Li Auto's Hybrid Car Strategy Boosts Its Shares to Near-Record Highs: In-Depth Stock Analysis

10 minutes for reading

The stock of Chinese hybrid car and electric vehicle manufacturer Li Auto Inc. (NYSE: LI) reached an all-time high of 47 USD in August 2023. At the time of writing on 4 December 2023, the shares were trading 31% below this mark, at 36 USD.

What distinguishes Li Auto Inc., and why do investors prefer to buy shares in this sector representative? We aim to answer these questions, examine the corporation's financial reports, and share experts' forecasts for its stocks in 2024.

Shift in the automotive industry: reduced focus on pure electric vehicles

Automakers are gradually scaling back investments in their electric vehicle production, probably due to concerns about a potential decline in demand. For example, on 26 October 2023, Ford Motor Company (NYSE: F) announced a suspension of 12 billion USD in investments in electric vehicles and a halt in constructing a battery factory.

According to Reuters, General Motors Company (NYSE: GM) and Honda Motor Company Ltd (NYSE: HMC) have abandoned plans to produce budget electric vehicles. As Bloomberg reports, Volkswagen Group (XETRA: VOWG) is abandoning plans to build an electric vehicle production plant. It is worth noting that the budget for this project was 2 billion EUR.

Developing and mass-producing this type of transportation incurs substantial expenses, leading to a high final vehicle cost that may not be affordable for the average consumer. At the same time, with environmental care still trending, there is an alternative for buyers seeking an environmentally friendly car but unable to afford an expensive electric vehicle – hybrid cars. These are equipped with an internal combustion engine and an electric motor powered by a battery. They also feature a unique system that harnesses the energy generated during braking to charge the battery.

The main types of hybrid cars include FHEV (Full Hybrid Electric Vehicle) and PHEV (Plug-in Hybrid Electric Vehicle). The FHEV charges the battery using energy released while the vehicle is in motion and during braking (note that an external power source cannot charge these batteries). The PHEB boasts larger batteries, which an external power source can charge, and a longer driving distance per one battery charge.

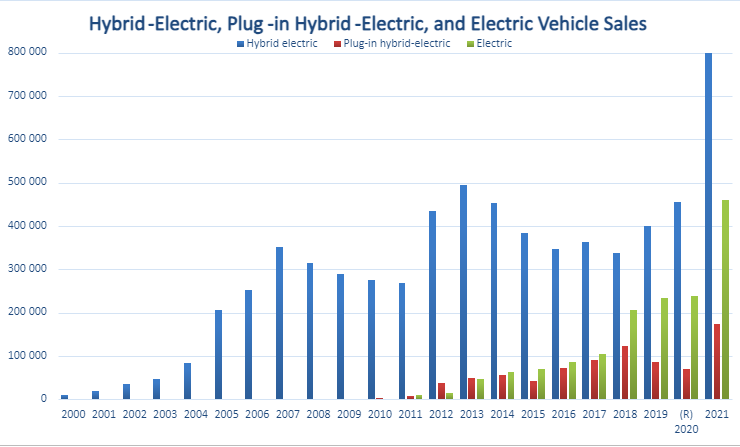

According to the Bureau of Transportation Statistics and the US Energy Information Administration, sales of full-hybrid electric vehicles outperform the electric vehicle statistics in the US and globally.

Li Auto’s automotive portfolio

Li Auto Inc. is a Chinese company specialising in electric and hybrid car production. It was founded in 2015, with its headquarters in Beijing.

The automaker’s website currently presents information on hybrid Li L7, Li L8, Li L9, and electric Li Mega. The first three models display an SUV body type, while the latter features an MPV body type.

Li Mega is the first electric vehicle in Li Auto’s line-up. A seven-seater minivan was unveiled at the Family Tech Day on 17 June 2023. A Qilin battery by CATL enables it to cover 500 km per 12 minutes of charge, with a driving range of 700 km. Additionally, the model is equipped with the Lixiang Tongxue voice assistant based on the Mind GPT artificial intelligence.

Li Auto versus competitors: market position and profitability

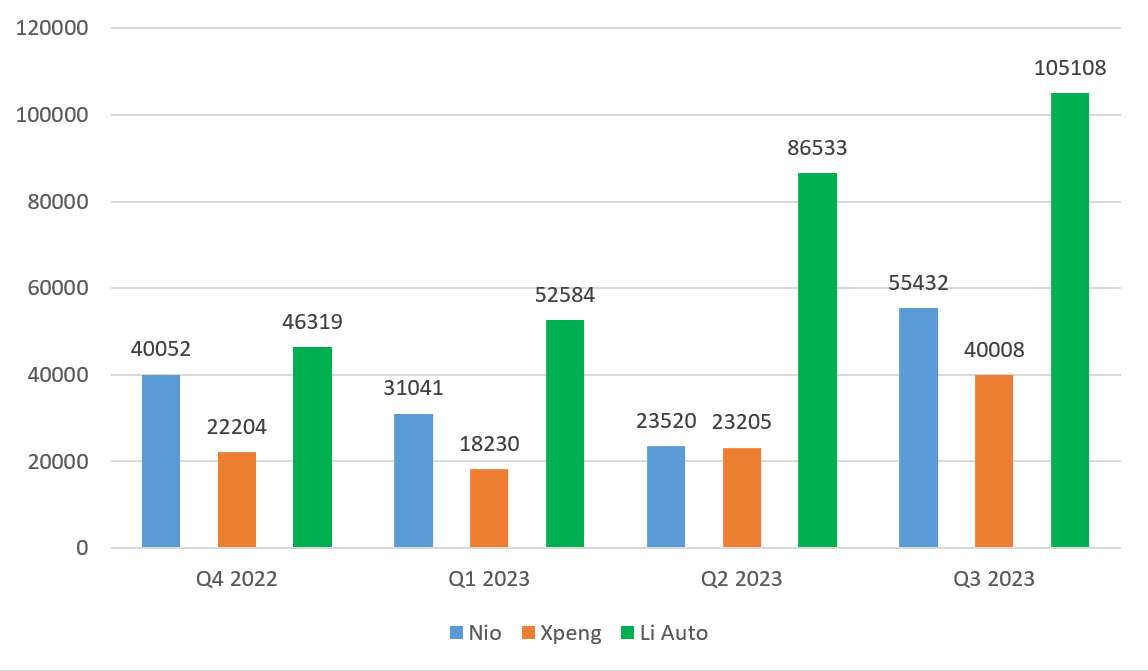

From January to September 2023, Xpeng Inc., NIO Inc., and Li Auto Inc. sold 126,067, 81,443, and 244,225 cars, respectively. The chart depicts the distribution of sales by quarter.

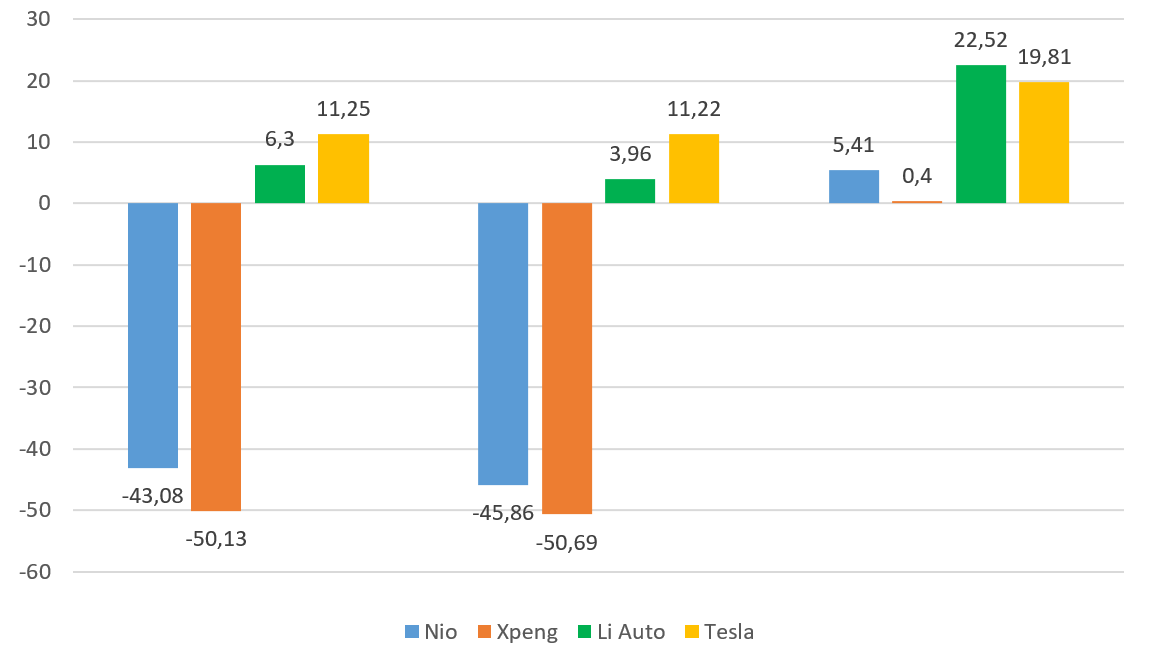

Looking at the margins of these companies and Tesla Inc. from Q3 2022 to Q3 2023 inclusive, it is important to note that:

- The gross margin shows the share of revenue after covering production costs

- The operating margin is the income generated from the company's primary operations, excluding interest on loans and taxes

- The profit margin shows the proportion of income retained as net profit after considering all costs

The chart shows that Li Auto Inc. and Tesla Inc. achieved positive business profitability. However, the US automaker boasts a higher profit margin, further allowing flexibility in reducing its electric vehicle prices. Additionally, it should be noted that the Chinese brand has an advantage in the driving range of its cars.

Stock market response: competitors vs. Li Auto

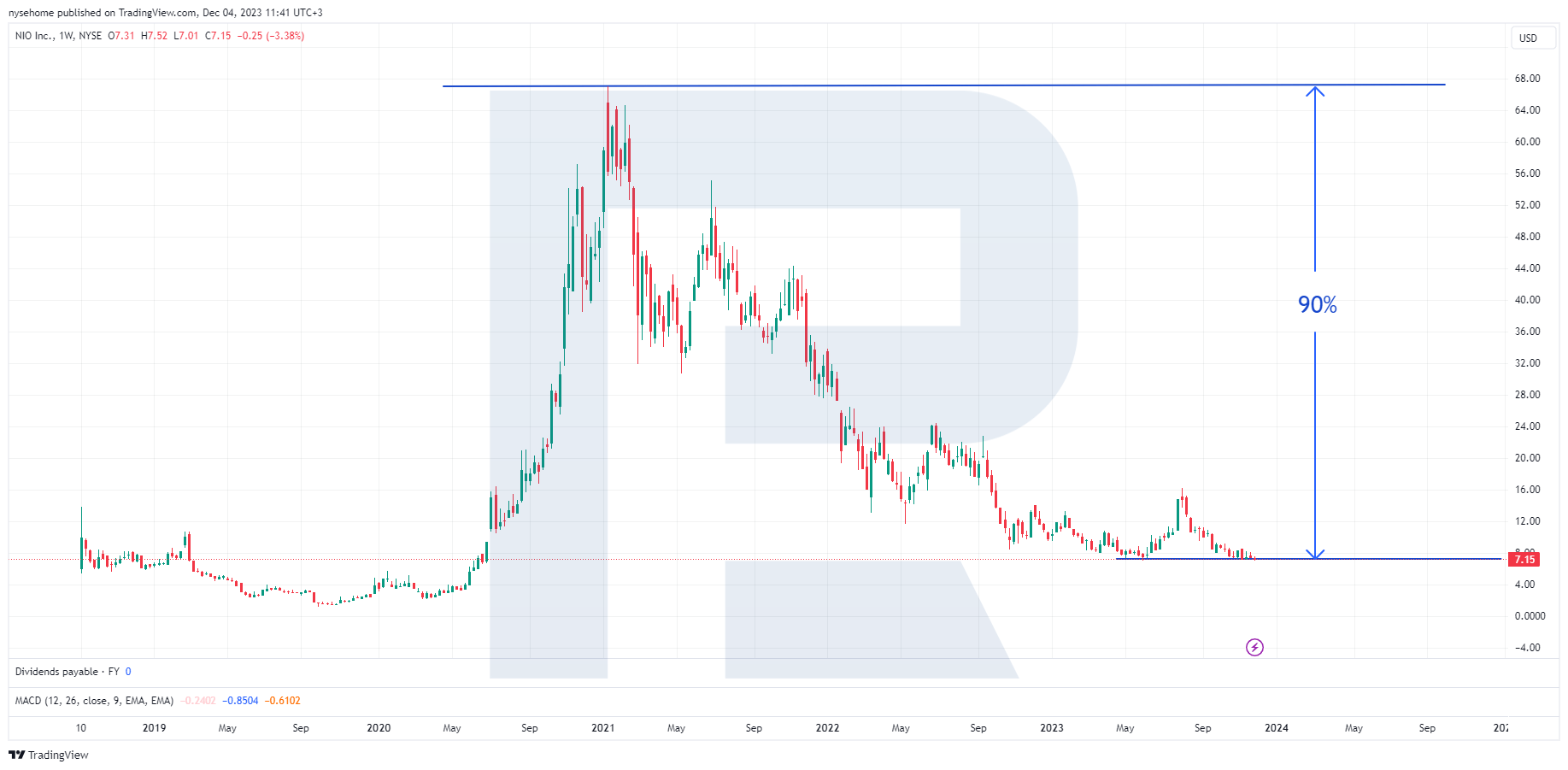

In 2020, NIO Inc., Li Auto Inc., and Xpeng Inc. stocks reached record values of 67, 48, and 74 USD, respectively. Tesla Inc.’s shares surged simultaneously, hitting their high of 415 USD on 4 November 2021. Subsequently, Chinese automakers' shares underwent a correction, with NIO Inc. stock losing more than others and dropping 90% from the maximum value at the time of writing. The quotes continue to drop, indicating this asset's lack of investor interest.

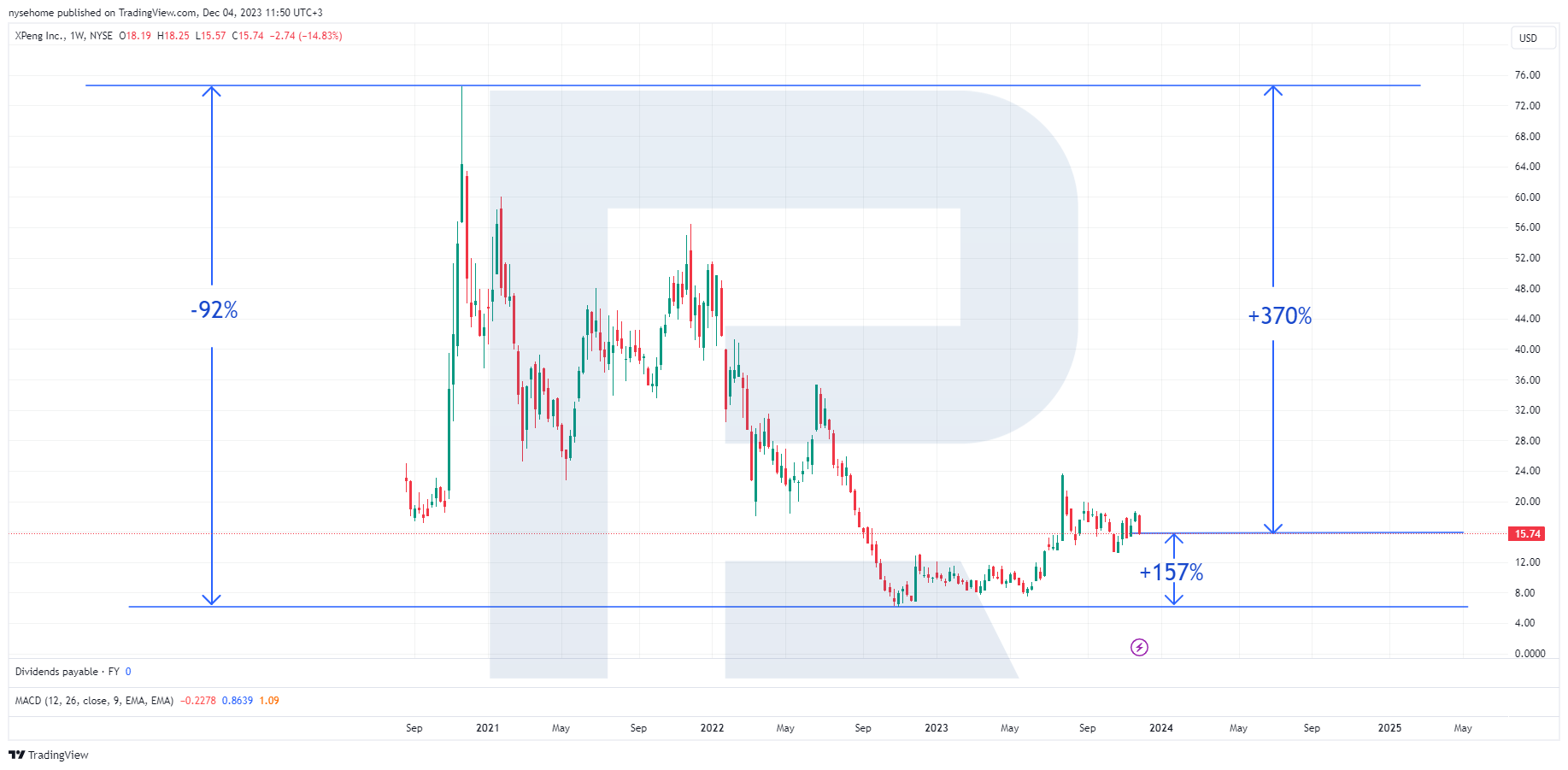

On 31 October 2022, Xpeng Inc. stock hit a low of 6 USD, marking a 92% decline from the maximum price. However, the shares have soared 157% by 4 December 2023. Their value would need to surge by another 370% to achieve a new high.

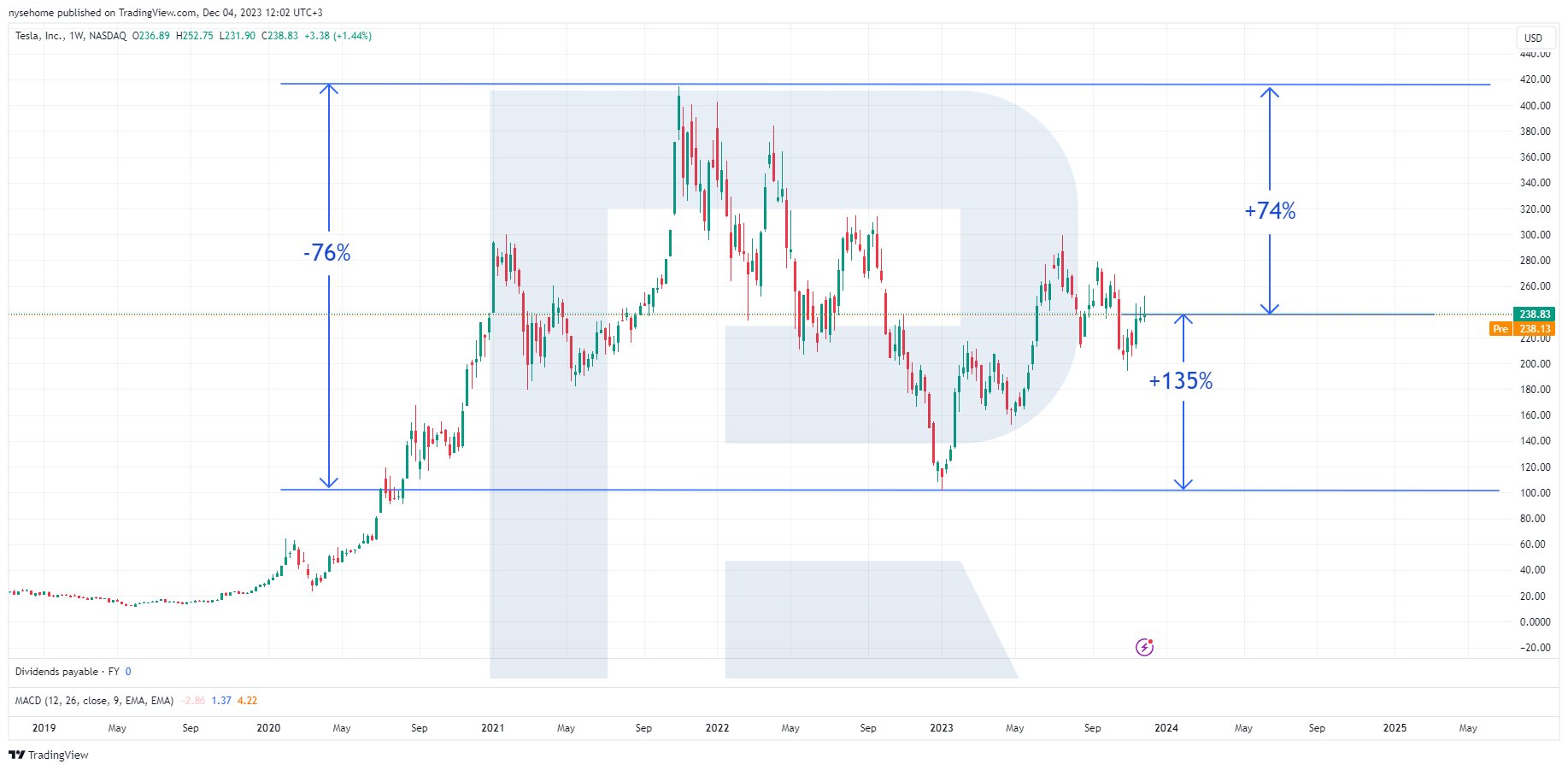

Tesla Inc. shares reached their lowest value of 102 USD on 3 January 2023, marking a 76% price decline from the record level. At the time of writing, the quotes have surged by 137% and need to gain another 74% to reach an all-time high.

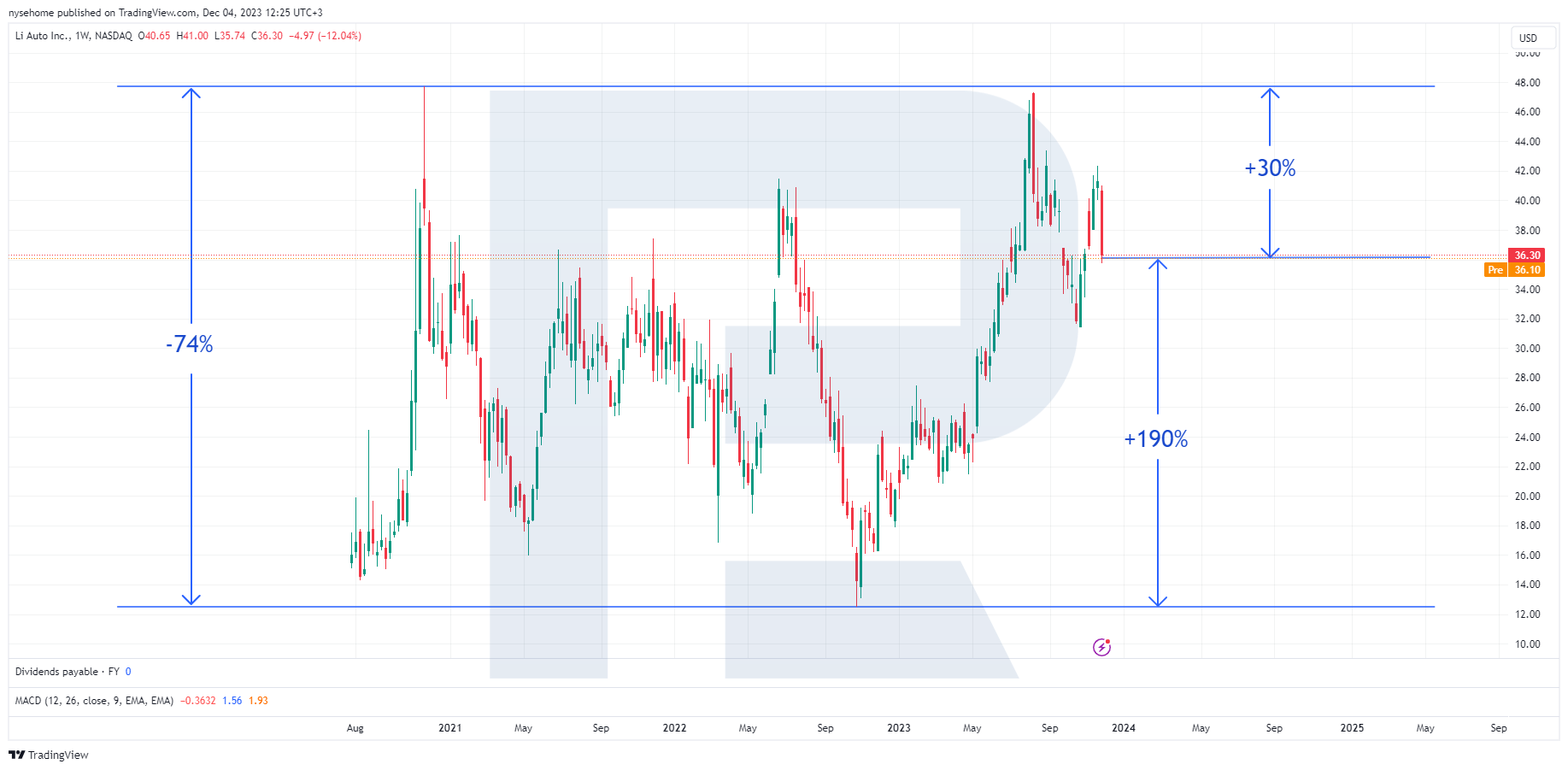

Li Auto Inc. shares hit a low of 12.50 USD on 24 October 2022, tumbling 74% from their peak value. By 7 August 2023, the stock had skyrocketed 278%, with less than 1 USD remaining to reach the all-time high. However, on 8 August, following the release of a robust quarterly report, investors seemed eager to lock in profits, resulting in a downturn in the stock. As at 4 December, the shares were trading 30% below their all-time high, presenting the most favourable outcome compared to the above companies' performance.

Li Auto’s financial health and sales performance

Li Auto Inc. released its Q3 2023 report on 9 November. Revenue surged by 271.2% compared to the statistics for the corresponding period in 2022, reaching 4.75 billion USD. Net profit amounted to 385.5 million USD or 0.46 USD per share, while a year ago, the company posted a loss of 232.7 million USD or 0.18 USD per share. Total deliveries increased by 296.3%, up to 105,108 cars.

Li Auto Inc. has reported a net profit for the fourth consecutive quarter. With a long-term debt ratio of 0.08, significantly below 1, it can be considered an outstanding result.

In September 2023, MSCI ESG Research raised Li Auto Inc.’s ESG rating from AA to AAA, signifying the company's adherence to sustainable development principles in environmental, social, and management areas. As stated in the management's report, the corporation became the first Chinese automaker to achieve 500,000 deliveries of vehicles powered by alternative energy sources. Each Li L-series model has surpassed 10,000 monthly deliveries for three consecutive months.

In-depth analysis of Li Auto stock

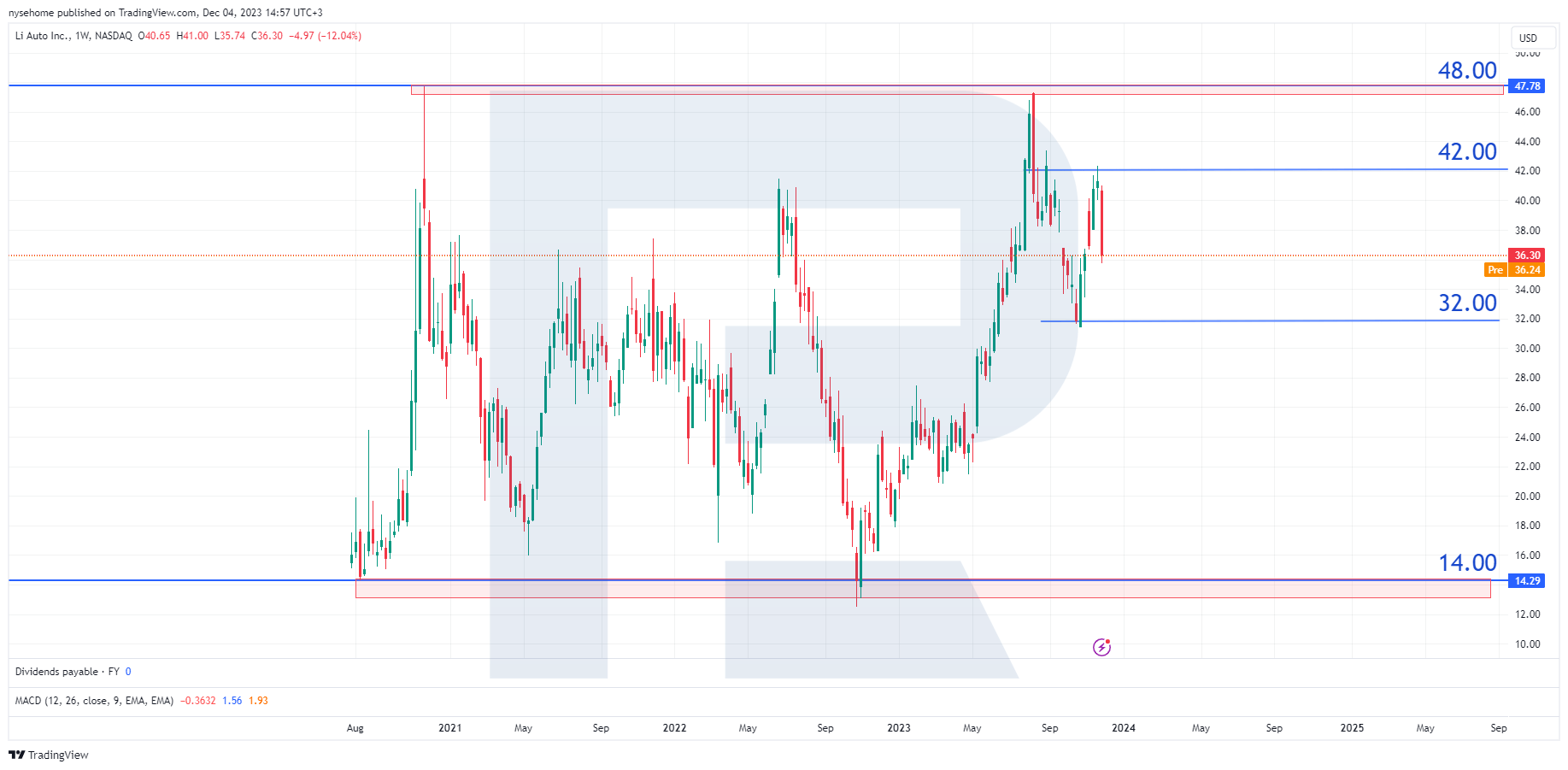

On a weekly timeframe, Li Auto Inc. stock has been trading within the 14-48 USD range since its IPO. In August 2023, the quotes tested the upper range boundary and, failing to breach it, underwent a correction to 31 USD. In October 2023, bulls made another attempt to test the resistance level of 48 USD, but the quotes could only rise to 42 USD. Following this, they headed downwards again and were hovering at 36 USD at the time of writing. The stock has an additional obstacle on its way to an all-time high – the resistance level of 42 USD.

On a daily timeframe, Li Auto Inc. shares continue to trade within an ascending trend, correcting to the trendline at the time of writing. A 32.00 USD mark and a trendline of 34 USD serve as support levels for the price. As the quotes move towards these values, investor demand may recover, potentially driving the price to the first resistance level of 42 USD. If the quotes break it, they may reach an all-time high of 48 USD.

In a negative scenario, the Chinese corporation’s shares could likely breach the support level of 32 USD, with the stock possibly declining to 27 USD per unit.

Expert predictions for Li Auto’s stock and industry outlook

- According to Barchart, four out of five analysts rated Li Auto Inc.’s stock as Strong Buy, and one expert gave it a Moderate Buy rating. The average price target reached 53.47 USD per unit

- Based on the MarketBeat information, four out of four analysts rated the automaker’s stock as Buy with a price target of 78.72 USD

- According to TipRanks, four of four analysts assigned a Strong Buy rating to Li Auto Inc.’s stock. The average 12-month price forecast is 53.75 USD per share, with the highest price of 62 USD and the lowest of 50 USD

- As Stock Analysis informs, the average 12-month price forecast for the automaker’s shares is 43.79 USD with a Strong Buy rating

- Simply Wall St predicts that Li Auto Inc.’s earnings and revenue will increase by 34.8% and 29.5% per annum, respectively. EPS is expected to increase by 27.4% per annum, and return on equity is forecast to be 20.6% in three years. According to the site analysts, a fair stock value is 57.67 USD

Based on a report by Mordor Intelligence, the hybrid vehicle market was valued at 231.77 billion USD in 2023, with the potential to reach 478.33 billion USD by 2028 at a compound annual growth rate of 12.83%. According to the International Energy Agency (IEA), global sales of environmentally friendly cars will increase by 35% in 2023, exceeding 40 million units.

Li Auto’s future plans and potential growth areas

- Expanding the line-up to 11 models by 2025

- Creating and launching a proprietary autonomous driving system Li AD Max 3.0

- Building over 300 fast charging stations along highways by the end of 2023 and over 3,000 stations by 2025

- Investing in research and development, marketing, and business scaling to create innovative technology, enhance product quality, and increase brand recognition and customer loyalty

- Entering foreign markets

- Planning to launch an electric vehicle priced at 29,700 USD this year, which may positively affect the number of the company’s clients

Conclusion

Li Auto Inc. seems to choose a more cautious business model, starting its operations with hybrid car development and production. The company embarked on the production of electric vehicles only after it began to generate net profit. Furthermore, it created favourable conditions for selling electric vehicles, which are more expensive than hybrid cars, by capturing a market share and making its brand recognisable.

Given the provided information, it may be concluded that Li Auto Inc. has stable financial position, with the company’s stock being popular among investors and car sales increasing every quarter. It may follow from analysts’ forecasts that the corporation’s shares might be an attractive option for long-term investments as experts expect their further growth.

* – The charts featured in this article originate from the TradingView platform, renowned for its extensive set of tools designed for financial market analysis. Functioning as a user-friendly and advanced online market data charting service, TradingView allows users to perform technical analysis, explore financial data, and connect with fellow traders and investors. Furthermore, it offers valuable guidance on effectively understanding how to read forex economic calendar, in addition to providing insights into various other financial assets.