McDonald's: Dividends in Focus

4 minutes for reading

Many people don't understand how one could just go and eat at McDonald's every day, be it in the US or Europe. Everyone understand this is unhealthy and not appropriate for anyone who is on a diet. This may, yet, be explained with a very simple thing: McDonald's values the customer's time, i.e. you just get in, have your lunch quickly, and continue doing your business. With the advance of the web and mobile networks, many issues are resolved on the spot and take much less time, which means wasting time on making an order at a local restaurant and then waiting for that order is totally nonsense.

McDonald’s phenomenon

At McDonald's, however, you've got many cashiers to choose from, and waiting for your meal is usually a matter of minutes, if not seconds. The customers also can see that all staff are doing their job without taking frequent breaks: everything is all for customer satisfaction achieved as soon as possible. Instead of cashier desks, however, the customers nowadays have also machines for making orders, which accept payments, too.

So indeed, if the order processing time has been a matter of minutes before, it's becoming a matter of seconds. The company, however, has gone even beyond that. When a customer walks in and does not know what to order, that increases the processing time drastically. With an app suggesting them a good meal option for the certain time of a day, however, the things are going to get much better. This might sound unreal a few decades ago, but now machines are sometimes much faster than people. This is why McDonald’s bought Dynamic Yield at $300M, becoming the largest company's deal for over the latest 20 years.

Dynamic Yield startup

Dynamic Yield is a startup company focusing on customizing sales AI development. This will help McDonald's (NYSE: MCD) create multiple menu options basing on the time of a day, the weather, and the certain McDonald's point workload. Thus, the customer will get their order faster, while the number of customers for the company will get increased. This, in its turn, will boost the company's earnings and dividends. This news is only bad for the competition.

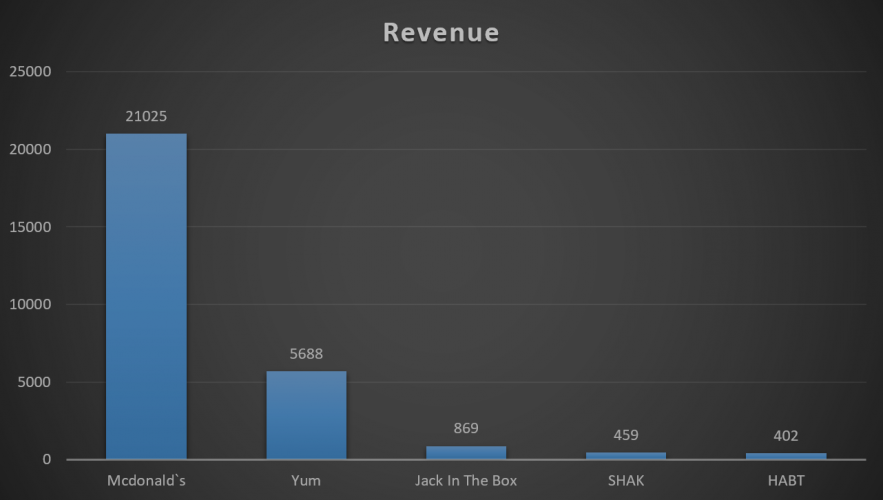

Speaking of the competition, such as Jack in the Box (NASDAQ: JACK), Habit (NASDAQ: HABT), Shake shack (NYSE: SHAK), and Yum (NYSE: YUM), they won't be able to beat McDonald's in terms of prices. Meanwhile, new techs by Dynamic Yield are also going to help the company dominate. The order machines will enable saving up on wages, which, thinking on the overall stuff count of 210K, is very much effective.

As for the risks, remote and home-office workers are surely among them, as well as the changing average age and demand of the customers. This is why the company has opted to partnering with UberEATS, which will enable shipping McDonald's food to homes; this will both retain some existing customers and attract the new ones. In terms of the yearly earnings, meanwhile, McDonald's is way ahead of the competition.

McDonald’s stock price analysis

Technically, the McDonald's stock looks strong enough. Since 2015, during an ascending trend, it surged by 100%, with the S&P500 rising only by 50%.

Still, such an abrupt bounce may be dangerous, with $200 becoming a powerful resistance for the stock. With the indices near their highs, any slump or fall may get mirrored with McDonald's.

The most interesting option is the dividend yield, which is now $4.64 per share , or 2.50% per annum, and has been rising each year since 1977.

The Wall Street analysts assume the yearly earnings will get boosted by 3% in 2019, and up to 8% in 2020. This way, buying this stock in order to speculate on its price is not the best idea, while holding it in the portfolio and increasing the long position in case it drops, is better.