Spread

Spread is the difference between the buy and sell prices of a particular asset at a particular point in time.

3 minutes for reading

Spread definition and meaning

Spread is the difference between the Ask and Bid price for stocks, bonds, currencies, and other financial assets over a certain time period. It is a unique indicator showing the demand and supply ratio for a particular asset. It is measured in points.

How to calculate the spread

Spread = Ask - Bid

- Ask is the price of a financial instrument at which there are current bids to sell it

- Bid is the price of a financial instrument at which there are current bids to buy it

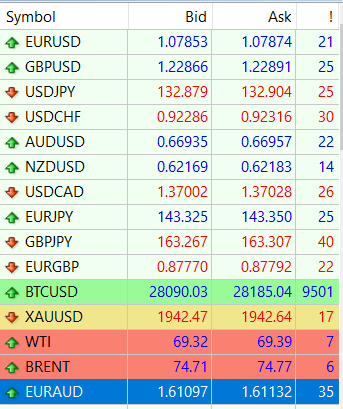

Let's take the most popular currency pair in terms of volume in international trading as an example – EUR/USD. At the time of writing, the Bid was 1.07853 and the Ask was 1.07874.

1.07874 - 1.07853 = 0,00021

Types of spreads

- Fixed spread – does not change during the trading session, does not depend on market conditions, and is always known in advance

- Variable (floating) spread – varies according to supply and demand in the market

What affects the spread?

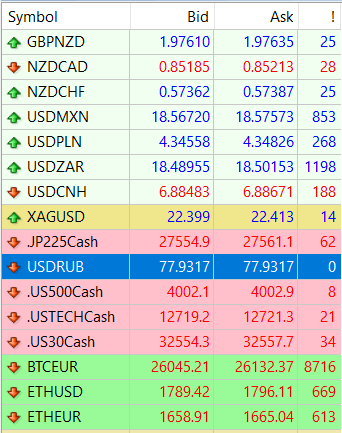

- Market liquidity. This term refers to how quickly and easily an asset can be converted into cash at a price close to the market price. The higher the liquidity of an asset, the lower the spread

- The type of currency pair. They are divided into major, cross-currency, and exotic pairs. Major currency pairs are those that are the most actively traded on the Forex market. In most cases, they are the ones with the tightest spreads because of their high level of liquidity and popularity among traders

- Time of day. Minimum spreads are seen during times of maximum market activity: during hours when trading sessions of exchanges from different regions coincide. For example, the EUR/USD spread may be minimal between 13:00 and 17:00 GMT, when the European and US exchanges are active

- Volatility. High levels of volatility in the market can trigger an increase in spreads as brokers and dealers try to reduce their risk

- Economic data. GDP, inflation, and employment data, as well as other important economic indicators, which were more positive than analysts expected, will create the conditions for a possible narrowing of the spread

- Geopolitical events. News of this nature could cause unexpected movements in the market and consequently change the spread

- The trade size. The larger the trade, the smaller the spread