Alibaba Shares Falling after Quarterly Report; Fines Pour Oil to Fire

4 minutes for reading

For the second time in a row, the quarterly report of Alibaba Group turned out inferior to the expectations of Wall Street analysts. Growth of quarterly revenue cannot save the corporation from the falling of shares.

The situation got worse when people heard that Alibaba, alongside JD.com and Baidu, was to pay a fine to the Chinese authorities for violating the antimonopoly law. See more details of what’s happened below.

Alibaba Group report for Q2, financial 2022: net profit drops by 87%

On November 18th, before the trading session in NYSE started, Alibaba Group published its financial report for July-September 2021. As I’ve mentioned above, the corporation demonstrated weaker results than the market had expected.

In Q2, financial 2022, the number of active users of all products of the IT giant, grew by 62 million people to 1.238 billion. 953 million out of them are users from China and 285 million people are from outside the country.

Important report details

- Revenue - $31.147 billion, +29%, forecast - $32.05 billion.

- Return on stock - $1.74, -38%, forecast - $1.93.

- Net profit - $0.52 billion, -87%.

Revenue of Alibaba Group department-wise

In the report, the Chinese company singles out such main spheres of business as commerce, cloud computations, digital media and entertainment, and innovations. In July-September, the marketplace brought the company $26.6 billion of revenue, which is 31% more than in the same period of 2020.

Revenue from the cloud storage increased by 33%, reaching $3.1 billion. Revenue from digital media and entertainment amounted to $1.3 billion, demonstrating growth by only 0.2%. As for innovations, they generated 37% more of revenue, reaching $223 million.

How Alibaba Group shares reacted

The share price of Alibaba Group (NYSE: BABA) started falling a day before the quarterly report was published: on November 17th, the quotations dropped by 4.07% to $161.58. When trades closed, the quotations had already dropped by 11.3% to $143.6. During the next trading session, the quotations went on falling, this time by 2.27% to $140.34. Note that the shares have already lost almost 40% of the price since the beginning of the year.

Chinese authorities fine Alibaba for violating the antimonopoly law

The main market regulator of China stated that Alibaba, Baidu, and JD.com had violated the law and were to pay a fine. The reason is as follows: the tech companies didn’t report 43 business agreements signed 2012 through 2021.

The regulator states that Alibaba didn’t declare the purchase of the cartographic and navigation company AutoNavi in 2014. Also, the company didn’t report buying 44% of shares of the Ele.me food delivery online service. This happened in 2018. Now the corporation had to pay $78,000 of fine.

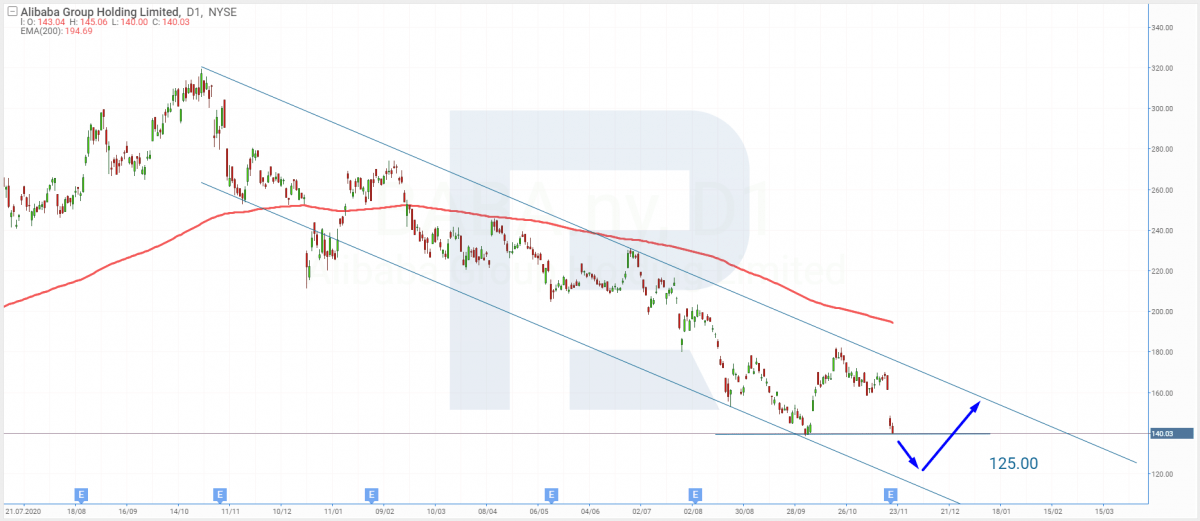

Tech analysis of Alibaba Group shares by Maksim Artyomov

After the financial report that was inferior to all expectations and the fines, the shares of the company are falling. On D1, the quotations reached the support level of $140. It is quite likely that upon testing this level, the quotations will break through it and go on falling.

One more signal, supporting the decline, will be the 200-days Moving Average: it is also declining. The aim of the decline can be the lower border of the channel at $125.

Summing up

Last week, the Chinese IT giant Alibaba Group reported its financial performance for Q2, financial 2022. Revenue grew by 29% while profit shrank by 87%. The main reasons for the decline are falling of consumer expenses in China, growing rivalry, and changes in the antimonopoly laws, experts say.

As for the latter thing, previously the trading platform made sellers sign an agreement forbidding their activities on other platforms. However, now sellers can spread their goods via all websites in China.

With these statistics, the company had to revise its forecast for the current financial year and decreased the growth of estimated income from 29.5% to 20-23%.

The weak report and poor forecast affected the share price of the company. Last Thursday, the shares in NYSE headed down and lost over 11%. And on Saturday, the Chinese market regulator fined the tech company for violating the antimonopoly law.