Buffett Increasing His Delta Airlines Share

6 minutes for reading

Previously, Warren Buffett was against investing into air companies, but lately, his opinion has changed. It's even more than that: the fund he manages, Berkshire Hathaway, is currently owning stocks of a few airline companies.

Air cargo market increasing

Around 10 or 15 years ago buying goods from Chinese online stores was very risky, as both payment and shipping methods were imperfect, and there was virtually no payback guarantee. Now that this is considered quite alright, the earnings in global online stores, such as Amazon (NASD: AMZN) and Alibaba (NYSE: BABA), rose drastically, thus, in its turn, increasing the air cargo market.

Passenger traffic increasing

Passenger traffic has increased a lot, too. People often go abroad by plane both on vacation and on business, this has become a part of nearly everyone's everyday life. The air companies surveys reveal a curious fact: the passenger shipping volumes are going to double in the next 20 years, with such touristic countries as Turkey and Thailand being top destinations. The APAC is also leading because of the actively growing business, with China already having more flights than the US.

The world is overall changing, largely because of the internet. An average air passenger is 32 years old. In Early 2000s, this could barely mean anything, as not everyone even had a landline phone. Most people did not leave their home country, sometimes the governments even prevented them from leaving. For many, the worldwide web was something strange and dangerous, to say nothing of buying anything in a country that lies a few thousands of miles away.

This 32-year-old average air passenger now usually has constant internet access, which adds much more mobility. With the web, the borders are nothing, people can easy communicate with the most remote corners of the world, use traveling services, book flights, hotels and apartments. A big problem for tourists was taking a lot of cash with them, which now is not a problem at all.

While the offshore countries are attracting businesses and investments, airplane tickets got very much cheaper overall, sometimes being as low as EUR 20.

Many governments remove visa requirements for some countries, which also increases the number of flights, especially if the distance between the destinations is large.

As such, the doubling number of air passenger traffic is not for nothing: it is well backed by the generation that is already very much used to the web. For modern people, traveling a few thousand of miles away is comparable to reaching the local store. Those people start talking about traveling while still being schoolchildren, so the rising number of passengers in the next 20 years is quite logical.

Warren Buffett interests in Airline Companies

When Buffett said he did not believe in the airline industry 20 years ago, he was quite right; the stocks would not rise then, and in fact, they started rising only after the 2008 crisis. It was not until Q3 2016 when the investor started buying Delta Airlines. He picked them at $38 and then continued the next quarter, already at $46. By late 2016, Berkshire Hathaway had 65,535,000 Delta shares. Later, Buffet picked another batch of 5,368,956 shares at $49. Currently, Berkshire Hathaway owns 8.19% of Delta Air Lines shares, also having American Airlines (NASDQ: AAL), Southwest Airlines (NYSE: LUV), and United Continental Holdings (NASDQ: UAL) in their portfolio, which totals $183B.

About Delta Airlines

Delta Airlines (NYSE: DAL) is one of the largest US air companies. Founded in 1924, it is headquartered in Atlanta, GA. The company owns 893 airplanes, all used for passenger shipping. Thankfully, Delta has never used Boeing 737 MAX 8, which is now under temporary ban after the accident in Ethiopia, which means the number of flights is not going to be reduced.

Apart from selling its shares to the Buffett's fund, Delta is also buying them out itself. In 2019, the company has so far bought shares on $1.30B. Delta is reporting its Q1 earnings in April, and the EPS is surely to grow after this buyout.

Sometimes, people tend not to understand why that happens, while in fact it's all very simple: with fewer shares in the market, the EPS is bound to rise. This makes it necessary to track the earnings, too, to understand the real health of the company.

The companies buy out their shares to gain investors' loyalty, too, as this way they show that the company is doing well in the market.

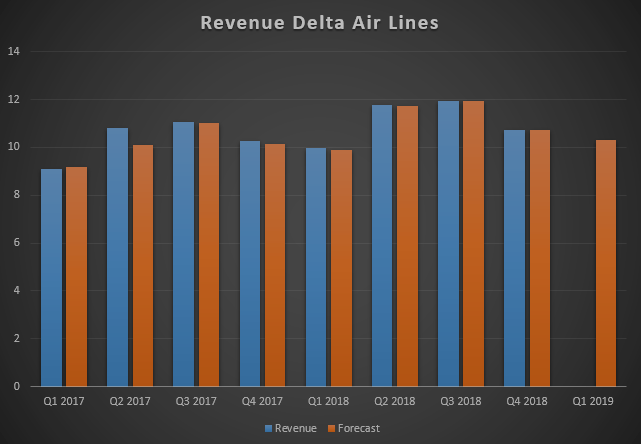

Delta Air Lines revenues

Delta's earnings are subject to seasonal factors, but, overall, the trend is positive. The P/E is at 7.86, a bit lower than the industry average of 9.37, while the dividend yield is 2.73% against 1.74%, and the short float is just 3%. Since 2016, the uptrend on W1 started slowing down, but the price is still above the 200-day SMA, which also acts as a support.

Delta Air Lines stocks tech analysis

On D1, however, the stock is getting weaker and may soon sink to $46.

The markets are getting worried prior to possible major indices fall. Some are expecting a crisis: the last one happened 10 years ago, and overall, they happened each 10 years over the last 30. Besides, the US will be electing a president in 2020, and nobody knows what that may trigger. This is why some long term traders may start locking in profits, while the indices are at their highs. The stock market was very volatile over 2018, which may be the first reversal signal.

In this light, Delta stock may reach $46 and head even lower. With such long terms strategies as those of Buffett, buying it right away is a good idea. If your goal is booking profits in the next three or four years, you'd better wait till the price is firmly between $40 and $60.

Conclusion

The travel market is growing at a double pace compared to the GDP, and the number of passenger flights is bound to rise day by day. Delta Air Lines operates in Asia, Africa, Middle East, Americas, Europe, and Australia, which makes it the only US air company connecting all continents, except the Antarctic.

Wherever the air traffic activity surges, Delta Airlines will be here. The overall market situation, however, may send the stock price lower, irrespective of the company's financial data. So, whether buying the shares and expect profits in two or three years is a good idea, is questionable. Waiting for a larger price might be a much better one.