading close to the upper boundary of the range, thanks to the orders received at the Dubai event.

Technical analysis of Boeing Company*

Conclusion

New orders at the Dubai Airshow will likely create favourable conditions for increasing Boeing’s revenue. But whether the company will register a profit will depend on optimising business processes and completing defence orders, as they account for most losses.

Before the COVID-19 pandemic, the company signed fixed-price contracts with the Department of Defense and NASA to produce fighter aircraft and satellites. When the budgets of these programmes exceeded the amounts specified in the contracts after the coronavirus crisis, the costs fell on the plane manufacturer.

These contracts expire in 2025-2026, and it is during this period that Boeing’s management aims to achieve profitability. In addition, a potential and desirable improvement in relations between the US and China may also positively affect the plane maker’s order portfolio.

* – The charts within this article are sourced from the TradingView platform, known for its wide array of tools for financial market analysis. As a convenient and high-tech online market data charting service, TradingView empowers users to conduct technical analysis, research financial data, and engage with other traders and investors. Additionally, it provides valuable guidance on how to read forex economic calendar effectively, along with insights into other financial assets.